Market Overview

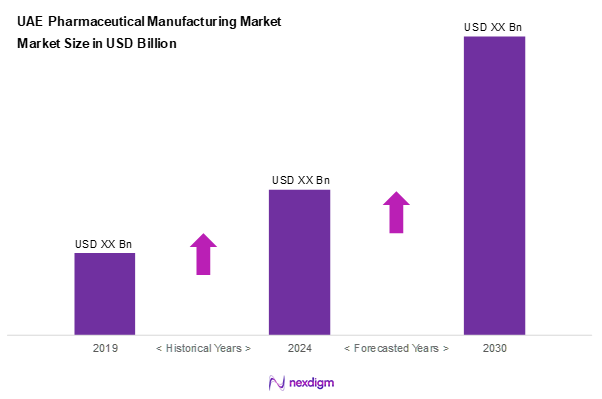

As of 2024, the UAE pharmaceutical manufacturing market is valued at USD 4.5 billion, with a growing CAGR of 7.4% from 2024 to 2030, driven by rising healthcare expenditure and a growing demand for high-quality medications within the region. Factors such as the increasing prevalence of chronic diseases and the government’s emphasis on affordable healthcare solutions contribute significantly to this market size. Moreover, with an aging population and a focus on self-sufficiency in pharmaceutical production, the sector is poised for continued growth and innovation.

Dominant cities in the UAE, particularly Dubai and Abu Dhabi, play a crucial role in the pharmaceutical manufacturing market due to their strategic location, advanced infrastructure, and support from government initiatives aimed at enhancing healthcare capabilities. Dubai’s position as a regional trade hub attracts various multinational pharmaceutical companies, whereas Abu Dhabi’s investments in healthcare infrastructure and biopharmaceuticals make it a central player in the market.

Market Segmentation

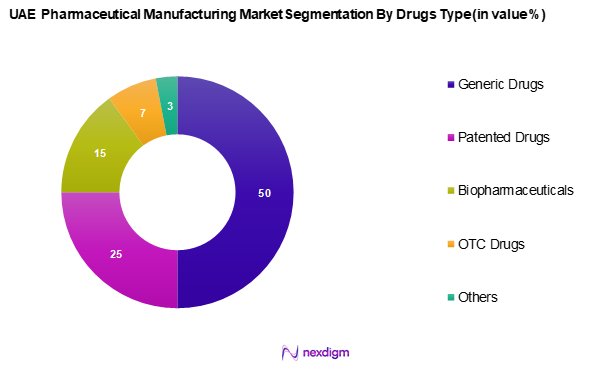

By Drugs Type

The UAE pharmaceutical manufacturing market is segmented into generic drugs, patented drugs, biopharmaceuticals, over-the-counter (OTC) drugs, and others. Among these, generic drugs hold a dominant market share, reflecting increasing cost-effectiveness and greater accessibility for patients. The rising prevalence of chronic diseases, coupled with the push for affordable medications, reinforces the popularity of generics across the healthcare landscape in the UAE. Additionally, strong competition in the sector has propelled manufacturers to invest in the production of high-quality generics, further solidifying their market presence.

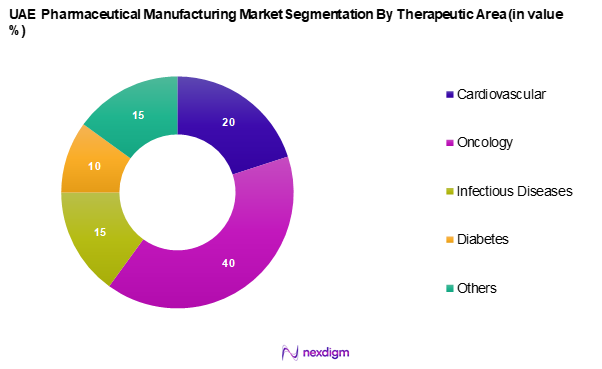

By Therapeutic Area

The UAE pharmaceutical manufacturing market is segmented into cardiovascular, oncology, infectious diseases, diabetes, and others. Oncology products dominate this segment, driven by the increasing incidence of cancer in the UAE and the corresponding need for innovative treatments and medications. The government’s initiatives to combat cancer and improve healthcare facilities have led to substantial investments in oncology-related pharmaceuticals. As a result, pharmaceutical manufacturers are focusing on developing specialized drugs to address the cancer care continuum, ensuring a solid foothold in the oncology segment.

Competitive Landscape

The UAE pharmaceutical manufacturing market is characterized by the presence of several key players, including local brands and international companies, which significantly influence market dynamics. Major players such as Julphar and Hikma Pharmaceuticals dominate the landscape due to their extensive product lines and robust distribution networks. This consolidation reflects the strong competitiveness and innovation within the sector, emphasizing the impact of these key companies on market trends.

| Company | Establishment Year | Headquarters | Revenue

(USD Mn) |

Market Strategy | R&D Capabilities | Market

Share % |

| Julphar | 1980 | Ras Al Khaimah | – | – | – | – |

| Hikma Pharmaceuticals | 1978 | Amman, Jordan | – | – | – | – |

| Neopharma | 2003 | Abu Dhabi, UAE | – | – | – | – |

| Gulf Drug | 1969 | Dubai, UAE | – | – | – | – |

| AdvaCare Pharma | 2005 | Wyoming, U.S.A. | – | – | – | – |

UAE Pharmaceutical Manufacturing Market Analysis

Growth Drivers

Increasing Healthcare Expenditure

The UAE government has been steadily prioritizing its healthcare sector through increased financial support and resource allocation. Investments have been consistently directed toward improving healthcare infrastructure, access to innovative treatments, and expansion of healthcare services. This progressive approach not only enhances patient outcomes but also fosters a supportive environment for pharmaceutical manufacturing. By emphasizing healthcare as a key pillar of national development, the government is helping create favourable conditions for growth in the domestic pharmaceutical industry.

Rising Aging Population

Demographic shifts in the UAE reveal a growing proportion of elderly residents, which is translating into higher demand for pharmaceuticals tailored to chronic disease management and elderly care. The increasing prevalence of age-related conditions such as cardiovascular disorders, diabetes, and arthritis is creating a sustained need for specialized medications. This demographic trend is expected to drive pharmaceutical consumption significantly and support long-term market expansion.

Market Challenges

Regulatory Compliance Issues

Pharmaceutical manufacturers in the UAE are required to navigate a complex and evolving regulatory environment. Authorities have implemented stringent quality and safety standards, and regulatory frameworks are frequently updated to ensure alignment with global best practices. While these regulations contribute to maintaining high-quality drug production, they also demand considerable investment in compliance and operational adjustments. Smaller players may find it particularly challenging to keep pace, potentially limiting their growth prospects.

Competition from Importation

The domestic pharmaceutical manufacturing industry faces strong competition from foreign producers, especially those based in countries known for low-cost production. A significant portion of pharmaceuticals consumed in the UAE are still imported, which puts pressure on local manufacturers to enhance efficiency, control costs, and ensure product differentiation. This competitive environment necessitates innovation and strategic partnerships to remain viable in the market.

Opportunities

Expansion in Biopharmaceutical Sector

The UAE is making strategic investments in its biopharmaceutical landscape, recognizing the potential of advanced biologics and personalized therapies. Supportive government initiatives and infrastructure development—such as dedicated science parks and research centers—are encouraging both local and international stakeholders to invest in biopharmaceutical R&D. With increasing interest in targeted therapies and innovation-driven healthcare, the biopharmaceutical segment presents a promising frontier for future growth in the UAE pharmaceutical manufacturing sector.

Future Outlook

Over the next five years, the UAE pharmaceutical manufacturing market is expected to witness substantial growth, driven by factors such as increasing healthcare spending, government initiatives promoting local production, and a growing demand for advanced pharmaceuticals. The focus on innovation and research, particularly in the biopharmaceutical sector, will further propel market dynamics. Additionally, the ongoing digital transformation within the industry is anticipated to reshape manufacturing approaches, enhancing efficiency and responsiveness to market needs.

Major Players

- AdvaCare Pharma

- Julphar

- Pharma Solutions

- GLOBALPHARMA

- Gulf Drug

- New Country Healthcare

- Neopharma

- Al Hayat Pharmaceuticals

- Hikma Pharmaceuticals PLC

- Shalina Healthcare

- NewBridge Pharmaceuticals

- Johnson & Johnson

- Pfizer

- AstraZeneca

- Others

Key Target Audience

- Pharmaceutical Manufacturers

- Government Agencies (UAE Ministry of Health and Prevention)

- Investments and Venture Capitalist Firms

- Healthcare Providers

- Distributors and Wholesalers

- Regulatory Bodies (Health Authority Abu Dhabi, Dubai Health Authority)

- Research Institutions

- Hospital Management Groups

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the UAE pharmaceutical manufacturing market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the UAE pharmaceutical manufacturing market. This includes assessing market penetration, the ratio of manufacturers to service providers, and resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with multiple pharmaceutical manufacturers to acquire detailed insights into drugs segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the UAE pharmaceutical manufacturing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Healthcare Expenditure

Rising Aging Population - Market Challenges

Regulatory Compliance Issues

Competition from Importation - Opportunities

Expansion in Biopharmaceutical Sector - Trends

Digital Transformation in Pharmaceuticals - Government Regulation

FDA Policies - SWOT Analysis

- Stakeholders Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Drugs Type

Generic Drugs

– Prescription Generics

– Branded Generics

Patented Drugs

– Blockbuster Drugs

– Orphan Drugs

Biopharmaceuticals

– Monoclonal Antibodies

– Recombinant Proteins

– Cell & Gene Therapy Products

Over-the-Counter (OTC) Drugs

– Pain Relievers

– Cough & Cold Remedies

– Antacids & Digestive Aids

Others

– Herbal/Traditional Medicines

– Nutraceuticals

– Veterinary Pharmaceuticals - By Therapeutic Area

Cardiovascular

– Antihypertensives

– Lipid-Lowering Agents

Oncology

– Chemotherapy Drugs

– Immunotherapy Drugs

Infectious Diseases

– Antibiotics

– Antivirals

Diabetes

– Insulins

– Oral Antidiabetics

Others

– Central Nervous System (CNS)

– Gastrointestinal

– Dermatologicals - By Distribution Channel

Wholesalers

– Government-Authorized Distributors

– Independent Distributors

Retail Pharmacies

– Chain Pharmacies (e.g., Aster, Life)

– Independent Pharmacies

Online Pharmacies

– App-Based Pharmacies

– Web Portals of Hospitals or Retailers

Hospitals

– Government Hospitals

– Private Hospital Pharmacies - By Region

Abu Dhabi

Dubai

Sharjah

Ajman

Ras Al Khaimah (RAK)

Fujairah

Umm Al Quwain - By Manufacturing Process Type

Contract Manufacturing

– Active Pharmaceutical Ingredients (APIs)

– Finished Dosage Form (FDF) Production

In-House Manufacturing

– Formulation Development

– Packaging and Labeling Units

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Drugs Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Distribution Channels, R&D Capabilities, Market Presence)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

AdvaCare Pharma

Julphar

Pharma Solutions

GLOBALPHARMA

Gulf Drug

New Country Healthcare

Neopharma

Al Hayat Pharmaceuticals

Hikma Pharmaceuticals PLC

Shalina Healthcare

NewBridge Pharmaceuticals

Johnson & Johnson

Pfizer

AstraZeneca

- Market Demand and Utilization

- Demand from Healthcare Facilities

- Purchasing Power and Budget Allocations

- Quality and Safety Concerns

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030