Market Overview

The nebulizer devices market is underpinned by a rapidly expanding global base and a disproportionately high respiratory-disease burden in the UAE. Globally, nebulizer devices are valued at about USD ~ billion, with forecasts indicating they may exceed USD ~ billion over the coming decade. Within the UAE, nebulizer filters alone generate roughly USD ~ million in revenue, with a measured 1.9% growth trajectory, indicating a stable installed base of nebulizers and regular replacement cycles. This demand is reinforced by high per-capita healthcare expenditure above USD 2,300, significantly above the global average.

Nebulizer utilization in the UAE is concentrated in Dubai, Abu Dhabi and Sharjah, where tertiary hospitals, specialized respiratory clinics and high-income home-care users are clustered. Dubai and Abu Dhabi together host over 100 hospitals and large integrated health systems such as Dubai Health and Emirates Health Services networks, alongside leading private facilities. These emirates also report a higher managed caseload of asthma and COPD relative to smaller emirates, with recent clinical work estimating asthma prevalence in the UAE at about 7–9% of the population and COPD between 3.7% and 5.3%, supporting sustained demand for nebulizer-based therapy.

Market Segmentation

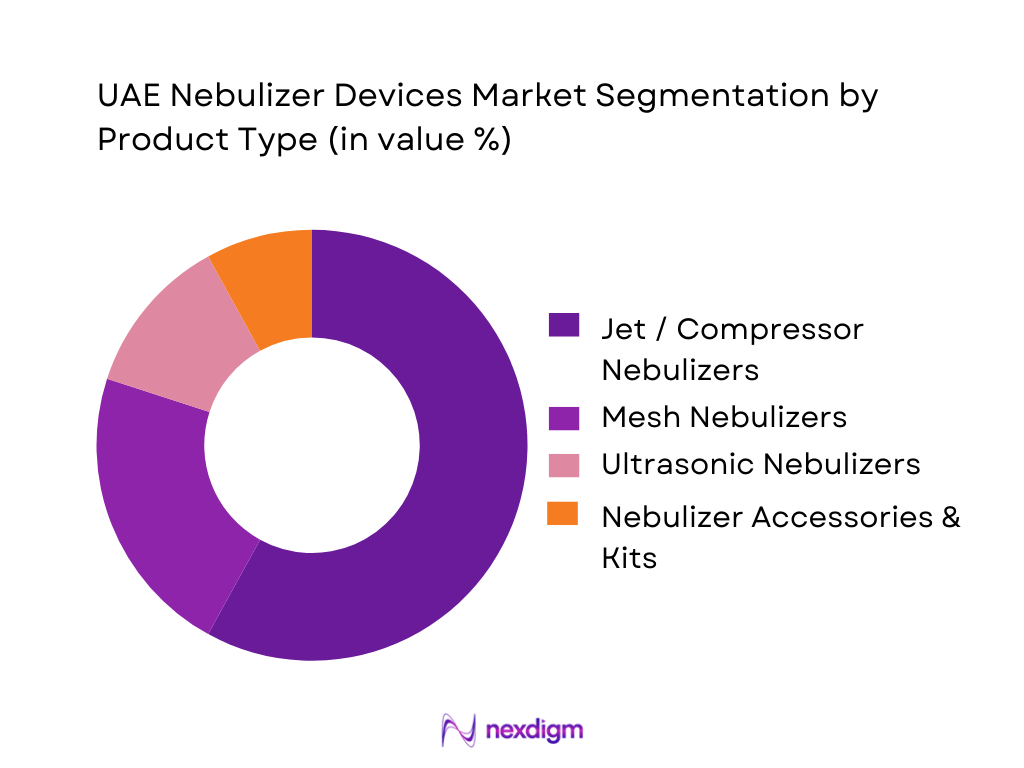

By Product Type

The UAE nebulizer devices market is segmented into jet/compressor nebulizers, mesh nebulizers, ultrasonic nebulizers and standalone accessories & kits. Jet/compressor nebulizers currently dominate the market owing to their proven clinical track record, lower unit cost and broad availability in hospital tenders and retail pharmacies. Global evidence shows jet nebulizers remain the largest type segment in nebulizer markets due to their robustness and cost-effectiveness. In the UAE, public hospitals and SEHA/EHS facilities typically standardize on compressor-based tabletop systems for asthma, COPD and pediatric bronchiolitis, while private hospitals and home-care providers continue to adopt them as the default modality, with mesh units reserved for high-compliance or travel-oriented patients. This entrenched installed base, plus continual demand for compressors in emergency departments and ambulances, keeps jet/compressor devices as the leading product category.

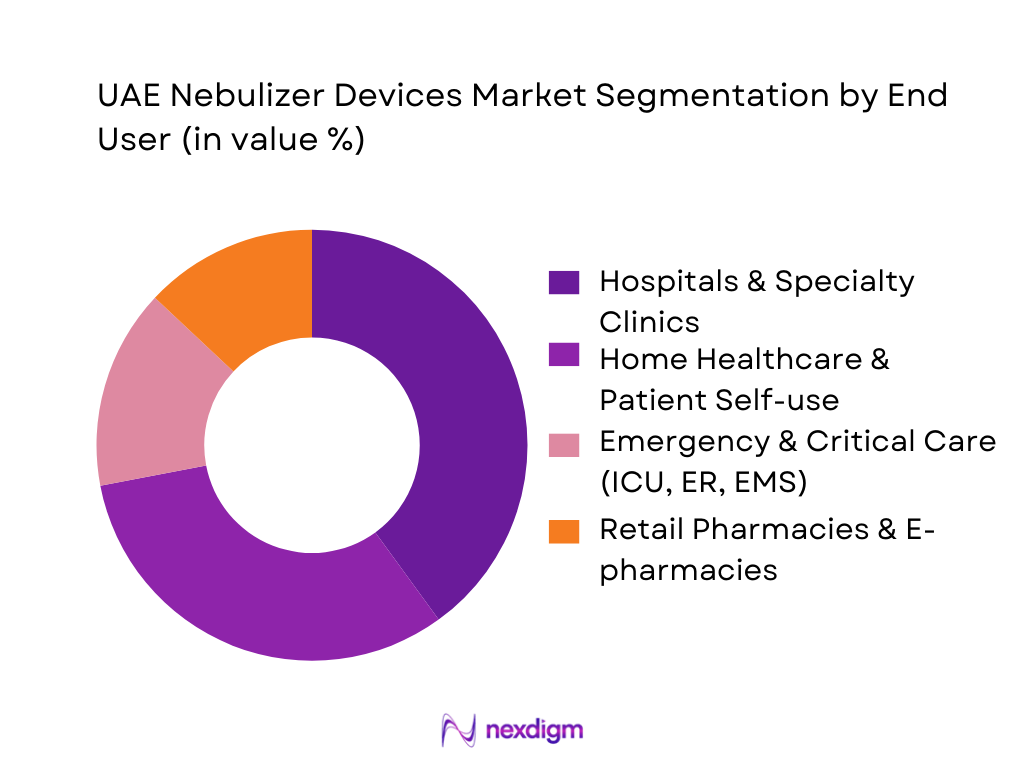

By End User

The UAE nebulizer devices market is segmented into hospitals & specialty clinics, home healthcare & patient self-use, emergency & critical care settings and retail pharmacies & e-pharmacies. Hospitals & specialty clinics currently dominate in value terms, driven by high rates of inpatient and outpatient management of asthma, COPD and acute lower respiratory tract infections. Global nebulizer data shows hospital settings lead in nebulizer consumption, with clinics and homecare following. In the UAE, tertiary facilities such as Cleveland Clinic Abu Dhabi, Rashid Hospital and American Hospital Dubai act as referral centers for complex respiratory cases, where nebulizers are routinely used in emergency rooms, ICUs and pulmonary wards. Reimbursement comfort, protocolized use in acute exacerbations and centralized device procurement all reinforce hospital-centric demand, with homecare growing but still secondary in overall spend.

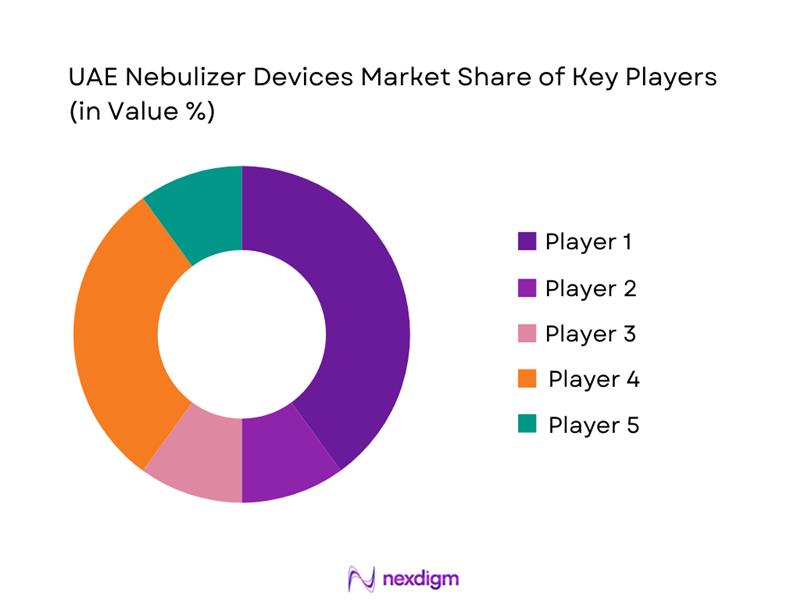

Competitive Landscape

The UAE nebulizer devices market is supplied by a mix of global respiratory device majors and multi-category home-health brands, alongside regional distributors who localize logistics, service and tender participation. Globally dominant nebulizer manufacturers such as Omron Healthcare, Philips, PARI, DeVilbiss and Rossmax are all active in the GCC through distributor partnerships, with their devices widely visible in UAE hospital formularies and retail channels. In practice, competition hinges on product reliability in high-throughput hospital environments, patient experience (noise, particle size, treatment time), availability of accessories and filters, and channel coverage across hospital tenders, MOHAP/SEHA/DHA facilities and retail pharmacy chains. E-pharmacies and online marketplaces are gradually intensifying price transparency, but for now procurement decisions remain strongly clinician- and biomedical-engineering-driven.

| Company | Establishment Year | Headquarters (Global) | Key Nebulizer Product Range | Core Technology Focus | Presence in UAE (Channel View) | Primary End-User Focus in UAE | Notable Differentiators / Strengths |

| Koninklijke Philips N.V. | 1891 | Amsterdam, Netherlands | ~ | ~ | ~ | ~ | ~ |

| Omron Healthcare, Inc. | 1933 (Omron Corp.) | Kyoto, Japan | ~ | ~ | ~ | ~ | ~ |

| PARI Respiratory Equipment | 1906 | Starnberg, Germany | ~ | ~ | ~ | ~ | ~ |

| DeVilbiss Healthcare (Drive DeVilbiss) | 1888 | Somerset, Pennsylvania, USA | ~ | ~ | ~ | ~ | ~ |

| Rossmax International Ltd. | 1988 | Taipei, Taiwan | ~ | ~ | ~ | ~ | ~ |

UAE Nebulizer Devices Market Analysis

Growth Drivers

Respiratory epidemiology indicators

The UAE’s growing and ageing population, reaching 10,678,556 residents and then 11,294,243 residents in successive recent years, creates a larger base of patients at risk of asthma and COPD, both key indications for nebulizer therapy. A recent Global Burden of Disease analysis for the Middle East and North Africa reports an age-standardised incidence rate of chronic respiratory diseases in the UAE, the highest in the region, underscoring a structurally high need for maintenance and rescue bronchodilator delivery. With life expectancy around 83 years, chronic respiratory conditions are managed over longer lifespans, supporting sustained demand for home and hospital nebulizer devices.

Urbanisation and indoor lifestyle effects

The UAE’s rapid demographic expansion, from 10,678,556 to 11,294,243 people within two consecutive recent years, is heavily concentrated in dense coastal cities such as Dubai and Abu Dhabi, where air-conditioned indoor living dominates daily life and long-term respiratory exposure. World Bank environmental data show mean annual PM2.5 exposure of 5 micrograms per cubic metre in the UAE, well above the WHO guideline, reflecting dust, construction, power generation and traffic—factors that exacerbate asthma and COPD and make nebulized bronchodilator and corticosteroid delivery a recurrent need. With more than ten million residents concentrated in urban corridors and frequently exposed to indoor allergens and cooled, recirculated air, the addressable base for home and outpatient nebulizer use remains structurally high.

Market Challenges

Competition from MDIs and DPIs

Global and regional respiratory guidelines adopted in UAE clinical practice typically recommend pressurised metered-dose inhalers (pMDIs) and dry-powder inhalers (DPIs) as first-line maintenance therapy for stable asthma and COPD, reserving nebulizers for acute exacerbations, paediatrics, elderly and those unable to coordinate inhaler use. A large multi-country Middle East survey reported COPD symptom prevalence of 7.2% in the UAE, one of the lowest in the region, yet with high use of inhaled maintenance therapies aligned to international protocols. With chronic respiratory disease incidence in the UAE estimated at ~ cases per 100,000, this entrenched inhaler-first prescribing culture constrains nebulizer share unless devices are tightly integrated into local treatment pathways and supported by superior outcomes data.

Price pressure in tenders and retail

Public and private payers in the UAE operate under visible cost pressure, filtering through to nebulizer procurement. The Central Bank of the UAE’s insurance sector report shows health insurance gross and net loss ratios for group health frequently clustering around 0.9–1.0, leaving limited margin buffers and incentivising strict tender price caps on respiratory devices. In Dubai, current health expenditure rose from ~ billion AED to ~ billion AED in consecutive years, only slightly ahead of population growth, implying the need to stretch budgets across more claims and encouraging volume-based discounts and substitution of lower-cost inhaler therapies over nebulizer prescriptions in both public tenders and retail pharmacies.

Market Opportunities

Smart / connected nebulizers with adherence tracking

The UAE’s strong digital-health and insurance infrastructure makes it an attractive early adopter for connected nebulizers. Dubai’s electronic health insurance portal processed ~ million healthcare transactions and over ~ million insurance claims in a recent year, demonstrating a mature digital data backbone that can integrate device-generated adherence feeds into claims and authorisation workflows. With more than 4 million insured lives on the DHA platform and rapidly expanding telemedicine services, payers can link nebulizer usage data to reimbursement rules, disease-management KPIs and early-warning flags for uncontrolled asthma or COPD. This environment favours Bluetooth-enabled mesh nebulizers and cloud platforms that can document dose timing and technique, supporting value-based contracts without the need for future utilisation forecasts.

Disease-management program bundles

Non-communicable diseases (NCDs) impose a substantial macroeconomic burden on the UAE, creating strong incentives for integrated asthma and COPD management models that bundle nebulizers with drugs, telemonitoring and education. Health Accounts data for Dubai show current health spending climbing from ~ billion AED to ~ billion AED, while WHO figures place current health expenditure at around 5.31% of GDP, highlighting the fiscal weight of chronic disease care. Government and UN health-tax briefs stress the need to reduce risk factors such as tobacco through taxation, underlining policy focus on NCDs and their complications. Against this backdrop, payers are open to bundled respiratory programs where nebulizer devices are embedded inside capitated or outcomes-based packages that reduce emergency visits and hospitalisations without requiring separate device budget expansions.

Future Outlook

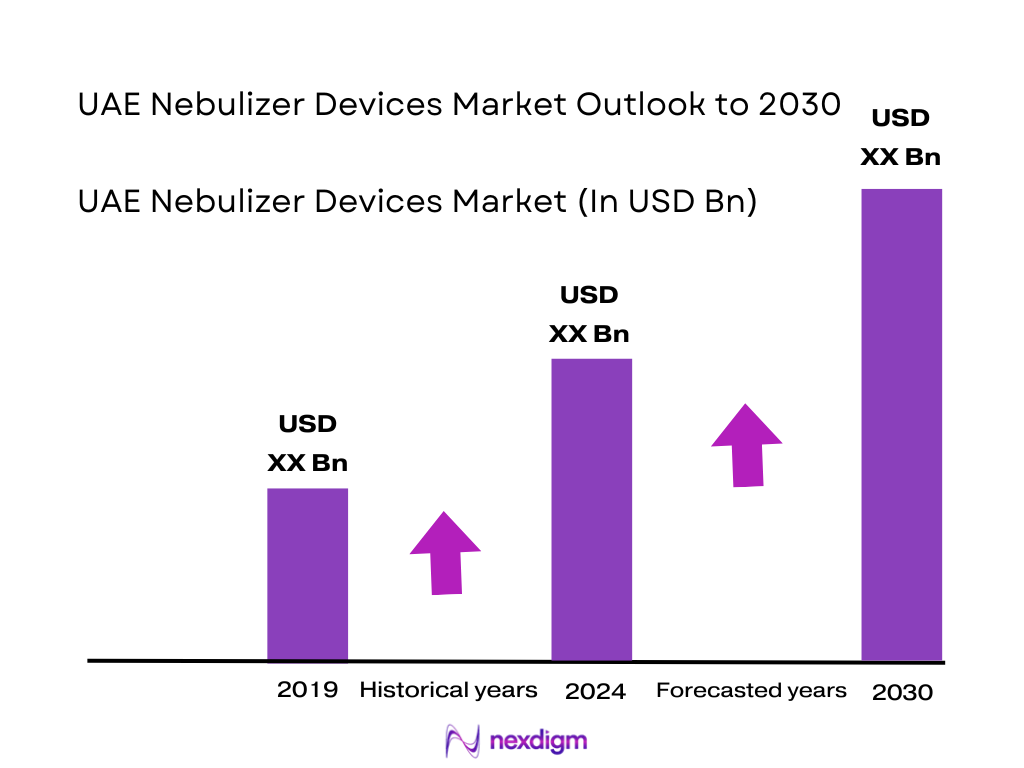

Over the next six years, the UAE nebulizer devices market is expected to grow steadily from its current niche base, supported by a rising burden of chronic respiratory disease, strong health-system investments and growing patient preference for home-based respiratory care. Global nebulizer markets are projected to grow at mid-single- to high-single-digit rates, and the UAE—given its high per-capita income and health spending—is well positioned to slightly outperform the global average in value terms.

In the short term, hospitals and specialty clinics will remain the anchor end-user segment, but home-care adoption is likely to accelerate as insurers and providers push for shorter inpatient stays and remote management of stable asthma/COPD cases. Portable mesh nebulizers and quieter, child-friendly compressors will see increasing uptake among urban, tech-savvy patients in Dubai and Abu Dhabi, especially as digital health apps and remote monitoring platforms integrate inhalation-adherence data. At the same time, competition from inhalers and smart inhaler platforms will cap overall volume growth, pushing nebulizer manufacturers to differentiate on niche use-cases (severe asthma, cystic fibrosis, high-acuity COPD) and on service, training and bundled maintenance contracts with hospital groups.

Major Players

- Koninklijke Philips N.V.

- Omron Healthcare, Inc.

- PARI Respiratory Equipment GmbH

- DeVilbiss Healthcare

- Rossmax International Ltd.

- Vyaire Medical, Inc.

- GF Health Products, Inc.

- Allied Healthcare Products, Inc.

- Trudell Medical International

- Teleflex Medical, Inc.

- Aerogen Ltd.

- Beurer GmbH

- Microlife Corporation

- Mindray

Key Target Audience

- Hospital procurement departments and biomedical engineering teams

- Specialty respiratory and pulmonology clinics

- Home-care and durable medical equipment providers

- Retail pharmacy chains and e-pharmacy platforms

- Health insurance companies and third-party administrators

- Medical device importers, distributors and GCC-focused trading companies

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the UAE nebulizer devices ecosystem, covering global manufacturers, local distributors, public and private hospitals, specialty clinics, pharmacies and home-care providers. Extensive secondary research from sources is combined with WHO, World Bank and UAE regulatory publications to define core variables: device types, end-user segments, installed base, replacement cycles, and respiratory-disease epidemiology. These variables frame both demand- and supply-side dynamics.

Step 2: Market Analysis and Construction

Historical data for the global nebulizer market and UAE respiratory-devices sub-segments are compiled, including revenues, growth rates and segment splits. A bottom-up view scales UAE demand from hospital-bed counts, outpatient volumes and asthma/COPD prevalence, while a top-down view allocates a share of global nebulizer and nebulizer-filters revenues to the UAE based on health-spend and disease-burden indices. Reconciliation of these approaches yields the central estimate for 2024 market size and the baseline segment shares across product type and end-user groups.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding dominant product types (jet/compressor), primary end-user segments (hospitals vs. home-care) and future growth drivers are validated through structured interviews and informal consultations with regional distributors, hospital biomedical engineers and respiratory clinicians who work with nebulizers daily. These discussions provide ground-level insight into tender specifications, device utilization patterns, failure modes, and preferences for specific brands or technologies, allowing refinement of both quantitative estimates and qualitative assessments of competitive positioning.

Step 4: Research Synthesis and Final Output

In the final stage, all data streams—quantitative models, expert feedback and secondary-research insights—are synthesized into a cohesive narrative. Scenario analysis is used to bracket the likely range of growth outcomes based on variables such as changes in asthma/COPD clinical guidelines, home-care reimbursement shifts, and the pace of adoption of alternative inhaled-drug delivery platforms. The resulting output is a validated, business-oriented view of the UAE nebulizer devices market, including size, structure, competitive dynamics and actionable implications for manufacturers, distributors, providers and investors.

- Executive Summary

- Research Methodology (Nebulizer device taxonomy and inclusion/exclusion criteria, classification by technology and care setting, data sources – public health datasets and trade statistics, primary interviews with pulmonologists/pediatricians/respiratory therapists in UAE, hospital procurement and distributor discussions, bottom-up hospital & pharmacy audit, triangulation with top-down macro and respiratory epidemiology data, forecasting logic for units and installed base, scenario-building framework, study limitations)

- Definition and Scope

- Clinical and Therapeutic Landscape

- Nebulizer Device Classification

- Care Setting Landscape

- Supply Chain and Value Chain

- Growth Drivers

Respiratory epidemiology indicators

Urbanisation and indoor lifestyle effects

Smoking and environmental exposure

Insurance coverage for chronic respiratory disease

Adoption of homecare and telehealth - Challenges

Competition from MDIs and DPIs

Price pressure in tenders and retail

Clinician preference and protocol alignment

Device maintenance and hygiene concerns

Service capacity

Import lead times and currency exposure - Opportunities

Smart/connected nebulizers with adherence tracking

Disease-management program bundles

Paediatric-friendly designs

Infection-control focused disposables

PPP opportunities in public hospitals - Trends

Shift toward low-noise and mesh technologies

Miniaturisation and travel-friendly devices

Teleconsultation-linked prescribing patterns

Pharmacy-led chronic care programs

Single-use hospital nebulizer kits - Regulatory and Reimbursement Analysis

- Procurement and Tendering Landscape

- Stakeholder Ecosystem Mapping

- Porter’s Five Forces Analysis

- Technology and Innovation Roadmap

- By Value, 2019-2024

- By Volume, 2019-2024

- Installed Base and Replacement Demand, 2019-2024

- Average Selling Price by Technology and Form Factor, 2019-2024

- By Device Technology (in Value %)

Jet/Compressor Nebulizers

Ultrasonic Nebulizers

Vibrating Mesh Nebulizers

Soft-Mist / Breath-Actuated Nebulizers

Smart / Connected Nebulizers Integrated with Apps or Telehealth Platforms - By Portability and Form Factor (in Value %)

Tabletop / Stationary Compressor Systems

Handheld Battery-Operated Units

Wearable / Pocket Mesh Devices

Pediatric-Themed Nebulizers for Children

ICU / Ventilator-Integrated Nebulizer Systems - By Clinical Indication (in Value %)

Asthma

Chronic Obstructive Pulmonary Disease

Cystic Fibrosis and Bronchiectasis

Acute Respiratory Infections and Bronchiolitis

Other Indications - By Patient Profile (in Value %)

Pediatric Patients

Adult Patients

Geriatric Patients

High-Risk Co-morbid Patients

Special-Needs and Low-Inspiratory-Flow Patients - By End User Setting (in Value %)

Public and Government Hospitals

Private Hospitals and Multispecialty Clinics

Standalone Pulmonology and Pediatric Clinics

Homecare and Long-Term Disease Management Programs

Community Pharmacies and Over-the-Counter Users - By Distribution Channel (in Value %)

Government Tenders and Group Purchasing Organisations

Direct Hospital and Clinic Procurement

Retail Pharmacies

E-Pharmacies and Online Marketplaces

Medical Equipment Dealers and Specialty Respiratory Stores - By Emirate / Region (in Value %)

Abu Dhabi

Dubai

Sharjah and Northern Emirates

Al Ain and Western Region

- Market Share Analysis of Major Players

- Cross-Comparison Parameters for Leading Nebulizer Brands in UAE (UAE device portfolio breadth by technology; MMAD particle size ranges across key models; average nebulization rate bands; noise level bands for home and paediatric use; device weight & portability indices; service and warranty network coverage across emirates; compliance with DHA/MOHAP registration, CE/FDA and ISO standards; hospital vs retail pharmacy vs e-pharmacy channel footprint)

- Pricing and Positioning Benchmarking

- SWOT Analysis of Major Players

- Go-to-Market and Distribution Strategy Assessment

- Detailed Company Profiles

Koninklijke Philips N.V. / Philips Respironics

Omron Healthcare

PARI GmbH / PARI Respiratory Equipment

Drive DeVilbiss Healthcare / Drive Medical

Aerogen

GE Healthcare

Rossmax International Ltd

Beurer GmbH

Microlife Corporation

GF Health Products, Inc.

Vectura Group plc

BESCO Medical

Bremed Ltd

Vyaire Medical, Inc.

- Public and Government Hospitals

- Private Hospitals and Specialty Clinics

- Retail and E-Pharmacy Channels

- Homecare and Chronic Disease Management Providers

- Patient and Caregiver Behaviour Insights

- By Value, 2019-2024

- By Volume, 2019-2024

- Installed Base and Replacement Demand, 2019-2024

- Average Selling Price by Technology and Form Factor, 2019-2024