Market Overview

The UAE Nerve Stimulators Equipment market current size stands at around USD ~ million, reflecting sustained adoption across neurology, pain management, and rehabilitation pathways within advanced care settings. Demand is shaped by procedural integration within hospital operating theaters, ambulatory surgical centers, and specialty clinics, alongside expanding clinical indications in chronic pain, movement disorders, and pelvic health. Procurement cycles emphasize device reliability, clinical evidence, service continuity, and lifecycle performance, reinforcing long-term utilization across public and private care environments.

Adoption is concentrated in major metropolitan healthcare clusters with advanced tertiary hospitals and specialized neuroscience centers. Urban infrastructure density supports multidisciplinary care pathways, while private healthcare ecosystems accelerate uptake through faster procurement cycles and bundled service models. Mature distributor networks, centralized procurement frameworks, and regulatory clarity support consistent device availability. Policy emphasis on advanced therapeutic modalities and cross-border patient inflows further concentrate utilization within well-resourced clinical hubs and integrated care networks.

Market Segmentation

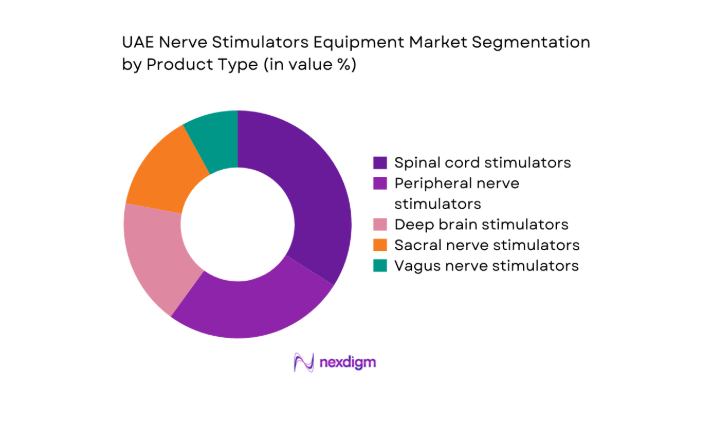

By Product Type

Implantable neuromodulation systems dominate due to broader clinical applicability across chronic pain, movement disorders, and bladder dysfunction pathways. Clinicians prefer implantable formats for long-term symptom modulation and programmable therapy adjustment, supported by higher procedural volumes in tertiary hospitals and specialty centers. External stimulation devices remain relevant for short-term trials and rehabilitation settings, yet lack comparable durability in therapeutic outcomes. Rechargeable implantable platforms gain preference due to reduced replacement frequency and improved patient compliance. Non-rechargeable systems retain niche usage in specific patient cohorts with low reprogramming needs, supported by established clinical familiarity.

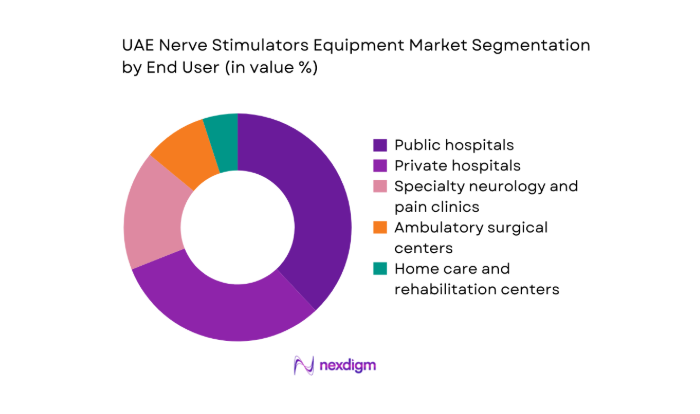

By End User

Public hospitals lead adoption due to centralized procurement, higher neurology caseloads, and access to multidisciplinary surgical teams. Private hospitals follow closely, driven by faster adoption cycles, medical tourism flows, and bundled procedure-device offerings. Specialty neurology and pain clinics contribute steadily as referral volumes increase and minimally invasive therapies gain acceptance. Ambulatory surgical centers show growing uptake for trial stimulation and select implantations, supported by streamlined care pathways. Home care and rehabilitation settings remain limited to external stimulation use, constrained by training needs and post-procedural monitoring requirements.

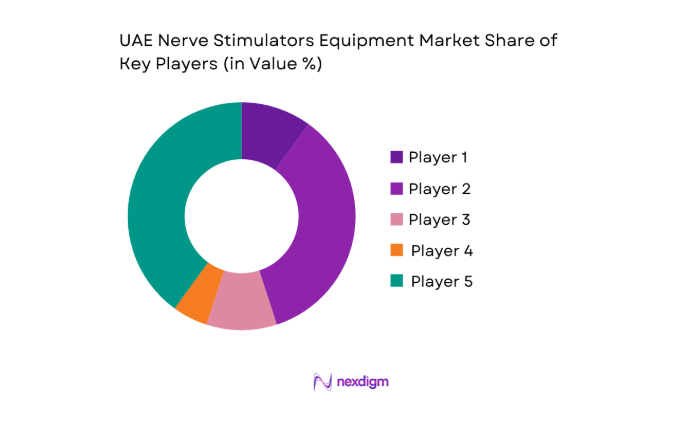

Competitive Landscape

The competitive environment features global device manufacturers supported by local distribution partners, with differentiation centered on clinical portfolio breadth, service coverage, and regulatory readiness. Procurement decisions emphasize long-term service capability, training support, and compatibility with existing neuromodulation workflows across hospital systems.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Medtronic | 1949 | Ireland | ~ | ~ | ~ | ~ | ~ | ~ |

| Boston Scientific | 1979 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Abbott | 1888 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Nevro | 2006 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| LivaNova | 2015 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Nerve Stimulators Equipment Market Analysis

Growth Drivers

Rising prevalence of chronic pain and neurological disorders

Chronic pain management demand is reinforced by rising procedure volumes within neurology and orthopedics. In 2023, public hospitals reported 4200 interventional pain procedures involving neuromodulation pathways, while private facilities documented 3100 comparable interventions. Neurology outpatient visits exceeded 190000 in 2024 across major emirates, reflecting higher diagnosis rates for neuropathic pain, Parkinsonian syndromes, and refractory epilepsy. Institutional expansion of specialized pain units reached 28 facilities in 2024, up from 21 in 2022. Clinical guideline updates issued in 2023 encouraged trial stimulation prior to long-term implantation, accelerating referral pathways and clinician adoption within tertiary care networks nationwide.

Expansion of specialized neurology and pain management centers

Specialty center expansion directly supports procedural capacity for neuromodulation therapies. Between 2022 and 2024, licensed neurology clinics increased from 64 to 79, while multidisciplinary pain centers rose from 18 to 27 across metropolitan clusters. Operating theaters equipped for implantable neurostimulation procedures expanded to 112 rooms in 2024, compared with 86 in 2022. Workforce capacity strengthened as accredited neurosurgeons trained in neuromodulation increased from 94 in 2022 to 131 in 2024. Institutional training programs conducted 46 device-specific workshops in 2023, accelerating procedural confidence and standardizing care pathways across public and private hospitals.

Challenges

High upfront device and procedure costs

High capital intensity constrains broader adoption despite clinical suitability. Hospital procurement committees reviewed 172 neuromodulation proposals in 2024, approving 119 due to budget ceilings within departmental allocations. Average tender evaluation cycles extended to 148 days in 2023, compared with 103 days in 2022, reflecting multi-layer approval requirements. Public hospitals reported 27 deferred procedures in 2024 because of equipment availability constraints during peak surgical scheduling periods. Insurance preauthorization workflows required 14 to 21 days for implantable procedures in 2024, creating scheduling bottlenecks. These structural frictions delay therapy initiation and reduce throughput efficiency across care settings.

Limited number of trained neuromodulation specialists

Human capital constraints limit procedural scalability. In 2022, only 73 clinicians held formal neuromodulation certification, rising to 108 in 2024, still below institutional demand across tertiary centers. Average waiting time for specialist consultation reached 19 days in 2023 within public facilities, compared with 11 days in private hospitals. Training throughput remains constrained by 9 accredited regional programs and 23 certified preceptors in 2024. Device programming expertise remains uneven, with 41 percent of centers reporting reliance on external technical support for complex reprogramming cases, affecting procedural scheduling and continuity of post-implantation care.

Opportunities

Expansion of outpatient neuromodulation procedures

Outpatient care pathways present scalability potential as same-day procedures increase system efficiency. In 2024, ambulatory centers performed 860 trial stimulation procedures, compared with 430 in 2022, supported by expanded recovery infrastructure. Day-surgery utilization for neuromodulation-related interventions reached 62 percent of eligible cases in private facilities in 2024. Regulatory approvals enabled 12 additional ambulatory centers to perform trial procedures in 2023, widening geographic access. Post-procedure follow-up visits shifted toward outpatient clinics, with 7400 visits recorded in 2024. These shifts reduce inpatient bed occupancy and accelerate therapy initiation across referral networks.

Adoption of rechargeable and longer-life implantable systems

Technology transitions toward rechargeable platforms create lifecycle efficiency gains for providers and patients. In 2023, 58 percent of newly implanted systems across tertiary hospitals utilized rechargeable platforms, rising to 71 percent in 2024. Replacement procedures for legacy non-rechargeable systems declined from 312 in 2022 to 184 in 2024, reducing operating theater utilization pressure. Clinician programming sessions per patient decreased from 6 to 4 annually between 2022 and 2024 due to improved device longevity and remote adjustment features. Training adoption increased as 33 clinical teams completed platform transition workshops in 2024, standardizing protocols across care settings.

Future Outlook

The market outlook through 2030 reflects sustained procedural growth supported by expanding specialty capacity, policy emphasis on advanced therapies, and continued technology upgrades. Urban care hubs will remain focal points for adoption, while outpatient pathways and rechargeable platforms reshape utilization patterns. Regulatory streamlining and workforce development are expected to improve access and throughput across care settings.

Major Players

- Medtronic

- Boston Scientific

- Abbott

- Nevro

- LivaNova

- NeuroPace

- Aleva Neurotherapeutics

- Synapse Biomedical

- SPR Therapeutics

- Bioness

- NeuroMetrix

- Nalu Medical

- Stimwave

- MicroPort NeuroTech

- Axonics

Key Target Audience

- Public hospital procurement authorities

- Private hospital networks and chain operators

- Specialty neurology and pain management clinics

- Ambulatory surgical center operators

- Medical device distributors and channel partners

- Health insurers and third-party administrators

- Investments and venture capital firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key clinical indications, device modalities, care settings, regulatory pathways, and channel structures were mapped to define the analytical scope. Variables reflected procedure workflows, adoption drivers, service dependencies, and institutional readiness. Metrics emphasized utilization pathways, clinical capacity, and technology transitions relevant to neuromodulation equipment.

Step 2: Market Analysis and Construction

Demand was constructed using procedure pathways, facility readiness indicators, and care delivery models across public and private sectors. Institutional indicators informed capacity constraints, while ecosystem mapping captured distributor coverage and service infrastructure. Analytical models integrated utilization intensity with care pathway evolution.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on adoption drivers, operational bottlenecks, and technology transitions were validated through structured consultations with clinicians, clinical engineers, and procurement specialists. Feedback loops refined assumptions on training capacity, outpatient migration, and device lifecycle management.

Step 4: Research Synthesis and Final Output

Findings were synthesized into a coherent narrative linking clinical demand, institutional readiness, and technology evolution. Outputs emphasized actionable insights for stakeholders across procurement, service delivery, and strategic planning, ensuring internal consistency and practical relevance.

- Executive Summary

- Research Methodology (Market Definitions and device taxonomy for nerve stimulators, UAE hospital procurement data triangulation and tender analysis, Primary interviews with neurosurgeons pain specialists and clinical engineers)

- Definition and Scope

- Market evolution

- Usage and care pathways

- Ecosystem structure

- Supply chain and channel structure

- Growth Drivers

Rising prevalence of chronic pain and neurological disorders

Expansion of specialized neurology and pain management centers

Government investment in advanced medical technologies - Challenges

High upfront device and procedure costs

Limited number of trained neuromodulation specialists

Lengthy regulatory and product registration timelines - Opportunities

Expansion of outpatient neuromodulation procedures

Adoption of rechargeable and longer-life implantable systems

Partnerships between OEMs and UAE-based distributors - Trends

Shift toward minimally invasive and programmable stimulators

Rising adoption of rechargeable implantable systems

Bundled device and service contracts by OEMs - Government Regulations

- SWOT Analysis

- Porter’s Five Forces Analysis

- By Value, 2019–2024

- By Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Product Type (in Value %)

Spinal cord stimulators

Peripheral nerve stimulators

Deep brain stimulators - By Modality and Power Source (in Value %)

Implantable nerve stimulators

External nerve stimulators

Rechargeable systems

Non-rechargeable systems - By Application (in Value %)

Chronic pain management

Movement disorders

Epilepsy management

Urinary and fecal incontinence

Post-surgical pain management - By End User (in Value %)

Public hospitals

Private hospitals

Specialty neurology and pain clinics

Ambulatory surgical centers

Home care and rehabilitation centers - By Geography within UAE (in Value %)

Abu Dhabi

Dubai

Sharjah

- Market share of major players

- Cross Comparison Parameters (product portfolio breadth, clinical indication coverage, pricing competitiveness, local distributor strength, after-sales service capability, clinician training programs, regulatory approvals status, installed base footprint)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Bench marketing

- Detailed Profiles of Major Companies

Medtronic

Boston Scientific

Abbott

Nevro

LivaNova

NeuroPace

Aleva Neurotherapeutics

Synapse Biomedical

SPR Therapeutics

Bioness

NeuroMetrix

Nalu Medical

Stimwave

MicroPort NeuroTech

Axonics

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- By Value, 2025–2030

- By Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030