Market Overview

The UAE Lipid Profiles Testing Market is estimated to be valued at approximately USD ~ million in 2024, driven by rising healthcare investments, increasing awareness of cardiovascular diseases (CVDs), and a surge in preventive health checkups. The growing aging population, along with a significant proportion of individuals with lifestyle diseases like diabetes and hypertension, has contributed to an uptick in lipid profile testing. Moreover, a thriving private healthcare sector, along with substantial government initiatives to promote preventive health, is bolstering market growth. Increased demand for routine health screenings across the UAE has created opportunities for growth, particularly in urban areas such as Dubai, Abu Dhabi, and Sharjah.

The UAE market for lipid profile testing is predominantly driven by major urban centers like Dubai, Abu Dhabi, and Sharjah. Dubai, with its advanced healthcare infrastructure and high standard of living, leads the charge in demand for diagnostic services, particularly among expatriates and locals with high disposable incomes. Abu Dhabi also contributes significantly, thanks to the city’s comprehensive healthcare system and government-supported initiatives to improve public health standards. The UAE’s high prevalence of chronic diseases like obesity, diabetes, and heart disease further boosts the demand for regular lipid profile tests in these regions.

Market Segmentation

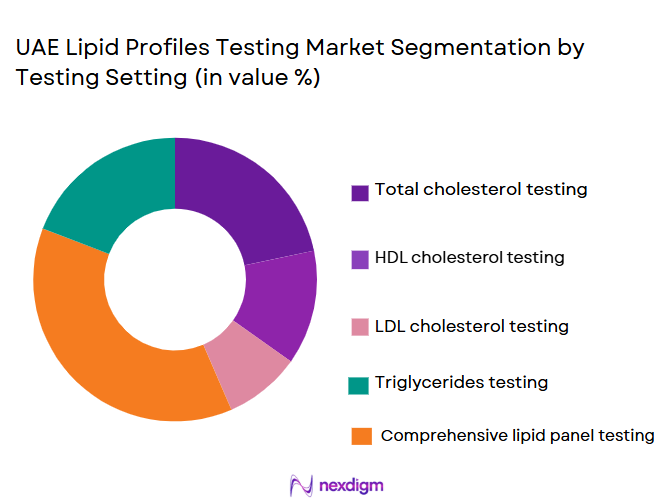

By Testing Setting

The UAE Lipid Profile Testing Market is segmented into several testing settings, including hospital laboratories, independent diagnostic labs, point-of-care clinics, and home test kits. Among these, hospital laboratories dominate the market share in 2024. This dominance is primarily due to their advanced medical infrastructure, capacity to handle large volumes of tests, and the integration of lipid profile testing into routine medical checkups and treatment plans for patients with chronic diseases. The widespread adoption of advanced automated testing systems in hospitals ensures efficiency, accuracy, and faster turnaround times, making hospital laboratories the preferred choice for both healthcare providers and patients.

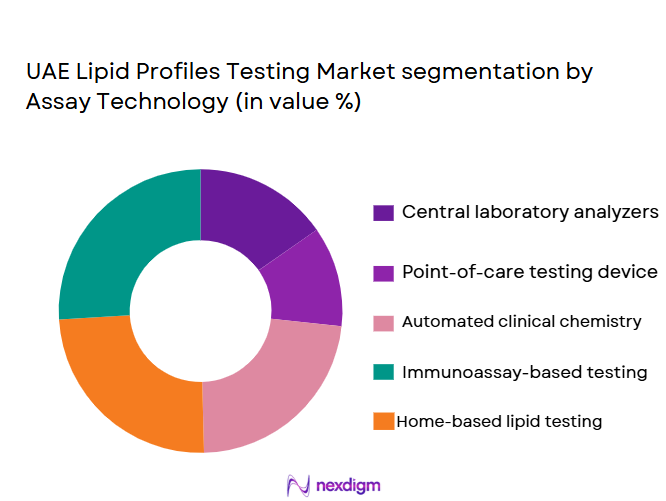

By Assay Technology

The market for lipid profile testing is also segmented by assay technology, which includes automated biochemistry analyzers, point-of-care (POC) testing devices, and home rapid test kits. Automated biochemistry analyzers hold the largest market share in 2024. These analyzers are widely used in hospital laboratories due to their high throughput and accuracy in analyzing blood samples for lipid profiles. They are also capable of handling multiple tests at once, ensuring a higher volume of tests can be processed, making them cost-effective for large medical centers. Moreover, technological advancements in biochemistry analyzers, such as the integration of AI for result interpretation and predictive analysis, further fuel the dominance of this segment.

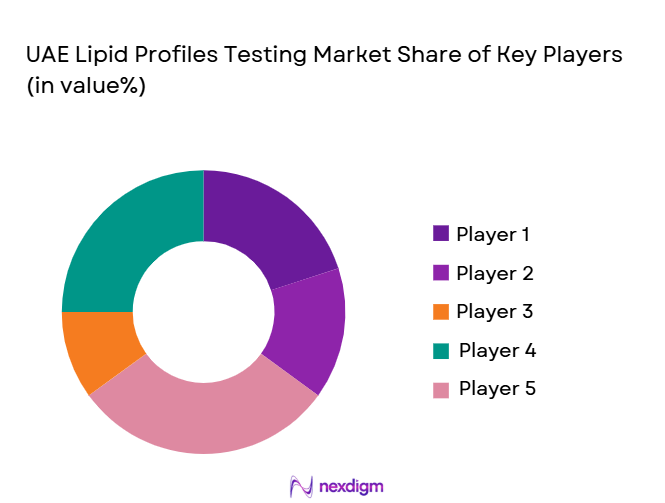

Competitive Landscape

The UAE Lipid Profile Testing Market is characterized by a mix of local diagnostic service providers and international players. Leading companies, including prominent hospital chains and independent laboratories, continue to drive the market through technological advancements and strategic partnerships. Key players also focus on expanding their service offerings to include more specialized lipid testing and increasing their market presence through partnerships with healthcare providers.

The competitive landscape is marked by consolidation in the hospital and diagnostic lab sectors, where the key players are leveraging high-throughput automated systems and expanding into underserved regions of the UAE. Moreover, the rise of point-of-care devices and home testing solutions has introduced new players to the market, competing on the basis of convenience and affordability.

| Company Name | Establishment Year | Headquarters | Key Parameters |

| Mediclinic Middle East | 2007 | Dubai | ~ |

| NMC Healthcare | 1974 | Abu Dhabi | ~ |

| Al Borg Diagnostics | 1999 | Dubai | ~ |

| Life Diagnostics | 2015 | Dubai | ~ |

| Aster DM Healthcare | 1987 | Dubai | ~ |

UAE Lipid Profiles Testing Market Dynamics

Growth Drivers

Rising Prevalence of CVD & Metabolic Diseases

The UAE is experiencing a rising prevalence of cardiovascular diseases (CVD) and metabolic disorders, leading to an increased demand for lipid profile testing. In 2024, the UAE health authorities reported that CVDs remain the leading cause of death, contributing to over ~% of total mortality. This is closely linked with a high rate of lifestyle-related conditions such as obesity and diabetes, which affect nearly 18% of the adult population. The government’s focus on managing chronic diseases through early diagnosis is fueling the demand for lipid profile tests as an integral part of screening and monitoring strategies.

Preventive Health Paradigm & Screening Culture

There has been a shift towards preventive healthcare in the UAE, supported by increasing public awareness and governmental initiatives promoting early screening. The UAE government introduced various health screening programs, including lipid profile tests, to monitor cardiovascular risks. In 2024, MOHAP introduced guidelines for periodic health checks for individuals aged ~ and above, which include lipid profiles as part of standard preventive tests. This has led to a rise in routine screenings across the country, further pushing the demand for lipid testing as part of the broader health check-up trend in the UAE population.

Challenges

Cost Sensitivity of Advanced Testing

The cost sensitivity associated with advanced lipid profile testing remains a key restraint in the UAE. While routine lipid testing is relatively accessible, more advanced lipid panels, such as those testing for particle size and number, remain prohibitively expensive for a significant portion of the population. In 2024, out-of-pocket expenses for patients can reach AED ~ for comprehensive lipid testing, excluding insurance coverage. The relatively high cost, particularly for advanced diagnostic tests, poses a challenge to their widespread adoption, limiting the testing to individuals who can afford the full spectrum of these health services.

Fragmented Laboratory Network

Another restraint in the UAE lipid profiles testing market is the fragmented laboratory network, which leads to inconsistency in the availability and quality of testing. Although major cities like Dubai and Abu Dhabi have well-established healthcare infrastructure, rural and remote areas face challenges in accessing reliable and consistent testing facilities. In 2024, around ~% of medical laboratories are concentrated in urban centers, while rural areas are underserved. This fragmented distribution of testing facilities limits the reach of lipid profile testing, especially in terms of accessibility and efficiency in less developed regions of the UAE.

Opportunities

Tele-Diagnostics & At-Home Screening Expansion

The expansion of tele-diagnostics and at-home screening solutions presents a significant opportunity for the UAE lipid profiles testing market. In 2024, several health startups and traditional healthcare providers have begun offering home testing kits for lipid profiles, capitalizing on the growing demand for convenient healthcare solutions. This trend is supported by the UAE’s Vision 2030 initiative, which focuses on improving healthcare accessibility and convenience. With advancements in telemedicine platforms, lipid tests can now be administered remotely, and results can be interpreted digitally, improving patient engagement and increasing the overall demand for lipid testing.

AI & Analytics for Risk Stratification

The integration of Artificial Intelligence (AI) and advanced analytics for risk stratification offers a promising opportunity in the UAE lipid profiles testing market. In 2024, the UAE is making strides in incorporating AI-driven health technologies that can analyze lipid profiles and predict cardiovascular risks with greater precision. AI-based solutions, which can process large datasets from lipid panels, provide clinicians with enhanced diagnostic insights and improve the accuracy of early-stage disease detection. The UAE’s investment in smart healthcare solutions and AI-driven tools in the public and private sectors supports this growing trend, providing a significant opportunity for the lipid testing market.

Future Outlook

Over the next six years, the UAE Lipid Profile Testing Market is expected to experience substantial growth, driven by the increasing adoption of advanced diagnostic technologies, a growing healthcare infrastructure, and expanding public awareness of heart disease prevention. The UAE’s healthcare sector is likely to continue benefiting from a combination of private investments and government initiatives focused on improving national health outcomes. The growing elderly population and rising lifestyle diseases such as hypertension and diabetes are expected to further increase demand for lipid profile testing services. Additionally, innovations in point-of-care testing and home-based lipid profile kits may further disrupt the market, offering more accessible options for consumers and healthcare providers alike.

Major Players in the Market

- Mediclinic Middle East

- NMC Healthcare

- Al Borg Diagnostics

- Life Diagnostics

- Aster DM Healthcare

- Thumbay Labs

- Cleveland Clinic Abu Dhabi

- Unilabs UAE

- Saudi German Hospitals Group

- Al-Diaa Diagnostics

- Q Labs Diagnostics

- Dubai Health Authority (DHA) Laboratories

- Al-Futtaim Healthcare

- Emirates Healthcare

- BioLabs UAE

Key Target Audience

- Healthcare Providers (Hospitals and Clinics)

- Independent Diagnostic Labs

- Insurance Companies (Health Insurance Providers)

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Health & Prevention, UAE)

- Medical Device Manufacturers (Lipid Testing Technologies)

- Pharmaceutical Companies

- Public Health Organizations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem of key stakeholders within the UAE Lipid Profile Testing Market. The goal is to pinpoint the most influential factors driving market dynamics, including technological advancements, healthcare policy changes, and evolving consumer needs. Data collection is conducted through secondary sources such as public health reports, healthcare statistics, and proprietary databases.

Step 2: Market Analysis and Construction

Historical data from reliable sources is analyzed to estimate the market’s current state, including test volume trends, laboratory services growth, and pricing dynamics. The relationship between testing frequency, patient demographics, and testing technologies will also be examined to forecast the market’s direction.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are conducted with industry professionals, healthcare executives, and lab operators. These consultations help refine initial assumptions about the market’s future growth trajectory, regulatory impacts, and technological shifts.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing insights gathered from stakeholders and integrating them into a cohesive market analysis. This is complemented by an in-depth study of emerging trends, innovations in diagnostic technology, and the impact of public health campaigns aimed at raising awareness of lipid profile testing.

- Executive Summary

- UAE Lipid Profiles Testing Market Research Methodology

Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising prevalence of cardiovascular diseases and lifestyle disorders

Growing emphasis on preventive healthcare and routine screening

Expansion of diagnostic infrastructure across public and private sectors - Market Challenges

High cost of advanced diagnostic systems

Reimbursement and pricing pressures

Shortage of skilled laboratory professionals - Market Opportunities

Increasing adoption of point-of-care lipid testing

Growth of home-based and self-testing solutions

Integration of lipid testing with digital health platforms - Trends

Shift toward automated and high-throughput analyzers

Rising demand for rapid and near-patient testing

Use of data analytics for population health management

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value 2019–2024

- By Installed Units 2019–2024

- By Average System Price 2019–2024

- By System Complexity Tier 2019–2024

- By System Type (In Value%)

Total cholesterol testing systems

HDL cholesterol testing systems

LDL cholesterol testing systems

Triglycerides testing systems

Comprehensive lipid panel testing systems - By Platform Type (In Value%)

Central laboratory analyzers

Point-of-care testing devices

Automated clinical chemistry platforms

Immunoassay-based testing platforms

Home-based lipid testing kits - By Fitment Type (In Value%)

Benchtop laboratory systems

Portable and handheld analyzers

Integrated laboratory automation systems

Cartridge-based testing systems

Standalone diagnostic analyzers - By EndUser Segment (In Value%)

Hospitals and multispecialty centers

Independent diagnostic laboratories

Clinics and primary care centers

Research and academic institutions

Home healthcare and individual users - By Procurement Channel (In Value%)

Direct manufacturer procurement

Authorized distributors and suppliers

Government and institutional tenders

Reagent rental and managed service contracts

Online and digital procurement platforms

- Market Share Analysis

- Cross Comparison Parameters

[Test accuracy, Product portfolio, Automation level, Pricing strategy, Distribution network] - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Abbott Laboratories

Roche Diagnostics

Siemens Healthineers

Beckman Coulter

Bio-Rad Laboratories

Thermo Fisher Scientific

Ortho Clinical Diagnostics

Sysmex

Mindray

Randox Laboratories

Horiba Medical

Arkray

DiaSys Diagnostic Systems

EKF Diagnostics

Nova Biomedical

- Hospitals focus on accuracy and high sample throughput

- Diagnostic labs prioritize automation and cost efficiency

- Clinics demand compact and rapid testing solutions

- Home users value convenience and ease of use

- Forecast Market Value 2025–2030

- Forecast Installed Units 2025–2030

- Price Forecast by System Tier 2025–2030

- Future Demand by Platform 2025–2030