Market Overview

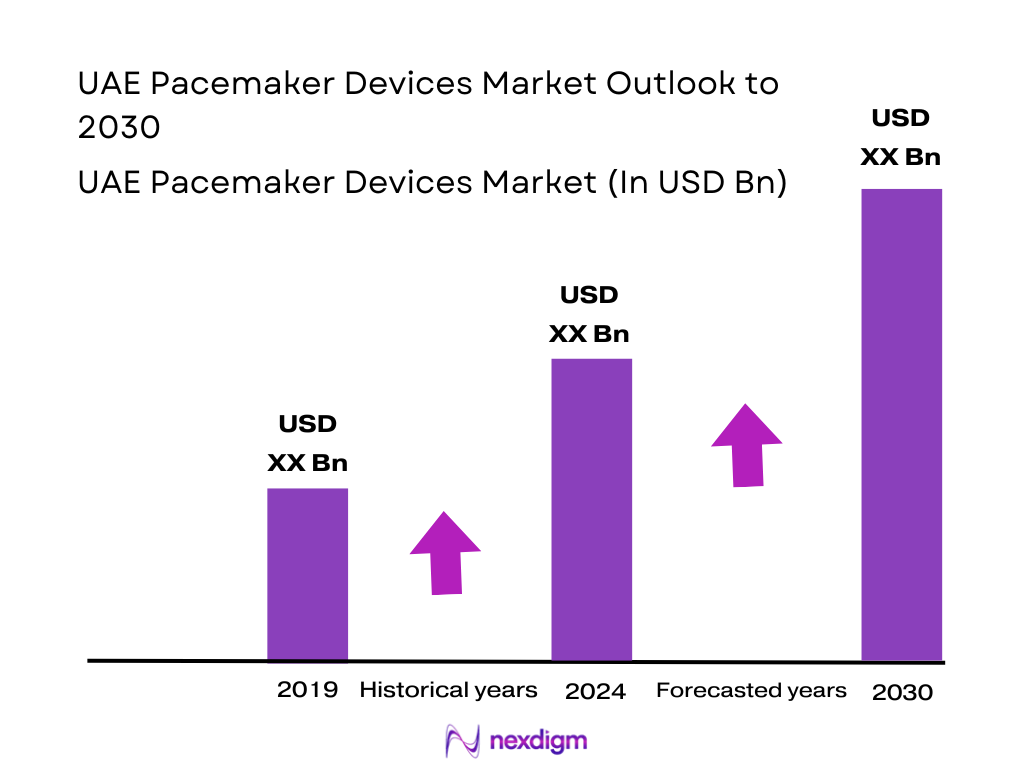

The UAE pacemaker devices market is valued at roughly USD ~ million, based on a rolling multi-year analysis that shows revenue climbing from around USD ~ million at the start of the window. This growth sits within a global pacemaker industry worth about USD ~ billion currently, supported by ageing populations and rising arrhythmia burden. In the UAE, rising cardiovascular risk factors, high per-capita healthcare spend and rapid adoption of MRI-compatible and leadless systems are key structural drivers, amplified by government investment in tertiary cardiology and cardiac rhythm management capacity.

The UAE pacemaker devices market is highly concentrated in Abu Dhabi and Dubai, which together account for most implant volumes due to their dense cluster of tertiary cardiac centres, teaching hospitals, and medical tourism hubs. Abu Dhabi region currently dominates the UAE pacemaker market, reflecting the capital’s wealth, SEHA-run public hospitals and strong referral networks. Dubai’s private hospital ecosystem, including large groups such as Emirates Hospitals, Saudi German, Aster and CMC, further anchors device usage, while other emirates still show lower but gradually rising penetration.

Market Segmentation

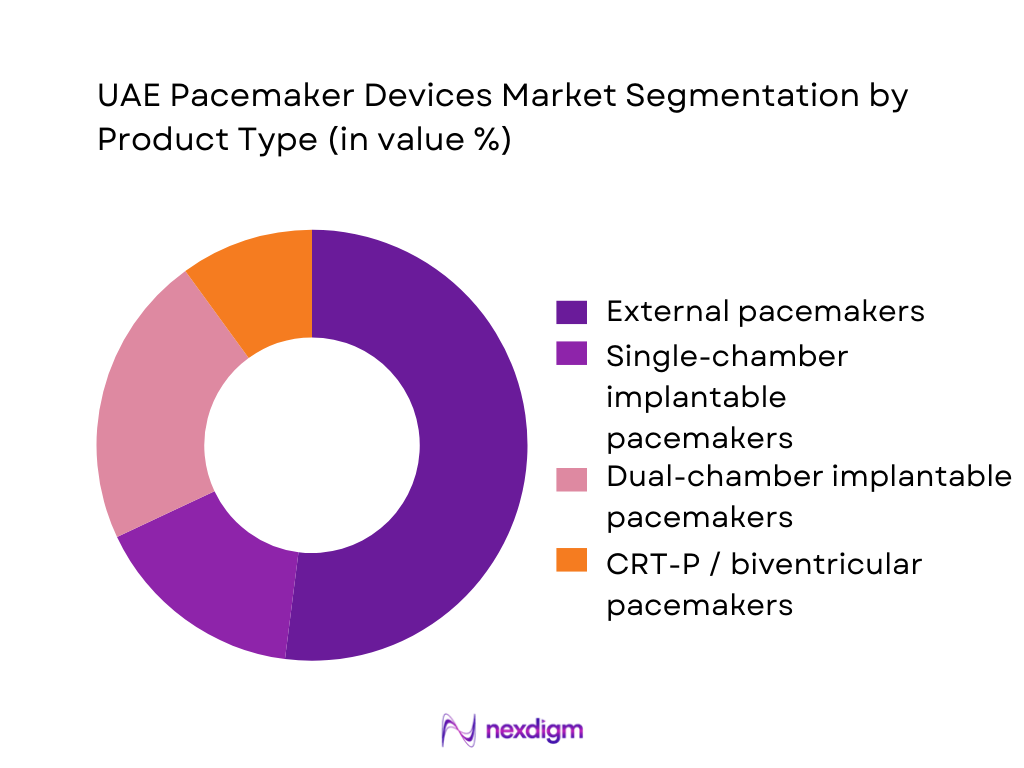

By Product Type

The UAE pacemaker devices market is segmented into external pacemakers, single-chamber implantable pacemakers, dual-chamber implantable pacemakers, and CRT-P/biventricular systems. External pacemakers currently hold the leading revenue position in the UAE. This dominance reflects relatively high temporary pacing utilisation in intensive care units, post-cardiac surgery settings, and during electrophysiology and interventional procedures in major public and private hospitals. The UAE’s role as a regional referral hub means complex cardiac cases from GCC and wider MENA often receive temporary pacing during stabilization or before definitive device therapy, driving utilisation of external systems. At the same time, high device pricing and relatively smaller chronic heart-failure and conduction-disorder cohorts versus Western markets keep long-term implant volumes more modest, reinforcing the weight of external pacemakers in the overall device mix.

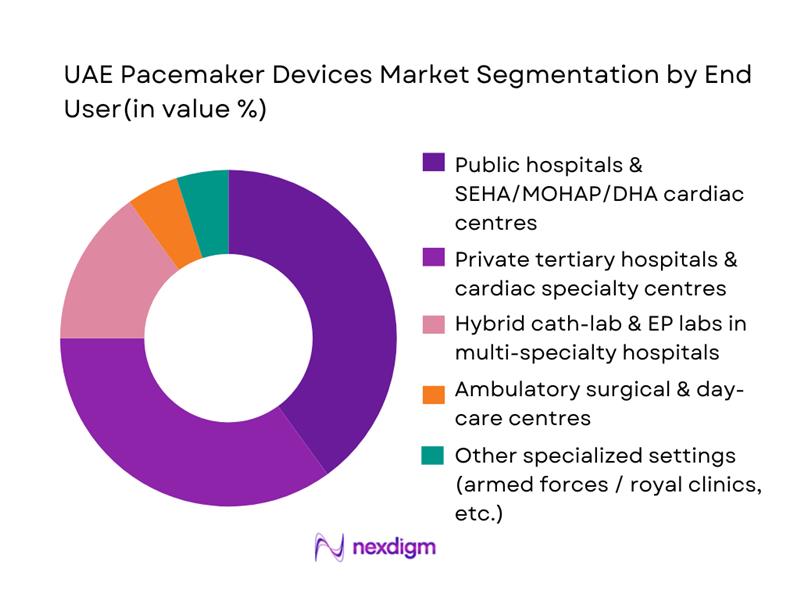

By End User

The UAE pacemaker devices market is segmented into public hospitals and SEHA/MOHAP/DHA cardiac centres, private tertiary hospitals and specialty heart institutes, hybrid cath-lab/EP units in multi-specialty facilities, ambulatory surgical centres, and other specialized settings. Public and large private cardiac centres together command the dominant market share. Abu Dhabi’s SEHA hospitals and Dubai Health Authority facilities provide subsidised or discounted implants for eligible citizens and residents, giving them strong volume leverage. Private groups in Dubai and Sharjah complement this by targeting insured expatriate and medical-tourism demand with advanced MRI-conditional and leadless pacing platforms from Medtronic, Abbott, Boston Scientific and BIOTRONIK. Pacemaker implantation requires cath-lab infrastructure, 24/7 cardiology coverage and follow-up device clinics; such capabilities are concentrated in these large centres, while ambulatory and day-care centres mainly handle diagnostics and limited follow-up rather than primary implantation, keeping their revenue share small.

Competitive Landscape

The UAE pacemaker devices market is anchored by a concentrated group of global cardiac rhythm management manufacturers, led by Medtronic, Abbott, Boston Scientific, BIOTRONIK and MicroPort, complemented by niche European and Asian OEMs. These players supply both external and implantable platforms, including MRI-conditional and leadless systems, through regional distributors and direct sales organisations. Market power is reinforced by portfolio breadth, long device track records, and integrated remote monitoring platforms, making formulary switching costly for hospitals. At the same time, price-sensitive public tenders, MOHAP/SEHA/DHA reimbursement criteria and intense clinical scrutiny of long-term safety and reliability maintain disciplined competition on value, not just on headline pricing.

| Company | Establishment Year | Global HQ (Region) | Key Pacemaker Lines (Illustrative) | Core Technology Focus (Pacemakers) | UAE / GCC Presence Model | Primary UAE Customer Base | Differentiating Strength in Pacemakers |

| Medtronic | 1949 | Dublin, Ireland (Operational HQ: Minneapolis, US) | ~ | ~ | ~ | ~ | ~ |

| Abbott | 1888 | Abbott Park, Illinois, US | ~ | ~ | ~ | ~ | ~ |

| Boston Scientific | 1979 | Marlborough, Massachusetts, US | ~ | ~ | ~ | ~ | ~ |

| BIOTRONIK | 1963 | Berlin, Germany | ~ | ~ | ~ | ~ | ~ |

| MicroPort CRM | 1998 | Clamart, France (CRM Headquarters) | ~ | ~ | ~ | ~ | ~ |

UAE Pacemaker Devices Market Analysis

Growth Drivers

Increasing prevalence of cardiovascular and rhythm disorders

Cardiovascular diseases (CVDs) remain the leading cause of mortality in the UAE: a recent 2024-published overview notes that CVDs account for approximately 36.7% of all deaths in the country, making heart disease the largest contributor to national mortality, overtaking cancer and other conditions. In parallel, a 2025 multi-centre study estimated that nearly 30% of the eligible adult population has established atherosclerotic cardiovascular disease (ASCVD), significantly increasing the pool of individuals at risk for conduction disorders and arrhythmias which may necessitate pacemaker therapy. This elevated burden of heart disease and related risk factors (e.g. hypertension, diabetes, obesity) directly expands the potential patient base for pacemakers, creating sustained demand. Given that pacemaker therapy addresses conduction abnormalities, the high underlying CVD prevalence and rising ASCVD risk ensure a steady and growing need for devices.

Expanding elderly and multi-morbidity population needing pacing

Although the UAE has a relatively young population compared with many Western nations, recent demographic and lifestyle shifts are increasing chronic disease burdens among middle-age and older adults. A 2023 study cited that risk factors like obesity, sedentary lifestyle, hypertension and diabetes — all contributing to earlier onset cardiovascular morbidity — remain widespread, even among younger age groups. As chronic comorbidities accumulate, the likelihood of conduction system disease, bradyarrhythmias, heart block, or heart-failure requiring pacing increases. The earlier onset of heart disease (often a decade sooner than in Western countries, per regional clinical observations) boosts the long-term addressable pool for pacemaker implantation and future replacement cycles. For device manufacturers and healthcare providers, this trend strengthens the case for investing in both implantable and follow-up pacing infrastructure, as the multi-morbid cohort will require long-term rhythm management rather than one-off interventions.

Market Challenges and Constraints

Capex intensity of EP labs and device inventories

Establishing and equipping electrophysiology (EP) labs and cath-labs capable of safe pacemaker implantation requires substantial capital expenditure. The UAE healthcare expansion data shows new hospitals and facilities, but building and maintaining EP infrastructure — with imaging, sterile labs, device inventory, follow-up units — remains financially intensive. Although exact national capex data for EP labs are not publicly broken out, the general cost pressures on hospital investments are documented: UAE healthcare providers face rising treatment and equipment costs, driven by imported medical technologies and staff salaries. Because pacemaker inventories (especially for advanced MRI-conditional or leadless devices) are expensive, hospitals must commit significant capital up-front before generating revenue via implants. This high capital outlay restricts adoption — especially in smaller or lower-volume hospitals — limiting market penetration to larger tertiary and well-funded private institutions.

Physician and center-level learning curves for advanced and leadless systems

Advanced pacing systems — such as leadless pacemakers, conduction-system pacing, and MRI-conditional devices — require specialized training and infrastructure, including EP lab expertise, imaging support, and ongoing device follow-up capability. The UAE has expanded its hospitals and general care capacity, but training electrophysiologists and technicians lags behind infrastructure growth. Regulatory and staffing reports note persistent need for qualified healthcare professionals to meet rising demand for quality services. Additionally, many public hospitals still operate more traditional cardiology setups, and shifting to newer pacing technologies involves a learning curve, procedural standardization, and post-implant follow-up protocols. This often slows adoption of advanced systems, as clinicians prefer legacy devices with which they are familiar — especially in settings where patient volume does not justify extensive training or inventory.

Opportunities

Upgrade potential from legacy to MRI-conditional devices

As UAE hospitals modernize and patients become more health-insurance aware, there is substantial opportunity for upgrading existing pacemaker estates from older, non-MRI-compatible devices to modern MRI-safe systems. Given that CVD remains the leading cause of death (≈ 36.7%), and that many patients live with comorbidities requiring periodic imaging, the demand for MRI-conditional pacemakers is rising. Moreover, health authorities’ increasing emphasis on digital health and integrated care — as evidenced by the deployment of national medical-record platforms across more than 3,000 facilities — suggests hospitals are enhancing infrastructure for managing follow-up and imaging needs. For device manufacturers, this presents a clear upgrade market: converting existing pacemaker patients to MRI-safe systems, generating replacement-device volume and recurring revenue.

White space for leadless pacing and conduction-system pacing

Given the structural growth of hospital infrastructure (10 new hospitals added in 2024, over 150 new clinics) and increasing private-sector engagement, many centers are yet to adopt state-of-the-art leadless or conduction-system pacing technologies. Coupled with the high burden of CVD and rising multi-morbidity among patients — many of whom may be unsuitable for multiple-lead implants due to comorbidities or lifestyle needs — leadless and conduction-system pacemakers provide a compelling alternative: less invasive, lower maintenance, and offering better long-term quality-of-life. As training improves and device costs decline, these technologies represent a “white-space” growth opportunity for OEMs and hospitals alike. The still-low penetration means early entrants can gain significant market share.

Future Outlook

Over the next several years, the UAE pacemaker devices market is expected to maintain mid-single-digit annual growth, underpinned by rising arrhythmia diagnosis, expanding catheterisation and EP lab capacity, and continued inflow of cardiovascular medical tourism. Grand View Research projects the UAE pacemakers market to grow from USD ~ million in the latest base year to USD ~ million by 2030, implying a forecast CAGR of about 4.4% from 2024 to 2030. to expand screening for atrial fibrillation and heart block, combined with MOHAP and emirate-level investments in digital health and remote monitoring, should favour premium MRI-compatible, leadless and connected pacemaker platforms, increasing average selling prices even as tenders remain price-competitive.

Major Players

- Medtronic plc

- Abbott Laboratories

- Boston Scientific Corporation

- BIOTRONIK SE & Co. KG

- MicroPort Scientific Corporation

- LivaNova PLC

- Lepu Medical Technology

- MEDICO S.p.A.

- Osypka Medical GmbH

- Oscor Inc.

- Shree Pacetronix Ltd.

- ZOLL Medical Corporation

- Integer Holdings Corporation

- Medico International / Medico S.p.A.

Key Target Audience

- Global and regional cardiac device OEM leadership

- Hospital procurement, biomedical engineering and cardiology department heads

- Private hospital groups and cardiology chains

- Health insurance companies and third-party administrators

- Government and regulatory bodies

- Investment and venture capital firms

- Digital health, remote monitoring and tele-cardiology platform providers

- Regional distributors and channel partners of cardiovascular and cardiac rhythm management devices

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map for the UAE pacemaker devices market, covering OEMs, regional distributors, cath-lab and EP-enabled hospitals, public payers and private insurers. Extensive desk research is conducted to capture device revenues, procedure volumes and infrastructure. The primary objective is to define critical variables including implant volumes by indication, product mix (external vs implantable), and pricing tiers across public and private settings.

Step 2: Market Analysis and Construction

In this phase, historical and current data points for UAE pacemaker revenues and volumes are compiled, starting from regional MEA pacemaker statistics through to UAE-specific databooks. A bottom-up model is built using estimated implants per active EP/cath-lab site, blended average selling prices by product tier, and device replacement cycles. Cross-checks are performed against the UAE cardiovascular devices market and global pacemaker benchmarks to ensure internal consistency, particularly for the 2024–2030 trajectory and the 4.4% CAGR assumption.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on product-mix evolution, end-user concentration, and adoption of MRI-conditional and leadless pacing are validated through structured interviews and computer-assisted calls with interventional cardiologists, electrophysiologists, cath-lab managers, and procurement leads in Abu Dhabi, Dubai and selected other emirates. These consultations refine assumptions around temporary vs implantable use, technology preferences, tender dynamics and patient profiles (citizen vs expatriate vs inbound medical tourists). Expert feedback is also used to calibrate segmentation shares and to understand potential regulatory or reimbursement inflection points that could alter growth trajectories.

Step 4: Research Synthesis and Final Output

The final phase synthesizes quantitative modelling and expert insights into a cohesive picture of the UAE pacemaker devices market. This includes triangulating top-down data from global and regional pacemaker reports with bottom-up estimates for the UAE, and reconciling any discrepancies through sensitivity analysis. Iterative validation with key market stakeholders ensures that revenue sizing, CAGR, segmentation splits and competitive positioning are robust. The result is a decision-grade view of market size, growth outlook, strategic opportunities and risks, tailored for business leaders and investors evaluating the UAE pacemaker devices space.

- Executive Summary

- Research Methodology (Market definitions and device classifications, inclusion/exclusion criteria for permanent vs temporary pacemakers, top-down triangulation from cardiovascular device spend and health-expenditure benchmarks, bottom-up modeling using implant volumes and cath-lab counts, pricing and ASP band construction across tenders and private lists, data sources and validation hierarchy, primary interviews with electrophysiologists, interventional cardiologists, biomedical engineers and procurement teams, assumptions on replacement cycles and device longevity, limitations and scenario-building approach)

- Definition, Scope and Device Taxonomy

- Epidemiology of Bradyarrhythmias and Conduction Disorders in UAE

- Role of Pacemakers within Cardiac Rhythm Management Continuum

- Evolution of Pacemaker Technology

- UAE Healthcare System Context for Pacemaker Therapy

- Growth Drivers

Increasing prevalence of cardiovascular and rhythm disorders

Expanding elderly and multi-morbidity population needing pacing

Rising density of EP labs and interventional cardiologists

Growing private hospital capacity and cardiac centers

Strengthening insurance coverage for rhythm-management procedures - Market Challenges and Constraints

Capex intensity of EP labs and device inventories

Physician and center-level learning curves for advanced and leadless systems

Procurement and price constraints in public tenders

Reimbursement caps in private insurance for device components

Competition from alternative therapies such as ablation in select indications - Opportunities

Upgrade potential from legacy to MRI-conditional devices

White space for leadless pacing and conduction-system pacing

Under-penetrated heart-failure cohorts for CRT-P

Scope for EP subspecialty expansion in secondary cities

Remote-monitoring platforms and digital pacemaker clinics - Emerging Clinical and Technology Trends

- Stakeholder & Ecosystem Mapping

- Porter’s Five Forces – UAE Pacemaker Devices

- Market Structure, Profit Pools and Competition Ecosystem

- By Value, 2019-2024

- By Implants / Units, 2019-2024

- By Average Selling Price and Device Mix, 2019-2024

- By Public vs Private Funding and Insurance Coverage, 2019-2024

- By Device Type (in Value %)

Single-chamber pacemakers

Dual-chamber pacemakers

CRT-P / biventricular pacemakers

Leadless pacemakers

His-bundle and conduction-system pacing devices - By Technology & Feature Class (in Value %)

Transvenous vs leadless systems

MRI-conditional vs legacy devices

Rate-responsive vs fixed-rate systems

Battery longevity tiers and power-management features

Remote monitoring and connectivity capabilities - By Clinical Indication & Patient Profile (in Value %)

AV block and conduction disease

Sick sinus syndrome, chronotropic incompetence

Heart-failure patients requiring CRT-P

Post-surgical and post-MI conduction complications

Paediatric and congenital heart-disease pacing - By End User and Care Setting (in Value %)

MOHAP tertiary hospitals, SEHA network hospitals

DHA hospitals and heart centers, private multi-specialty hospitals

Stand-alone cardiac and electrophysiology centers

International medical tourists treated in UAE hubs

Implant vs follow-up workload distribution across facilities - By Implantation Setting & Care Pathway (in Value %)

Dedicated electrophysiology labs

Cardiac catheterization labs

Hybrid operating rooms

Intra-operative and ICU / CCU temporary pacing use

Day-care vs in-patient pathways

Emergency vs elective implantation patterns - By Procurement & Payer Channel (in Value %)

Federal and emirate-level public tenders

Group purchasing for hospital networks

Private hospital direct sourcing

Distributor-mediated supply for smaller centers

Private insurance reimbursement pathways

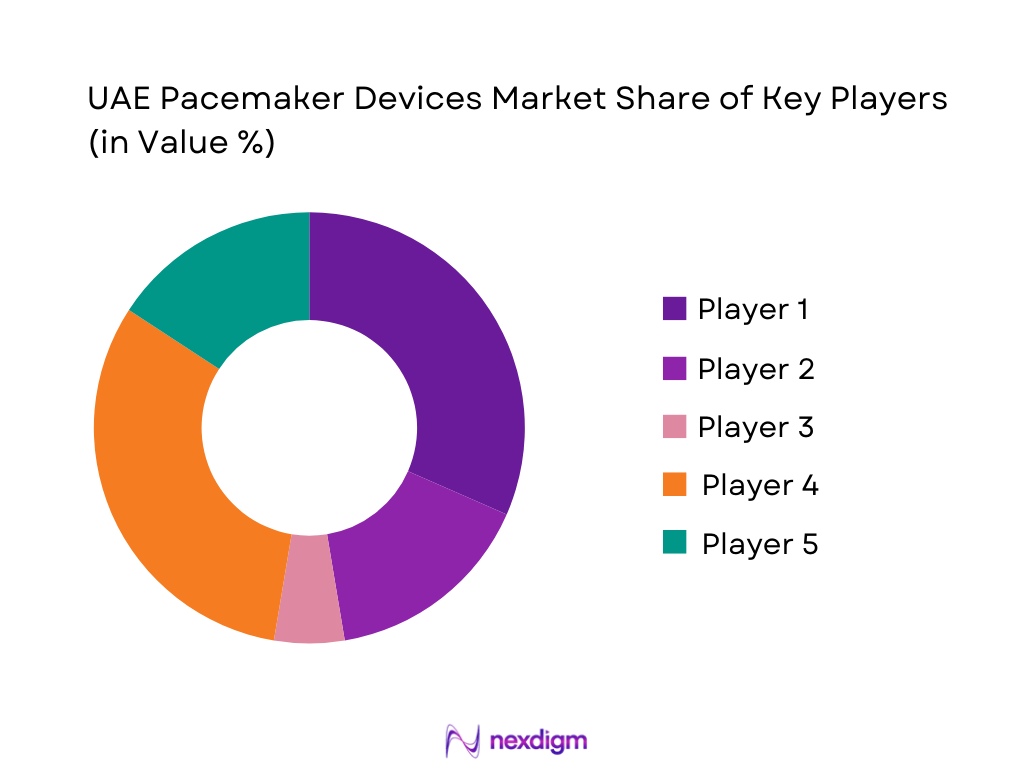

- Market Share Analysis of Major Players – Value and Implants

- Cross Comparison Parameters (Company overview and pacemaker-portfolio breadth, UAE and broader GCC presence and registration footprint, device-mix across single / dual / CRT-P / leadless systems, MRI-conditional and remote-monitoring capability depth, average generator longevity and replacement-interval positioning, key UAE reference centers and KOL partnerships, tender wins and strategic accounts across public and private networks, local distributor, service coverage and clinical-support infrastructure)

- Strategic Positioning and SWOT Analysis of Major Players)

- Pricing, Contracting and Commercial Model Analysis

- Detailed Profiles of Major Companies

Medtronic plc

Abbott Laboratories

Boston Scientific Corporation

BIOTRONIK SE & Co. KG

MicroPort Scientific Corporation

LivaNova PLC / Sorin Group Heritage

Lepu Medical Technology

MEDICO S.p.A.

Osypka Medical GmbH

Oscor Inc.

Shree Pacetronix Ltd.

Zoll Medical Corporation

Cook Medical

Vitatron

- Public Tertiary and Teaching Hospitals

- Private Multi-Specialty Hospitals and Cardiac Centers

- Procurement, Budgeting and Evaluation Committees

- Clinician, Technician and Patient Preference Insights

- Referral Pathways and Patient Access

- By Value, 2025-2030

- By Implants / Units, 2025-2030

- By Average Selling Price and Device Mix, 2025-2030

- By Public vs Private Funding and Insurance Coverage, 2025-2030