Market Overview

The UAE Pain Control Pumps Equipment market current size stands at around USD ~ million, reflecting steady adoption of infusion-based analgesia solutions across acute and ambulatory care pathways. Demand is anchored in expanding surgical caseloads, rising oncology interventions, and protocol-driven postoperative pain management practices. The ecosystem spans device manufacturers, authorized distributors, hospital biomedical teams, and clinical stakeholders, with procurement shaped by centralized tenders and service-level agreements. Technology differentiation centers on safety software, programmability, and infection control features supporting standardized care delivery across settings.

Activity is concentrated in Abu Dhabi, Dubai, and Sharjah, where tertiary hospitals, specialty surgical centers, and oncology hubs anchor demand. Infrastructure maturity, accreditation-driven care standards, and concentrated private sector investments reinforce device penetration in these cities. Free zone–enabled distribution networks, logistics access, and proximity to regulatory bodies streamline device onboarding and service response. Policy alignment with patient safety frameworks and digital health initiatives further accelerates institutional uptake within leading care clusters.

Market Segmentation

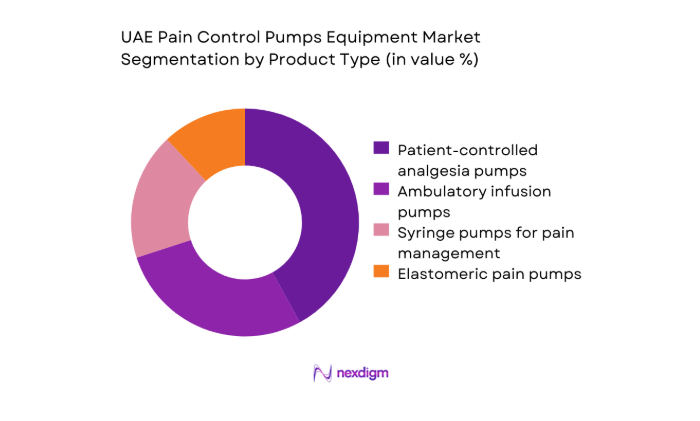

By Product Type

Dominance is shaped by clinical protocol preferences and care setting intensity. Programmable patient-controlled analgesia systems lead utilization in tertiary hospitals due to safety interlocks, dose error reduction software, and auditability that aligns with accreditation requirements. Ambulatory infusion systems are gaining traction in day surgery and oncology follow-up pathways, supported by portability and simplified workflows. Elastomeric devices address short-duration discharge use, while syringe-based configurations remain embedded in perioperative anesthesia carts. Replacement cycles are influenced by service uptime, consumable compatibility, and lifecycle management agreements, reinforcing standardized fleets across multi-site hospital networks and private provider groups.

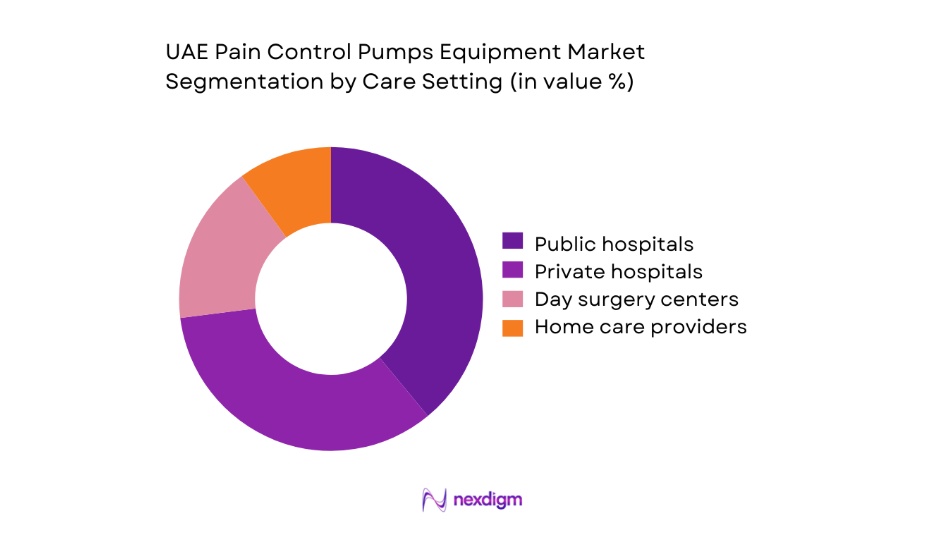

By Care Setting

Utilization concentration mirrors infrastructure density and reimbursement pathways. Public hospitals anchor protocol-driven deployment for post-operative and oncology pain pathways, supported by centralized tenders and maintenance contracts. Private hospitals emphasize programmable systems for case-mix complexity and service differentiation. Day surgery centers prioritize portability and rapid turnover, while home care providers expand ambulatory pump use for palliative and chronic pain continuity. Channel efficiency, device training availability, and service response times shape adoption rates, with bundled service agreements influencing fleet standardization across multi-facility operators and integrated care networks.

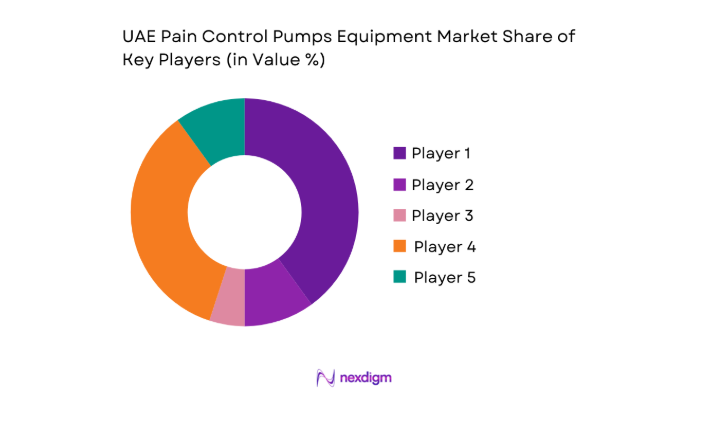

Competitive Landscape

Competition reflects portfolio breadth, service coverage, regulatory readiness, and channel depth, with differentiation centered on safety software, lifecycle services, and tender competitiveness across public and private providers.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Becton, Dickinson and Company | 1897 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| B. Braun Melsungen AG | 1839 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Baxter International | 1931 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Fresenius Kabi | 1999 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Terumo Corporation | 1921 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Pain Control Pumps Equipment Market Analysis

Growth Drivers

Rising surgical volumes in tertiary care hospitals

Tertiary hospitals in Abu Dhabi and Dubai expanded operating room utilization across 2022–2024, supported by new specialty wings and workforce growth. The number of licensed surgeons increased by 120 in 2023 and 140 in 2024 across major hospital networks, while anesthesia staffing rose by 95 clinicians over the same period. Inpatient bed additions reached 430 in 2024 across tertiary campuses, enabling higher case throughput. Postoperative pain protocols increasingly mandate programmable infusion systems for high-acuity pathways. Accreditation audits conducted in 2023 emphasized dose error reduction software adoption, driving procurement cycles. Procedure mix growth in orthopedics, oncology surgery, and bariatrics sustains consistent device utilization.

Growing prevalence of cancer and chronic pain conditions

Cancer registries recorded 4,900 new diagnoses in 2023 across major emirates, with oncology day-care sessions rising by 18,700 encounters in 2024. Chronic pain clinic appointments expanded by 22,400 visits in 2023, reflecting referral pathway maturation and multidisciplinary programs. Palliative care service lines added 9 new outpatient clinics in 2024, increasing ambulatory analgesia utilization. National care pathways updated in 2023 recommend patient-controlled analgesia for selected oncology and postoperative cohorts. Workforce training programs certified 260 nurses in infusion device competencies during 2024, supporting safe scale-up. These indicators sustain baseline demand across acute and ambulatory pain management settings.

Challenges

High capital cost of advanced programmable infusion pumps

Capital committee approvals for biomedical equipment faced longer review cycles in 2023, with median approval timelines extending to 94 days across public facilities. Procurement batches were consolidated into fewer awards, reducing fleet refresh frequency. Biomedical engineering teams reported 1,120 maintenance tickets in 2024 linked to aging pump fleets, increasing downtime risks. Preventive maintenance compliance audits flagged 37 facilities for calibration backlogs during 2023. Hospital budget committees prioritized imaging and critical care upgrades, constraining allocations for pain management equipment refresh. These constraints delay adoption of newer safety software generations and limit rapid replacement in high-throughput surgical units.

Lengthy tender cycles and price pressure in public sector procurement

Public sector tenders in 2023 averaged 178 days from specification to award, compressing deployment timelines for clinical pathways. Technical evaluations introduced 14 additional compliance checks in 2024, extending vendor onboarding. Framework agreements capped annual device quantities, limiting rapid scale during peak surgical periods. Contract renewals required revalidation of service coverage across 27 facilities, straining distributor service capacity. Payment cycles averaged 120 days in 2024, affecting inventory readiness. These procurement dynamics slow fleet modernization, constrain service responsiveness during demand spikes, and delay rollout of upgraded safety features aligned with updated clinical protocols.

Opportunities

Growth of day-care surgeries and ambulatory pain management

Day surgery throughput increased by 31,600 cases in 2024 across metropolitan hubs, driven by pathway redesign and anesthesia protocols enabling same-day discharge. Ambulatory centers expanded operating suites by 14 rooms in 2023, raising turnover intensity. Clinical guidelines updated in 2024 support short-duration infusion protocols for orthopedic and minimally invasive procedures. Home follow-up programs added 1,280 enrolled patients in 2023, creating continuity of analgesia beyond discharge. Nurse-led device education modules trained 180 staff in ambulatory workflows during 2024. These shifts favor portable infusion platforms, standardized consumables, and service bundles aligned to rapid care transitions.

Home-based and outpatient pain management program expansion

Home care networks added 23 service nodes in 2024 across urban clusters, improving last-mile clinical support. Palliative outreach teams increased visits by 9,700 in 2023, expanding demand for portable infusion management. Telehealth pain consultations grew by 41,200 sessions in 2024, reinforcing continuity protocols requiring reliable ambulatory devices. National digital health policies issued in 2023 prioritize remote monitoring integration, accelerating device interoperability requirements. Community nursing certification programs graduated 210 clinicians in 2024, strengthening home-based infusion competency. These institutional signals support scalable outpatient pain pathways, service-led device adoption, and recurring consumables utilization without expanding inpatient bed dependency.

Future Outlook

Adoption will deepen as protocol standardization and digital health integration mature across tertiary and ambulatory pathways through 2030. Public sector procurement reforms and service-led contracting are expected to streamline fleet refresh cycles, while home-based care expansion supports portable device uptake. Interoperability and safety software will remain core differentiators.

Major Players

- Becton, Dickinson and Company

- B. Braun Melsungen AG

- Smiths Medical

- Baxter International

- Fresenius Kabi

- Terumo Corporation

- Moog Inc.

- ICU Medical

- Micrel Medical Devices

- Mindray Medical

- Medtronic

- Nipro Corporation

- Zyno Medical

- ACE Medical

- Woo Young Medical

Key Target Audience

- Tertiary and quaternary hospitals

- Private hospital networks

- Day surgery and ambulatory centers

- Home healthcare providers

- Group purchasing and procurement organizations

- Biomedical engineering departments

- Investments and venture capital firms

- Government and regulatory bodies with agency names

Research Methodology

Step 1: Identification of Key Variables

Clinical pathways, care settings, device categories, safety software features, service coverage, and regulatory readiness were mapped to define scope. Utilization contexts across inpatient, ambulatory, and home settings were prioritized to capture workflow dependencies and lifecycle management variables.

Step 2: Market Analysis and Construction

Demand drivers were constructed from surgical throughput, oncology care activity, staffing capacity, and accreditation requirements. Channel dynamics and service models were structured around tender mechanisms, distributor coverage, and maintenance SLAs influencing deployment velocity.

Step 3: Hypothesis Validation and Expert Consultation

Clinical leads, procurement managers, and biomedical engineers were consulted to validate workflow fit, training needs, and service response expectations. Regulatory reviewers informed device onboarding timelines and compliance checkpoints shaping procurement readiness.

Step 4: Research Synthesis and Final Output

Findings were synthesized into segmentation, competitive positioning, and pathway-specific implications. Insights were stress-tested against policy direction, digital health priorities, and service capacity constraints to ensure actionable, implementation-ready outputs.

- Executive Summary

- Research Methodology (Market Definitions and care pathway mapping for infusion-based pain management devices, Primary interviews with anesthesiologists pain specialists and hospital procurement leads across UAE, Channel checks with authorized distributors and tender-awarded suppliers)

- Definition and Scope

- Market evolution

- Usage and care pathways

- Ecosystem structure

- Supply chain and channel structure

- Growth Drivers

Rising surgical volumes in tertiary care hospitals

Growing prevalence of cancer and chronic pain conditions

Expansion of private hospital networks and specialty surgical centers - Challenges

High capital cost of advanced programmable infusion pumps

Lengthy tender cycles and price pressure in public sector procurement

Limited trained clinical staff for pump programming and monitoring - Opportunities

Growth of day-care surgeries and ambulatory pain management

Home-based and outpatient pain management program expansion

Adoption of smart pumps with dose error reduction software - Trends

Shift toward programmable PCA pumps with safety software

Increasing use of elastomeric pumps for ambulatory care

Integration of infusion pumps with hospital EMR systems - Government Regulations

- SWOT Analysis

- Porter’s Five Forces Analysis

- By Value, 2019–2024

- By Shipment Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Product Type (in Value %)

Patient-controlled analgesia pumps

Ambulatory infusion pumps

Syringe pumps for pain management

Elastomeric pain pumps - By Therapy Type (in Value %)

Post-operative analgesia

Chronic pain management

Cancer pain management

Palliative care pain management - By Care Setting (in Value %)

Public hospitals

Private hospitals

Day surgery centers

Home care and ambulatory care providers - By End User Specialty (in Value %)

Anesthesiology departments

Pain management clinics

Oncology departments

Orthopedic and surgical units - By Distribution Channel (in Value %)

Direct sales to hospitals

Authorized medical device distributors

- Market share of major players

- Cross Comparison Parameters (product portfolio breadth, pump safety features and software, pricing and tender competitiveness, local service and maintenance capability, regulatory compliance and approvals, distributor network strength, training and clinical support, warranty and service SLAs)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Becton, Dickinson and Company

B. Braun Melsungen AG

Smiths Medical

Baxter International

Fresenius Kabi

Terumo Corporation

Moog Inc.

ICU Medical

Micrel Medical Devices

Mindray Medical

Medtronic

Nipro Corporation

Zyno Medical

ACE Medical

Woo Young Medical

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- By Value, 2025–2030

- By Shipment Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030