Market Overview

As of 2024, the UAE pet care market is valued at USD 24.4 million, with a growing CAGR of 6.4% from 2024 to 2030, driven by the rising trend of pet ownership and spending on pet-related products and services. A significant factor driving this growth is the increasing disposable income of residents, allowing for greater investment in premium pet care products. The rise of e-commerce platforms also enhances market accessibility, contributing to a substantial year-on-year growth.

Cities like Dubai and Abu Dhabi dominate the UAE pet care market due to their large expatriate populations and affluent residents. The preferences for pet ownership in these urban areas have led to increased demand for specialized pet services and high-quality products. Additionally, the robust retail infrastructure and a wide range of pet care facilities further establish these cities as pivotal centers for the pet care industry.

Market Segmentation

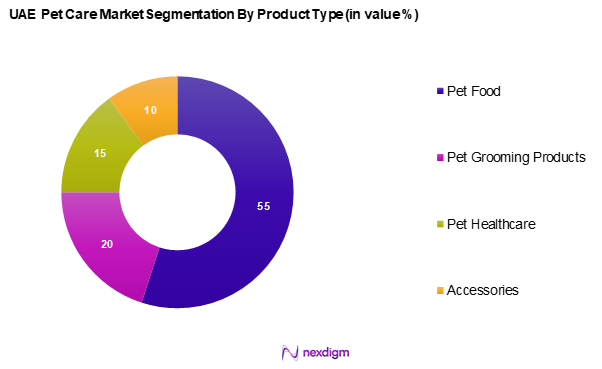

By Product Type

The UAE pet care market is segmented into pet food, pet grooming products, pet healthcare, and accessories. Among these, pet food holds the largest market share due to the growing trend of premiumization in pet nutrition. Pet owners are increasingly inclined to invest in high-quality, specialized food products tailored to the nutritional needs of their pets. This shift towards premium pet food is further supported by the increasing awareness of pet health, leading to a higher willingness to spend on organic and holistic options.

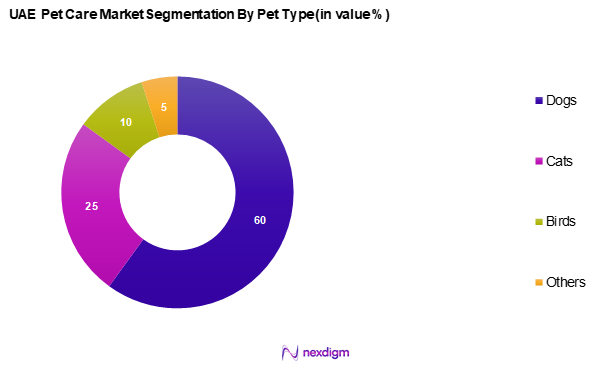

By Pet Type

The UAE pet care market is segmented into dogs, cats, birds, and others. Dogs dominate this segment as the preferred pet among UAE households. The increasing popularity of dog ownership is attributed to their companionship and suitability for family environments. Furthermore, pets are often considered part of the family; hence, pet owners tend to allocate more budget for quality products and services, reinforcing the growth of dog-related pet care.

Competitive Landscape

The UAE pet care market is dominated by key players such as PetSmart, Royal Canin, and Zoetis, as well as other notable brands. This consolidation highlights the significant influence of these key companies, which have established strong positions through extensive product ranges and reliable distribution networks.

| Major Players | Year Established | Headquarters | Product Types Offered | Market Strategies | Revenue (2024 est.) | Distribution Channels |

| PetSmart | 1967 | Ohio, USA | – | – | – | – |

| Royal Canin | 1968 | Aimargues, France | – | – | – | – |

| Zoetis | 1950 | New Jersey, USA | – | – | – | – |

| Hill’s Pet Nutrition | 1948 | Kansas, USA | – | – | – | – |

| Mars Petcare | 1935 | Virginia, USA | – | – | – | – |

UAE Pet Care Market Analysis

Growth Drivers

Increasing Pet Ownership

Pet ownership in the UAE has witnessed substantial growth, driven by evolving social dynamics where pets are increasingly regarded as integral family members. The cosmopolitan environment of cities like Dubai and Abu Dhabi, along with a diverse expatriate population, has contributed to a rising demand for pet-related products and services. This expanding pet population indicates a robust market, supported by favourable societal trends.

Rising Disposable Incomes

With improving economic conditions, disposable incomes in the UAE have continued to rise, allowing pet owners to allocate more resources toward high-quality pet care products and services. Urban centres, home to affluent demographics, are seeing a particular increase in spending on premium pet food, specialized healthcare, and grooming services. Additionally, the prevalence of dual-income households further strengthens the financial capacity for pet ownership, boosting overall market expansion.

Market Challenges

Regulatory Compliance Issues

Strict regulatory requirements pose hurdles for pet care businesses in the UAE, particularly concerning the import and sale of pet food and veterinary products. Authorities have implemented stringent health and safety regulations, making compliance a complex process. Many brands face difficulties in meeting these standards, leading to delays in market entry and increased operational costs. Such barriers can limit product variety and slow innovation in the sector.

Intense Competition

The pet care market in the UAE is highly competitive, with both international and local brands vying for consumer attention. Retail channels are densely populated, particularly in major urban centers, creating an environment where businesses must continuously innovate to retain customer loyalty. As consumer preferences shift toward premium and specialized products, companies that fail to adapt risk losing market relevance. The abundance of choices available to pet owners also makes brand differentiation a crucial challenge.

Opportunities

E-Commerce Growth

The rise of digital shopping has significantly influenced the pet care industry in the UAE. Online retail platforms provide consumers with a convenient way to access a diverse range of pet products, contributing to the growing prominence of e-commerce in the sector. The shift towards mobile shopping, particularly among tech-savvy pet owners, presents an opportunity for businesses to expand their digital presence and enhance customer engagement through targeted online strategies.

Expansion of Pet Healthcare Services

The increasing awareness of pet well-being has led to a surge in demand for advanced veterinary services, pet insurance, and specialized healthcare solutions in the UAE. Pet owners are becoming more conscious of preventive care, including regular check-ups, vaccinations, and wellness treatments. This growing emphasis on pet health has prompted veterinary clinics, pet hospitals, and mobile veterinary services to expand their offerings. Additionally, the rise of premium and organic pet supplements reflects a broader trend toward holistic pet care, presenting a lucrative opportunity for businesses in the sector.

Future Outlook

The UAE pet care market is expected to experience significant growth, driven by increased pet ownership, evolving consumer preferences towards premium products, and the expansion of e-commerce platforms. As the focus on pet health and wellness continues to grow, innovations in pet products will further stimulate market demand. A growing awareness of pet welfare and health issues will also contribute to the expansion of the market in the coming years.

Major Players

- PetSmart

- Royal Canin

- Zoetis

- Hill’s Pet Nutrition

- Mars Petcare

- Petland

- Dubai Pet Food

- Beco Pets

- Pet Zone

- Fresco Pet

- Mera Dog Food

- Four Paws

- Catit

- Pets Arabia

Key Target Audience

- Pet Owners

- Veterinarians

- Government and Regulatory Bodies (Ministry of Climate Change and Environment)

- Retailers and Distributors

- Investors and Venture Capitalist Firms

- Pet Care Startups

- E-commerce Companies

- Pet Grooming and Boarding Services

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the UAE pet care market. This step relies on extensive desk research, combining secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the UAE pet care market will be compiled and analysed. This includes evaluating market penetration, the ratio of retail outlets to service providers, and the resultant revenue generation. Additionally, an assessment of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing a diverse range of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple pet care product manufacturers and service providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the UAE pet care market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Key Milestones of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Pet Ownership

Rising Disposable Incomes - Market Challenges

Regulatory Compliance Issues

Intense Competition - Opportunities

E-Commerce Growth - Trends

Rise in Premium Pet Products

Increasing Focus on Pet Health and Wellness - Government Regulation

Pet Health Regulations

Import Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Pet Food

– Dry Food (Kibble)

– Wet/Canned Food

– Organic/Natural Food

– Prescription Diets

– Treats & Snacks

Pet Grooming Products

– Shampoos & Conditioners

– Brushes & Combs

– Nail Clippers

– Deodorizers & Wipes

Pet Healthcare

– Flea & Tick Control

– Vitamins & Supplements

– Dental Care Products

– Dewormers & Vaccines

Accessories

– Collars & Leashes

– Toys & Chewables

– Beds & Carriers

– Litter Boxes & Training Pads - By Pet Type (In Value %)

Dogs

– Small Breeds

– Medium Breeds

– Large Breeds

Cats

– Domestic Cats

– Pedigree Cats

Birds

– Parakeets

– Parrots

– Canaries & Others

Others

– Rabbits

– Hamsters

– Fish & Reptiles - By Sales Channel (In Value %)

Online Retail

Pet Speciality Stores

Supermarkets/Hypermarkets

Veterinary Clinics - By Region (In Value %)

Dubai

Abu Dhabi

Sharjah

Ajman

Ras Al Khaimah

Fujairah - By Age of Pet (In Value %)

Puppies/Kittens

– Specialized Nutrition

– Basic Vaccination Kits

– Teething Toys

Adults

– Maintenance Food

– Active Lifestyle Products

Seniors

– Joint Supplements

– Senior Diet Formulas

– Mobility Aids

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths & Weaknesses, Organizational Structure, Revenues, Distribution Channels & Retail Presence, Product Portfolio, Pricing Strategy, Customer Engagement & Loyalty Programs, Unique Value Offering)

- SWOT Analysis of Major Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Companies

PetSmart

Royal Canin

Zoetis

Hill’s Pet Nutrition

Mars Petcare

Petland

Dubai Pet Food

Beco Pets

Pet Zone

Fresco Pet

Mera Dog Food

Four Paws

Catit

Pets Arabia

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Preferences and Consumer Behaviour

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030