Market Overview

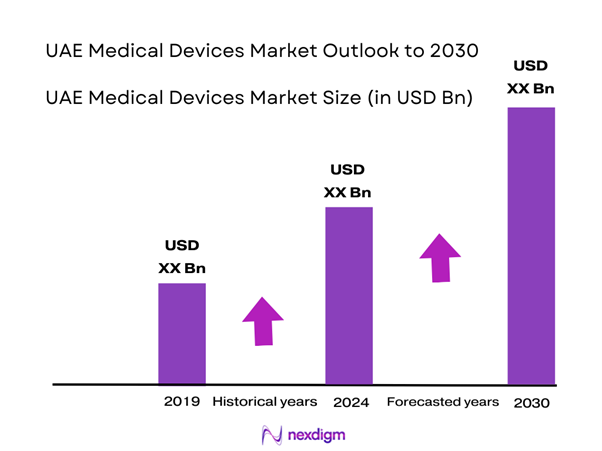

The UAE medical devices market is valued at USD 3.8 billion in 2024 with an approximated compound annual growth rate (CAGR) of 8.87% from 2024-2030, propelled by a healthcare industry experiencing rapid growth due to increased government healthcare spending and technological innovations. The market is supported by the rising prevalence of chronic diseases, an aging population, and a shift towards preventive healthcare. Expanding access to healthcare services and a robust supply chain further drive market dynamics, facilitating the availability of advanced medical technologies.

Key cities dominating the UAE medical devices market include Dubai and Abu Dhabi, primarily due to their strategic location as healthcare hubs in the Middle East. Dubai’s modern infrastructure and growing medical tourism, combined with Abu Dhabi’s focus on healthcare excellence and innovation, contribute to their prominence. These cities attract investments, foster partnerships with global medical device firms, and undertake initiatives to enhance healthcare accessibility, thereby strengthening their market position.

The rapid progress in medical technology, spearheaded by innovation in diagnostics, imaging, and patient monitoring solutions, significantly drives the UAE medical devices market. Spending on healthcare R&D is projected to exceed AED 10 billion by end of 2025, facilitating the adoption of advanced medical technologies. Notable advancements include the introduction of minimally invasive surgical techniques and telemedicine solutions that enhance patient access and care delivery.

Market Segmentation

By Product Type

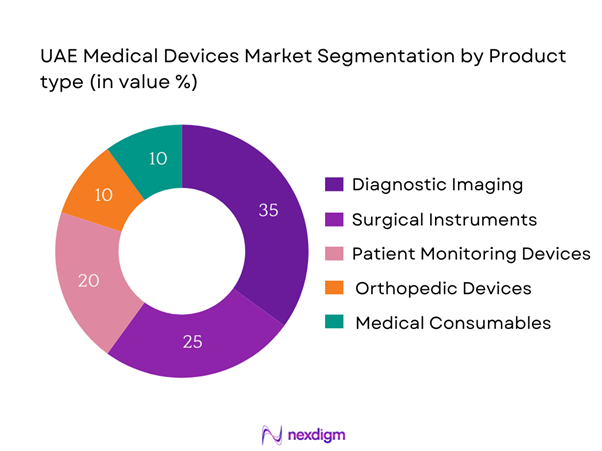

The UAE medical devices market is segmented by product type into diagnostic imaging, surgical instruments, patient monitoring devices, orthopedic devices, and medical consumables. The diagnostic imaging segment dominates the market primarily because of advancements in imaging technologies, including MRI, CT scans, and ultrasound systems, which are increasingly adopted in hospitals and clinics across the UAE. The dominance of the diagnostic imaging segment can be attributed to the increasing emphasis on early disease detection and the growing number of healthcare facilities equipped with advanced imaging systems. The rise in the number of accredited facilities and a growing population requiring regular diagnostic services further bolster this segment’s market share.

By Application

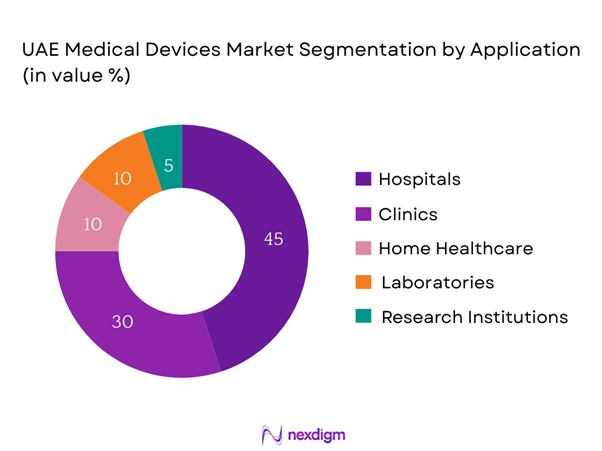

The market is also segmented by application into hospitals, clinics, home healthcare, laboratories, and research institutions. Hospitals account for the largest share due to their vast consumption of medical devices for various medical procedures and patient care. Hospitals lead this segment primarily due to their extensive resource allocation towards purchasing advanced medical equipment that enhances patient outcomes. Increased government funding in healthcare infrastructure and rising patient volumes seeking treatment further cement hospitals’ position as a dominant consumer of medical devices.

Competitive Landscape

The UAE medical devices market features several key players, contributing to a competitive landscape that significantly influences market trends and growth. The UAE medical devices market is dominated by major players such as GE Healthcare, Siemens Healthineers, and Philips Medical Systems. These companies leverage their extensive product portfolios, advanced technologies, and strong distribution networks to maintain a competitive edge in the market. The market consolidation reflects their strategic partnerships and ongoing innovation, which are critical for meeting the evolving medical needs in the region.

| Company | Establishment Year | Headquarters | Market Focus | Product Range | R&D Investment |

| GE Healthcare | 1892 | Chicago, USA | – | – | – |

| Siemens Healthineers | 1847 | Erlangen, Germany | – | – | – |

| Philips Medical Systems | 1891 | Amsterdam, Netherlands | – | – | – |

| Medtronic | 1949 | Minneapolis, USA | – | – | – |

| Abbott Diagnostics | 1888 | Abbott Park, USA | – | – | – |

UAE Medical Devices Market Analysis

Growth Drivers

Aging Population

The aging population in the UAE poses a significant driver for the medical devices market. The population aged 65 and older is projected to reach approximately 1 million by end of 2025, constituting about 9% of the total population. This demographic shift leads to an increased demand for medical devices, particularly those related to chronic disease management. With the rise in age-related health issues such as cardiovascular diseases, diabetes, and mobility impairments, healthcare systems are compelled to invest in advanced medical technologies to cater to this vulnerable population segment. The increasing healthcare expenditure reflects the necessity to adapt to the changing demographic profile.

Increased Prevalence of Diseases

The rise in the prevalence of non-communicable diseases (NCDs) such as diabetes, hypertension, and obesity in the UAE is a key growth driver for the medical devices market. As per the World Health Organization, approximately 30% of adults in the UAE are afflicted with diabetes, and projections indicate that this number will continue to rise. Furthermore, the UAE recorded around 25% of its adult population classified as hypertensive in 2022. The burgeoning healthcare costs associated with NCD management underscore the importance of advanced medical technologies, prompting healthcare entities to enhance their investment in medical devices aimed at improved diagnosis and treatment.

Market Challenges

Regulatory Compliance

The regulatory landscape poses significant challenges for medical device manufacturers and distributors in the UAE. The Ministry of Health and Prevention (MoHAP) enforces strict regulatory requirements that include adherence to international quality standards and certifications. Compliance with the latest regulations often requires a considerable investment in quality management systems and regulatory submissions. Moreover, the time involved in obtaining necessary approvals and certifications can lead to delays in the product launch, thereby hindering market growth. In 2022, the UAE imposed fines on about 30% of non-compliant medical devices, highlighting the stringent regulatory environment that businesses must navigate.

High Import Tariffs

High import tariffs on medical devices remain a challenging factor for companies operating in the UAE market. The average import tariff for medical devices is around 5%, but this can vary significantly depending on the product category, leading to increased costs for manufacturers and distributors. A noteworthy impact was seen in 2022 when increased tariffs on specific medical equipment raised operational costs by approximately 10%, affecting pricing strategies for medical devices. The regulatory environment coupled with high tariffs constrains competition and can lead to delays in acquiring the latest technologies, as affordability becomes an issue for healthcare providers.

Opportunities

Expansion of Telemedicine

The COVID-19 pandemic has catalyzed the growth of telemedicine in the UAE, creating substantial opportunities for the medical devices market. In 2022, it was reported that telemedicine consultations increased by over 200%, reflecting the heightened acceptance of virtual healthcare services among patients. Current statistics indicate that around 40% of the population has utilized telehealth services. The UAE government is actively promoting telemedicine as part of its healthcare strategy, facilitating the integration of remote monitoring devices and digital health solutions. This trend signals a shift towards more convenient and efficient healthcare delivery, creating a robust market for telehealth-related medical devices in the coming years.

Surge in Health Consciousness

A growing trend in health consciousness among the UAE population is driving the demand for innovative medical devices, particularly wearable fitness and health monitoring devices. Reports indicate that the fitness tracker market in the UAE reached USD 120 million in 2022, marking a significant increase in consumer interest. This surge is fueled by increasing awareness of preventive healthcare and wellness, as UAE residents seek to actively monitor their health indicators like heart rate, activity levels, and sleep patterns. Initiatives by health authorities to promote a healthier lifestyle, alongside the popularity of fitness apps and devices, underline an emerging market for wearables that offer real-time health tracking and analytics aimed at enhancing overall wellness.

Future Outlook

Over the next five years, the UAE medical devices market is anticipated to witness robust growth driven by continuous advancements in medical technology, increased healthcare expenditure by the government, and a growing population with rising healthcare demands. The proliferation of innovative healthcare solutions, coupled with the expansion of telehealth and digital health tools, is expected to reshape the market landscape. Growing awareness among consumers regarding health and wellness will also significantly influence market dynamics, fostering a demand for modern healthcare infrastructure and devices.

Major Players

- GE Healthcare

- Siemens Healthineers

- Philips Medical Systems

- Medtronic

- Abbott Diagnostics

- Johnson & Johnson

- Becton Dickinson

- Boston Scientific

- Stryker Corporation

- 3M Healthcare

- Terumo Corporation

- OMRON Corporation

- Schneider Electric

- Baxter International

- Smith & Nephew

Key Target Audience

- Healthcare Providers

- Hospitals Administration

- Medical Device Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Health Authority of Abu Dhabi, Dubai Health Authority)

- Home Healthcare Services

- Research Institutions and Laboratories

- Medical Distributors and Wholesalers

Research Methodology

Step 1: Identification of Key Variables

This step involves constructing a comprehensive ecosystem map that identifies all significant stakeholders within the UAE medical devices market. Extensive desk research is employed to gather critical industry-level information from secondary databases, ensuring an accurate portrayal of key market variables. The aim is to delineate and define the variables that exert influence over market dynamics.

Step 2: Market Analysis and Construction

During this phase, historical data is compiled and assessed concerning the UAE medical devices market. The analysis focuses on examining market penetration rates, the ratios of devices and services, and the ensuing revenue generation. An evaluation of service quality metrics is conducted to affirm the reliability of the revenue estimates, ensuring they reflect true market conditions.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and put to the test through direct consultations with industry experts representing a diverse range of companies within the medical device sector. These consultations are facilitated through methods such as computer-assisted telephone interviews (CATIs), providing invaluable operational and financial insights from experienced practitioners, all of which play a critical role in verifying and refining market data.

Step 4: Research Synthesis and Final Output

In the final phase, detailed engagements with major medical device manufacturers are conducted. Insights related to product segments, sales performance, consumer preferences, and other relevant factors are collected to complement and verify statistics produced through the bottom-up approach. This interaction ensures a comprehensive and validated analysis of the UAE medical devices market, capable of supporting report conclusions effectively.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Historical Context

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain and Value Chain Assessment

- Growth Drivers

Aging Population

Increased Prevalence of Diseases

Technological Advancements - Market Challenges

Regulatory Compliance

High Import Tariffs - Opportunities

Expansion of Telemedicine

Surge in Health Consciousness - Key Trends

Rise of Wearable Devices

Focus on Minimally Invasive Procedures - Government Regulation

Regulatory Framework

Import and Export Policies - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Diagnostic Imaging

– X-ray Systems

– Ultrasound Machines

– Magnetic Resonance Imaging (MRI)

– Computed Tomography (CT) Scanners

– PET & SPECT Scanners

Surgical Instruments

– General Surgical Tools

– Minimally Invasive Instruments

– Robotic Surgical Devices

– Electrosurgical Equipment

– Endoscopic Devices

Patient Monitoring Devices

– Blood Pressure Monitors

– Electrocardiogram (ECG) Devices

– Pulse Oximeters

– Temperature Monitors

– Cardiac Monitors

Orthopedic Devices

– Joint Replacement Implants

– Spinal Devices

– Orthobiologics

– Trauma Fixation Devices

Medical Consumables

– Syringes & Needles

– Gloves and Gowns

– Catheters

– Bandages & Dressings

– Surgical Sutures - By Application (In Value %)

Hospitals

– Emergency & Trauma

– ICU/CCU Units

– Diagnostic Labs

– Surgical Suites

Clinics

– General Practice Clinics

– Specialty Clinics

– Day Surgery Centers

Home Healthcare

– Remote Patient Monitoring

– Chronic Care Equipment

– Mobility Aids

Laboratories

– Clinical Labs

– Diagnostic Centers

– Pathology Labs

Research Institutions

– Academic Medical Centers

– Biomedical Research Labs

– Device Testing Facilities - By Distribution Channel (In Value %)

Direct Sales

Distributors

Online Retail - By End-User (In Value %)

Healthcare Providers

– Public and Private Hospitals

– Specialty Clinics

– Diagnostic Labs

Patients

– Chronic Disease Management (e.g., diabetic kits, BP monitors)

– Post-operative Care Devices

– Mobility and Assistive Devices

Government Institutions

– Ministry of Health and Prevention (MoHAP)

– SEHA (Abu Dhabi Health Services Company)

– DHA (Dubai Health Authority)

– Armed Forces Medical Services - By Region (In Value %)

Abu Dhabi

Dubai

Sharjah

Northern Emirates

- Market Demand and Utilization Patterns

- Purchasing Power Dynamics

- Regulatory and Compliance Requirements

- Needs and Preferences of End Users

- Decision-Making Processes

- Market Share of Major Players by Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Unique Value Propositions, Market Reach, R&D Investments, Regulatory Compliance, Product Portfolio Breadth, Manufacturing Capabilities, After-Sales Service & Support Infrastructure, and Technology Integration)

- SWOT Analysis of Major Competitors

- Pricing Analysis of Key Players

- Detailed Profiles of Major Companies

GE Healthcare

Siemens Healthineers

Philips Medical Systems

Medtronic

Abbott Diagnostics

Johnson & Johnson

Becton Dickinson

Boston Scientific

Stryker Corporation

3M Healthcare

Terumo Corporation

OMRON Corporation

Schneider Electric

Baxter International

Smith & Nephew

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030