Market Overview

The UAE Predictive Analytics in Healthcare market is anchored in the wider healthcare analytics spend, valued at USD ~ million, with demand reinforced by the broader digital health expansion from USD ~ million to USD ~ million in the most recent two-year window. Predictive analytics adoption is being driven by scale-up of enterprise EHR environments, push toward measurable clinical quality outcomes, and the operational requirement to forecast patient volumes, acuity, and resource utilization—especially in multi-facility systems where real-time decisioning is tied to throughput and cost controls.

Within the UAE, Dubai and Abu Dhabi lead adoption because they concentrate large hospital networks, specialty care clusters, and health-system digital transformation programs that can operationalize predictive models in high-volume pathways (ED, ICU, radiology, chronic care). Dubai is explicitly referenced as the largest domestic hub for healthcare analytics activity in published market coverage. On the supply side, solution leadership is influenced by technology ecosystems and vendors headquartered primarily in the U.S. and Europe, whose platforms are widely deployed by enterprise providers and insurers and are adapted to local privacy and hosting requirements through regional cloud zones and local implementation partners.

Market Segmentation

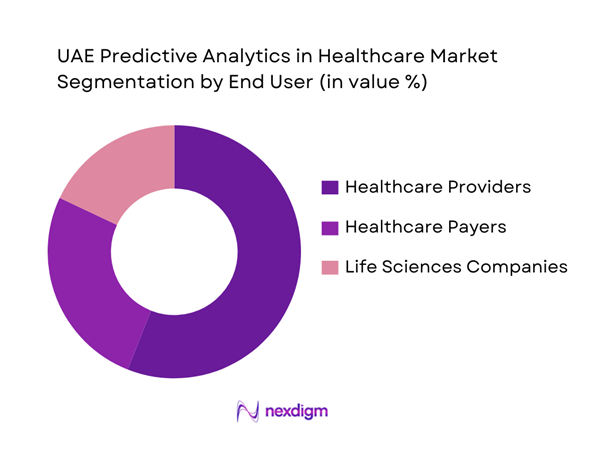

By End User

The UAE Predictive Analytics in Healthcare market is segmented by end user into healthcare providers, healthcare payers, and life sciences companies. Recently, healthcare providers hold the dominant share because predictive analytics is most readily monetized where clinical and operational data are generated at scale—inside hospitals and multi-site networks. Providers deploy predictive models for early deterioration signals (sepsis/ICU risk), ED inflow forecasting, length-of-stay prediction, readmission risk, OR scheduling optimization, and imaging/worklist prioritization. This segment also benefits from stronger ownership of longitudinal EHR data, richer real-time telemetry (labs, vitals, imaging), and direct accountability for patient outcomes and throughput. In practice, provider-led deployments become enterprise platforms that later extend to payers and life sciences via data sharing, registries, and real-world evidence pipelines—reinforcing providers as the first and largest buyers of predictive capabilities.

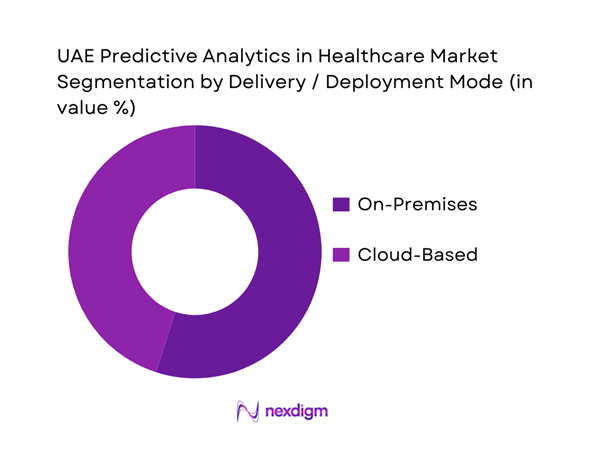

By Delivery / Deployment Mode

The UAE Predictive Analytics in Healthcare market is segmented into on-premises and cloud-based models. Recently, on-premises remains the dominant mode because predictive analytics in healthcare often touches highly sensitive patient and claims datasets and must fit stringent governance, auditability, and system integration requirements. Many enterprise providers prefer tighter control over data access, model execution, and identity management—especially when models must run close to core clinical systems (EHR, LIS, RIS/PACS) with low latency and high uptime. On-premises deployments also simplify integration with legacy interfaces and allow customization for locally defined clinical pathways, Arabic/English documentation patterns, and facility-level protocols. While cloud adoption is accelerating for experimentation, scaling, and MLOps, on-premises remains a common “system of record” posture where governance and operational risk considerations outweigh speed-to-deploy advantages.

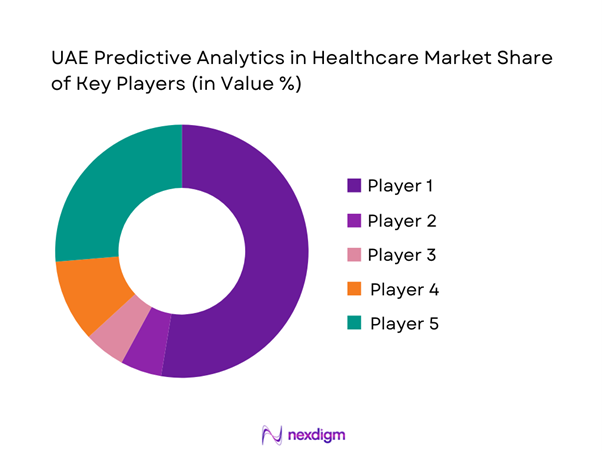

Competitive Landscape

The UAE Predictive Analytics in Healthcare market features a mix of global health-tech leaders, hyperscale cloud providers, analytics specialists, and health data platforms competing on clinical workflow integration, model performance and explainability, data governance, and deployment flexibility (on-prem + cloud). Competition is shaped by the ability to operationalize predictive models inside hospital command centers, population health programs, payer claims systems, and life-science RWE pipelines—often through local systems integrators and partnerships with hospital groups.

| Company | Est. year | HQ | UAE go-to-market & presence | Core predictive use-cases | Data & interoperability strength | Deployment posture | Model governance / explainability | Typical buyer focus |

| Oracle Health (Cerner) | 1979 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Microsoft (Azure + Fabric + AI) | 1975 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| SAS | 1976 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| IBM | 1911 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| IQVIA | 1982 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Predictive Analytics in Healthcare Market Analysis

Growth Drivers

Care Model Transition

UAE healthcare delivery is shifting toward coordinated, data-led care because the system is operating at scale and needs tighter control over avoidable utilization. The UAE economy provides strong capacity for digital health investments, with GDP at USD ~ billion and GDP per capita at USD ~. In Dubai alone, inpatient activity is large enough to justify predictive risk stratification and discharge planning: total hospital admissions reached ~ in the latest reporting cycle, and the emirate also licenses a broad outpatient ecosystem with ~ polyclinics, ~ pharmacies, and ~ optical centers—creating longitudinal patient journeys that benefit from predictive outreach, care-gap detection, and deterioration forecasting across settings. At the national level, the unified record direction supports a move from episodic treatment to longitudinal population risk management—where predictive analytics becomes a core “care navigation” layer for chronic disease follow-ups, post-acute monitoring, and specialty referral prioritization.

Payer Efficiency Requirements

Insurers and TPAs in the UAE are increasingly pushed to use predictive analytics because utilization is growing in large urban systems and payer controls must become more granular than manual pre-authorization. Macro conditions amplify this: with GDP at USD ~ billion and GDP per capita at USD ~, the UAE supports high service intensity, and that intensity shows up in care volumes—Dubai reported ~ inpatient admissions in the most recent reporting cycle. For payers, this scale creates continuous need for predictive tools that flag high-risk members early, forecast claims severity, and detect anomalous billing patterns across a large provider universe. Predictive models also help payers optimize network steering when exchanges unify patient journeys: Dubai’s health information exchange has unified over ~ patient records and connected more than ~ healthcare facilities, enabling richer claims-to-clinical reconciliation and stronger fraud/waste identification signals when permitted by governance. As payer-provider contracting becomes more outcomes-linked, prediction is increasingly used to quantify risk pools, expected utilization, and care management ROI on a member cohort basis.

Challenges

Data Quality and Standardization

Predictive models are only as strong as the underlying data, and UAE healthcare data originates from a large, heterogeneous provider base with varying documentation practices, coding maturity, and data completeness. Dubai alone licenses a broad set of facilities—~ polyclinics, ~ pharmacies, and ~ optical centers—and also records high inpatient throughput with ~ admissions in the latest reporting cycle, which increases the likelihood of inconsistent structured fields across sites. While exchanges significantly improve availability, they can also surface inconsistencies at scale: consolidated patient records across ~ facilities and unique clinical records accessed by ~ users. These volumes make quality issues more visible—duplicate identities, missing timestamps, and inconsistent coding—directly impacting model training, calibration, and fairness across sub-populations. Strong macro capacity enables remediation investment, but standardization remains a continuous operational challenge.

Interoperability Limitations

Even with strong exchanges, interoperability remains a practical constraint because predictive analytics requires real-time or near-real-time data flows into operational workflows. Exchange platforms connect ~ facilities and unify ~ patient records, while another hosts ~ unique clinical records and serves ~ users—yet predictive use cases still depend on consistent interface standards, reliable identity matching, and event-driven integration with EHR/LIS/RIS systems at each site. Federal alignment helps but also adds complexity, which means cross-emirate interoperability must reconcile differing operational policies and technical baselines. High care throughput raises the bar for uptime, latency, and data completeness—any delay or missing feed can degrade a model’s clinical usefulness. Macro strength supports investment, but real interoperability is a multi-year systems engineering effort.

Opportunities

Federated and Distributed Analytics

Federated and distributed analytics is a near-term growth lever in the UAE because the country already has exchange-scale data assets but must balance privacy, localization, and multi-entity governance. The opportunity is grounded in the current size of connected datasets: unified patient records across ~ facilities, and unique clinical records enabling access for ~ users. These volumes create a practical pathway for federated learning and distributed risk models where sensitive patient data stays within controlled environments while model parameters or aggregated signals are shared for population-level prediction. Federal linkage direction strengthens the case by consolidating medical data across local health authorities and connecting national and emirate systems, which can expand federated analytics beyond a single emirate. With GDP USD ~ billion, the UAE can fund the enabling layers needed to scale predictive programs without expanding raw data movement.

Federal and Emirate-Level Platform Scaling

Platform scaling across federal and emirate layers is a strong opportunity because the UAE already demonstrates proof of scale in the largest emirates, and the next growth step is standardizing predictive capabilities across care clusters. Dubai’s system has a measurable operational base with ~ inpatient admissions and a large provider universe that benefits from unified predictive programs. Abu Dhabi’s exchange-scale assets enable broad cohort modeling, including imaging-informed pathways. National coordination via federal initiatives is positioned to link local health authority datasets and systems, which can allow predictive platform services to be reused across emirates rather than rebuilt per entity. Macro capacity supports the shift from project implementations to reusable national platforms that increase adoption velocity without relying on future-facing numbers.

Future Outlook

Over the next several years, the UAE Predictive Analytics in Healthcare market is expected to expand rapidly as providers industrialize AI-enabled decisioning across high-volume pathways and payers intensify analytics-led cost controls. Predictive models will increasingly shift from project deployments to platformized capabilities. As Dubai and Abu Dhabi health systems mature data foundations, adoption should broaden from operational forecasting toward precision risk models, imaging triage, and longitudinal chronic care prediction—supported by cloud-scale compute and tighter governance requirements.

Major Players

- Oracle Health

- SAS

- IBM

- Microsoft

- IQVIA

- Oracle

- Optum

- McKesson

- Verisk Analytics

- Allscripts / Veradigm

- AWS

- Google Cloud

- SAP

- Siemens Healthineers

Key Target Audience

- Hospital groups & integrated provider networks

- Government and regulatory bodies

- Healthcare payers / insurers & TPAs

- Life sciences companies

- Diagnostic networks & imaging providers

- Health-tech platform vendors & systems integrators

- Investments and venture capitalist firms

- Large employer groups & corporate healthcare buyers

Research Methodology

Step 1: Identification of Key Variables

We build a UAE healthcare analytics ecosystem map covering providers, payers, life sciences, cloud platforms, and integrators. Desk research is used to define market boundaries for predictive analytics. We finalize assumptions around buyer types, deployment patterns, and data sources.

Step 2: Market Analysis and Construction

We compile historical and current UAE healthcare analytics revenues from credible published datasets and align them to predictive analytics adoption pathways. We map where predictive value is created and triangulate demand using procurement patterns and platform rollouts.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses through structured expert interviews with hospital CIO/CDO teams, payer analytics leaders, and implementation partners. We verify deployment choices, buying criteria, integration timelines, and governance constraints.

Step 4: Research Synthesis and Final Output

We synthesize findings into a consolidated model and stress-test results against vendor positioning, reference deployments, and capability benchmarks. We finalize market narrative on adoption drivers, constraints, and opportunity spaces.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Scope Boundary Conditions, Data Governance Considerations, Market Sizing Approach, Top-Down and Bottom-Up Triangulation, Primary Research Approach, Secondary Research Approach, In-Depth Stakeholder Interviews, Demand-Supply Mapping, Model Validation Logic, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution of Predictive Healthcare in UAE

- Care Pathway Hotspots for Predictive Analytics

- Patient Journey Touchpoints Suitable for Prediction

- Stakeholder Map

- Growth Drivers

Care Model Transition

Payer Efficiency Requirements

National Digital Health Programs

Provider Capacity Constraints

Healthcare Data Exchange Maturity - Challenges

Data Quality and Standardization

Interoperability Limitations

Model Governance and Validation

Clinical Trust and Explainability

Workflow Integration Barriers

Privacy and Data Localization Constraints - Opportunities

Federated and Distributed Analytics

Federal and Emirate-Level Platform Scaling

Precision and Preventive Care Enablement

Value-Based Care Analytics

Population-Level Risk Management - Trends

GenAI and Predictive Analytics Convergence

Real-Time Streaming and Event-Based Analytics

Arabic Clinical NLP Enablement

Synthetic Data Utilization

Edge AI for Monitoring and Alerts - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- Pricing and Commercial Models

- By Value, 2019–2024

- By Volume, 2019–2024

- By Spend Category, 2019–2024

- By Fleet Type (in Value %)

Risk Stratification

Clinical Deterioration and Early Warning

Readmission Prediction

ED Demand Forecasting

Length-of-Stay Prediction - By Application (in Value %)

Population Health

Care Management

Hospital Operations

Revenue Cycle and Claims

Clinical Trials and Real-World Evidence - By Technology Architecture (in Value %)

EHR Structured Data

Clinical Notes and NLP

Medical Imaging Signals

Lab and Pathology Data

Wearables and Remote Patient Monitoring

Claims and Eligibility Data - By Connectivity Type (in Value %)

On-Premise

Private Cloud

Public Cloud

Sovereign Cloud

Hybrid Edge-to-Cloud - By End-Use Industry (in Value %)

Government Providers

Private Hospital Groups

Specialty Clinics

Diagnostic Networks

Insurers and TPAs - By Region (in Value %)

Abu Dhabi

Dubai

Northern Emirates

- Market Share Assessment of Major Players

- Cross Comparison Parameters (HIE integration readiness, UAE data residency and PDPL posture, clinical model performance metrics, explainability and clinician trust tooling, real-time and latency capability, Arabic clinical NLP maturity, MLOps and model drift governance, integration depth and deployment burden)

- Competitive Positioning Matrix

- Partner Ecosystem Mapping

- SWOT of Major Players

- Detailed Profiles of Major Companies

Oracle Health

Epic Systems

InterSystems

Microsoft

Google Cloud

Amazon Web Services

IBM

SAS

Palantir

Siemens Healthineers

GE HealthCare

Philips

IQVIA

G42 / Core42

M42

- Demand and Utilization Mapping

- Buyer Personas and Decision Units

- Workflow Fit Assessment

- Data Readiness Assessment

- Procurement and Vendor Selection Criteria

- By Value, 2025–2030

- By Volume, 2025–2030

- By Spend Category, 2025–2030