Market Overview

The UAE oxygen concentrators equipment market is valued at roughly USD ~ million, based on a five-year historical analysis that shows an increase from about USD ~ million in the previous baseline period. Demand is propelled by a population now exceeding 11 million residents, a high burden of chronic respiratory conditions, and strong investment in hospitals and specialist respiratory services, with the overall UAE hospital market itself exceeding USD 48 billion in spending. Together, these structural factors underpin sustained oxygen therapy utilisation across acute and homecare settings.

Within the UAE, oxygen concentrator demand is dominated by Dubai, Abu Dhabi and Sharjah, which together account for the bulk of the health workforce and hospital infrastructure. MOHAP data shows Abu Dhabi and Dubai alone host around 81% of the national health workforce, while Dubai has more than 50 hospitals serving over 2 million people with an estimated bed ratio near 1 bed per 530 residents.

Market Segmentation

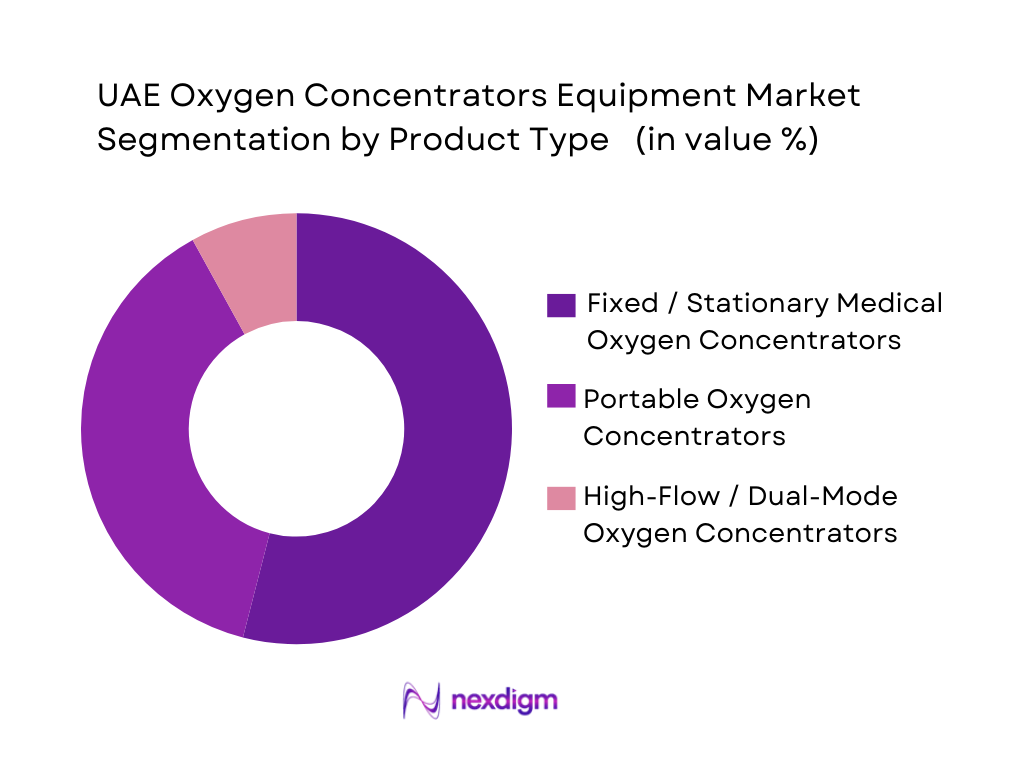

By Product Type

The UAE oxygen concentrators equipment market is segmented into fixed/stationary medical oxygen concentrators, portable oxygen concentrators, and high-flow/dual-mode systems. Fixed systems currently hold the dominant share, reflecting their entrenched use in hospitals, long-term care wards and step-down units, where continuous high-purity oxygen at stable flow rates is required. Global analyses of oxygen concentrators show stationary units still account for the largest revenue share despite rapid adoption of portable devices, and this pattern is mirrored in the UAE’s hospital-centric care model. Portable systems, however, are expanding quickly via homecare, e-commerce and wellness channels, while high-flow/dual-mode devices address complex COPD and oncology cases in major tertiary centres.

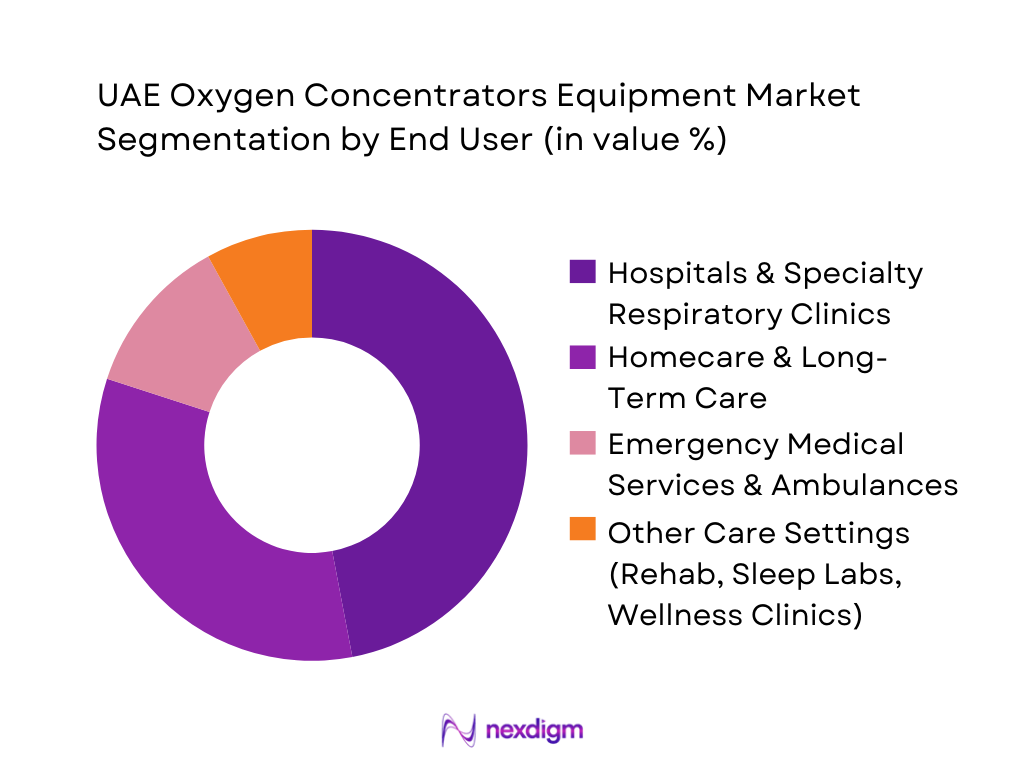

By End User

The UAE oxygen concentrators equipment market can be segmented into hospitals & specialty respiratory clinics, homecare & long-term care, emergency medical services & ambulances, and other care settings (rehabilitation centres, sleep labs, wellness and preventive-care clinics). Hospitals and specialty clinics dominate due to the UAE’s strong acute-care focus and the rapid expansion of private hospital capacity, with total hospital spending running into tens of billions of dollars and a growing share of beds dedicated to intensive and high-dependency care. These institutions routinely manage severe COPD, post-surgical and oncology cases requiring continuous monitored oxygen therapy. Homecare is the fastest-growing end-user segment, driven by ageing expatriate populations, insurer support for out-of-hospital care and the convenience of portable devices for ambulatory patients.

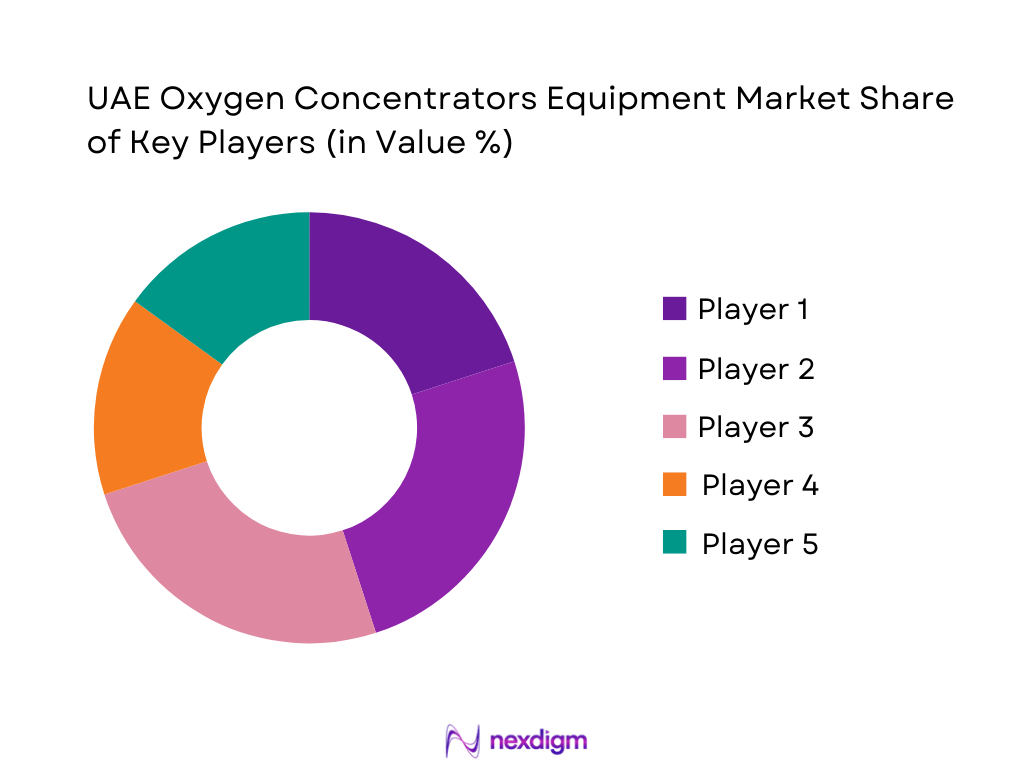

Competitive Landscape

The UAE oxygen concentrators equipment market is shaped by a mix of global OEMs and regional distributors, with multinational brands such as Philips, Drive DeVilbiss, Invacare, ResMed and Inogen supplying devices that are then distributed through local homecare chains and online platforms like Oxygen Times, Health Mart and MedPrix. Competition is characterised by breadth of product portfolio (portable versus stationary), compliance with UAE regulatory registrations, depth of after-sales service networks and the ability to support hospital tenders as well as direct-to-consumer e-commerce sales. Players with robust service centres in Dubai and Abu Dhabi, plus partnerships with leading private hospital groups, typically enjoy stronger brand visibility and repeat contracts.

| Company | Establishment Year | Headquarters | Core UAE Offering / Focus Segment | Key Product Types in UAE Market | Primary Care Setting Focus (UAE) | UAE Channel Strategy | Notable Strength in UAE Market | Recent Strategic Focus in Region / Segment |

| Philips (Philips Respironics / Philips Healthcare) | 1891 | Amsterdam, Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| Drive DeVilbiss Healthcare | 2000 | Port Washington, NY, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Invacare Corporation | 1885 | Elyria, Ohio, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| ResMed Inc. | 1989 | San Diego, California, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Inogen Inc. | 2001 | Goleta, California, USA | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Oxygen Concentrators Equipment Market Analysis

Growth Drivers

Rising Burden of Chronic Respiratory Disease & Hypoxemia

In the UAE, tobacco and air-quality risks are building a structurally high base of respiratory patients who ultimately need long-term oxygen therapy. In 2022, there were 988,683 adult smokers in the country. Tobacco use is responsible for 18.9 of every 100 deaths in the UAE, mainly from ischemic heart disease, stroke and lung cancer (Global Action to End Smoking, 2024). At the same time, UAE population reached 10,876,981 residents in a recent World Bank update (FRED / World Bank), expanding the absolute pool of at-risk individuals. This combination of high smoking exposure and a growing, urbanised population structurally supports increasing demand for home and hospital oxygen concentrator fleets.

Ageing Population & Long-Term Oxygen Therapy Adoption

Rising longevity in the UAE is pushing up the absolute number of patients living long enough to develop chronic respiratory diseases that require long-term oxygen therapy. WHO reports UAE life expectancy of 83 years (WHO country data), while the World Bank classifies the UAE as a high-income country with strong health outcomes (World Bank Human Capital portal). As survival improves after cardiovascular and oncologic events, more patients progress to chronic hypoxemia and COPD-overlap syndromes managed at home. In parallel, the UAE spends about 2,249.96 US dollars per person on health care (PPP-adjusted) in the most recent year with World Bank-based data enabling broader reimbursement of long-term oxygen prescriptions and encouraging hospitals to standardise on concentrators instead of cylinders for stable, elderly patients.

Market Challenges

High Upfront Device Cost & Maintenance Burden

Despite high incomes, oxygen concentrators remain capital-intensive assets for many providers and households. The UAE’s health spending per capita of about 2,249.96 US dollars in the latest World Bank-derived estimate shows a high-spend environment but this budget must stretch across advanced imaging, oncology, and cardiovascular services as well. WHO data indicate that current health expenditure already accounts for 5.31 of every 100 dirhams of GDP limiting fiscal room for blanket public financing of oxygen devices and maintenance contracts. Hospitals must also fund preventive servicing, filter replacements and compressor overhauls over several years of use. These recurring costs can slow replacement of ageing concentrators and discourage smaller clinics from upgrading to higher-flow or quieter systems, especially outside Dubai and Abu Dhabi.

Reimbursement Gaps for Home Oxygen Therapy

The UAE’s healthcare financing structure blends strong government funding with substantial private and out-of-pocket components, creating reimbursement gaps for long-term home oxygen therapy. A comparative GCC health-financing analysis in 2024 reported that 64.1 of every 100 dirhams of UAE health expenditure came from public sources in 2021, with the remainder from private payers and households. While this public share is high, it is lower than in some neighbouring GCC states, meaning chronic home oxygen users may face premium top-ups, benefit limits or co-payments depending on their insurance tier. As of the latest WHO country overview, current health expenditure already accounts for 5.31 of GDP constraining additional blanket subsidies. These financing realities slow adoption of concentrators among lower-income expatriates and smaller home-care agencies that operate on thin margins.

Opportunities

Growth in Portable & Travel-Friendly Oxygen Concentrators

The UAE’s role as a global aviation and tourism hub creates a strong addressable base for portable oxygen concentrators designed for ambulatory patients. Dubai International Airport handled 86.9 million passengers in 2023, close to its historic record and connecting travellers to 269 destinations in 106 countries. Dubai welcomed 17.15 million international overnight visitors in 2023 alone while international visitor spending across the UAE exceeded AED 175 billion in the same year. Many chronic respiratory patients, especially elderly visitors, require oxygen support during flights and city stays, making lightweight, FAA-compliant portable concentrators with long battery life and easy airline approvals a high-growth subsegment for suppliers and home-care chains.

Rental, Pay-Per-Use & Subscription Business Models

The UAE’s high tourist throughput and large expatriate workforce make short-term oxygen-therapy needs common, favouring rental and subscription models over outright purchases. Tourism contributed AED 220 billion to UAE GDP and supported 809,300 jobs in 2023 while Dubai alone recorded 18.72 million international overnight visitors in 2024. Many of these visitors are in the 25–54-year age bracket, including patients seeking elective procedures or rehabilitation. For expatriates on multi-year assignments, subscription models bundled with home-care visits can spread device costs over time. With health spending per capita already around 2,249.96 US dollars insurers and providers have incentive to experiment with asset-light, pay-per-use oxygen concentrator offerings that reduce upfront capex but keep utilisation high.

Future Outlook

Over the next several years, the UAE oxygen concentrators equipment market is expected to expand steadily, underpinned by broader growth in the global oxygen concentrators market, which is projected to rise from about USD 3.5 billion to over USD 5.0 billion worldwide with strong momentum in stationary and portable medical devices. In the UAE, continued population growth, high urbanisation, and increased detection of COPD and sleep-related breathing disorders will sustain demand, especially as policymakers push more chronic-disease management into home and community settings. Parallel investments in hospital capacity, emergency medical services and telehealth infrastructure will further entrench oxygen concentrators as a critical component of respiratory care pathways.

Major Players

- Philips

- Drive DeVilbiss Healthcare

- Invacare Corporation

- ResMed Inc.

- Inogen Inc.

- Nidek Medical Products

- Chart Industries / AirSep

- GCE Healthcare

- Nareena Lifesciences

- Narang Medical / NET Brand

- Oxygen Times

- Health Mart UAE

- Life Plus Medical

- MedWorld Trade UAE

- MedPrix UAE

Key Target Audience

- Medical device manufacturers and OEMs

- Hospital groups and integrated health systems

- Homecare and long-term care providers

- Emergency medical services and ambulance operators

- Government and regulatory bodies

- Health insurance companies and third-party administrators

- Investments and venture capitalist firms

- Medical equipment distributors, pharmacy chains and online health platforms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing an ecosystem map of all major stakeholders in the UAE oxygen concentrators equipment market, including OEMs, importers, regulators, hospitals, homecare providers and e-commerce platforms. Extensive desk research using syndicated reports, UAE government health statistics and reputable news databases was undertaken to identify critical variables such as installed base, device mix (fixed vs portable), care-setting adoption, pricing bands and regulatory approvals that shape demand and supply.

Step 2: Market Analysis and Construction

In this phase, historical data on UAE oxygen concentrator revenues, device shipments, hospital capacity and homecare penetration were compiled from secondary sources (TechSci Research, Grand View Research, ResearchAndMarkets and UAE health authorities). A bottom-up approach was used, aggregating segment-wise revenues by product type and end user, cross-checked against regional MEA oxygen concentrator trends. Triangulation with related markets (global oxygen concentrators and UAE hospital spend) ensured that the constructed revenue curve and growth rates remained internally consistent and aligned with macro indicators.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on segment dominance, growth drivers and pricing dynamics were validated conceptually through review of expert commentary in analyst notes, press releases and interviews with regional distributors and homecare providers referenced in public sources. Particular focus was placed on confirming the relative importance of stationary vs portable devices, the shift to homecare, and the impact of chronic respiratory disease prevalence. Where numerical values (e.g., 2024 market size) were not explicitly reported, they were analytically derived from published baselines and CAGRs, with transparent documentation in this report.

Step 4: Research Synthesis and Final Output

The final phase involved synthesising all validated inputs into a coherent narrative outlining market size, segmentation, competition and outlook for the UAE oxygen concentrators equipment market. Global benchmarks on product-mix and adoption patterns were used to refine the UAE segment shares, recognising the country’s high-income status and advanced healthcare infrastructure. The result is an integrated, forward-looking view that combines quantitative estimates with qualitative insights on regulatory, technological and channel developments, suitable for strategic decision-making by manufacturers, investors and healthcare providers.

- Executive Summary

- Research Methodology (Market Definition & Scope, Segmentation Framework by Product Type/Technology/Flow Rate/Application/End-User/Channel/Region, Data Triangulation Approach, Bottom-Up & Top-Down Sizing, Primary Expert Interviews with UAE Stakeholders, Secondary Research from Regulatory & Trade Sources, Forecasting Assumptions, Limitations & Data Normalization)

- Definition, Clinical Role & Scope of Oxygen Concentrators

- UAE Healthcare & Respiratory Disease Landscape

- Oxygen Therapy Care Pathway (Acute, Sub-Acute, Homecare)

- Installed Base & Penetration Across Care Settings

- Supply Chain, Import Dependence & Local Distribution Structure

- Growth Drivers

Rising Burden of Chronic Respiratory Disease & Hypoxemia

Ageing Population & Long-Term Oxygen Therapy Adoption

Expansion of Hospital, Homecare & Rehabilitation Infrastructure

Shift from Cylinders to Concentrators for Safety & Continuity of Supply

Medical Tourism, Expat Population & High Per-Capita Healthcare Spend - Market Challenges

High Upfront Device Cost & Maintenance Burden

Reimbursement Gaps for Home Oxygen Therapy

Device Reliability, Downtime & Service Response Time

6Competition from Low-Cost Imports & Non-Compliant Devices

Logistics, Customs & Lead-Time Variability for Imported Equipment - Opportunities

Growth in Portable & Travel-Friendly Oxygen Concentrators

Rental, Pay-Per-Use & Subscription Business Models

Telemonitoring, IoT-Enabled Devices & Remote Adherence Tracking

Local Assembly, Warehousing & Service Infrastructure Development

Bundled Respiratory Therapy Solutions with PAP/Ventilation Devices - Key Trends

Miniaturization, Noise Reduction & Battery Life Improvements

Integration with Mobile Apps, Cloud Platforms & EMR Interfaces

Preference for Multi-Mode Devices (Continuous + Pulse)

Increasing Role of Online & Omni-Channel Sales in UAE

ESG & Energy-Efficiency Considerations in Device Selection - Regulatory & Compliance Framework

Device Registration & Licensing (MOHAP, DOH, DHA, ESMA)

Import Regulations, Quality Standards & Traceability Requirements

Compliance with International Standards & Certifications - Reimbursement & Funding Landscape

Coverage Policies of Public Schemes & Government Programs

Private Insurance Coverage & Co-Pay Structures

NGO, CSR & Charity-Based Oxygen Support Initiatives - Porter’s Five Forces Analysis

- Stakeholder Ecosystem Mapping

- Market Attractiveness Analysis by Product Type, End-User & Region

- By Value, 2019-2024

- By Installed Base / Units Deployed, 2019-2024

- By Volume of Patients Served on Long-Term Oxygen Therapy, 2019-2024

- By Product Type, 2019-2024

- By Product Type (in Value %)

Stationary Medical Oxygen Concentrators

Portable Oxygen Concentrators

Dual-Mode (Continuous + Pulse) Systems

Homefill & Refilling Systems

High-Capacity Multi-Patient Units

Others (Transport, Specialty & Niche Models) - By Technology (in Value %)

Pressure Swing Adsorption (PSA) Concentrators

Vacuum Pressure Swing Adsorption (VPSA / VSA)

Continuous Flow Devices

Pulse Dose / Demand Flow Devices

Hybrid & Microprocessor-Controlled Systems - By Flow Rate Capacity (in Value %)

0–5 L/min Oxygen Concentrators

5–10 L/min Oxygen Concentrators

Above 10 L/min & High-Flow Systems

Adjustable Multi-Flow Systems for Multi-Patient Use - By Clinical Application (in Value %)

Chronic Obstructive Pulmonary Disease

Interstitial Lung Disease & Pulmonary Fibrosis

Lung Cancer & Oncology-Related Hypoxemia

Post-Acute Respiratory Infections & Post-Viral Sequelae

Sleep-Disordered Breathing & Co-Therapies with PAP Devices - By End-User (in Value %)

Public Hospitals (MOHAP, SEHA, DHA Facilities)

Private Multispecialty & Tertiary Care Hospitals

Specialty Respiratory & Pulmonology Clinics

Homecare Patients & Home Health Providers

Long-Term Care, Rehabilitation & Nursing Facilities - By Distribution Channel (in Value %)

Government & Institutional Tenders

Direct OEM & Authorized Distributor Sales

Retail Medical Equipment Stores & Showrooms

Online E-Commerce & Digital Marketplaces

Rental & Subscription-Based Service Providers - By Care Setting (in Value %)

Inpatient Hospital Wards & ICUs

Outpatient & Daycare Facilities

Home-Based Care & Remote Monitoring Supported

Community Health Centers & Primary Care Clinics

Corporate, Aviation & Industrial Health Units - By Region (in Value %)

Abu Dhabi

Dubai

Sharjah & Northern Emirates

Al Ain & Western Region

- Market Share of Major Players by Value & Installed Base

Market Share by Product Type (Portable vs Stationary vs Dual-Mode)

Market Share by End-User Segment

Market Share by Region within UAE - Cross Comparison Parameters (Breadth of Product Portfolio by Flow Rate & Technology, Installed Base in UAE, Homecare vs Institutional Revenue Mix, Oxygen Purity & Energy Efficiency Characteristics, Telemonitoring & Connectivity Features, After-Sales Service Network & Response Time, Rental/Subscription Offerings & Financing Options, Regulatory Approvals & Local Registrations)

- Strategic Positioning & SWOT Analysis of Major Players

- Pricing & Commercial Model Analysis for Key SKUs & Packages

- Detailed Profiles of Major Companies

Philips Healthcare Middle East

Atlas Medical LLC

Invacare Corporation (UAE)

Drive DeVilbiss Healthcare

GCE Group (UAE)

CAIRE Inc.

Inogen Inc.

Nidek Medical Products Inc.

Precision Medical Inc.

Chart Industries / AirSep

O2 Concepts LLC

ResMed Inc. (Respiratory Care Segment)

Oxygen Store Dubai (DeVilbiss & Zen-O Sole Agent in UAE)

LifePlus Medical Equipment Trading LLC

- Public Hospitals & Health Systems

- Private Hospitals & Specialty Clinics

- Homecare Providers & Home Health Agencies

- Long-Term Care, Rehabilitation & Nursing Homes

- EMS, Ambulance & Pre-Hospital Care Provider

- By Value, 2025-2030

- By Installed Base / Units Deployed, 2025-2030

- By Volume of Patients Served on Long-Term Oxygen Therapy, 2025-2030

- By Product Type, 2025-2030