Market Overview

The UAE Mobile Cardiac Monitors market current size stands at around USD ~ million, reflecting sustained demand for ambulatory cardiac diagnostics across acute and remote care settings. The market is shaped by expanding adoption of continuous monitoring devices within clinical pathways, growing integration with digital health platforms, and increasing reliance on telemetry-enabled care models. Device utilization is embedded within cardiology-led diagnostic workflows and post-acute monitoring protocols, supported by service-based operating models and managed monitoring programs across care settings.

Demand concentration is highest in major urban healthcare hubs where tertiary hospitals, cardiac specialty centers, and private healthcare networks are clustered. Infrastructure maturity, availability of advanced diagnostic facilities, and higher penetration of connected care platforms drive stronger adoption in these cities. The ecosystem benefits from centralized procurement systems, specialized distributor networks, and supportive regulatory pathways for medical devices. Policy alignment toward remote care, chronic disease management, and digital health integration further strengthens market depth in these regions.

Market Segmentation

By Product Type

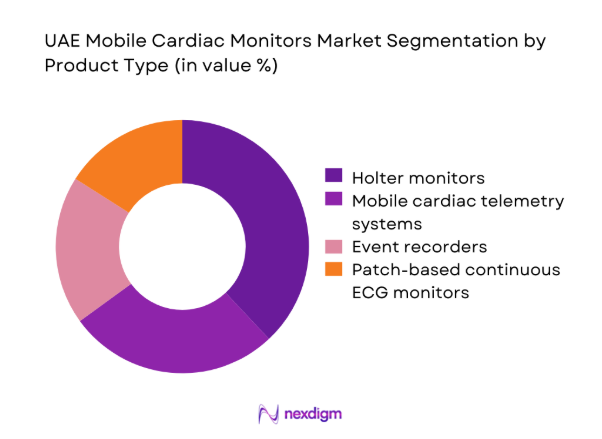

Holter monitors and mobile telemetry systems dominate demand due to established clinical acceptance and routine integration into cardiology diagnostics. Patch-based continuous ECG monitors are gaining traction as providers prioritize patient comfort, longer monitoring duration, and outpatient workflows. Event recorders continue to serve episodic monitoring needs, particularly for intermittent arrhythmia detection. Product preference is influenced by clinical use cases, device wearability, data capture duration, and compatibility with remote monitoring platforms. Procurement decisions also reflect service bundling, reporting turnaround times, and device reliability in high-throughput diagnostic environments, reinforcing dominance of multi-day continuous monitoring solutions across care pathways.

By End Use Setting

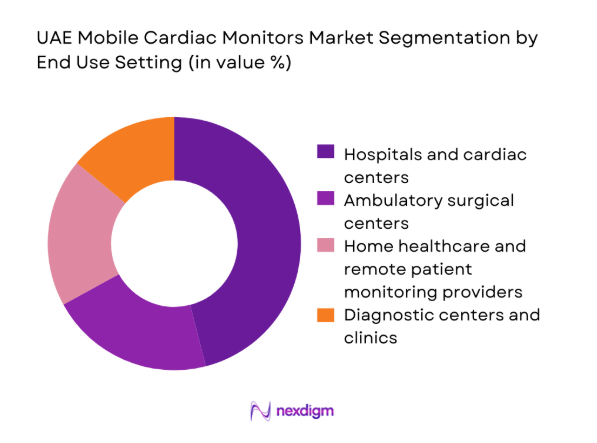

Hospitals and cardiac centers account for the largest share due to centralized diagnostics, high patient inflow, and integration with inpatient and outpatient cardiology workflows. Ambulatory surgical centers increasingly utilize mobile monitors for pre-procedure screening and post-procedure surveillance. Home healthcare and remote patient monitoring providers are expanding adoption as care pathways shift toward outpatient management and early discharge protocols. Diagnostic clinics contribute steady demand driven by referral-based testing and screening programs. End use segmentation reflects differences in care intensity, monitoring duration, reimbursement alignment, and the operational capacity to manage continuous data streams across care settings.

Competitive Landscape

The competitive landscape is shaped by diversified portfolios across continuous and intermittent monitoring, localized service infrastructure, and strong channel partnerships with hospital networks. Market positioning is influenced by regulatory readiness, integration capabilities with hospital IT systems, and service reliability for high-volume diagnostic workflows. Competitive differentiation increasingly centers on platform interoperability, clinical workflow integration, and post-sale service responsiveness.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Philips Healthcare | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| GE HealthCare | 1892 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Medtronic | 1949 | Ireland | ~ | ~ | ~ | ~ | ~ | ~ |

| Abbott | 1888 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Boston Scientific | 1979 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Mobile Cardiac Monitors Market Analysis

Growth Drivers

Rising prevalence of cardiovascular diseases in the UAE

Cardiovascular disease burden is rising across the UAE, with 2023 hospital discharge records indicating 412000 admissions linked to cardiac conditions and arrhythmias. Emergency department visits for palpitations and syncope reached 168000 cases in 2024, reflecting diagnostic demand growth. National screening initiatives conducted across primary care facilities reported 124000 individuals flagged for rhythm irregularities in 2023. Cardiology outpatient visits exceeded 236000 encounters in 2024, driving utilization of ambulatory diagnostics. Increased life expectancy to 78 years in 2024 and urban lifestyle risk factors reinforce sustained monitoring demand across care pathways.

Expansion of remote patient monitoring programs

Remote patient monitoring programs expanded across public and private providers, with 2023 reporting 94 accredited digital health programs supporting post-discharge cardiac care. Telehealth consultations for cardiology follow-ups reached 186000 sessions in 2024, increasing reliance on continuous data streams. National digital health infrastructure supported integration of 320 hospital facilities with remote monitoring platforms by 2024. Home-based care programs recorded 71000 enrolled cardiac patients in 2023, supported by connected devices. Regulatory approvals for remote care workflows in 2022 accelerated institutional adoption, strengthening demand for mobile monitoring devices embedded within virtual care pathways nationwide.

Challenges

High device and service costs limiting broad adoption

Procurement budgets face pressure as hospital capital expenditure approvals in 2023 declined to 72 percent of planned allocations across secondary care facilities. Annual maintenance contracts for connected medical devices increased administrative load across 418 procurement departments in 2024. Device lifecycle replacement cycles average 36 months, constraining fleet expansion within fixed budgets. Public sector tender cycles extended to 14 months in 2024, delaying refresh programs. Import dependency across 62 licensed distributors increases logistics complexity, while inventory turnover days averaged 98 in 2023, creating friction in scaling device availability across decentralized care settings.

Reimbursement variability across public and private payers

Reimbursement frameworks remain fragmented, with 2024 claims audits showing 39 coding pathways across insurers for ambulatory monitoring services. Average claim processing time extended to 41 days in 2023, affecting provider cash flow for monitoring programs. Public payer coverage criteria varied across 7 emirate-level authorities in 2024, complicating standardized service deployment. Private insurer prior-authorization requirements applied to 58 percent of monitoring claims in 2023, limiting clinician prescribing flexibility. Disparate coverage rules for remote monitoring constrained enrollment rates across 64 contracted provider networks nationwide.

Opportunities

Expansion of telecardiology services across emirates

Telecardiology networks expanded in 2023 to 112 virtual clinics linked to tertiary hospitals, enabling distributed diagnostic workflows. Referral turnaround time for cardiac consults fell to 3 days in 2024, increasing utilization of ambulatory monitoring prior to specialist review. Inter-emirate patient transfers for cardiology reduced by 19000 cases in 2023 as virtual triage scaled. National telehealth licensing issued 860 clinician permits by 2024, supporting broader deployment. Integration of monitoring data into electronic records across 284 facilities in 2024 enables scalable telecardiology models anchored by continuous mobile diagnostics.

Adoption of AI-enabled arrhythmia detection algorithms

AI-enabled diagnostic tools received regulatory clearance in 2022, accelerating deployment across hospital networks. By 2024, 146 facilities integrated algorithm-assisted ECG interpretation into routine workflows, reducing manual review time. Automated triage systems processed 2.3 million ECG segments in 2023 within clinical platforms, improving detection sensitivity for atrial fibrillation. Training programs certified 980 clinicians in AI-supported diagnostics by 2024, supporting operational readiness. Institutional pilots demonstrated reduced report turnaround from 48 hours to 12 hours in 2023, strengthening clinical acceptance and scalability of intelligent monitoring solutions.

Future Outlook

Future growth will be shaped by deeper integration of mobile monitoring into virtual care pathways, expanded regulatory support for remote diagnostics, and broader interoperability with hospital information systems. Adoption is expected to intensify across outpatient and home-based care models through 2030 as digital health infrastructure matures and telecardiology coverage expands nationwide.

Major Players

- Philips Healthcare

- GE HealthCare

- Medtronic

- Abbott

- Boston Scientific

- iRhythm Technologies

- AliveCor

- Hillrom

- Spacelabs Healthcare

- Schiller AG

- Nihon Kohden

- Bittium

- CardioComm Solutions

- Biotronik

- Masimo

Key Target Audience

- Tertiary care hospitals and cardiac specialty centers

- Ambulatory surgical centers and day-care clinics

- Home healthcare and remote patient monitoring providers

- Health insurance providers and payer organizations

- Government and regulatory bodies with agency names

- Public hospital procurement authorities

- Medical device distributors and channel partners

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Clinical use cases, device modalities, care settings, and connectivity requirements were defined based on cardiology workflows and remote monitoring protocols. Regulatory pathways, reimbursement structures, and procurement mechanisms were mapped to establish boundary conditions for adoption. Data parameters were aligned with care delivery models and institutional reporting standards.

Step 2: Market Analysis and Construction

Demand drivers were structured across inpatient, outpatient, and home-based pathways, incorporating digital health infrastructure readiness. Ecosystem linkages between providers, distributors, and service platforms were analyzed to construct the operating model. Institutional indicators informed scenario framing across care settings.

Step 3: Hypothesis Validation and Expert Consultation

Clinical specialists, hospital administrators, and digital health program leads were consulted to validate assumptions on workflow integration and operational constraints. Regulatory and reimbursement interpretations were cross-checked with institutional practices. Feedback loops refined adoption pathways and risk factors.

Step 4: Research Synthesis and Final Output

Insights were synthesized into cohesive narratives across demand, supply, and policy dimensions. Analytical outputs were aligned to consulting-grade frameworks for strategic decision-making. Findings were structured to support investment, procurement, and operational planning.

- Executive Summary

- Research Methodology (Market Definitions and device taxonomy alignment, Hospital and cardiology clinic procurement interviews across UAE emirates, Distributor and channel partner shipment data triangulation, Installed base mapping by care setting and monitoring modality, Regulatory approvals and reimbursement policy review in UAE, Competitive intelligence from tenders and contracts, Pricing benchmarks from public and private healthcare providers)

- Definition and Scope

- Market evolution

- Usage and care pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising prevalence of cardiovascular diseases in the UAE

Expansion of remote patient monitoring programs

Government investments in digital health infrastructure

Growing adoption of ambulatory and home-based cardiac care

Increasing awareness and screening for arrhythmias

Rising private healthcare spending and medical tourism - Challenges

High device and service costs limiting broad adoption

Reimbursement variability across public and private payers

Data privacy and cybersecurity concerns in remote monitoring

Integration challenges with hospital IT and EMR systems

Limited trained technicians for continuous monitoring services

Patient adherence and device wearability issues - Opportunities

Expansion of telecardiology services across emirates

Adoption of AI-enabled arrhythmia detection algorithms

Partnerships with insurance providers for RPM coverage

Deployment in corporate wellness and preventive screening programs

Growth of subscription-based monitoring services

Localization of manufacturing and service support - Trends

Shift toward patch-based continuous ECG monitoring

Increasing use of cloud platforms for real-time data analytics

Integration with wearable health ecosystems

Growing demand for lightweight and long-duration devices

Bundling of devices with monitoring and reporting services

Standardization of data interoperability protocols - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Shipment Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Product Type (in Value %)

Holter monitors

Mobile cardiac telemetry systems

Event recorders

Patch-based continuous ECG monitors - By Modality (in Value %)

Single-lead monitors

Multi-lead monitors

Continuous monitoring devices

Intermittent monitoring devices - By Connectivity (in Value %)

Bluetooth-enabled monitors

Cellular-enabled monitors

Wi-Fi enabled monitors

Hybrid connectivity devices - By End Use Setting (in Value %)

Hospitals and cardiac centers

Ambulatory surgical centers

Home healthcare and remote patient monitoring providers

Diagnostic centers and clinics - By Distribution Channel (in Value %)

Direct sales to hospitals

Medical device distributors

E-procurement and government tenders

Private healthcare group procurement

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (product portfolio breadth, device accuracy and validation, connectivity and platform integration, pricing and commercial models, local service and technical support, regulatory approvals in UAE, distributor network strength, contract wins and key hospital partnerships) - SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Philips Healthcare

GE HealthCare

Medtronic

Abbott

Boston Scientific

iRhythm Technologies

BioTelemetry

AliveCor

Preventice Solutions

Hillrom

Spacelabs Healthcare

Schiller AG

Nihon Kohden

Bittium

CardioComm Solutions

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Shipment Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030