Market Overview

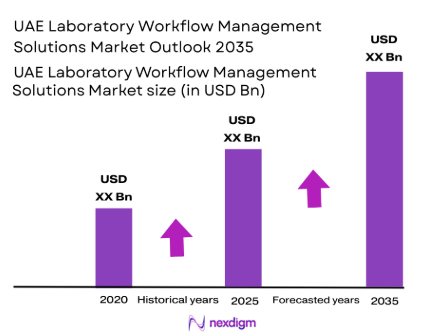

The UAE Laboratory Workflow Management Solutions market is valued at approximately USD ~ million in 2024. This market is largely driven by the increasing demand for automation and digital transformation in laboratories across various sectors such as healthcare, research, and pharmaceuticals. The UAE government’s initiatives to advance healthcare infrastructure, coupled with the rising need for precision and compliance in lab operations, fuel the adoption of laboratory management solutions. These solutions streamline operations, improve data accuracy, and meet international regulatory standards, especially in diagnostic and research labs.

Dubai and Abu Dhabi dominate the UAE Laboratory Workflow Management Solutions market due to their advanced healthcare infrastructure and investment in technological innovation. These cities house leading healthcare institutions, research labs, and diagnostic centres, driving the demand for integrated workflow management solutions. The rapid growth of the UAE’s healthcare sector, supported by government funding and a regulatory push for modernizing laboratory operations, positions these cities as primary hubs for the adoption of laboratory workflow solutions. Additionally, Dubai’s vision to become a smart city enhances the need for digitized laboratory solutions

Market Segmentation

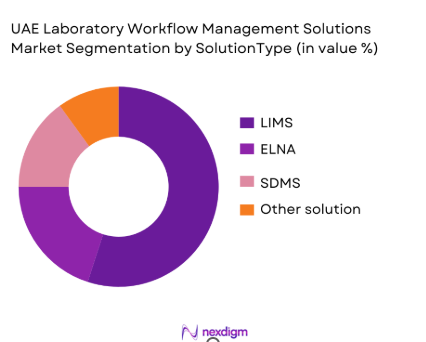

By Solution Type

The UAE Laboratory Workflow Management Solutions market is primarily segmented by solution type, including Laboratory Information Management Systems (LIMS), Electronic Lab Notebooks (ELNs), and Scientific Data Management Systems (SDMS). LIMS dominates the market due to its essential role in automating data collection, sample tracking, and regulatory compliance, particularly in healthcare and pharmaceutical laboratories. The increasing need for high-level data accuracy and the growing trend toward paperless lab operations significantly contribute to the dominance of LIMS in laboratory workflow management.

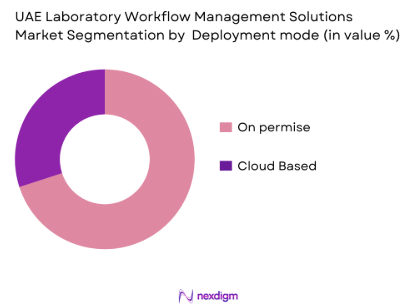

By Deployment Mode

The market is segmented into cloud-based and on-premise solutions, with cloud-based solutions showing strong dominance. Cloud-based solutions are preferred due to their scalability, cost-effectiveness, and ease of access across multiple devices. This deployment model is ideal for laboratories with high operational flexibility, such as those in hospitals and research centers, where real-time data accessibility is crucial. The flexibility of cloud systems also allows labs to streamline workflows without the need for heavy upfront infrastructure costs.

Competitive Landscape

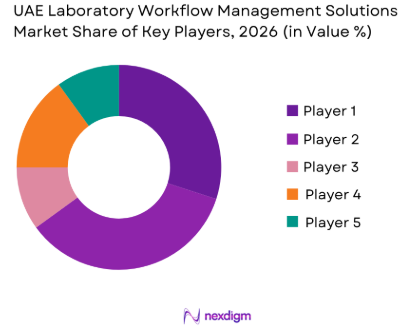

The UAE Laboratory Workflow Management Solutions market is highly competitive, with key global players offering a range of solutions designed to meet the unique needs of laboratories. Leading companies such as Thermo Fisher Scientific, Labware, and Abbott Laboratories dominate the market by providing comprehensive LIMS and data management solutions. These companies maintain a competitive edge through technological innovation, robust product offerings, and strong relationships with healthcare and research institutions in the UAE. The market is characterized by continuous advancements in AI and automation, which are being incorporated into existing workflow management solutions.

| Company | Establishment Year | Headquarters | Core Solutions Offered | Deployment Mode | Focus Segment | Integration Capabilities | Regional Presence |

| Thermo Fisher Scientific | 1956 | USA | LIMS, ELNs, SDMS | Cloud & On-premise | ~ | ~ | ~ |

| Labware | 1989 | USA | LIMS | Cloud & On-premise | ~ | ~ | ~ |

| Abbott Laboratories | 1888 | USA | LIMS, SDMS | Cloud & On-premise | ~ | ~ | ~ |

| PerkinElmer | 1937 | USA | LIMS, ELNs | Cloud & On-premise | ~ | ~ | ~ |

| Agilent Technologies | 1939 | USA | LIMS, ELNs, SDMS | Cloud & On-premise | ~ | ~ | ~ |

UAE Laboratory Workflow Management Solutions Market Analysis

Growth Drivers

Government Investments in Healthcare and Research Infrastructure

The UAE’s supportive government investment climate significantly enhances healthcare and laboratory infrastructure, which directly drives demand for advanced laboratory workflow management solutions. In 2024, current health expenditure per capita in the UAE is USD ~ PPP, reflecting sustained financial commitment to healthcare services and infrastructure modernization. This level of health spending enables the procurement of advanced laboratory technologies, digital systems, and integration platforms across hospitals, diagnostic centres, and research institutions, ensuring labs can handle high volumes of clinical and research data efficiently. Increased funding for healthcare infrastructure fosters adoption of workflow management solutions.

Increasing Regulatory Compliance in Medical and Environmental Labs

Regulatory frameworks in the UAE strongly emphasize quality, safety, and accuracy in laboratory operations, which boosts the adoption of structured workflow management systems. Authorities such as the Dubai Health Authority mandate that all clinical lab services adhere to strict licensing procedures and quality standards, including accreditation and standardized operational protocols. These regulations require clinical laboratories to implement robust quality control, data tracking, and reporting systems to maintain compliance. As a result, laboratories invest in workflow solutions that ensure alignment with regional regulatory requirements and global standards, enhancing service reliability and safety.

Market Challenges

High Cost of Deployment and Integration

The cost of deploying comprehensive laboratory workflow management solutions — including software licensing, system integration, and ongoing maintenance — remains a key challenge in the UAE market. Advanced systems often require substantial upfront investment in IT infrastructure, staff training, and ongoing technical support. Many small and mid-sized laboratories face budget constraints due to these high implementation costs. In the UAE’s healthcare landscape, where public and private entities compete for resources across infrastructure, staffing, and technology, allocating significant capital to workflow solutions poses a barrier to rapid adoption, especially for organizations with limited digital transformation budgets.

Data Security Concerns in Cloud-Based Solutions

As laboratories increasingly adopt cloud-based workflow management platforms, concerns about data privacy and security have emerged as a stumbling block. Healthcare data — including patient details, test results, and research outputs — is highly sensitive and subject to stringent confidentiality requirements. Many laboratory stakeholders are cautious about storing this information on third‑party cloud infrastructures due to potential risks related to unauthorized access, breaches, or compliance issues with local data protection laws. These concerns make decision‑makers more hesitant to fully transition to cloud‑centric systems without robust security frameworks and compliance assurance

Opportunities

Growing Demand for AI-Driven Lab Management Solutions

The UAE’s strategic focus on artificial intelligence creates fertile ground for advanced, AI‑enabled laboratory workflow solutions. The country’s national AI strategy supports integrating intelligent technologies across sectors including healthcare and life sciences, encouraging laboratories to adopt AI for predictive analytics, anomaly detection, and workflow optimization. AI‑enhanced systems can streamline complex operations, reduce errors in data processing, and offer intelligent scheduling and resource allocation insights. This creates opportunities for vendors to provide sophisticated AI‑driven management platforms that boost lab performance and operational insight, aligning with national priorities on innovation and digital transformation.

Expansion of Biotech and Pharma Industries in UAE

The UAE’s expanding biotechnology and pharmaceutical sectors present a substantial opportunity for laboratory workflow management solutions. The biotechnology market is valued at around USD ~billion, reflecting significant capacity for research and innovation within life sciences, genomics, and biopharma development. This growth is supported by government strategies and investment initiatives aimed at enhancing R&D capabilities and attracting international life sciences entities. As biotech and pharma labs scale operations and increase experimental throughput, they require advanced workflow solutions to manage complex data streams, ensure compliance, and support research workflows — driving demand for more integrated management platforms.

Future Outlook

Over the next five years, the UAE Laboratory Workflow Management Solutions market is expected to continue its steady growth, driven by further investments in healthcare infrastructure, the integration of cloud-based technologies, and advancements in automation and AI. Laboratories will increasingly demand integrated solutions to enhance operational efficiency, improve data accuracy, and ensure regulatory compliance. Government initiatives aimed at modernizing the healthcare and research sectors, alongside growing demand for digital transformation, will propel the adoption of laboratory workflow management solutions in the region.

Major Players

- Thermo Fisher Scientific

- Labware

- Abbott Laboratories

- PerkinElmer

- Agilent Technologies

- Bio-Rad Laboratories

- VWR International

- Siemens Healthiness

- Roche Diagnostics

- Lab Vantage Solutions

- STARLIMS (Abbott Informatics)

- Beckman Coulter

- Mettler Toledo

- Horiba Scientific

- Dassault Systems (BIOVIA)

Key Target Audience

- Healthcare Providers and Hospitals

- Diagnostic Laboratories and Research Institutions

- Pharmaceuticals and Biotech Companies

- Healthcare IT Providers and Solution Integrators

- Investment and Venture Capital Firms

- Government and Regulatory Bodies

- Diagnostic Equipment Distributors

- Healthcare Technology Providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping all critical variables influencing the UAE Laboratory Workflow Management Solutions market, including technology adoption trends, regulatory frameworks, and growth opportunities in healthcare and research sectors. This phase utilizes desk research, industry reports, and government data to construct an ecosystem analysis.

Step 2: Market Analysis and Construction

We compile and analyze data from key stakeholders, such as laboratory professionals, technology providers, and regulatory bodies, to assess the adoption rates and financial impact of laboratory management solutions in the UAE.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding the growth of laboratory management solutions are validated through interviews with industry experts, including healthcare IT professionals, laboratory managers, and solution providers. These consultations provide critical insights into the operational needs and challenges faced by laboratories.

Step 4: Research Synthesis and Final Output

In the final phase, the collected data is synthesized, and a comprehensive market report is produced. This includes insights on future market trends, opportunities, challenges, and competitive dynamics, ensuring that the report accurately reflects the UAE Laboratory Workflow Management Solutions market landscape.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis & Evolution

- Timeline of Major Players’ Entry

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Regulatory Framework & Compliance Standard

- Growth Drivers

Government Investments in Healthcare and Research Infrastructure

Increasing Regulatory Compliance in Medical and Environmental Labs

Adoption of Digitalization in Lab Processes and Automation - Market Challenges

High Cost of Deployment and Integration

Data Security Concerns in Cloud-based Solutions - Opportunities

Growing Demand for AI-driven Lab Management Solutions

Expansion of Biotech and Pharma Industries in UAE - Trends

Rise of IoT Integration in Lab Workflow Management

Shift Towards Automation and Robotics in Lab Operations - Government Regulation and Compliance Landscape

Healthcare and Pharmaceutical Lab Accreditation in UAE

Standards for Environmental Lab Testing and Reporting

- By Value, 2019-2025

- By Volume, 2019-2025

- By Solution Pricing, 2019-2025

- By Adoption Rate in Public vs. Private Sector, 2019-2025

- By Deployment Type (by value %)

Cloud-based vs On-premise

By Industry Vertical

Healthcare & Diagnostics

Pharmaceuticals

Food & Beverage

Environmental Testing - By End-User (by value %)

Research Laboratories Diagnostic Laboratories

Industrial Testing Labs - By Solution Type (by value %)

Sample Management

Data Integration

Reporting, and Others - By Region (by value %)

Dubai

Abu Dhabi

Sharjah, and Other Emirates

- Market Share of Major Players by Value/Volume in 2024

Market Share by Solution Type - Cross-Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Number of Dealers/Distributors, Margins, Production/Development Capacity, Unique Value Offerings)

- Pricing Analysis for Major Players in the UAE Market

- SWOT Analysis of Leading Players

- Detailed Profiles

Thermo Fisher Scientific

Labware

VWR International

Abbott Laboratories

PerkinElmer

Agilent Technologies

Siemens Healthineers

Roche Diagnostics

Bio-Rad Laboratories

Beckman Coulter

Horiba Scientific

Labcorp

Abbott Laboratories

Chemware

Mettler Toledo

- Laboratory Workflow Demand and Utilization

- Budget Allocation and Decision-making Process for Solutions

- Needs, Desires, and Pain Point Analysis in Labs

- Regulatory and Compliance Requirements

- End-User Buying Patterns and Preferences

- By Value, 2026-2030

- By Volume, 2026-2030

- By Average Price of Solutions, 2026-2030