Market Overview

The UAE machine learning in healthcare market is valued at USD ~ million in 2024, while credible local-market tracking of early deployments puts 2023 market at USD ~ million—a gap largely explained by differing scope (pilot deployments vs. broader AI/ML healthcare spend). Demand is being pulled by “data-ready” national health information exchange rails—Malaffi’s ~ clinical records and NABIDH’s ~ patient records across ~ facilities—which materially reduce friction for training, validation, and enterprise integration of ML models into care workflows.

Abu Dhabi and Dubai dominate adoption because they concentrate the UAE’s highest digital maturity providers, health data platforms, and AI infrastructure anchors. Abu Dhabi benefits from a strong public-health funding base and a dense innovation stack (including G42/M42 and national AI research capacity), while Dubai’s private hospital groups and medical tourism engine create fast ROI pathways for imaging AI, workflow automation, and patient-engagement ML. This is reinforced by the intensity of care activity in the two hubs—Abu Dhabi reporting ~ visits and Dubai ~ visits—which makes scale-out of ML-assisted triage, reporting turnaround optimization, and documentation automation commercially compelling.

Market Segmentation

By Use Case

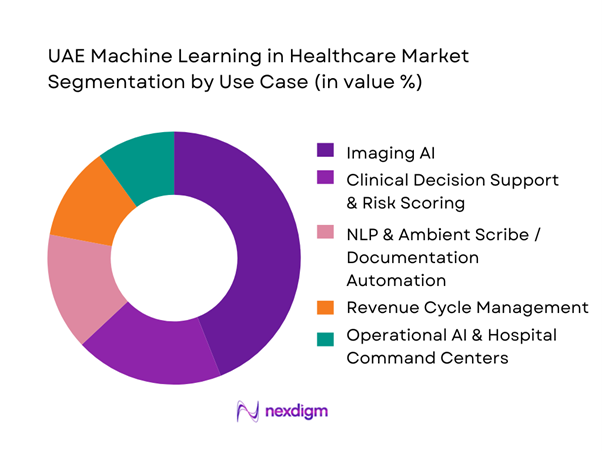

UAE machine learning in healthcare is segmented into imaging AI, clinical decision support, NLP/ambient scribe, RCM analytics, and operational command-center ML. Imaging AI dominates because radiology is the most “ML-ready” domain: data is standardized (DICOM), workflows are already digitized via PACS/RIS, and clinical validation pathways for imaging algorithms are more mature globally, reducing perceived risk for UAE providers. UAE hubs also face throughput pressure and high specialty demand, making faster radiology turnaround and triage economically attractive. Local HIE scale further enables model monitoring and enterprise rollouts across multi-site networks. Finally, medical tourism reinforces demand for high-volume diagnostics and specialty imaging—exactly where ML can deliver measurable productivity improvements without requiring full EHR re-architecture on day one.

By Deployment Model

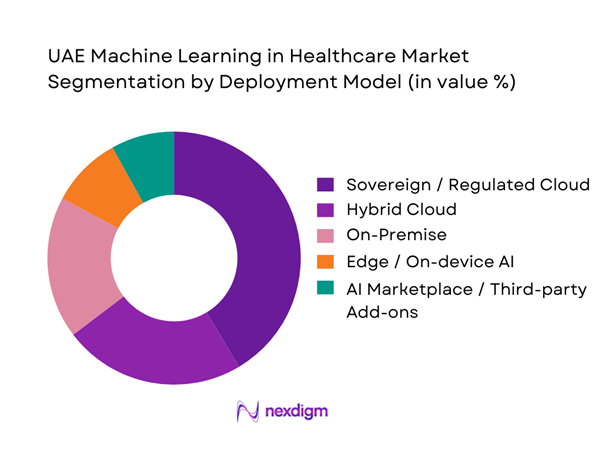

UAE machine learning in healthcare is segmented into on-premise, sovereign/regulated cloud, hybrid, edge inference, and AI marketplace add-ons. Sovereign/regulated cloud leads because UAE healthcare AI must align with privacy, data residency, and security expectations—PDPL plus emirate-level controls and cybersecurity governance (e.g., ADHICS) materially shape procurement. Regulated cloud reduces time-to-scale for imaging AI, CDS, and workflow automation by providing elastic compute for inference and monitoring while keeping hosting within approved jurisdictions and local data centers. It also lowers upfront CapEx for mid-sized providers that want ML capabilities but lack specialized infrastructure teams. Hybrid follows as a pragmatic transition state for providers modernizing legacy HIS/EHR stacks. On-prem remains relevant for highly sensitive workflows and legacy deployments, while edge and marketplace models are emerging as integration patterns mature.

Competitive Landscape

The UAE machine learning in healthcare market is relatively concentrated: global medtech and health IT incumbents anchor enterprise deployments through imaging platforms and EHR/HIS integrations, while specialist AI vendors win use-case “wedges” (stroke triage, chest imaging, oncology/pathology AI) and then expand via partnerships with major UAE provider groups. Entry barriers are driven by clinical validation requirements, integration depth (RIS/PACS/EHR/HIE), and compliance posture for regulated deployment.

| Company | Est. year | HQ | UAE go-to-market motion | ML strength area | Typical integration layer | Deployment preference | Regulatory posture | Signature buyer groups |

| M42 (G42 Healthcare + Mubadala Health) | 2023 | Abu Dhabi, UAE | ~ | ~ | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Erlangen, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| GE HealthCare | 1994 | Milwaukee, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Philips (Healthcare) | 1891 | Eindhoven, Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| Aidoc | 2016 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Machine Learning in Healthcare Market Analysis

Growth Drivers

Expansion of Unified Patient Records and HIE Connectivity

The expansion of unified patient records and health information exchange (HIE) platforms in the UAE has created a robust foundation for machine learning deployments in healthcare. Abu Dhabi’s Malaffi HIE has reached ~ clinical records, encompassing ~ unique patient profiles connected across ~ healthcare facilities and accessed by over ~ authorised clinical users, including doctors, nurses, and allied health professionals. This level of data aggregation significantly accelerates machine learning model training and validation because comprehensive, longitudinal patient histories—spanning diagnoses, treatments, labs, imaging, and medications—are available for advanced analytics and predictive modeling in real time. In addition, national efforts in integrating Riayati, Malaffi, and Nabidh into a National Unified Medical Record further strengthen interoperability across emirates, enabling standardized, cross-facility data availability that reduces integration overheads for ML workflows. These unified records support advanced use cases such as risk scoring, readmission prediction, pharmacogenomics insights, and imaging analytics—areas that require large, diverse datasets to deliver reliable and clinically meaningful outputs. The practical availability of billions of records with radiology images and integrated clinical data makes the UAE uniquely positioned to deploy machine learning systems at scale, especially in diagnostics and care optimization domains.

Imaging Volume Growth and Radiologist Productivity Needs

The rise in diagnostic imaging volume in the UAE presents a direct impetus for machine learning application, particularly in image analysis and workflow automation. Radiology examinations—including X-rays, CT scans, MRI, and ultrasounds—are systematically tracked in hospital data repositories, with official hospital reports showing radiology exam statistics segmented by facility and emirate. While specific national counts are published by Emirates Health Services’ open data program, they underscore the high throughput of imaging services that strain radiologist capacity and turnaround time. Advanced machine learning tools that automatically triage critical findings, assist in measurements, or pre-annotate studies can meaningfully reduce radiologist backlog and improve diagnostic throughput. The diagnostic imaging subsystem of Malaffi allows access to radiology image exchange from over ~ facilities, with millions of images shared across the network, enhancing the dataset available for algorithmic interpretation. Given the UAE healthcare ecosystem’s investments in modern MRI, CT, and digital X-ray platforms, the availability of large imaging volumes—both structured and unstructured—supports more comprehensive ML model training and quicker clinical deployment cycles. As radiology imaging remains a core referral and diagnostic discipline across UAE’s network of public and private hospitals, the need to improve radiologist productivity is a tangible growth driver for machine learning solutions tailored to imaging workflows.

Challenges

Clinical Safety, Bias Risk and Local Population Generalizability

A major challenge for machine learning deployment in UAE healthcare is ensuring clinical safety and population-specific accuracy. The UAE’s demographic structure is highly diverse, with nearly ~ expatriate population, representing varied ethnic, genetic, and lifestyle profiles. Models trained on homogeneous datasets risk bias and reduced predictive accuracy across this multi-ethnic patient base. UAE healthcare regulators require demonstrable clinical validation, yet local longitudinal datasets remain relatively young compared to mature markets. The Ministry of Health and Prevention emphasizes patient safety governance, increasing scrutiny on algorithmic decision support. From a macro lens, the UAE’s healthcare workforce includes ~ nationalities, increasing variability in clinical practice patterns that ML systems must adapt to. Ensuring safe deployment requires continuous retraining and monitoring—raising implementation complexity and slowing procurement cycles.

Data Governance, Consent and Cross-Entity Data Sharing Constraints

Machine learning programs in UAE healthcare face a structural constraint: governance and consent management must work across multiple legal entities, emirate systems, and data controllers—and the compliance load is non-trivial when models require longitudinal, multi-provider records. The UAE’s Federal Decree-Law No. ~ (PDPL) has been in force since ~ and sets obligations around lawful processing, safeguarding, and recordkeeping, which directly affects ML workflows that involve model training, re-training, monitoring, and third-party processing. In Dubai alone, NABIDH’s exchange connects ~ healthcare facilities, meaning consent logic, access controls, audit trails, and “who can see what” rules must scale across a very large provider graph—especially for cross-facility ML use-cases such as readmission prediction, longitudinal chronic risk scoring, or multi-site imaging analytics. The macro environment makes the governance problem bigger, not smaller: the UAE’s population is ~ and the economy is large enough to sustain high data velocity, with GDP of USD ~ billion, translating into continuous healthcare utilization, claim events, imaging events, and medication events that ML systems want to learn from.

Opportunities

Emirate-Scale Predictive Risk Programs Integrated into HIEs

A significant opportunity lies in deploying predictive risk models at emirate scale using existing HIE infrastructure. Malaffi and NABIDH already aggregate billions of clinical datapoints, enabling system-wide risk stratification for chronic disease, emergency admissions, and preventive screening. Abu Dhabi’s public health programs monitor millions of insured residents, offering centralized deployment potential for ML-driven early warning systems. Government healthcare spending exceeding USD ~ billion supports long-term digital health investments without reliance on short-term ROI cycles. Integrating ML directly into HIE layers allows consistent application across public and private providers, creating unified population health intelligence. This positions the UAE uniquely to operationalize predictive analytics beyond individual hospitals and toward regional health management.

Imaging AI Expansion Beyond Triage

Beyond emergency triage, imaging AI presents strong expansion potential into quantitative diagnostics and workflow automation. UAE imaging centers generate millions of scans annually, spanning oncology, cardiology, neurology, and orthopedics. Government investment in advanced imaging infrastructure—including MRI and CT installations—continues to rise as part of healthcare modernization. Machine learning applications for lesion quantification, disease progression tracking, and structured reporting can significantly enhance clinical decision support. With high diagnostic volumes concentrated in Abu Dhabi and Dubai, scale deployment becomes operationally feasible. This evolution from alert-based AI to full diagnostic augmentation represents a major value-creation opportunity grounded in existing clinical activity rather than speculative demand.

Future Outlook

Over the next five to six years, the UAE machine learning in healthcare market is expected to expand rapidly as providers move from pilots to scaled, multi-facility deployments. The growth engine will increasingly shift from “single-module AI” to platformized ML embedded across imaging, clinical decision support, documentation automation, and operational analytics. Sovereign cloud capacity, stronger interoperability across HIE rails, and procurement patterns that prioritize measurable outcomes will define vendor selection. Abu Dhabi and Dubai will remain the anchor hubs, with Sharjah and the Northern Emirates following as reference architectures mature and localized implementation capacity expands.

Major Players

- Siemens Healthineers

- GE HealthCare

- Philips

- Agfa HealthCare

- Sectra

- InterSystems

- Oracle Health

- Aidoc

- Qure.ai

- Viz.ai

- Annalise.ai

- Lunit

- M42

- Prognica Labs

Key Target Audience

- Government and regulatory bodies

- CIO/CMIO offices of public provider networks

- Chief Digital/Innovation leaders in private hospital groups

- Health Information Exchange operators and data platform leadership

- Payers, insurers and TPAs

- Diagnostic imaging chain leadership

- Cloud and sovereign infrastructure stakeholders serving healthcare

- Investments and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

We begin by mapping the UAE machine learning in healthcare ecosystem across demand-side and supply-side participants. Desk research is used to define variables such as deployment models, regulated use cases, integration depth, and compliance requirements.

Step 2: Market Analysis and Construction

We construct the market using historical commercialization signals—enterprise deployments, imaging AI module rollouts, and platform contracts—then align these with infrastructure readiness indicators. We analyze where ML is monetized to avoid double counting across platforms.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on segment dominance, pricing logic, and procurement cycles are validated via structured expert conversations. We triangulate buyer requirements around validation evidence, workflow fit, data governance, and time-to-value to refine adoption curves and competitive positioning.

Step 4: Research Synthesis and Final Output

We synthesize findings into a bottom-up and top-down reconciliation. Outputs are reviewed for internal consistency across segments and for alignment with UAE-specific regulatory constraints and infrastructure realities.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Scope Boundary Conditions, Market Sizing Approach, Triangulation Logic, Primary Interview Program Design, KOL and Clinical Validation Inputs, Vendor Revenue Mapping, Buyer Spend Mapping, Use-Case Adoption Scoring, Regulatory and Policy Benchmarking, Data Reliability and Limitations, Sensitivity Analysis, Key Conclusions)

- Definition and Scope

- Market Genesis and Adoption Context

- UAE Digital Health Rails and Data Readiness

- ML Adoption Lifecycle in UAE Healthcare

- Supply Chain and Value Chain Analysis

- Business Cycle and Budgeting Cadence

- Growth Drivers

Expansion of Unified Patient Records and HIE Connectivity

Imaging Volume Growth and Radiologist Productivity Needs

Chronic Disease Burden and Preventive Screening Push

Hospital Throughput Optimization

Payer Focus on Claims Integrity and Medical Cost Containment - Challenges

Clinical Safety, Bias Risk and Local Population Generalizability

Data Governance, Consent and Cross-Entity Data Sharing Constraints

Interoperability Gaps

Model Monitoring, Drift and Accountability

Procurement Friction - Opportunities

Emirate-Scale Predictive Risk Programs Integrated into HIEs

Imaging AI Expansion Beyond Triage

Clinical Documentation Intelligence

Remote Monitoring and ML for Post-Acute and Chronic Pathways

Life Sciences Real-World Evidence Enablement - Trends

Responsible AI Standards and Model Governance

Sovereign and Local Hosting Requirements

Shift from Point AI to Enterprise Clinical AI Platforms

Multimodal AI Adoption

Workflow-Native AI Integration - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Buyer Type, 2019–2024

- By Use-Case Cluster, 2019–2024

- By Deployment Mix, 2019–2024

- By Revenue Model Mix, 2019–2024

- By Application (in Value %)

Clinical Decision Support ML

Medical Imaging AI

Population Health and Risk Stratification

Revenue Cycle, Claims and Fraud Analytics

Patient Flow, Capacity and Workforce Optimization - By End-Use Industry (in Value %)

Multi-specialty Hospitals and Hospital Groups

Specialty Centers

Diagnostic Labs and Imaging Centers

Health Insurers and TPAs

Public Health Programs and Screening Initiatives - By Technology Architecture (in Value %)

Structured EHR Data

Medical Imaging Data

Pathology and Digital Histology

Claims and Billing Data

Remote Monitoring and Patient-Generated Data - By Connectivity Type (in Value %)

On-Premise

Cloud

Hybrid

Embedded-in-EMR

API-First and Standalone Platforms - By Region (in Value %)

Abu Dhabi

Dubai

Sharjah

Northern Emirates

- Market Share of Major Players by Value

- Cross Comparison Parameters (Emirate-level deployment footprint, regulatory readiness and compliance posture, integration depth with national digital health rails, clinical validation strength, model governance and MLOps maturity, data hosting and security architecture, workflow embedment and adoption enablement, commercial model and value realization)

- SWOT Analysis of Major Players

- Pricing and Commercial Model Analysis

- Detailed Profiles of Major Companies

M42

G42 Healthcare

PureHealth

Oracle Health

Epic Systems

Microsoft

Google Cloud

Amazon Web Services

NVIDIA

IBM Merative

SAS

Siemens Healthineers

GE HealthCare

Philips

Qure.ai

- Demand and Utilization Patterns

- Procurement and Budget Allocation Structures

- Decision-Making Unit Mapping

- Needs, Pain Points and Adoption Barriers

- Vendor Selection Criteria

- Implementation Journey

- By Value, 2025–2030

- By Buyer Type, 2025–2030

- By Use-Case Cluster, 2025–2030

- By Deployment Mix, 2025–2030

- By Revenue Model Mix, 2025–2030