Market Overview

The UAE wearable technology (mobile monitoring devices) market generated revenue of USD ~ million and is anchored by wrist-worn monitoring devices that bundle continuous or near-continuous tracking (heart rate, sleep, SpO₂, activity) with smartphone ecosystems, telco retail bundles, and employer wellness programs. The demand-side pull is reinforced by a rebound in device replacement cycles and global category momentum, with wearable-device shipments projected worldwide at ~ million units, supported by a replacement-driven refresh dynamic shaping purchases across mature and emerging markets.

Within the UAE, Dubai and Abu Dhabi dominate deployments because they concentrate private hospital groups, premium retail, corporate headquarters, and regulated telehealth pilots, conditions that accelerate adoption of medical-adjacent wearables such as post-discharge monitoring and lifestyle disease tracking alongside consumer devices. On the supply side, market gravity is shaped by global device OEMs headquartered in the U.S., China, and Korea because they control operating system ecosystems, sensors, and app marketplaces, driving product cadence and feature localization. The UAE policy push toward technology-based health services, including telemedicine, further strengthens the Dubai–Abu Dhabi demand corridor.

Market Segmentation

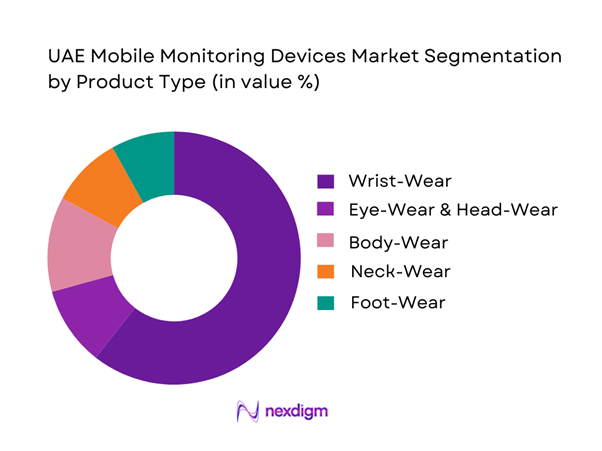

By Product Type

The UAE mobile monitoring devices market is segmented by product type into wrist-wear, eye-wear and head-wear, foot-wear, neck-wear, body-wear, and others. Recently, wrist-wear has the dominant revenue position because it is the default form factor for continuous, passive monitoring. It enables always-on sensing such as PPG heart-rate, motion, and sleep staging, supports notifications and payments, and benefits from strong distribution through operator bundles, mass retail, pharmacy chains, and OEM stores. Wrist-worn devices also map cleanly to medical-adjacent workflows including trend-level screening, medication adherence nudges, and post-episode wellness monitoring, while staying within established consumer purchasing behavior.

By Application

The UAE mobile monitoring devices market is segmented into consumer electronics, healthcare, enterprise and industrial applications, and others. Consumer electronics typically dominates in-country spend because the UAE has a premium device mix encompassing smartphones, smartwatches, and earbuds, and a high propensity for lifestyle-led upgrades driven by ecosystem stickiness, gifting cycles, and brand launches routed through Dubai’s retail channels. Healthcare-led wearables are growing structurally, especially where regulated telehealth guidelines and chronic-condition monitoring protocols are operationalized, but procurement cycles, integration requirements such as EHR connectivity and clinical validation, and privacy and security workflows tend to slow large-scale clinical rollout relative to direct-to-consumer demand. UAE telemedicine services and Dubai telehealth clinical guidance help legitimize remote monitoring pathways, supporting healthcare use-cases even when consumer demand remains the volume engine.

Competitive Landscape

The UAE mobile monitoring devices market is shaped by a mix of global device OEMs that bring ecosystems, sensors, and app platforms, and medical-grade monitoring specialists focused on clinical validation, hospital integration, and regulated workflows. Competitive intensity is highest in wrist-wear and consumer health monitoring, where brand ecosystems, app stickiness, and retail visibility matter most, while clinical adjacencies are influenced by provider partnerships, compliance readiness, and integration capability with telehealth pathways.

| Company | Est. Year | HQ | Core mobile monitoring device categories | Health sensing depth | Ecosystem / app stack | UAE go-to-market motion | Clinical adjacency | Update cadence & feature velocity | Data/privacy posture (high-level) |

| Apple | 1976 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Samsung | 1938 | South Korea | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Huawei | 1987 | China | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Garmin | 1989 | Switzerland (Garmin Ltd is based in the U.S.; corporate registration varies by disclosure) | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Alphabet (Fitbit) | 2015 (Fitbit founded 2007; acquired by Google/Alphabet later) | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Mobile Monitoring Devices Market Analysis

Growth Drivers

RPM readiness and virtual care expansion

Dubai’s digital-care plumbing is already producing the signals that mobile monitoring devices such as connected blood pressure cuffs, CGM and SMBG add-ons, wearable ECG patches, oximeters, and smart thermometers depend on. Telehealth consultations reached nearly ~ and electronic prescriptions exceeded ~ in the latest reported year, alongside more than ~ licensed telehealth service providers in the emirate, creating a natural pull for remote vitals capture to reduce repeat visits and improve continuity of care. On the system-demand side, the UAE recorded ~ hospital visits and ~ emergency and accident clinic visits across government and private sectors, which raises the value of triage-at-a-distance and clinician dashboards fed by home devices. The macro ability-to-pay and scale context remains supportive, with the UAE economy reported at USD ~ billion and the population base at ~, supporting large, technology-enabled provider networks and broad consumer device affordability.

Chronic disease burden alignment

Mobile monitoring devices map tightly to the UAE’s high-throughput chronic-care reality, where blood pressure and glucose monitoring sit at the core of primary and specialty follow-up, while wearable rhythm and oxygen monitoring increasingly support cardiology and pulmonary pathways. Utilization pressure is visible in system volumes, with ~ hospital visits and ~ emergency and accident clinic visits reported in national health-sector statistics, indicating frequent touchpoints where continuous at-home vitals can prevent avoidable escalations. The care infrastructure is sufficiently dense to operationalize remote patient monitoring, with hospitals and beds tracked nationally across government and private sectors and emirate-by-emirate capacity reporting. The macro base supports sustained chronic-care technology adoption, with a population of ~ and an economy of USD ~ billion underpinning insurer and provider investment in connected-care models, while also supporting consumer adoption of clinically oriented wearables and certified home devices that reduce clinic congestion and improve medication titration cycles.

Challenges

Regulatory approvals and device listings

Mobile monitoring devices face a structurally higher compliance burden than general consumer wearables because the UAE healthcare system is strongly regulated across emirate and federal layers, and procurement buyers increasingly demand evidence of registration, clinical intent, and secure data handling. This friction matters because volume is high and institutional buying is concentrated, with ~ hospital visits recorded nationally and ~ emergency and accident clinic visits creating large tenders and standardized requirements for devices that may feed clinical decisions. Dubai’s telehealth ecosystem, with more than ~ licensed telehealth service providers, increases the need for consistent device governance because multiple providers may request, interpret, and store patient-generated data. On the connectivity side, mobile subscribers reached ~, mobile broadband subscribers ~, and coverage is near-universal, which expands usage but also broadens regulatory concern over how device data flows across apps, cloud platforms, and cross-border vendors. As a result, time-to-market is often shaped by documentation depth, local licensing readiness, and alignment with approved scopes of practice rather than product performance alone.

Clinical validation requirements

Clinical validation is a gating factor in the UAE because providers and regulators operate in a high-acuity, high-expectation environment where device readings can influence medication titration, escalation decisions, and discharge outcomes. System scale makes error costly, with ~ hospital visits and ~ emergency and accident clinic visits, meaning even a small rate of false alarms from oximeters, ECG patches, or cuff-based blood pressure devices can create operational noise and clinician fatigue. At the same time, digital care volumes in Dubai, with nearly ~ telehealth consultations and more than ~ electronic prescriptions, increase the number of encounters where clinicians depend on patient-generated measurements instead of in-facility vitals. Macro capability is not the constraint, as a USD ~ billion economy can fund pilots and quality assurance, but the challenge lies in converting pilots into scaled protocols with evidence suitable for hospital committees, payer reviewers, and medico-legal assurance.

Opportunities

Hospital-at-home programs

Hospital-at-home models represent a strong growth vector for mobile monitoring devices in the UAE because they directly target high facility utilization while aligning with digital care readiness. Nationally, ~ hospital visits and ~ emergency and accident clinic visits illustrate a scale where shifting even defined cohorts such as post-procedure observation, stable chronic exacerbations, and step-down monitoring into home settings can materially relieve beds and emergency departments without new infrastructure. Dubai’s digital layer is already active, with nearly ~ telehealth consultations, more than ~ electronic prescriptions, and over ~ licensed telehealth providers providing the operational scaffold for at-home rounds, prescription renewals, and escalation. Connectivity is not a bottleneck, with ~ mobile subscribers and ~ mobile broadband subscribers enabling continuous device data flow and video check-ins. The near-term implication is increased demand for clinical-grade home kits bundled with onboarding, multilingual user experiences, and secure clinician dashboards.

Post-discharge monitoring pathways

Post-discharge monitoring is one of the most defensible near-term opportunities because it ties directly to measurable hospital performance indicators while using existing digital channels. System volumes of ~ hospital visits and ~ emergency and accident clinic visits imply substantial repeat-contact risk that can be reduced through structured device-based follow-up for cardiometabolic, respiratory, and post-surgical cohorts. Dubai’s telehealth traction, with nearly ~ telehealth consultations and more than ~ electronic prescriptions, allows discharge teams to schedule remote follow-ups, refill workflows, and rapid escalation without forcing clinic visits, while more than ~ licensed telehealth providers indicate a broad vendor and operator base capable of embedding monitoring services. Telecom quality benchmarks covering ~ kilometers of roads and execution of approximately ~ voice calls per operator illustrate the operational emphasis on connectivity performance, which is crucial for continuous monitoring and patient communication. The commercial upside centers on protocolized discharge bundles adopted by hospital groups and insurers as standard practice.

Future Outlook

Over the next planning cycle, the UAE mobile monitoring devices market is expected to expand through higher attachment of health sensors in mainstream wrist-wear, deeper integration of wearables into insurer and employer wellness programs, and gradual institutionalization of remote monitoring workflows as telehealth standards mature. The direction of travel is toward integrated device, software, and services bundles incorporating subscriptions, coaching, and analytics, with Dubai and Abu Dhabi continuing to act as testbeds for premium experiences and regulated digital health pathways. The UAE emphasis on technology-based health services, including telemedicine, supports these adoption vectors.

Major Players

- Apple

- Samsung Electronics

- Huawei Technologies

- Garmin

- Alphabet

- Xiaomi

- Sony

- Adidas

- Nike

- Oura

- Zepp Health

- Polar Electro

- Withings

- Omron Healthcare

Key Target Audience

- Hospital groups and integrated provider networks

- Home healthcare and post-acute care providers

- Health insurers and TPAs

- Corporate benefits and human resources wellness buyers

- Telehealth and remote care platform operators

- Pharmacy chains and medical device retailers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We build a UAE-specific ecosystem map across OEMs, distributors, telcos, pharmacy and retail, providers, and payers, then define variables that move revenues such as device ASP bands, refresh cycles, sensor attachment, channel mix, and enterprise procurement triggers. Desk research leverages secondary sources and regulatory references for telehealth pathways.

Step 2: Market Analysis and Construction

We compile historical revenue signals and triangulate with channel indicators including telco bundles, premium retail intensity, and institutional procurement patterns. Market construction separates consumer wearables from healthcare-led monitoring adjacencies, ensuring segment logic aligns with how devices are purchased and deployed in the UAE.

Step 3: Hypothesis Validation and Expert Consultation

We validate adoption hypotheses via structured expert interactions with distributors, category managers, provider digital-health leads, and insurer wellness stakeholders. The objective is to confirm what is deployed, how often devices are replaced, and which monitoring features are paid for versus considered optional.

Step 4: Research Synthesis and Final Output

We synthesize findings into a bottom-up and top-down model, verifying conclusions against stated market endpoints and documented segmentation frameworks. Final deliverables include competitive benchmarking, adoption barriers, and go-to-market implications specific to Dubai and Abu Dhabi-led demand clusters.

- Executive Summary

- Research Methodology (Market definitions & device boundary, UAE-specific assumptions, abbreviations, triangulated market sizing framework, tender and deal trace methodology, primary interview architecture with providers, payers, distributors and OEMs, channel price capture approach, installed-base build logic, data-quality scoring, limitations and validation rules)

- Definition and Scope

- Market Genesis and Evolution

- Care Delivery Context

- UAE Digital Health Stack Context

- Market Stakeholder Map

- Growth Drivers

RPM readiness and virtual care expansion

Chronic disease burden alignment

Hospital capacity optimization needs

Consumer wearable penetration into clinical workflows

Government digital health initiatives - Challenges

Regulatory approvals and device listings

Clinical validation requirements

Data privacy and cybersecurity risks

Workflow adoption barriers

Reimbursement ambiguity - Opportunities

Hospital-at-home programs

Post-discharge monitoring pathways

Specialty cardiac monitoring expansion

AI-driven alerting and triage

Payer-led and employer-led monitoring programs - Trends

Patch-based monitoring adoption

Multi-sensor device convergence

Edge analytics deployment

Virtual ward models

Device-as-a-service commercial models - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By ASP Bands, 2019–2024

- By Installed Base vs New Adds, 2019–2024

- By Fleet Type (in Value %)

Portable multi-parameter vital signs monitors

Ambulatory ECG monitors

Pulse oximeters

Ambulatory blood pressure monitors

Continuous glucose monitoring devices - By Application (in Value %)

Cardiac monitoring

Diabetes monitoring

Respiratory monitoring

Hypertension and chronic disease management

Post-acute and post-surgical monitoring - By Technology Architecture (in Value %)

Clinical-grade enterprise monitoring platforms

Hybrid clinical-consumer monitoring systems

Patch-based continuous monitoring architecture

Edge analytics-enabled monitoring devices

Cloud-native remote monitoring platforms - By Connectivity Type (in Value %)

Bluetooth and BLE

Wi-Fi

Cellular

Hybrid connectivity

Store-and-forward connectivity - By End-Use Industry (in Value %)

Hospitals

Ambulatory clinics

Home healthcare providers

Employer and occupational health programs

Pharmacies and retail health providers - By Region (in Value %)

Abu Dhabi

Dubai

Sharjah

Northern Emirates

- Competitive Intensity Map

Market Share Snapshot - Cross Comparison Parameters (Regulatory coverage depth, clinical portfolio breadth, interoperability readiness, cybersecurity and privacy posture, UAE service footprint, tender competitiveness, analytics and alerting maturity, channel strength)

- Pricing and Commercial Models

- Partner and Distribution Landscape

- Competitive Moats

- Detailed Profiles of Major Companies

Philips

GE HealthCare

Siemens Healthineers

Medtronic

Masimo

Nihon Kohden

Mindray

Dräger

Baxter

Abbott

Omron Healthcare

Withings

iHealth

Schiller

- Clinical Workflow Fit

- Decision-Making Unit Structure

- Procurement and Tender Mechanics

- Utilization and Device Economics

- Pain Point Analysis

- Adoption Enablers

- By Value, 2025–2030

- By Volume, 2025–2030

- By ASP Bands, 2025–2030

- By Installed Base vs New Adds, 2025–2030