Market Overview

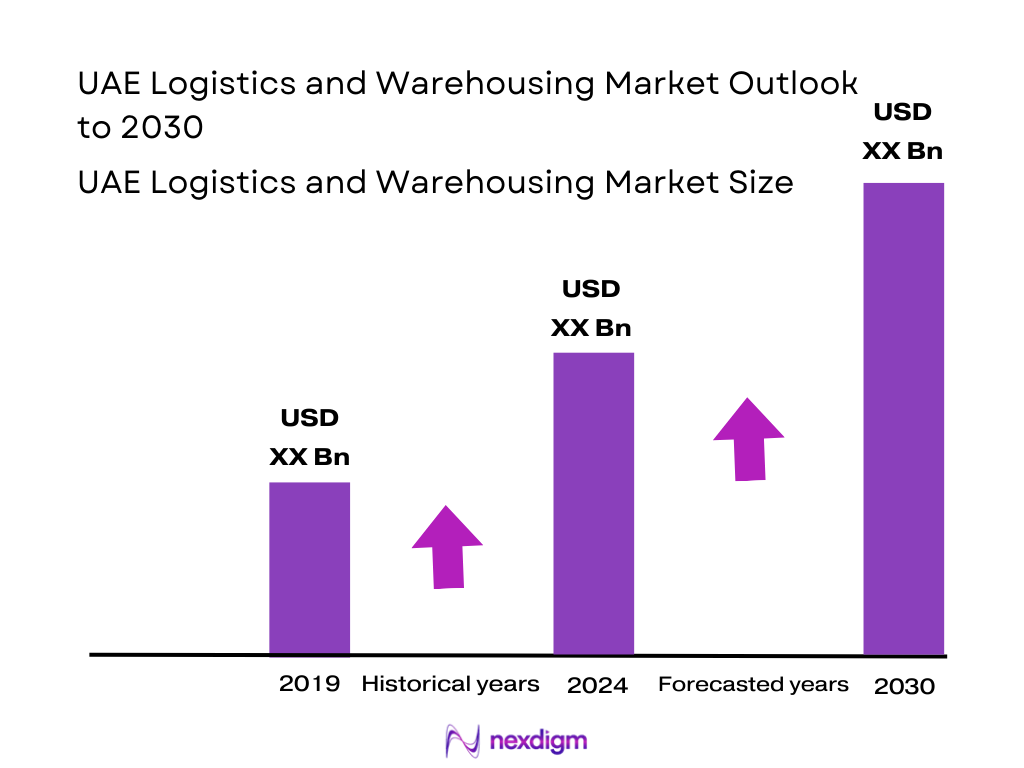

The UAE logistics market is valued at USD 38.6 billion in 2024. From 2019 through 2023 it showed steady expansion stemming from trade facilitation, rapid growth in e‑commerce, and infrastructure investment in ports and warehousing. The significant rise in warehousing & distribution services especially contributes to value creation in this segment.

Dubai leads as the dominant logistics hub due to Jebel Ali Port’s global throughput (handling over 70 million containers annually via DP World) and major airports like DXB handling 2.2 million tonnes of cargo in 2024. Abu Dhabi, along with its KEZAD free zone and Abu Dhabi Ports, also anchors logistics expansion. The strategic location linking Asia, Africa and Europe, world‑class infrastructure and regulatory support underpin dominance.

Market Segmentation

By Service Segment

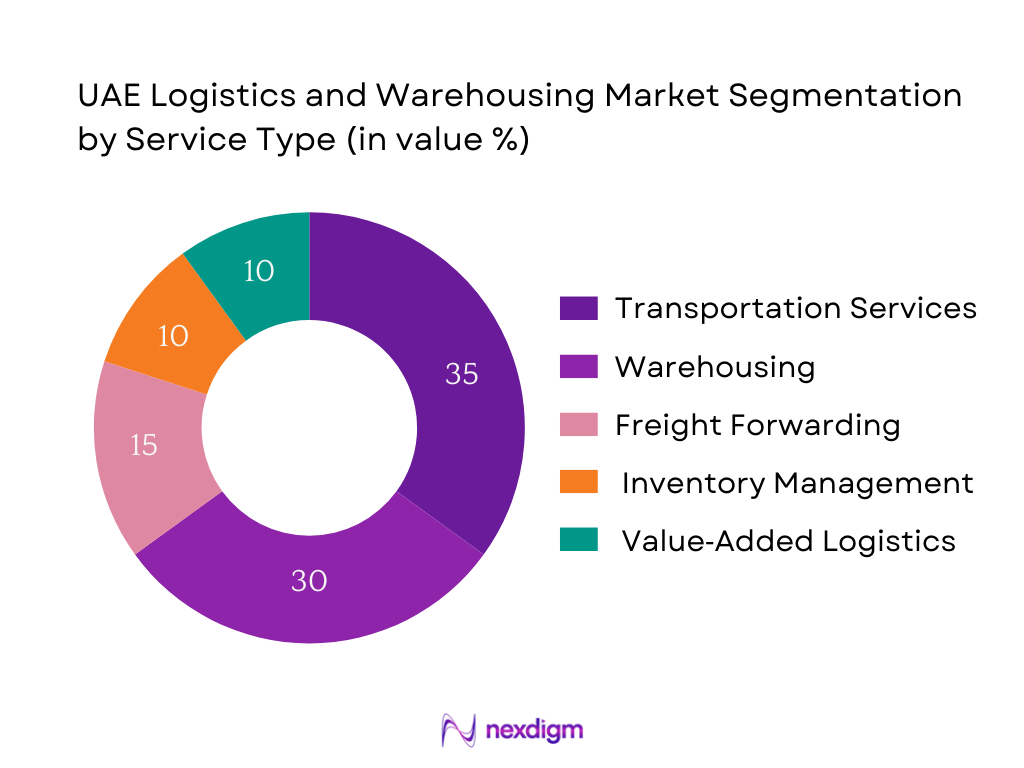

The UAE logistics market is segmented by service type into transportation, warehousing & distribution, freight forwarding, inventory management, value‑added logistics, and integration & consulting. Warehousing & Distribution Services currently dominate with highest growth momentum in 2024 due to surging demand for cold‑chain, contract logistics, and increasingly reshoring regional fulfillment hubs. Investments by major free‑zones and e‑commerce firms have ramped up warehouse capacity, making this sub‑segment the clear leader.

By Freight Forwarding

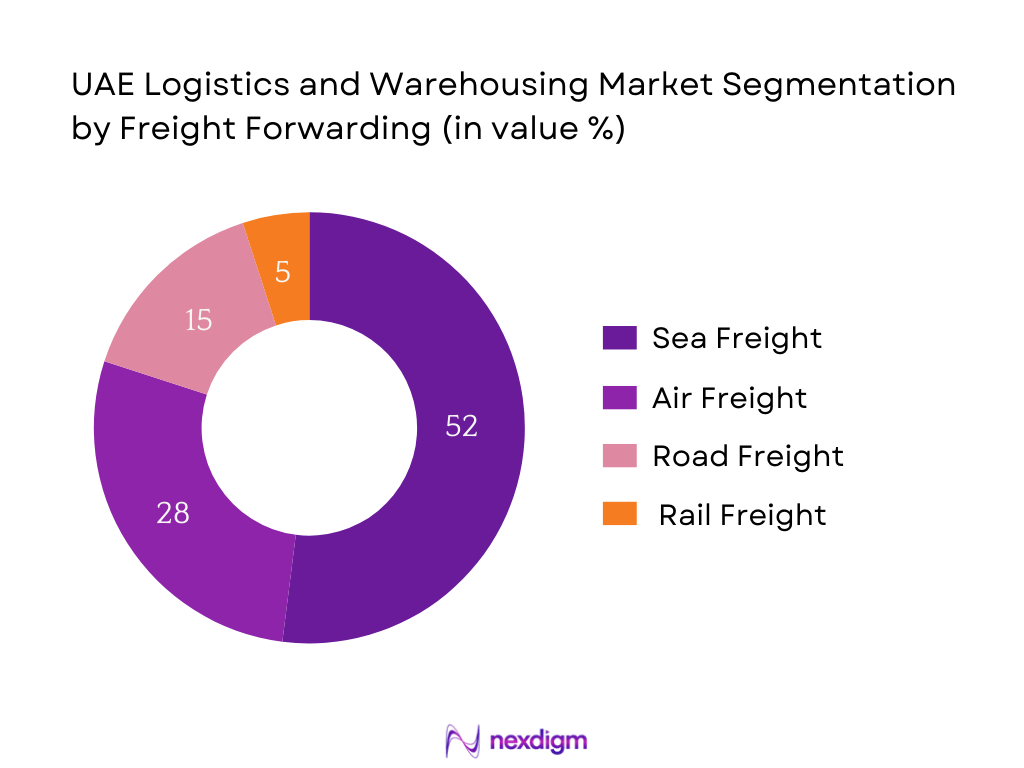

The UAE market is segmented by freight mode into sea, air, road, and rail/multimodal. Sea Freight dominates in 2024 due to Jebel Ali Port’s position as the largest container handling facility in the region, with throughput exceeding 13.7 million TEU. The port’s direct connectivity to over 180 shipping lines and capacity for handling mega-vessels enables cost-efficient transport for imports, re-exports, and trans-shipment. Additionally, integration with free-zones like JAFZA streamlines customs clearance, making sea freight the preferred mode for bulk commodities and containerized goods in regional and global trade.

By Warehousing

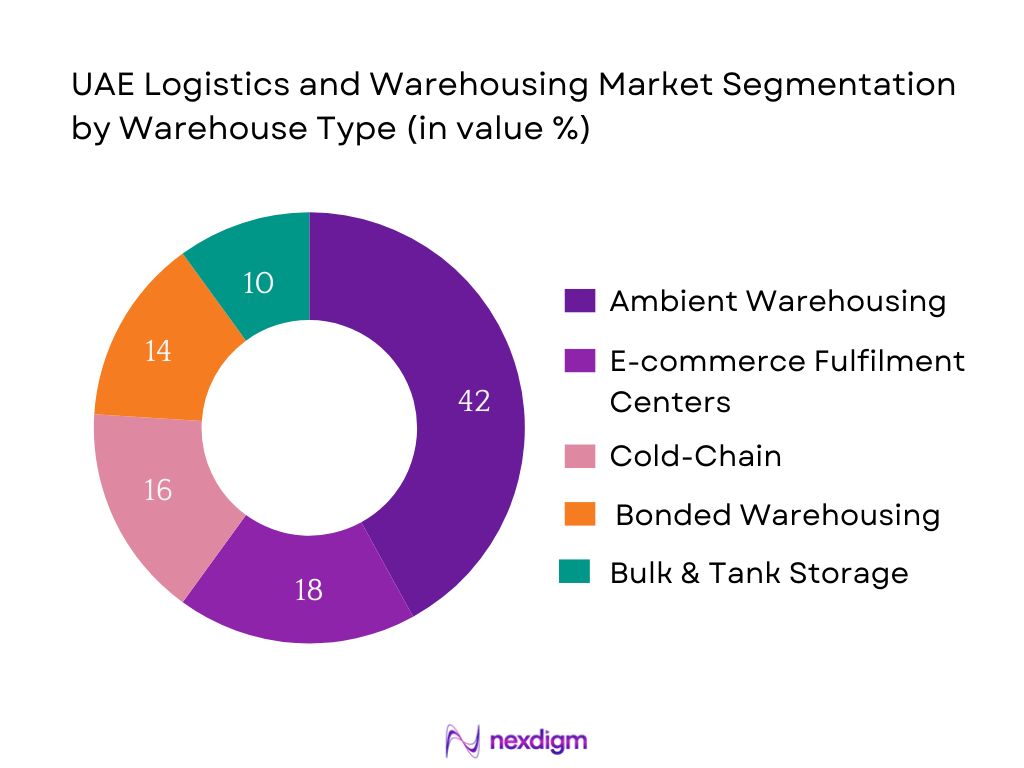

The UAE warehousing market is segmented by facility type into ambient warehousing, temperature-controlled warehousing, bonded/free-zone warehousing, e-commerce fulfilment centers, and bulk/open-yard & tank storage. Ambient warehousing holds a dominant share in 2024 due to its wide applicability across FMCG, electronics, general retail and industrial goods, and its extensive footprint in hubs such as JAFZA, KEZAD and DAFZA. Operators favor ambient facilities for cost-efficient storage, high pallet density, and rapid throughput for regional re-exports. Proximity to Jebel Ali Port, Khalifa Port, DXB/DWC and major arterial highways enables fast port-to-shelf cycles. Growing adoption of WMS, AMRs and put-to-light systems in ambient facilities improves pick rates and dock-to-stock times, while seamless bonded linkages and customs integrations allow quicker cross-border movements, reinforcing ambient’s scale advantages over more specialized formats.

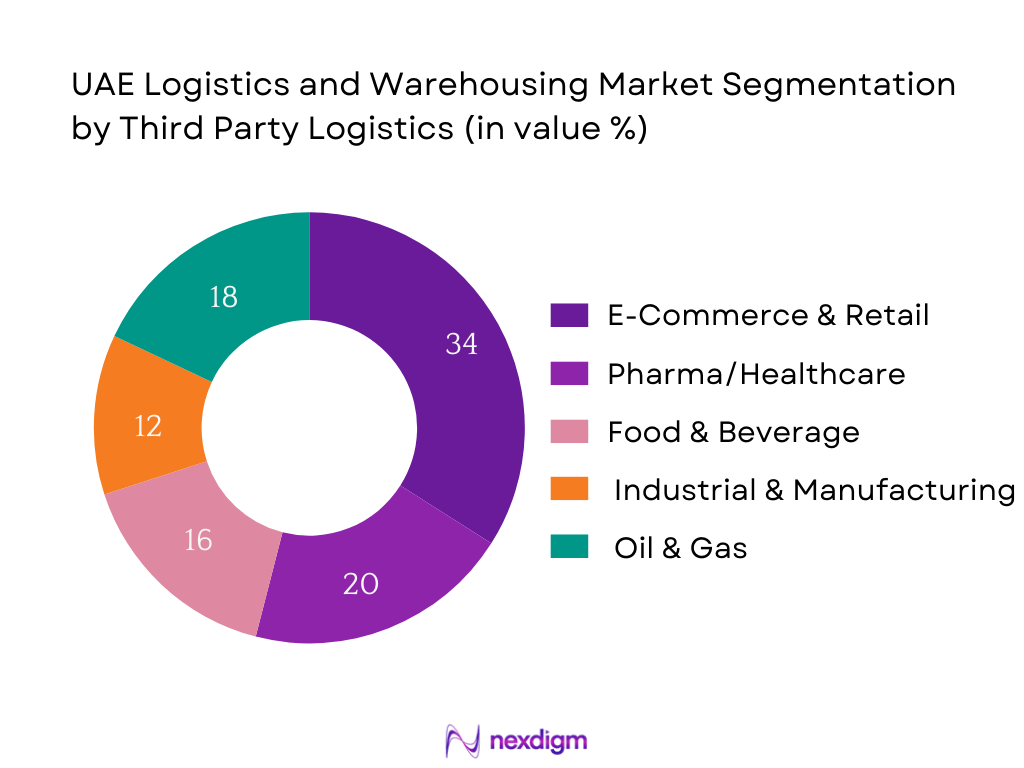

By 3PL

The UAE 3PL market is segmented by verticals including e-commerce & retail, pharma/healthcare, food & beverage, industrial & manufacturing, oil & gas, and automotive & spare parts. E-Commerce & Retail is the leading vertical in 2024, driven by the UAE’s AED 27.5 billion e-commerce market and growing consumer demand for faster fulfilment. 3PL providers manage inventory in strategically located warehouses near ports and airports, enabling same-day and next-day deliveries. This vertical benefits from advanced WMS, automated picking systems, and integration with customs for cross-border orders, making it the most competitive and fastest-growing segment.

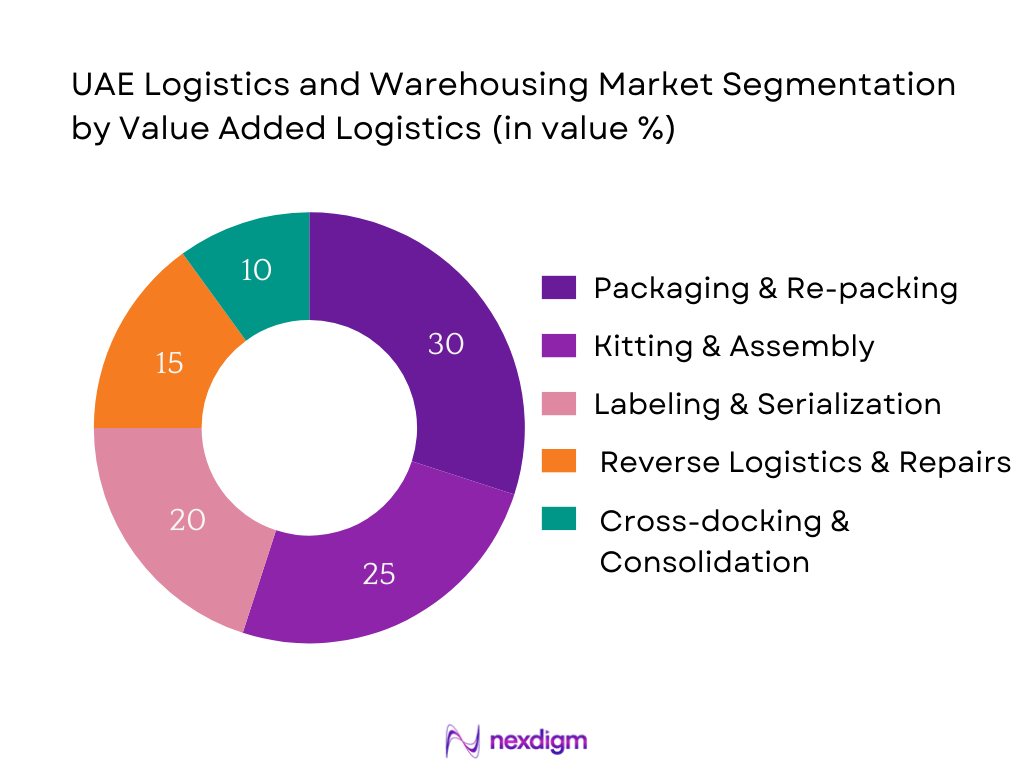

By Value-Added Services

The UAE VAS market is segmented by type into kitting & assembly, labeling & serialization, packaging & re-packing, reverse logistics & repairs, and cross-docking & consolidation. Packaging & Re-packing is the dominant sub-segment in 2024 due to the high volume of goods transiting through free-zones that require re-labelling, GCC-specific compliance stickers, and export-ready packaging. Operators in JAFZA and KEZAD handle large-scale re-packing for FMCG, pharmaceuticals, and electronics to meet market-specific standards, enabling faster re-export and minimizing lead times.

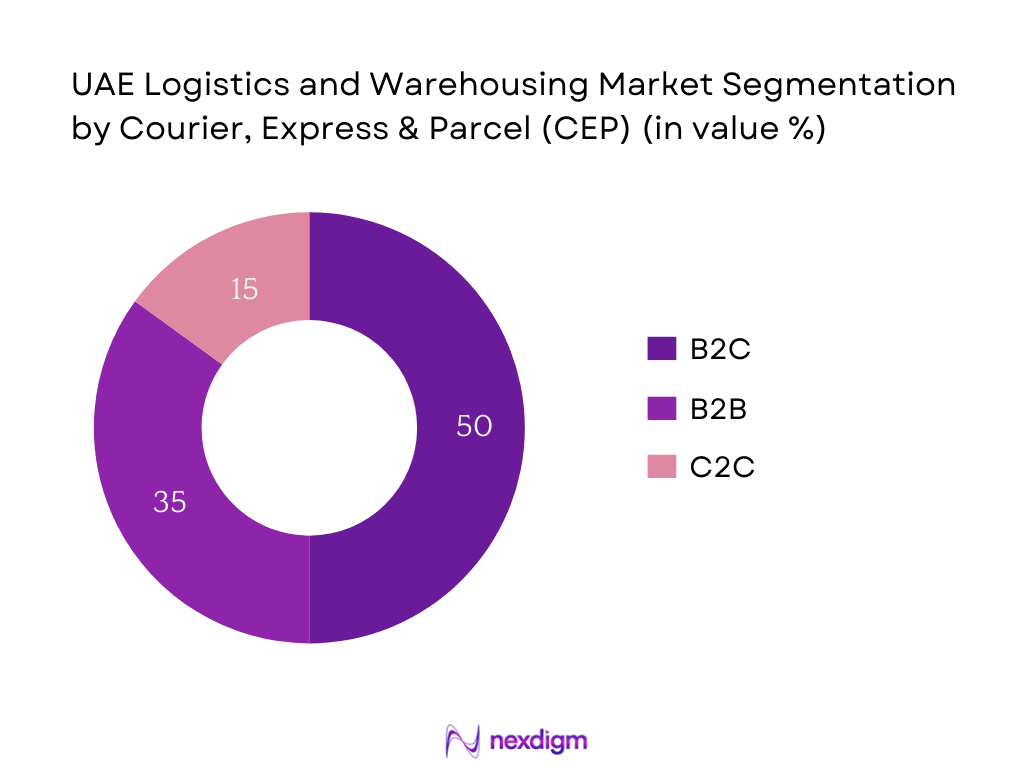

By Courier, Express & Parcel (CEP)

The UAE CEP market is segmented into B2B, B2C, and C2C deliveries. B2C leads in 2024, supported by the exponential growth of e-commerce and cross-border online shopping. International orders, especially from China, the US, and Europe, are consolidated in bonded warehouses in Dubai and Abu Dhabi before being dispatched to consumers across the GCC. CEP operators have expanded same-day and next-day delivery capabilities in urban centers like Dubai and Abu Dhabi, complemented by parcel lockers and pickup points for last-mile efficiency.

Competitive Landscape

The UAE logistics market is dominated by a handful of large players—DP World, AD Ports, Agility, Aramex, DHL, DB Schenker—and this concentration reflects the strategic advantage of integrated port‑free‑zone‑logistics providers.

| Company | Established | Headquarters | TEU Throughput (annual) | Cold‑Chain Capacity (m³) | Free‑zone Facility (sq ft) | Digital Platform Integration | Emirates Presence | Partnerships & Alliances |

| DP World | 2005 | Dubai, UAE | – | – | – | – | – | – |

| AD Ports Group | 2006 | Abu Dhabi, UAE | – | – | – | – | – | – |

| Agility Logistics | 1979 | Kuwait (UAE ops lead) | – | – | – | – | – | – |

| Aramex | 1982 | Dubai, UAE | – | – | – | – | – | – |

| DHL Supply Chain | 1969 | Germany (UAE branch) | – | – | – | – | – | – |

UAE Logistics & Warehousing Market Analysis

Growth Drivers

Strategic Trade Location between Asia, Europe & Africa

The UAE served as a trade hub moving approximately 20,300,000 TEU of containers through its ports in 2022, rising from 19,182,000 TEU in 2021. This high throughput reflects global trade resilience. Dubai International Airport handled 2,200,000 metric tonnes of cargo in 2024, delivering over one‑fifth (20.5%) year‑on‑year cargo growth. These volumes emphasize the UAE’s strategic location connecting Asia, Africa and Europe via marine and air corridors, positioning logistics players to manage massive cross‑continental freight flows.

Expansion of E‑commerce Fulfilment

E‑commerce in the UAE recorded AED 27.5 billion in retail value in 2023. Online retail penetration forms ~4.2% of total retail sales in UAE in 2024—higher than GCC average. With nearly 3.3 million active e‑commerce users spending an average USD 1,590 each in 2023, demand for warehousing space—particularly urban fulfilment, bonded and cold‑chain facilities—has surged, driving logistics growth linked to consumer behaviour.

Market Challenges

High Land & Operating Costs in Prime Free‑zones

Prime free‑zones such as JAFZA and KEZAD have annual land lease rates exceeding AED 200 per sq ft in key logistics parks (industry leasing data, 2023). These high base costs raise entry barriers for mid‑tier logistics firms and SMEs. Additionally, utility and labour expenses in these zones push operational overheads well above AED 50 million annual spend for mid‑size warehouses, limiting scalability for price‑sensitive customers and affecting cost efficiencies of 3PL operations.

Regulatory Complexity Across Emirates

Logistics operators must navigate licensing differences across UAE’s seven emirates. For example, customs clearance timelines vary: Dubai Customs processes most bonded shipments within 48 hours, whereas smaller emirates average 72 hours per shipment cycle (official customs data, 2023). Variability in VAT compliance structures between emirates adds administrative overhead, increasing compliance staff needs by approximately 20% for national operators managing cross‑Emirate logistic flows.

Opportunities

Growth in Cross‑border E‑commerce Fulfilment

The UAE e‑commerce retail value reached AED 27.5 billion in 2023. Cross‑border online retail constitutes over 60% of this volume, with consumers ordering from international merchants. As 5.7 million users are expected by 2029, logistics players can leverage bonded and free‑zone fulfilment capacities for distribution hubs. This market current scale presents opportunity for scaling global fulfilment services, reverse logistics, and value‑added services to international brands targeting MENA via UAE.

Green Logistics & Sustainable Warehousing

UAE renewable energy generation rose significantly: Abu Dhabi’s clean energy portfolio reached over 5,000 MW by late 2024. Logistics operators within free‑zones are mandating solar installation on warehouse rooftops, reducing grid consumption by over 30% in 2023. Firms retrofitting insulation and efficient HVAC tech report energy reductions of AED 1.2 million annually per 100,000 m² facility. These investments, driven by sustainability mandates and cost optimisation, open green certification opportunities and lead to demand for eco‑friendly warehousing assets among multinational clients.

Future Outlook

Over the coming period the UAE Logistics & Warehousing market is set to grow steadily, driven by ongoing expansion of free‑zones, development of Etihad Rail inter‑emirate freight links, and strong demand from e‑commerce and pharmaceuticals verticals. Government initiatives, including integrated customs systems and green logistics standards, are expected to support continuous modernization. The market is projected to grow at a CAGR of around 6.1% during 2024–2030, rising from USD 169.7 billion in 2024 to approximately USD 241.6 billion by 2030.

Major Players

- DP World

- AD Ports Group

- Agility Logistics

- Aramex

- DHL Supply Chain

- DB Schenker

- DSV‑Panalpina

- GAC Group

- Emirates Logistics / Emirates Post

- Century Express

- Gulftainer / Momentum Logistics

- Al‑Futtaim Logistics

- Kuehne + Nagel

- CEVA Logistics

- TCS Express

Key Target Audience

- Strategic investments and venture capitalist firms

- Sovereign wealth & infrastructure investors

- Major e‑commerce retailers & fulfilment arms

- Cold‑chain pharmaceutical distributors

- Multi‑national import/export corporations

- Emirates Free‑zone authorities (e.g. JAFZA, KEZAD)

- Airport & port operators (e.g. DP World, Dubai Airports)

- Government and regulatory bodies (e.g. UAE Ministry of Economy, Federal Customs Authority)

Research Methodology

Step 1: Identification of Key Variables

An initial ecosystem map was constructed covering stakeholders across multimodal freight, warehousing, free‑zones, and e‑commerce. Extensive secondary research from customs data, DP World, JAFZA, Etihad Rail, industry databases defined core variables.

Step 2: Market Analysis and Construction

Historical data from 2019–2023 was analyzed using top‑down and bottom‑up approaches. Revenue by segment (transport, warehousing, forwarding) and volume indicators (TEU, ton‑km, sq ft capacity) were reconciled to build consistent estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on drivers (e‑commerce, rail, free‑zones) were validated using CATI and interviews with logistics managers in UAE, free‑zone authorities, port operators and leading 3PL providers to triangulate figures.

Step 4: Research Synthesis and Final Output

Direct engagement with major logistics players and free‑zone operators provided segment-level insights into freight flows, capacity utilization, cold‑chain and digital integration, refining the bottom‑up estimates and ensuring final validity for the UAE logistics market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In‑Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players (DP World, AD Ports, Aramex, Agility, etc.)

- Business Cycle (Import, Export, Domestic Distribution, Reverse Logistics)

- Supply Chain and Value Chain Analysis (Port‑to‑Warehouse‑to‑Last Mile; Bonded & Free‑zone Linkages)

- By Value (AED / USD), 2019-2024

- By Volume (TEUs, ton‑km, sq ft warehousing capacity), 2019-2024

- By Average Price (Freight rate per ton‑km, warehouse rent per sq ft), 2019-2025

- By Service Type (In Value %)

Freight Forwarding

Warehousing

Third Party Logistics (3PL)

Value Added Service

Courier, Express, and Parcel (CEP) - By Service Provider Model (In Value %)

2PL

3PL

4PL - By Customer Vertical (In Value %)

E‑Commerce & Retail

Healthcare & Pharma

Food & Beverage

Manufacturing & Industrial

Oil & Gas - By Geography/Free‑zone Region (In Value %)

Dubai – JAFZA

Abu Dhabi – KEZAD / AD Ports

Sharjah Inland Container Depot

Fujairah Corridor

- Executive Summary

- UAE Warehousing Ecosystem (free-zone & on-shore developers, 3PLs/contract logistics, cold-chain operators, automation vendors)

- Value Chain Analysis of Warehousing (inbound → receiving → storage → VAS → pick/pack → dispatch → returns)

- Trends in UAE Warehousing (build-to-suit in KEZAD/JAFZA, micro-fulfilment near urban nodes, WMS/robotics, ESG retrofits)

- Commercial Models in UAE Warehousing (dedicated BTS, multi-client shared, bonded, temperature-controlled, fulfillment centers)

- Technological Advancements in Warehousing (AS/RS, AMRs, put-to-light, yard management, digital twins, energy optimization)

- Cold-Chain & Pharma Warehousing Overview (GDP compliance, lane certification, reefer cross-docking)

- E-commerce Fulfilment Business Model (SLA-based pick-pack-ship, returns, marketplace integration, last-mile orchestration)

- Major Operational Challenges (land availability near ports/airports, peak season capacity, labor productivity, utility load)

- Key Benefits of Automated & Green Warehouses (throughput gains, order accuracy, energy savings, compliance)

- Cross Comparison – Major Warehouse Developers/3PL Facility Portfolios (total sq ft, temperature-controlled m³, automation level, proximity to port/airport, WMS tier, ESG certifications, fire-life safety spec, ramp/door density)

- UAE Warehousing Market Size (USD Billion), 2019-2024

Market Segmentation, 2024:

– By Facility Type (Ambient, Temperature-Controlled, Bonded, Bulk/Open-yard, Fulfilment Centers)

– By Ownership/Operating Model (Build-to-Suit, Leased Multi-Client, Dedicated Contract Logistics, Free-zone vs On-shore) - UAE Warehousing Future Market Size (USD Billion), 2025-2030

- Executive Summary

- UAE 3PL Ecosystem (integrators, regional 3PLs, niche cold-chain/healthcare specialists, CEP tie-ups, free-zone partners)

- Value Chain Analysis of 3PL Services (transport, warehousing, VAS, customs brokerage, returns, control tower)

- Trends in 3PL Contracts (long-term CL contracts, performance-based SLAs, sector-specific playbooks, near-shoring)

- Commercial Models (management fee + pass-through, open-book, gain-share, hybrid)

- Technological Advancements in 3PL (TMS/WMS integration, OMS for e-commerce, IoT temp logging, API to ATLP/MAQTA)

- Sector Playbooks Overview (Pharma GDP, F&B cold-chain, Retail omnichannel, O&G project logistics, Automotive after-market)

- 3PL Business Model & Network Design (hub-and-spoke across JAFZA-KEZAD-DWC, cross-dock, pooled transport)

- Key Challenges Leading to 3PL Outsourcing (capex for automation, skill gaps, customs complexity, variability in demand)

- Benefits of 3PL Partnerships (scalability, faster time-to-serve, compliance depth, digital visibility, risk-sharing)

- Cross Comparison – Major 3PLs in UAE (vertical coverage, network nodes, cold-chain m³, e-commerce capabilities, SLA performance, tech stack depth, sustainability program, regional re-export reach)

- UAE 3PL Market Size (USD Billion), 2019-2024

- Market Segmentation, 2024:

– By Vertical (E-commerce & Retail, Pharma/Healthcare, F&B, Industrial/Manufacturing, Oil & Gas, Automotive)

– By Service Bundle (Transport-only, Warehousing-only, Contract Logistics End-to-End, Customs Brokerage-led Solutions) - UAE 3PL Future Market Size (USD Billion), 2025-2030

- Executive Summary

- UAE Freight Forwarding Ecosystem (DP World, AD Ports Group, JAFZA, KEZAD, DAFZA, DWC, airlines, shipping lines, customs authorities)

- Value Chain Analysis of Freight Forwarding (shipper → consolidator → carrier booking → customs/bonded → last-mile)

- Trends in UAE Multimodal Transportation (trans-shipment via Jebel Ali, sea-air via DWC/DXB, digital documentation, sustainability)

- Commercial Models in UAE Transportation Market (port-to-door, door-to-port, hub-and-spoke, sea-air interline)

- Technological Advancements in Freight Forwarding (e-AWB, eBL, API with ATLP/NAU, IoT tracking, control towers)

- Digital Freight Aggregator Market Overview (platforms integrating ocean/air/road rates, instant quotes, capacity visibility)

- Digital Truck Aggregators Business Model (spot marketplace, contract lanes, dynamic routing, proof-of-delivery)

- Major Challenges Driving the Rise of Digital Freight Platforms (rate volatility, documentation errors, dwell time, empty miles)

- Major Benefits of Digital Freight Aggregator Platforms (faster quoting, milestone visibility, automated compliance, analytics)

- Cross Comparison – Major Digital Freight Aggregators (coverage of modes, UAE lane density, customs integration, SLA, visibility depth, pricing transparency, fintech offerings, SME onboarding)

- UAE Freight Forwarding Market Size (USD Billion), 2019-2025

- Market Segmentation by Type of End-users, 2021 (Retail & E-commerce, Pharma/Healthcare, Oil & Gas, Automotive & Spare Parts, Industrial/Manufacturing, Others) and by Type of Mode, 2024 (Sea, Air, Road, Rail/Multimodal)

- UAE Freight Forwarding Future Market Size (USD Billion), 2025-2030

- Executive Summary

- UAE VAS Ecosystem (kitting/assembly providers, labeling/serialization, returns processing, refurbishment, light manufacturing)

- Value Chain of VAS (pre-inbound prep → postponement → customization → compliance labeling → reverse logistics)

- Trends in VAS (postponement for GCC re-exports, SKU personalization, bonded re-work, sustainability-driven refurbish)

- Commercial Models (per-activity tariff, per-order, per-SKU, project-based, gain-share on cost avoidance)

- Technological Advancements (MES-lite within warehouse, vision QC, serialization for pharma, IoT for condition tracking)

- Customs & Compliance VAS Overview (re-export documentation, HS classification support, COO management, bonded re-packing)

- Reverse Logistics & Repairs Business Model (triage, grading, refurbishment, certified disposal)

- Challenges Driving VAS Adoption (high import lead times, SKU proliferation, retail seasonality, returns rate in e-commerce)

- Benefits of VAS (inventory reduction via postponement, faster speed-to-shelf, compliance readiness, better NPS)

- Cross Comparison – VAS Providers (service breadth, regulated sector readiness, throughput per shift, quality yield, IT integration depth, facilities in free-zones, ESG practices, repair/refurb capability)

- UAE VAS Market Size (USD Billion), 2019-2024

- Market Segmentation, 2024

– By VAS Type (Kitting & Assembly, Labeling & Serialization, Packaging & Re-packing, Reverse Logistics & Repairs, Cross-docking & Consolidation)

– By End-user (E-commerce & Retail, Pharma/Healthcare, F&B, Electronics, Automotive Aftermarket) - UAE VAS Future Market Size (USD Billion), 2025-2030

- Executive Summary

- UAE CEP Ecosystem (integrators, postal operator, regional express players, last-mile tech platforms, lockers/PUDs)

- Value Chain Analysis of CEP (first-mile → sortation → line-haul → last-mile → returns)

- Trends in CEP (same-day/next-day standardization, PUDO networks, cross-border DDP solutions, cashless COD, lockers)

- Commercial Models (per-shipment tariff, tiered SLA, volumetric slabs, subscription for SMEs, cross-border bundles)

- Technological Advancements (route optimization, address intelligence, shipment-level tracking, returns portals, locker APIs)

- CEP for Cross-border E-commerce (duty-paid solutions, bonded fulfillment, multi-origin consolidation, reverse pipelines)

- Urban Micro-Fulfilment & Hyperlocal Delivery Model (dark stores, bike fleets, temperature-controlled last-mile)

- Challenges Catalyzing Digital Last-mile Platforms (failed delivery rate, address ambiguity, peak seasonal spikes, rider churn)

- Benefits of Advanced CEP Networks (higher first-attempt success, shorter door-to-door, improved CX, lower return-to-origin)

- Cross Comparison – Major CEP Players (network coverage, delivery speed tiers, international reach, failed-delivery ratio, locker/access point count, tech stack, returns handling, sector certifications)

- UAE CEP Market Size (USD Billion), 2019-2024

- Market Segmentation, 2024:

– By Customer Type (B2B, B2C, C2C)

– By Service Speed (Same-day, Next-day, Economy/International) - UAE CEP Future Market Size (USD Billion), 2025-2030

- Growth Drivers

Strategic Trade Location between Asia, Europe & Africa

Expansion of E‑commerce Fulfilment

Investment in Cold‑Chain & Pharma Corridors

Rail & Multi‑modal Integration (Etihad Rail Links)

Free‑zone Infrastructure Expansion - Market Challenges

High Land & Operating Costs in Prime Free‑zones

Regulatory Complexity Across Emirates

Intense Competition Among 3PL Providers

Skilled Workforce Shortages in Automation & Cold‑chain Handling - Opportunities

Growth in Cross‑border E‑commerce Fulfilment

Green Logistics & Sustainable Warehousing

High‑value Temperature‑controlled Storage Demand - Trends

Warehouse Automation & Robotics Adoption

Blockchain for Trade Documentation

Digital Freight Marketplaces Integration - Government Regulation

Free‑zone Customs Structuring

VAT Implementation and Compliance

Import/Export Licensing Rules - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision‑Making Process

- Market Share of Major Players on the Basis of Value/Volume

Market Share of Major Players by Logistics Service Segment - Cross Comparison Parameters (Company Overview, Service Portfolio, Cold‑Chain Capacity in m³, TEU Throughput, Free‑zone Footprint, Digital Platform Integration, Number of Emirates Presence, Strategic Partnerships, Technology Differentiators)

- SWOT Analysis of Major Players

- Pricing Analysis Basis Service Type for Major Players in UAE Logistics & Warehousing Market

- Detailed Profiles of Major Companies

DP World

AD Ports Group (Maqta Gateway, AD Ports Logistics)

Gulftainer / Momentum Logistics

Agility Logistics

Al‑Futtaim Logistics

Aramex

DB Schenker

DHL (Express & Supply Chain)

DSV‑Panalpina

GAC Group

Emirates Logistics

TCS Express

APL / Global Shipping Lines

SkyNet / Skycom Express

Century Express

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030