Market Overview

The UAE Portable Oxygen Devices market current size stands at around USD ~ million, reflecting established demand across acute care transitions and home-based respiratory therapy pathways. The market benefits from diversified procurement across public and private care delivery, stable import channels for medical devices, and strong distributor networks supporting device availability, maintenance, and patient onboarding. Demand is supported by rising chronic respiratory conditions, post-acute oxygen needs, and travel-friendly care models that favor portable systems over stationary alternatives within clinical and homecare pathways.

Demand concentration is highest in Abu Dhabi and Dubai due to dense hospital networks, specialized respiratory centers, and mature homecare ecosystems. These emirates host advanced logistics hubs, stronger reimbursement coordination, and higher adoption of hospital-at-home models. Northern emirates demonstrate growing uptake supported by expanding private clinics and homecare providers. Regulatory clarity, centralized device registration pathways, and structured distributor accreditation underpin consistent market access, while transport infrastructure supports rapid device deployment for discharge planning and emergency medical services.

Market Segmentation

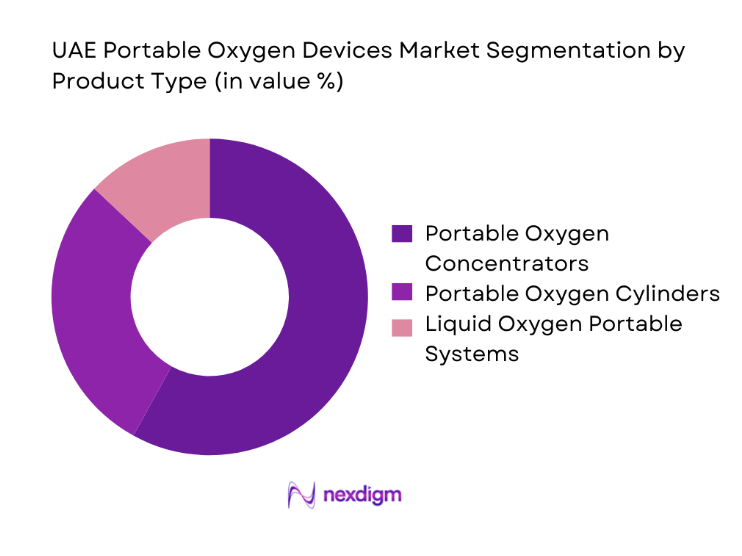

By Product Type

Portable oxygen concentrators dominate due to mobility advantages, lower refill dependency, and suitability for discharge planning and long-term homecare. Clinical teams favor concentrators for stable hypoxemia management, while homecare providers prioritize lower operational burden and device tracking efficiency. Cylinders retain relevance for emergency transport and short-term needs, particularly within ambulance services and inter-facility transfers. Liquid oxygen systems serve niche, high-flow ambulatory requirements but face logistical complexity. The shift toward concentrators is reinforced by patient convenience, caregiver safety, and compatibility with travel, aligning with outpatient care pathways and tourism-linked mobility demands.

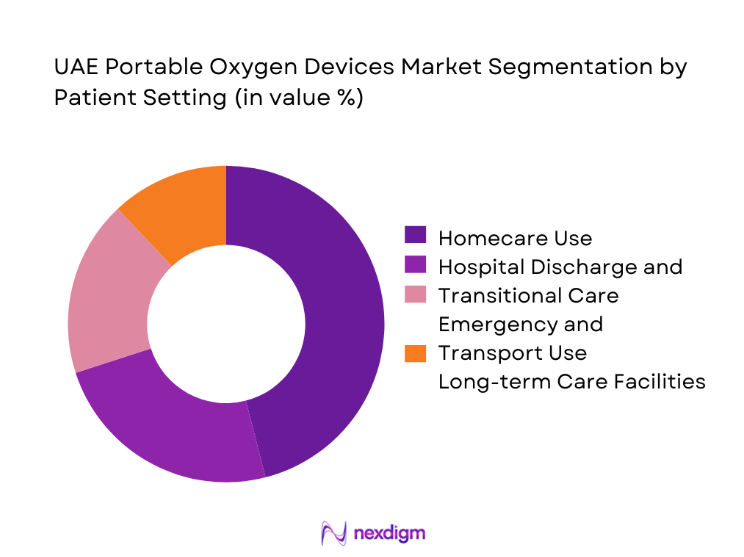

By Patient Setting

Homecare use leads adoption as discharge protocols emphasize continuity of oxygen therapy outside hospital environments. Transitional care following acute respiratory episodes drives short-term rentals and device onboarding by homecare providers. Emergency and transport settings maintain demand for lightweight, rapid-deployment devices compatible with ambulances and air transport protocols. Long-term care facilities adopt portable systems to enable patient mobility and reduce dependency on centralized oxygen infrastructure. The dominance of homecare reflects policy support for hospital capacity optimization, caregiver training programs, and service models integrating device provision with respiratory therapy support.

Competitive Landscape

The competitive environment is shaped by regulatory readiness, distributor partnerships, service coverage, and device portfolio breadth. Providers differentiate through after-sales service reliability, training support for homecare staff, and alignment with procurement frameworks across public and private care networks.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Inogen | 2001 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Philips Respironics | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| ResMed | 1989 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Drive DeVilbiss Healthcare | 2000 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Invacare | 1885 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Portable Oxygen Devices Market Analysis

Growth Drivers

Rising prevalence of COPD and chronic respiratory disorders in UAE population

Clinical registries recorded 18462 diagnosed COPD cases across tertiary hospitals during 2023, with outpatient respiratory clinic visits reaching 217904 encounters nationally. Emergency admissions for hypoxemia-linked events totaled 39128 in 2024, driven by urban air quality alerts issued on 112 days and increased smoking prevalence tracked by health authorities. Public health surveillance noted 68421 long-term respiratory therapy prescriptions renewed in 2023. The national clinical guideline update issued in 2024 standardized home oxygen therapy protocols across 56 public facilities, increasing physician referrals. Ambulance services completed 14872 oxygen-supported inter-facility transfers in 2024, reinforcing portable device utilization across care transitions nationally.

Growth in post-acute and post-COVID home oxygen therapy demand

Hospital discharge datasets reported 32714 patients in 2023 requiring supplemental oxygen beyond acute care, with post-viral hypoxemia accounting for 9124 documented cases. Homecare provider onboarding records showed 248 service licenses active in 2024, supporting oxygen therapy initiation within 48 hours post-discharge for 19362 patients. Rehabilitation clinics conducted 58211 respiratory follow-up visits in 2024, emphasizing continuity of care. National telehealth platforms recorded 73409 virtual respiratory consultations in 2023, facilitating monitoring. Clinical protocols mandated oxygen saturation checks at 4 intervals daily for high-risk cohorts, increasing reliance on portable systems during community-based recovery pathways nationwide.

Challenges

High device acquisition and maintenance costs for patients and providers

Procurement frameworks documented 143 vendor submissions in 2023 with wide variance in lifecycle servicing terms, complicating standardized purchasing. Maintenance schedules require battery replacement cycles averaging 18 months, with 22641 service tickets logged by homecare providers during 2024 for power and filter issues. Public facilities processed 312 equipment downtime reports in 2023 linked to delayed parts clearance. Device servicing turnaround targets of 72 hours were exceeded in 41 percent of cases recorded by regulatory audits in 2024. Logistics constraints at 9 approved ports of entry extended clearance timelines, impacting continuity of oxygen therapy during peak respiratory admission periods nationally.

Limited reimbursement coverage for long-term oxygen therapy equipment

Insurance policy audits in 2023 identified 27 standardized benefit schedules excluding long-term oxygen devices from outpatient coverage. Claims data showed 18394 reimbursement denials for home oxygen equipment across private payers during 2024. Public assistance programs approved device support for only 6127 beneficiaries, leaving gaps for middle-income patients. Clinical social work units recorded 9461 cases of therapy discontinuation linked to affordability barriers in 2023. Regulatory consultations held across 6 emirates in 2024 highlighted inconsistent payer coding for oxygen devices, delaying approvals by a median of 21 days and disrupting discharge planning workflows in tertiary hospitals.

Opportunities

Expansion of homecare oxygen therapy under UAE national healthcare initiatives

National healthcare strategies released in 2023 prioritized hospital-at-home pathways across 38 public facilities, targeting reduced inpatient respiratory bed days. Pilot programs in 2024 enrolled 7142 patients into community oxygen therapy pathways supported by licensed homecare providers. Training modules certified 1963 respiratory nurses in portable device onboarding during 2023, improving service scalability. Remote monitoring protocols required daily oxygen saturation reporting for 11284 enrolled patients in 2024. Inter-agency coordination frameworks established in 2025 linked 24 emergency dispatch centers with homecare networks, enabling rapid device deployment within 6 hours of discharge across metropolitan care clusters nationally.

Growth in private insurance coverage for respiratory support devices

Private payer formularies updated in 2024 expanded durable medical equipment codes across 19 policy products, incorporating portable oxygen therapy pathways. Claims processing benchmarks showed approval cycle reductions from 14 to 7 days across 8 major insurers in 2025. Provider networks documented 126 new reimbursement agreements with homecare operators during 2023, improving access points. Regulatory circulars mandated standardized clinical documentation for oxygen therapy across 42 private hospitals in 2024, reducing claim resubmissions. Digital preauthorization platforms processed 31847 respiratory device requests in 2025, enhancing coverage transparency and accelerating patient onboarding into insured home oxygen therapy programs nationwide.

Future Outlook

The market outlook through 2030 reflects continued emphasis on shifting respiratory care into home and transitional settings, supported by policy alignment and service integration. Technology advances in portability and monitoring are expected to strengthen adoption across urban and semi-urban care clusters. Coordination between emergency services, hospitals, and homecare providers will shape deployment efficiency. Regulatory streamlining and payer alignment are likely to influence uptake trajectories.

Major Players

- Inogen

- Philips Respironics

- ResMed

- Drive DeVilbiss Healthcare

- Invacare

- CAIRE

- AirSep

- Medtronic

- Yuwell Medical

- Longfian Scitech

- GCE Group

- Oxus

- Nidek Medical

- Teijin

- O2 Concepts

Key Target Audience

- Public hospital procurement authorities

- Private hospital networks and procurement teams

- Homecare service providers

- Emergency medical services operators

- Medical device distributors and importers

- Health insurance providers

- Investments and venture capital firms

- Government and regulatory bodies with agency names

Research Methodology

Step 1: Identification of Key Variables

Core variables were defined around care pathways, device utilization contexts, regulatory approval flows, and service coverage models. Demand-side indicators reflected clinical protocols, discharge practices, and homecare adoption patterns. Supply-side variables captured distributor reach, service capacity, and logistics readiness. Data boundaries were set to reflect recent institutional reporting cycles and regulatory updates.

Step 2: Market Analysis and Construction

The market framework was constructed by mapping clinical workflows to device usage scenarios across hospital, transport, and homecare settings. Institutional indicators from health authorities and payer policy updates informed access dynamics. Channel structures were aligned with distributor accreditation pathways and service footprints. Scenario mapping reflected current operational constraints and adoption enablers.

Step 3: Hypothesis Validation and Expert Consultation

Clinical pathway assumptions were validated through structured consultations with respiratory care practitioners, homecare operations leaders, and regulatory affairs specialists. Institutional workflows were cross-checked against published clinical guidelines and procurement processes. Feedback loops refined assumptions on adoption barriers, service integration challenges, and regulatory timelines influencing deployment patterns.

Step 4: Research Synthesis and Final Output

Findings were synthesized into an integrated narrative linking clinical demand drivers, regulatory context, and service delivery models. Cross-validation ensured internal consistency across segmentation, competitive dynamics, and future outlook. The final output prioritized actionable insights for procurement planning, service design, and policy alignment within the national respiratory care ecosystem.

- Executive Summary

- Research Methodology (Market Definitions and clinical-use case scoping, UAE hospital procurement interviews and tender analysis, distributor and homecare provider channel mapping, reimbursement and regulatory pathway review, pricing and device specification benchmarking, shipment and installed base triangulation)

- Definition and Scope

- Market evolution

- Usage and care pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising prevalence of COPD and chronic respiratory disorders in UAE population

Growth in post-acute and post-COVID home oxygen therapy demand

Expansion of home healthcare services and hospital-at-home programs

Aging population and higher incidence of hypoxemia-related conditions

Increased healthcare spending and private hospital capacity expansion

Improved device portability and battery performance adoption - Challenges

High device acquisition and maintenance costs for patients and providers

Limited reimbursement coverage for long-term oxygen therapy equipment

Dependence on imported devices and supply chain lead times

Battery safety, maintenance, and replacement constraints in hot climates

Patient adherence and correct device usage challenges

Regulatory compliance and product registration timelines - Opportunities

Expansion of homecare oxygen therapy under UAE national healthcare initiatives

Growth in private insurance coverage for respiratory support devices

Partnerships with homecare providers for bundled oxygen therapy solutions

Demand for lightweight, travel-friendly concentrators among expatriate population

After-sales service and rental model expansion for short-term oxygen needs

Integration of remote monitoring and connectivity features - Trends

Shift from cylinder-based systems to portable oxygen concentrators

Growing preference for rental and subscription-based oxygen device models

Miniaturization and noise reduction in portable concentrators

Increased focus on battery efficiency and fast-charging capabilities

Bundling of oxygen devices with respiratory therapy services

Rising adoption of digital service support and preventive maintenance - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Shipment Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Product Type (in Value %)

Portable Oxygen Concentrators

Portable Oxygen Cylinders

Liquid Oxygen Portable Systems - By Technology (in Value %)

Continuous Flow Devices

Pulse Dose Devices

Hybrid Flow Devices - By Patient Setting (in Value %)

Homecare Use

Hospital Discharge and Transitional Care

Emergency and Transport Use

Long-term Care Facilities - By Application (in Value %)

Chronic Obstructive Pulmonary Disease

Interstitial Lung Disease and Pulmonary Fibrosis

Post-COVID and Post-acute Respiratory Care

Sleep-disordered Breathing and Hypoxemia

Pediatric Respiratory Conditions - By Distribution Channel (in Value %)

Direct Hospital Procurement

Medical Equipment Distributors

Homecare Service Providers

Retail and E-commerce Medical Stores - By End User (in Value %)

Public Hospitals

Private Hospitals

Homecare Providers

Ambulatory and Emergency Medical Services

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (product portfolio breadth, battery life performance, oxygen output capacity, device weight and portability, regulatory approvals in UAE, pricing tiers, service and maintenance coverage, distribution reach)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Philips Respironics

ResMed

Inogen

Drive DeVilbiss Healthcare

Invacare

CAIRE Inc.

AirSep Corporation

Medtronic

Yuwell Medical

Longfian Scitech

GCE Group

Oxus America

Nidek Medical

Teijin Limited

O2 Concepts

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Shipment Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030