Market Overview

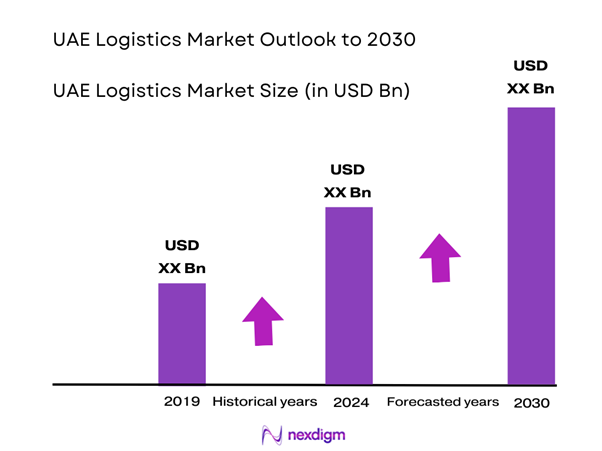

The UAE logistics market is valued at approximately USD 41.14 billion in 2025 with an approximated compound annual growth rate (CAGR) of 6.30% from 2025-2030, demonstrating significant growth driven by the rapid expansion of e-commerce, increasing trade activities, and strategic investments in infrastructure. The market is propelled forward by initiatives such as the Dubai Logistics City project, which aims to enhance logistics capabilities and streamline supply chains.

Dominant cities such as Dubai and Abu Dhabi are at the forefront of the UAE logistics market, benefitting from their strategic geographic location connecting Europe, Asia, and Africa. These cities serve as vital trade hubs, housing advanced logistics facilities that cater to multi-national companies. The establishment of free trade zones and streamlined customs processes in these locations enhances their attractiveness for businesses, making them pivotal players in the logistics landscape.

Investments in infrastructure development play a pivotal role in boosting the UAE’s logistics market. The UAE government allocated USD 203 billion to the transportation sector in its 2021-2030 budget, emphasizing improvements in logistics capabilities. Projects such as the Dubai Metro expansion and the Abu Dhabi Airport’s new terminal are set to enhance overall transport efficiency. Moreover, the 2022 updates to the National Transport Strategy further emphasize sustainable transport solutions to support the urban mobility framework, ensuring that the logistics sector is well-positioned for future demands.

Market Segmentation

By Mode of Transport

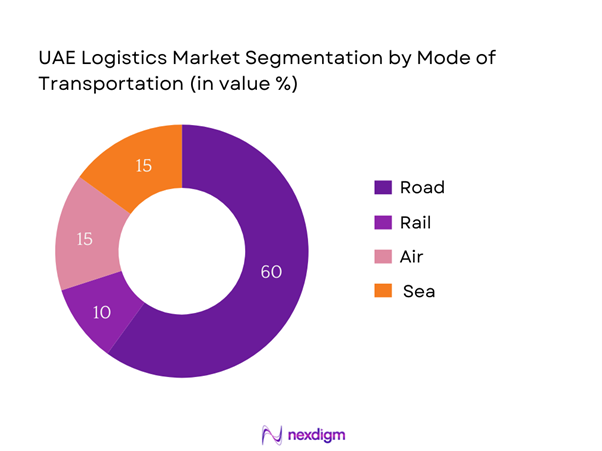

The UAE logistics market is segmented by mode of transport into road logistics, rail logistics, air logistics, and sea logistics. Among these, road logistics dominates the market share due to its flexibility and extensive reach for last-mile delivery. The UAE boasts a well-developed road network facilitating efficient freight movement across cities and to remote areas, reducing the time and cost associated with transportation. Leading logistics providers invest significantly in fleet expansion and route optimization technologies, cementing road logistics as the preferred mode for many businesses.

By Service Type

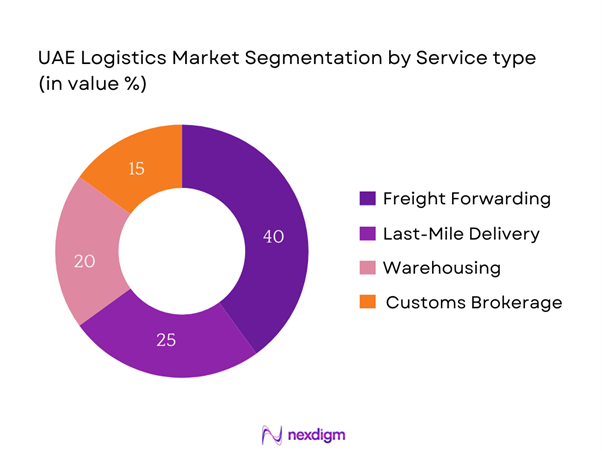

The UAE logistics market is also segmented by service type, which includes freight forwarding, last-mile delivery, warehousing, and customs brokerage. Freight forwarding holds a dominant position in the market, driven by the increasing international trade volumes and the demand for end-to-end supply chain solutions. As businesses expand their reach globally, they increasingly rely on freight forwarding services to streamline their logistics operations, manage customs clearance, and ensure timely delivery of goods. The integration of technology in freight forwarding processes, such as digital platforms that facilitate tracking and management, additionally boosts its market share.

Competitive Landscape

The UAE logistics market is characterized by intense competition, with several key players dominating the sector. Notable companies include Emirates Logistics, DP World, and Agility Logistics. These major players leverage their extensive networks and technological innovations to maintain a competitive edge. For instance, DP World is renowned for its significant investment in port infrastructure and smart logistics solutions, positioning itself as a leader in the logistics industry.

| Company | Establishment Year | Headquarters | Mode of Transport | Service Type | Technology Innovations | Market Position |

| Emirates Logistics | 2004 | Dubai | – | – | – | – |

| DP World | 2005 | Dubai | – | – | – | – |

| Agility Logistics | 1979 | Kuwait | – | – | – | – |

| Aramex | 1982 | Dubai | – | – | – | – |

| Kuehne + Nagel | 1890 | Switzerland | – | – | – | – |

UAE Logistics Market Analysis

Growth Drivers

Increasing E-commerce Penetration

The UAE has experienced a robust growth in e-commerce, which has escalated logistics demand. In 2021, the total value of e-commerce transactions in the UAE was USD 4.2 billion, and it is projected to reach approximately USD 8.5 billion by the end of 2025. The exponential rise in online shopping, driven by changing consumer preferences and the proliferation of digital payment solutions, is bolstering the logistics sector’s growth. The UAE’s internet penetration stood at around 99% in early 2023, further supporting this e-commerce boom, as more consumers turn to online platforms for their shopping needs.

Strategic Location as a Trade Hub

The UAE’s strategic geographic position between Europe, Asia, and Africa makes it a critical trade hub. In 2022, Dubai’s Jebel Ali Port was ranked among the top 10 container ports globally, handling over 14 million TEUs (Twenty-foot Equivalent Units) of cargo. This prime location facilitates regional and international trade, attracting numerous multinational logistics companies to set up operations in free zones. Additionally, the UAE’s extensive air and sea infrastructure, supported by over 300 daily flights and a network of more than 200 shipping routes, enhances its competitive advantage as a logistics gateway.

Market Challenges

High Operational Costs

High operational costs remain a significant challenge in the UAE logistics market. In 2023, fuel costs constituted about 30% of total operational expenses for logistics companies, stemming from fluctuating global oil prices. The UAE’s reliance on imported raw materials further exacerbates these costs, especially amid rising freight charges attributed to global supply chain disruptions. Additionally, limited labor availability has led to increased wage demands, contributing further to the logistics cost burden. These economic factors create pressure on profit margins for logistics companies operating in a dynamic and competitive environment.

Regulatory and Compliance Barriers

Navigating the regulatory framework can be complex for logistics firms in the UAE, posing potential barriers to efficiency. The UAE operates under various business and trade regulations, which can vary between free zones and the mainland. Compounded by a multitude of customs regulations and compliance requirements, businesses often face delays and increased costs in shipping. The introduction of stringent safety and environmental standards has further incentivized firms to upgrade their operations, leading to significant compliance expenditures that can stifle growth, especially for smaller enterprises.

Opportunities

Growth in the E-commerce Sector

The growing e-commerce sector presents substantial opportunities for logistics providers. Currently valued at USD 4.2 billion and expected to nearly double by end of 2025, e-commerce logistics is increasingly reliant on efficient last-mile solutions. Retail giants are restructuring their logistics frameworks to meet the rising consumer demand for fast delivery services. Furthermore, local initiatives, including the development of e-commerce logistics parks, aim to improve storage and distribution capabilities. This shift towards online shopping creates demand for innovative logistics solutions, enhancing growth potential in the sector.

Technological Advancements

The logistics industry is rapidly adopting technological innovations, offering opportunities for improved operational efficiencies. The adoption of IoT solutions is expected to rise significantly, with forecasts indicating approximately 50 million connected devices by end of 2025 in the logistics sector. Automation, including warehouse robotics and AI-driven analytics, has begun transforming supply chain processes, driving down costs and enhancing service delivery. Companies that leverage these technologies can create competitive advantages, making them more responsive to market changes and consumer demands.

Future Outlook

Over the next five years, the UAE logistics market is expected to experience substantial growth driven by increasing demand for efficient supply chain solutions, further technological advancements, and a growing trend toward sustainability in logistics operations. With e-commerce projected to expand significantly, logistics solutions will need to adapt to the evolving needs of consumers. Additionally, government initiatives aimed at fostering innovation and infrastructure development are likely to create new opportunities within the market, strengthening the overall logistics ecosystem.

Major Players

- Emirates Logistics

- DP World

- Agility Logistics

- Aramex

- Kuehne + Nagel

- Hellmann Worldwide Logistics

- FedEx Express

- DHL Supply Chain

- Cegelec

- Abu Dhabi Ports

- Gulftainer

- Juma Al Majid Group

- National Marine Dredging Company

- Al-Futtaim Logistics

- JAS Forwarding

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Ministry of Economy, Federal Transport Authority)

- Logistics and Supply Chain Managers

- E-commerce Businesses

- Retail Businesses

- Manufacturing Companies

- Freight Forwarding Agents

- Technology Solution Providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the UAE logistics market. This step utilizes extensive desk research, integrating a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics such as transportation preferences, service requirements, and regulatory impacts.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data related to the UAE logistics market. This includes assessing market penetration for various logistic services, evaluating the ratio of various transportation modes to service providers, and understanding revenue generation. Additionally, an evaluation of service quality metrics will be conducted to ensure reliability and accuracy in revenue estimates while identifying trends affecting the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through direct consultations with industry experts, using computer-assisted telephone interviews (CATIs). These discussions will involve representatives from diverse companies in the logistics sector and will provide valuable operational and financial insights, contributing significantly to refining the data and affirming the hypotheses formed about market conditions and trends.

Step 4: Research Synthesis and Final Output

The final phase involves engaging directly with multiple logistics service providers to acquire granular insights into product segments, sales performance, and consumer preferences. This interaction is essential to verify and complement the statistics derived from the top-down and bottom-up approach employed earlier in the research, ensuring a comprehensive, accurate, and validated analysis of the UAE logistics market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing E-commerce Penetration

Strategic Location as a Trade Hub

Infrastructure Development Investments - Market Challenges

High Operational Costs

Regulatory and Compliance Barriers - Opportunities

Growth in the E-commerce Sector

Technological Advancements - Trends

Sustainable Logistics Practices

Digitalization in Supply Chain Management - Government Regulation

Trade Policies

Safety and Compliance Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Mode of Transport (In Value %)

Road Logistics

– Full Truck Load (FTL)

– Less-than-Truck Load (LTL)

– Temperature-Controlled Road Transport

Rail Logistics

– Bulk Cargo Rail Transport

– Containerized Rail Services

– Intermodal Rail Solutions

Air Logistics

– Express Air Freight

– Scheduled Cargo Flights

– Charter Services for High-Value Goods

Sea Logistics

– Full Container Load (FCL)

– Less-than-Container Load (LCL)

– Refrigerated Shipping (Reefer)

– Ro-Ro (Roll-on/Roll-off) Services - By Service Type (In Value %)

Freight Forwarding

– International Freight Forwarding

– Domestic Freight Forwarding

– Multimodal Transport Solutions

Last-Mile Delivery

– Same-Day Delivery

– Next-Day Delivery

– Scheduled Deliveries for B2B/B2C

Warehousing

– General Warehousing

– Cold Storage Warehousing

– Bonded Warehousing

Customs Brokerage

– Import Clearance

– Export Documentation

– Duty and Compliance Management - By End-User Industry (In Value %)

E-commerce

– B2C Fulfillment

– Reverse Logistics

– Omnichannel Delivery

Retail

– Hypermarkets & Supermarkets Supply Chain

– Fashion and Apparel Logistics

– Electronics Retail Supply Chain

Manufacturing

– Inbound Logistics

– Just-in-Time (JIT) Logistics

– Parts & Components Distribution

Food & Beverage

– Cold Chain Management

– Perishable Goods Logistics

– Beverage Distribution Networks

Healthcare

– Pharmaceutical Cold Chain

– Medical Equipment Handling

– Clinical Supplies and Trial Logistics - By Region (In Value %)

Dubai

Abu Dhabi

Sharjah

Northern Emirates - By Technology (In Value %)

IoT-Enabled Logistics

– Smart Fleet Tracking

– Sensor-Based Warehouse Monitoring

– Predictive Maintenance via Telematics

Autonomous Vehicles

– Driverless Delivery Vans

– Automated Drones for Urban Delivery

– Pilot Projects for Autonomous Freight Trucks

Robotics in Warehousing

– Automated Guided Vehicles (AGVs)

– Robotic Pick-and-Pack Systems

– Conveyor and Sorting Robotics

Blockchain for Cargo Tracking

– Real-Time Shipment Visibility

– Tamper-Proof Ledger for Compliance

– Smart Contracts for Customs and Payments

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Distribution Channels, Number of Touchpoints and Service Locations, Fleet and Facility Infrastructure, Technology Adoption, Client Segments Served, Geographic Reach, Unique Value Offering, Sustainability Practices)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Emirates Logistics

DP World

FedEx Express

DHL Supply Chain

Agility Logistics

Aramex

Hellmann Worldwide Logistics

Kuehne + Nagel

Cegelec

Abu Dhabi Ports

National Marine Dredging Company

Gulftainer

Juma Al Majid Group

Al-Futtaim Logistics

JAS Forwarding

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030