Market Overview

The UAE Patient-Provider Communication Platforms market (often tracked within the country’s patient engagement solutions spend covering portals, secure messaging, reminders, telehealth engagement, and RPM-linked communication workflows) generated USD ~ million in revenue in 2024, supported by a strong historical base and accelerated provider digitization. The market’s step-up from 2023 is reinforced by the UAE’s broad digital-health momentum—the UAE digital health market is valued at USD ~ million in 2024—creating a larger budget envelope for omnichannel engagement, EMR/HIE integration, and patient self-service experiences.

The market’s demand concentration is led by Dubai and Abu Dhabi due to their high density of large multi-specialty hospital groups, international patient inflows, and faster digitization of patient access, appointment workflows, and care coordination models. These emirates also host the majority of enterprise-grade health systems and specialty networks, making them the primary adopters of integrated patient portals, contact-center enabled digital front doors, and secure messaging embedded into clinical workflows. On the supply side, UAE adoption is strengthened by the presence of global health IT vendors and CPaaS providers that can localize Arabic/English experiences and support high-volume messaging orchestration.

Market Segmentation

By Solution Type

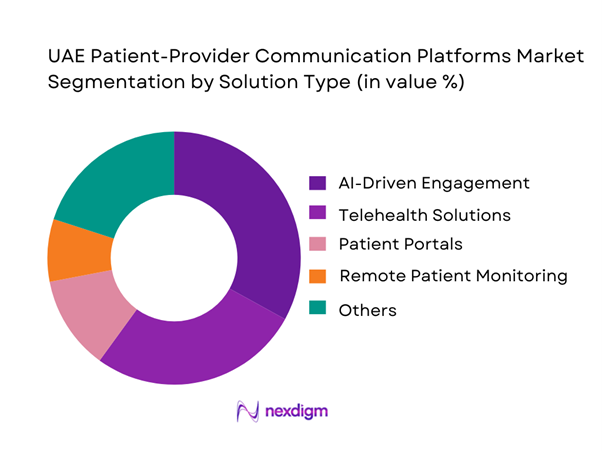

The UAE Patient-Provider Communication Platforms market is segmented by solution type into AI-driven engagement, telehealth solutions, patient portals, remote patient monitoring, population health management, and appointment & medication reminders. Recently, AI-driven engagement has a dominant position in this segmentation because UAE providers are scaling omnichannel patient journeys that require routing, automation, and triage-like interaction handling across high-volume touchpoints (appointments, results follow-ups, pre-visit intake, chronic care nudges, and post-discharge check-ins). AI-enabled tooling also reduces operational load on call centers and patient access desks by handling repetitive interactions and guiding patients to the right service line, while enabling structured data capture that improves downstream clinical documentation and analytics. In addition, AI-driven engagement is commonly purchased as part of broader “digital front door” programs, which accelerates deployments in large hospital groups and multi-site clinic networks where standardization and automation deliver faster ROI.

By Delivery Type

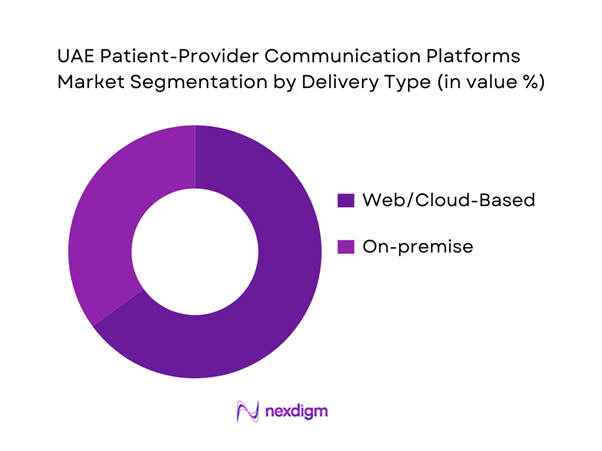

The market is commonly structured into web/cloud-based and on-premise deployments. In the UAE, web/cloud-based deployments tend to dominate platform rollouts because communication platforms need rapid scalability for message throughput, channel orchestration (e.g., app + SMS + email + voice), and frequent feature updates (templates, workflows, consent rules, analytics dashboards). Cloud models also shorten implementation cycles for multi-facility groups by enabling centralized governance (identity, consent, routing rules) while still integrating into EMR and patient portal layers. Additionally, cloud deployments align with the procurement preference for managed services and SLA-backed operations—critical for patient access, appointment confirmation, and results communication where downtime directly impacts patient experience and clinic utilization. On-premise remains relevant for certain institutions with stricter internal hosting choices or legacy architectures, but it generally imposes higher upgrade and integration overheads compared to modern API-first cloud stacks.

Competitive Landscape

The UAE Patient-Provider Communication Platforms market features a mix of enterprise health IT stacks (EMR-native portals and messaging) and communications/CX platforms that layer omnichannel engagement, contact center workflows, and orchestration on top of provider systems. This creates a landscape where a few large global vendors shape enterprise deployments, while CPaaS and CX players often win channel orchestration, WhatsApp/SMS delivery, and high-volume outreach programs—either directly or through system integrators and provider digital transformation programs. The market’s structure reflects the need for clinical workflow embedding, interoperability, and localized patient experience at scale.

| Company | Est. Year | HQ | UAE Commercial Footprint | Core Communication Capability | Integration Depth (EMR/HIS/CRM) | Omnichannel Support | Deployment Options | Analytics & Reporting | Typical Buyer Profile |

| Epic (MyChart ecosystem) | 1979 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Oracle Health (Cerner) | 1979 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Philips | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Twilio | 2008 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Genesys | 1990 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Patient-Provider Communication Platforms Market Analysis

Growth Drivers

HIE-driven continuity of care

The UAE’s push toward continuity of care makes patient-provider communication platforms more “must-have” because they operationalize notifications, results follow-ups, referrals, and care coordination across facilities that increasingly run on digitized records. In Dubai alone, by ~, all hospitals (~) had implemented EMRs and private clinics (~) reached EMR implementation scale, which strengthens the technical base for HIE-connected outreach (secure messaging, discharge instructions, and longitudinal follow-up). This demand is reinforced by the UAE’s macro capacity to fund digital transformation: GDP of USD ~ billion and GDP per capita of USD ~, while population reached ~—scale that supports high-volume, standardized patient communication workflows across multi-site networks.

Digital front door scale-up

Digital front doors (online appointment booking, reminders, pre-visit instructions, e-forms, post-visit follow-ups, and contact-center deflection) scale faster in the UAE because of strong national digital identity penetration and telecom readiness—both prerequisites for frictionless patient authentication and high deliverability. The official UAE PASS page lists ~ users, indicating broad identity-layer availability for secure logins, consent flows, and patient self-service. On the connectivity side, open-data series shows active mobile subscriptions of ~, supporting omnichannel communications where app + SMS + voice can be orchestrated at enterprise scale. These enablers operate within a high-capacity economy, which underpins sustained provider investments in patient experience and access modernization.

Challenges

Clinical workflow adoption friction

Even with strong digital infrastructure, adoption friction persists because communication tools must fit clinician time, documentation norms, and escalation rules—otherwise messaging becomes an extra layer rather than a workflow accelerator. Dubai’s EMR penetration provides the baseline but also exposes complexity: by ~, ~ hospitals had implemented EMRs and ~ private clinics were in scope of EMR adoption measurement, meaning communication platforms must integrate into heterogeneous clinical templates, specialty workflows, and operational models across a large facility base. Scaling training and governance is non-trivial when the ecosystem itself is large, as the investment guide reports ~ healthcare facilities in Dubai, which increases variance in staff maturity and standard operating procedures. This sits within a macro environment of population ~, raising patient-volume expectations and pushing providers to standardize—often faster than clinical change management can keep pace.

Multilingual UX and accessibility gaps

In the UAE, multilingual UX is not optional; patient communication must be understandable across Arabic and English at minimum and often across additional languages due to the resident mix. This creates operational burdens: templates, clinical instructions, consent prompts, and patient education content must be localized without losing clinical meaning—while remaining accessible across different devices and digital literacy levels. Digital identity and telecom readiness can accelerate scale but also amplifies the consequences of poor UX at volume. UAE PASS is listed at ~ users, implying wide reach of authenticated digital interactions; active mobile subscriptions stand at ~, meaning patients can receive high-frequency outreach across channels. When such reach is present, unclear multilingual content increases inbound call volume, missed appointments, and patient dissatisfaction. Macro context reinforces service expectations: GDP per capita of USD ~ typically correlates with higher patient service standards and lower tolerance for confusing digital experiences.

Opportunities

WhatsApp-first patient engagement

A WhatsApp-first engagement strategy is an opportunity in the UAE because patient communications succeed when they meet patients where they already spend time—on mobile—and when deliverability remains high across reminders, instructions, and service navigation. Even without using market-size metrics, the “reach mechanics” are visible in official telecom and identity indicators: active mobile subscriptions stand at ~, while the digital identity page lists UAE PASS at ~ users—together supporting authenticated, mobile-centric patient journeys. The UAE’s addressable base is also clearly large: population stands at ~, and GDP capacity supports ongoing digital service expansion. The opportunity for communication platform vendors and providers is to design consented, compliant WhatsApp-aligned workflows (e.g., appointment lifecycle, pre-visit checklists, results readiness notifications) while keeping sensitive clinical content in secure channels and using WhatsApp-style interactions for navigation, confirmations, and service orchestration.

AI-enabled triage and symptom capture

AI-enabled triage and structured symptom capture is a high-impact opportunity because it converts unstructured patient demand (calls, walk-ins, vague complaints) into routable, documentable inputs that reduce manual load and accelerate the right care pathway. The UAE’s outpatient-heavy service mix makes this especially relevant: health accounts show AED ~ million outpatient curative care spending, indicating a large outpatient workload where front-end triage and structured intake can reduce rework and improve throughput. At the same time, deployment feasibility is supported by digitization depth: EMR implementation covered ~ hospitals, enabling workflow embedding and record linkage for AI-assisted intake and escalation. Telecom and identity layers support scale and governance—active mobile subscriptions stand at ~ and UAE PASS is listed at ~ users, supporting authenticated, consent-aware intake. The near-term growth lever is to use current service volumes and digitization maturity to operationalize AI intake without claiming future statistics.

Future Outlook

Over the next several years, the UAE Patient-Provider Communication Platforms market is expected to expand steadily as providers prioritize digital front doors, reduced appointment leakage, and higher service-line utilization while improving patient experience. Growth will be driven by deeper automation in patient access, tighter EMR/HIE connectivity, and increased use of AI-driven engagement for triage-like routing, structured intake, and proactive outreach. As competition intensifies, differentiation will increasingly depend on omnichannel deliverability, workflow embedding, and measurable operational ROI.

Major Players

- Okadoc

- Epic

- Oracle Health

- InterSystems

- Salesforce

- Microsoft

- Philips

- Twilio

- Infobip

- Vonage

- Genesys

- NICE

- Zendesk

- LeadSquared

Key Target Audience

- Hospital groups and integrated delivery networks

- Multi-site specialty clinic networks

- Home healthcare providers and post-acute care operators

- Healthcare payers and TPAs

- Healthcare contact center / BPO operators serving providers

- Digital health platform buyers within provider ecosystems

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We begin by mapping the UAE ecosystem across providers, payers, CPaaS/CX vendors, EMR/HIS platforms, and integrators. Desk research is used to define variables that drive platform adoption—channel mix, workflow ownership, integration depth, and compliance requirements—ensuring the market definition remains communication-platform specific.

Step 2: Market Analysis and Construction

We compile historical demand indicators and procurement patterns for patient engagement and communication tooling, aligning them to revenue pools (platform licensing, messaging orchestration, implementation, managed services). This step also benchmarks adoption by care setting and enterprise vs mid-market provider cohorts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through CATIs with provider IT leaders, patient access heads, and vendor delivery teams. Inputs focus on buyer priorities, implementation timelines, channel performance, and realized operational outcomes to validate assumptions around solution mix and deployment choices.

Step 4: Research Synthesis and Final Output

We synthesize triangulated findings into a consolidated market model and narrative. Final validation includes cross-checks with vendor positioning, tender language patterns, and stakeholder interviews to ensure the conclusions are consistent, defensible, and relevant for investment and go-to-market decisions.

- Executive Summary

- Research Methodology (Market definitions & scope boundaries, UAE-specific assumptions, abbreviations, demand-side & supply-side mapping, market sizing approach, triangulation logic, primary interview framework, buyer validation workshops, limitations & sensitivity checks)

- Definition and Scope

- Market Genesis and Digital-Health Evolution Context

- Care Delivery and Patient Journey Touchpoint Map

- Ecosystem Timeline of Key Initiatives and Platform Milestones

- Communication Value Chain and Data Flow

- Stakeholder Landscape

- Growth Drivers

HIE-driven continuity of care

Digital front door scale-up

Patient experience KPI mandates

Outpatient throughput pressure

Chronic care follow-up automation - Challenges

Clinical workflow adoption friction

Multilingual UX and accessibility gaps

Interoperability constraints

Data residency and consent complexity

ROI justification requirements - Opportunities

WhatsApp-first patient engagement

AI-enabled triage and symptom capture

Remote pathway nudging

Payer-led engagement programs

Integrated pharmacy and lab journeys - Trends

UAE PASS-enabled digital identity

Conversational interfaces

Omnichannel orchestration

Structured digital intake forms

Low-code workflow automation

Analytics-led patient experience optimization - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Provider Adoption Base, 2019–2024

- By Active Patient Users, 2019–2024

- By Interaction Volume and Channel Mix Evolution, 2019–2024

- By Fleet Type (in Value %)

Patient portals

Secure messaging and inbasket platforms

Appointment and reminder automation platforms

Digital front door platforms

Contact-center engagement platforms

Care coordination and outreach platforms - By Application (in Value %)

In-app chat

SMS

WhatsApp

Email

Voice and IVR

Video consult

Webchat - By Technology Architecture (in Value %)

Government health networks

Private hospital groups

Specialty clinics

Primary care providers

Day surgery centers

Home healthcare providers - By Connectivity Type (in Value %)

UAE-hosted cloud

On-premise

Hybrid deployment

Managed services - By End-Use Industry (in Value %)

EMR-embedded platforms

HIE-connected platforms

Standalone platforms with APIs - By Region (in Value %)

Dubai

Abu Dhabi

Sharjah

Northern Emirates

- Market share snapshot

- Cross Comparison Parameters (UAE regulatory compliance readiness, HIE and EMR integration depth, omnichannel coverage and deliverability, patient identity and consent linkage, Arabic and English UX localization, UAE hosting and data residency posture, clinical workflow embedding and routing logic, engagement analytics and SLA support model)

- Competitive positioning matrix

- Product capability benchmarking

- Integration and partner ecosystem benchmarking

- SWOT Analysis of Key Players

- Detailed Profiles of Major Companies

Okadoc

Epic

Oracle Health

InterSystems

Salesforce

Microsoft

Philips

Twilio

Infobip

Vonage

Genesys

NICE

Zendesk

LeadSquared

UniteEMR

- Demand and utilization patterns

- Budget ownership and approval structure

- Decision-making unit composition

- Needs, desires, and pain-point analysis

- Vendor selection and implementation journey

- Success metrics and KPI framework

- By Value, 2025–2030

- By Provider Adoption Base, 2025–2030

- By Active Patient Users, 2025–2030

- By Interaction Volume and Channel Mix Evolution, 2025–2030