Market Overview

The UAE otoscope equipment market is valued at approximately USD ~ million in the base year, derived from published data indicating the market size in 2024. Growth to this level has been driven by increased healthcare investment in the UAE, rising incidence of ear-related disorders, adoption of advanced diagnostic/visualisation otoscopes (digital/video) and strong outpatient & hospital infrastructure supporting ENT screening and diagnostics.

Major UAE cities such as Dubai and Abu Dhabi dominate the otoscope equipment market owing to their advanced tertiary-care hospitals, high healthcare spending per capita, concentration of private clinics and ENT specialists, and status as medical-tourism hubs. These metropolitan centres serve large expatriate populations and regional referral networks, which creates both high demand and adoption of premium diagnostic equipment ahead of smaller emirates.

Market Segmentation

By Product Type

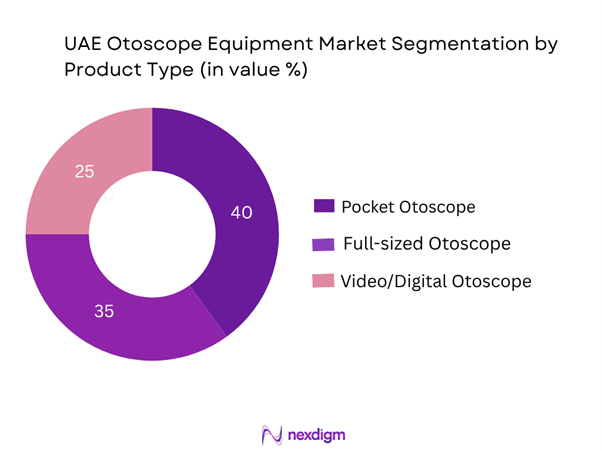

In the UAE otoscope equipment market, the pocket otoscope sub-segment holds the dominant share (approximately 40% in 2024) due to its cost-effectiveness, ease of deployment in outpatient clinics and general-practice settings, and widespread use for routine ear examinations. Many smaller clinics and mobile health units favour portable pocket models because they require less infrastructure and have lower maintenance. Full-sized otoscopes are widespread in hospital settings but incur higher CAPEX, while video/digital otoscopes, though growing rapidly due to tele-ENT and digital documentation use, still represent a smaller share because of higher priced equipment and service requirements.

By End-User

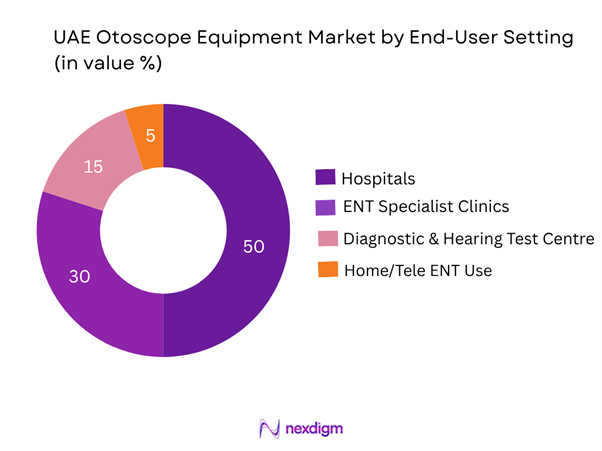

Hospitals capture the largest share in the UAE otoscope equipment market (around 50% in 2024) because they handle higher patient volumes, invest in advanced diagnostics, and require multiple units across wards and outpatient departments. Large multispecialty hospitals in the UAE tend to standardise on reliable otoscope equipment across departments, driving volume. ENT specialist clinics follow, with strong demand for diagnostic precision and often premium video/digital otoscopes. Diagnostic & hearing-test centres contribute a smaller share, while home/tele-ENT use remains nascent and thus lower share.

Competitive Landscape

The competitive environment in the UAE otoscope market is characterised by several global and regional device manufacturers and distributors who serve the region via import channels, local service infrastructure and partnerships with hospital groups. Market consolidation is moderate, with a handful of key players controlling sizeable device portfolios and service networks.

|

UAE Otoscope Equipment Market Analysis

Key Growth Drivers

Rising healthcare expenditure per capita

The UAE’s current health expenditure per capita reached USD 2,315 in 2022, up from USD 2,250 in 2021. This elevated spending underpins investment in advanced diagnostic equipment, including otoscope devices, enabling hospitals and clinics to adopt modern instrumentation. Increased budgets facilitate the procurement of premium full-sized and video otoscopes over lower-cost alternatives, thereby driving demand for high-end otoscope equipment across UAE healthcare settings.

High hospital outpatient throughput

In 2022, total hospital outpatient visits in the UAE reached 23,298,220, with the government sector accounting for 6,687,218 and the private sector 16,611,002 visits. The sheer volume of patient encounters necessitates reliable otoscope equipment in both general-practice and specialist ENT settings to support ear, nose and throat examinations as part of routine outpatient workflows, thereby fuelling demand for otoscope equipment.

Key Market Challenges

Concentrated healthcare spending share

Data indicates that health spending represented 4.68% of GDP in the UAE in 2022. While high compared to some emerging markets, the ratio still imposes budget discipline across device procurement, particularly for high-cost video/digital otoscopes. Hospitals may prioritise multi-purpose diagnostic platforms, which can constrain dedicated otoscope equipment demand.

Replacement and servicing burdens of advanced devices

The UAE healthcare system shows large device turnover requirements: hospital bed stock grew to 19,102 beds in 2022 (9,948 public + 9,154 private) and bed turnover rate rose to 50.3 admissions per bed. Hospitals facing high throughput and occupancy demand strong after-sales support and maintenance infrastructure — factors that add to total cost of ownership for premium otoscope equipment and may constrain purchases in smaller clinics or lower-margin settings.

Emerging Market Opportunities

Growing investment in outpatient and clinic-based ENT services

Total outpatient visits exceeded 23.3 million in 2022. As primary-care and specialist clinics expand capacity to manage ENT disorders in ambulatory settings, portable pocket and handheld otoscope equipment deployment is expected to accelerate, representing a white-space opportunity within the market.

Rising digital healthcare transformation

The UAE ranks 26th in the 2024 World Index of Healthcare Innovation, with a strong focus on technology uptake and fiscal sustainability. This favourable innovation climate presents opportunity for wireless, connected and video otoscope systems integrating with hospital IT platforms and tele-ENT initiatives, enabling distributors and manufacturers to capture premium device demand.

Future Outlook

Over the next six years the UAE otoscope equipment market is expected to demonstrate steady growth driven by continuing healthcare infrastructure investment, rising prevalence of ear disorders (particularly among children and expatriate populations), increasing adoption of digital/video otoscopes and tele-ENT solutions, and initiatives by government and private hospital networks to upgrade diagnostic equipment standards. Continued emphasis on preventive ear-care screening, integration of imaging into electronic health records, and expansion of outpatient ENT services will further support demand. As device sophistication rises (connectivity, AI-enabled diagnostics) and replacement cycles shorten, manufacturers and distributors with strong service & training capabilities will be well-positioned. The market also offers white-space opportunities in home-based otoscopy, telemedicine-linked devices, and refurbished equipment segments for clinics seeking cost efficiencies.

Major Players

- 3M Company

- Welch Allyn (Hill-Rom)

- HEINE Optotechnik GmbH & Co. KG

- Olympus Corporation

- Medline Industries

- American Diagnostic Corporation

- Riester GmbH

- MidMark Corporation

- Inventis SRL

- Luxamed GmbH & Co. KG

- Prestige Medical

- Graham-Field Health Products

- Firefly Global

- KaWe (Kirchner & Wilhelm GmbH & Co. KG)

- Groupe Spengler Holtex

Key Target Audience

- Medical-device manufacturers and suppliers of otoscope equipment

- Distributors and regional sales/after-sales service providers

- Private hospital chains and multi-specialty clinics (ENT departments)

- Healthcare investors and venture-capital firms (investments & venture-capitalist firms)

- Government and regulatory bodies (e.g., Dubai Health Authority, Abu Dhabi Department of Health, Ministry of Health & Prevention UAE)

- Diagnostic centres and outpatient ENT service providers

- Telemedicine/remote-care solution providers integrating otoscopy

- Health system procurement & CAPEX planners in UAE hospitals

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing an ecosystem map encompassing all major stakeholders within the UAE otoscope equipment market—manufacturers, importers/distributors, hospital/clinic purchasers, regulatory bodies and end-users. This step was underpinned by extensive desk-research, utilising secondary data from market-reports, import-export data, regulatory filings and proprietary healthcare-device databases, with the objective to identify and define the critical variables that influence market dynamics (e.g., device type, modality, service life, user type).

Step 2: Market Analysis and Construction

In this phase, historical data for the UAE otoscope equipment market was compiled and analysed—including market values for 2023 and 2024, unit volumes (where available), device replacement cycles, and average selling prices (ASPs). An assessment of uptake trends across hospitals, ENT clinics and diagnostic centres was conducted, drawing on import data, distributor supply-chain information and interviews to validate demand patterns.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses (such as the dominance of pocket otoscopes, the growth rate of video/digital otoscopes, segmental shares by end-user) were developed and validated through interviews (telephonic/video) with industry experts representing device manufacturers, regional distributors in the UAE, and procurement leads at major UAE hospital groups. These consultations provided operational insight, pricing, product lifecycle and service-support data.

Step 4: Research Synthesis and Final Output

The final phase involved consolidating data from the bottom-up approach (individual product/segment data, distributor pipelines) with top-down estimations (overall market size, growth trends) and validating against primary-research feedback. Forecast modelling (2024-2030) was constructed based on CAGR derivations and market drivers. The synthesis ensures that the final analysis of the UAE otoscope equipment market is comprehensive, accurate and actionable for business professionals.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions (device classification: pocket, full-sized, video; modality: wired vs wireless; portability: wall-mounted, handheld, standalone, Data Sources, Market Sizing Approach, Segment Forecasting Methodology, Consolidated Research Approach, Limitations and Assumptions)

- Market Definition & Scope

- Market Genesis & Evolution

- Timeline of Major Device Innovations & Regulatory Milestones in UAE

- Supply-Chain & Value-Chain Analysis

- Business Cycle & Device Replacement Cycle

- Key Growth Drivers

Rising ENT disease prevalence

Preventive ear-care programmes

Digital/tele-ENT trends - Key Market Challenges

High device cost

Regulatory import barriers

Device maintenance/servicing - Opportunities

Wireless/video otoscope adoption

Substitution of ageing devices

Remote-monitoring adoption - Trends

Portable devices penetration

AI/analytics integrated otoscopes

Disposable specula tips - Regulatory & Reimbursement Landscape

GCC-UAE device registration

Tendering policies

Import duties

Quality standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value (USD million), 2019-2024

- By Unit Volume (Number of Devices), 2019-2024

- By Average Selling Price (ASP) – per device category, 2019-2024

- By Product Type (In Value %)

Pocket Otoscope

Full-sized Otoscope

Video Otoscope

(Optional) Hybrid/Attachment Otoscope - By Modality (In Value %)

Wired Digital Otoscope

Wireless Bluetooth/Smart-Device-Connected Otoscope - By Portability & Installation Type (In Value %)

Wall-Mounted Otoscope

Handheld / Portable Otoscope

Standalone / Trolley-Based Otoscope System - By End-User (In Value %)

Hospitals (General & Multispecialty)

ENT Specialist Clinics / Centres

Diagnostic Imaging & Hearing-Test Centres

Home-Healthcare / Telemedicine Use - By Emirate-/Region (In Value %)

Dubai

Abu Dhabi

Sharjah & Northern Emirates

Other Emirates

- Market Share of Major Players (by Value / Units)

- Cross-Comparison Parameters (Company Overview, Business Strategy, Recent Developments, Strength, Weakness, Organisational Structure, UAE & GCC Revenue, Revenue by Product Type, Number of Device Models in UAE, Distribution Channel Presence in UAE, Service/Support Infrastructure, Device ASP in UAE, Device Warranty/Consumables Ecosystem)

- SWOT Analysis of Major Players

- Pricing-SKU Analysis (device cost breakdown, ASP trends by product type in UAE)

- Company Profiles of Major Players

3M Company

Welch Allyn

HEINE Optotechnik

Olympus Corporation

American Diagnostic Corporation

Riester GmbH

MidMark Corporation

Inventis SRL

Luxamed GmbH & Co. KG

Prestige Medical

Graham‑Field Health Products

Firefly Global

KaWe (Kirchner & Wilhelm GmbH + Co. KG)

Medline Industries

Groupe Spengler Holtex

- Demand & Utilisation Patterns

- Purchasing Power & Budget Allocations

- Clinical Needs, Pain-Points & Buying Criteria

- Decision-Making Process

- Service & After-Sales Requirements

- By Value (USD million), 2025-2030

- By Unit Volume (Number of Devices), 2025-2030

- By Average Selling Price (ASP), 2025-2030