Market Overview

The UAE Prenatal Genetic Testing market is valued at USD ~, reflecting its growing structural importance within the country’s maternal and fetal healthcare ecosystem. Demand is anchored in the steady rise of high-risk pregnancies, increased clinical focus on early-stage anomaly detection, and the healthcare system’s transition from reactive treatment models to preventive and predictive care frameworks. The market has become a core component of prenatal pathways, particularly in private maternity care, where genetic screening is increasingly positioned as a standard of care rather than an optional diagnostic add-on.

Within the country, Dubai and Abu Dhabi dominate prenatal genetic testing activity due to their concentration of tertiary hospitals, fertility centers, and advanced diagnostic laboratories that integrate genomic services into routine antenatal care. These cities benefit from stronger healthcare investment flows, higher private insurance penetration, and a large expatriate population that is more receptive to advanced screening options. At the technology and supply level, the market is influenced by global innovation hubs that lead in sequencing platforms, bioinformatics tools, and test-panel development, shaping local adoption patterns through partnerships and technology transfer without direct reference to specific foreign markets.

Market Segmentation

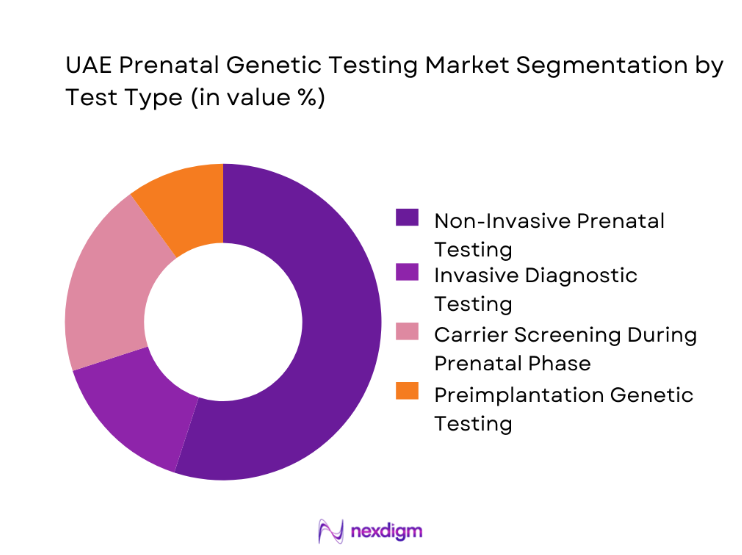

By Test Type

The UAE Prenatal Genetic Testing market is segmented by test type into Non-Invasive Prenatal Testing, Invasive Diagnostic Testing, Carrier Screening Panels, Preimplantation Genetic Testing, and Biochemical Risk Screening. Among these, Non-Invasive Prenatal Testing dominates the segment due to its strong clinical acceptance, safety profile, and ability to deliver high diagnostic confidence without procedural risk to the fetus. Physicians increasingly recommend non-invasive methods as the first-line screening tool, particularly for aneuploidy detection, as it aligns with patient preferences for low-risk procedures. The rapid technological maturation of sequencing-based screening platforms has further enhanced test accuracy and turnaround times, making NIPT operationally attractive for hospitals and laboratories alike. In addition, broader awareness campaigns and integration into standard antenatal care packages have normalized its use across both average-risk and high-risk pregnancy groups, reinforcing its leadership position within the test-type landscape.

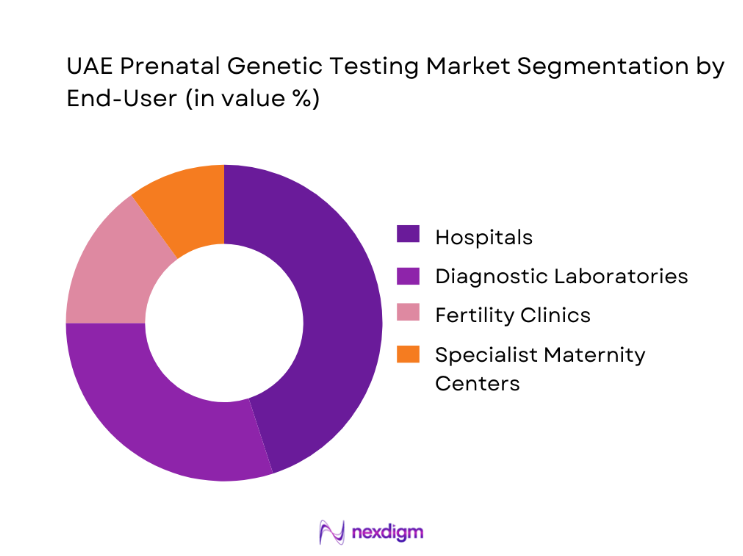

By End-Use

By end-use customer type, the UAE Prenatal Genetic Testing market is segmented into Tertiary Care Hospitals, Private Maternity Clinics, Fertility and IVF Centers, Independent Diagnostic Laboratories, and Public Healthcare Facilities. Tertiary care hospitals account for the largest share as they function as primary referral centers for high-risk pregnancies and complex maternal-fetal cases. These institutions possess the infrastructure to integrate genetic screening into multidisciplinary care models involving obstetricians, genetic counselors, and neonatologists. Their procurement scale also enables them to adopt advanced testing platforms and negotiate comprehensive service agreements with diagnostic providers. Furthermore, hospitals benefit from stronger insurance alignment and patient trust, positioning them as the preferred venue for prenatal genetic testing. This institutional dominance is reinforced by ongoing investments in women’s health centers of excellence, which increasingly treat genetic screening as a clinical necessity rather than an optional diagnostic layer.

Competitive Landscape

The UAE Prenatal Genetic Testing market is dominated by a few major players, including Illumina and global or regional brands like Natera, Roche Diagnostics, and Thermo Fisher Scientific. This consolidation highlights the significant influence of these key companies.

| Company | Est. Year | HQ Location | Test Portfolio Breadth | NGS Platform Adoption | Local Lab Presence | Clinical Partnerships | Regulatory Certifications | Service Reach (Hospitals/Clinics) |

| Illumina | 1998 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Natera | 2004 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Roche Diagnostics | 1896 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Thermo Fisher Scientific | 1956 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Eurofins | 1987 | Luxembourg | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Prenatal Genetic Testing Market Analysis

Growth Drivers

Rising Maternal Age and High-Risk Pregnancy Incidence

The steady increase in maternal age across the UAE has amplified the incidence of high-risk pregnancies, directly expanding the clinical need for prenatal genetic testing. As obstetricians encounter more cases associated with chromosomal abnormalities and inherited conditions, genetic screening becomes an essential diagnostic step rather than a discretionary service. This demographic shift has triggered higher referral volumes to diagnostic laboratories and reinforced the role of early screening in reducing downstream healthcare costs. The outcome is a structurally embedded demand base that supports long-term market stability.

Expansion of IVF and Assisted Reproduction Services

The rapid growth of fertility clinics and assisted reproduction programs has created a strong downstream pull for prenatal and preimplantation genetic testing services. Couples undergoing fertility treatments increasingly seek genetic assurance to minimize the risk of inherited disorders, driving routine adoption of carrier screening and embryo testing. This trend not only boosts testing volumes but also elevates the perceived value of advanced genomic solutions within reproductive healthcare, positioning genetic testing as a core component of fertility success strategies.

Challenges

High Cost of Advanced Genetic Testing

Despite rising demand, the cost of advanced genetic screening remains a significant barrier to universal adoption. Premium pricing of sequencing-based tests limits accessibility for segments of the population without comprehensive insurance coverage. This creates uneven market penetration and constrains growth in price-sensitive patient cohorts. Providers must balance technological sophistication with affordability to unlock the next phase of market expansion.

Shortage of Trained Genetic Counselors

The market faces a structural bottleneck in the availability of qualified genetic counselors capable of supporting patients through complex test interpretations. Without adequate counseling infrastructure, test results risk being underutilized or misunderstood, reducing the perceived value of prenatal genetic screening. This talent gap places additional pressure on hospitals and laboratories to invest in training and digital support solutions.

Opportunities

Expansion of Universal Prenatal Screening Programs

The gradual policy shift toward preventive healthcare creates an opportunity to embed prenatal genetic testing into standardized maternal care protocols. As screening moves from optional to routine, test volumes are expected to rise significantly, supported by public awareness initiatives and institutional endorsement.

Localization of Sequencing and Bioinformatics

Establishing local sequencing and data analysis capabilities presents a major opportunity to reduce turnaround times and operational costs. Localization also strengthens data governance and aligns with national healthcare digitization priorities, making the market more resilient and scalable.

Future Outlook

The UAE Prenatal Genetic Testing market is positioned for sustained strategic growth as genetic screening becomes an integral component of mainstream maternal care. The convergence of technological maturity, healthcare system modernization, and rising patient expectations will continue to reshape service delivery models. Over the coming years, the market will evolve from a specialist-driven diagnostic niche into a standardized preventive healthcare pillar, supported by deeper hospital integration, stronger digital infrastructure, and broader acceptance across diverse patient demographics.

Major Players

- Illumina

- Natera

- Roche Diagnostics

- Thermo Fisher Scientific

- Eurofins Genomics

- BGI Genomics

- Myriad Genetics

- Abbott Molecular

- PerkinElmer

- Centogene

- Igenomix

- Berry Genomics

- Quest Diagnostics

- Invitae

- NIPT International

Key Target Audience

- Hospital groups and healthcare providers

- Diagnostic laboratory networks

- Fertility and IVF clinic operators

- Investments and venture capitalist firms

- Health insurance companies

- Medical technology distributors

- Government and regulatory bodies

- Healthcare infrastructure developers

Research Methodology

Step 1: Identification of Key Variables

This phase involved mapping the prenatal genetic testing ecosystem across providers, technologies, and care pathways. Secondary research sources and internal healthcare intelligence were used to define the critical variables shaping market structure and demand behavior.

Step 2: Market Analysis and Construction

Historical service adoption patterns, test utilization metrics, and institutional procurement models were analyzed to build a consistent market framework. This step ensured alignment between clinical activity and revenue flows.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses were validated through structured discussions with clinicians, laboratory directors, and healthcare administrators. These insights refined assumptions around adoption barriers, pricing sensitivity, and future demand trajectories.

Step 4: Research Synthesis and Final Output

All findings were synthesized through a bottom-up validation approach, integrating qualitative insights with quantitative modeling to deliver a coherent and decision-ready market narrative.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, terminology and abbreviations, prenatal genetic testing taxonomy and care pathway mapping, market sizing logic by test volume and risk stratified utilization, revenue attribution across assays sequencing reagents and interpretation services, primary interview program with OB GYN clinics labs payers and regulators, data triangulation and validation approach, assumptions limitations and data gaps)

- Definition and Scope

- Market Genesis and Evolution of Prenatal Genetic Testing in the UAE

- Maternal Age Trends and High Risk Pregnancy Screening Drivers

- Care Pathway Mapping Across Antenatal Care Fetal Medicine and Genetic Counseling

- Public Program Role and Private Provider Screening Dynamics

- Local Testing Capacity versus Send Out Testing Pathways

- Growth Drivers

Rising maternal age and higher screening uptake

Increasing awareness of NIPT accuracy and safety

Growth of private maternity care and premium diagnostics

Improved access to fetal medicine and ultrasound services

Expansion of genetic counseling capacity and referrals - Challenges

Reimbursement variability and affordability barriers for NIPT

Turnaround time dependency on send out testing logistics

Counseling workload and informed consent requirements

False positive management and follow up invasive procedure rates

Data privacy and cross border genomic data governance - Opportunities

Localization of NIPT sequencing capacity and bioinformatics

Broader adoption of microdeletion and expanded NIPT panels

Partnerships with maternity hospital networks and OB GYN clinics

Digital counseling platforms and patient education workflows

Integration of prenatal testing with carrier screening pathways - Trends

Shift from serum screening to cfDNA based NIPT in private care

Growth in expanded panels and fetal anomaly investigation

More structured referral pathways to fetal medicine centers

Greater emphasis on reporting clarity and counseling support

Increasing use of WES for unexplained fetal anomalies - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Test Volume, 2019–2024

- By Screening vs Diagnostic Testing Split, 2019–2024

- By Public vs Private Provider Revenue Split, 2019–2024

- By Fleet Type (in Value %)

Government hospitals and maternal health programs

Private hospital networks

Women’s health and OB GYN clinics

Fetal medicine and specialist centers

Independent reference laboratories - By Application (in Value %)

First trimester aneuploidy screening

Non invasive prenatal testing for common trisomies

Microdeletion and expanded NIPT screening

Invasive diagnostic confirmation and follow up testing

High risk pregnancy monitoring and counseling - By Technology Architecture (in Value %)

Serum screening and ultrasound combined testing

cfDNA based NIPT sequencing workflows

Microarray based prenatal diagnostic testing

Targeted PCR based mutation testing

Whole exome sequencing for fetal anomaly workups

Send out testing and international reference lab workflows - By Connectivity Type (in Value %)

Standalone lab reporting workflows

LIS integrated genetic testing operations

Digital counseling and teleconsult platforms

EHR integrated ordering and results delivery

Cloud based variant interpretation and knowledgebases - By End-Use Industry (in Value %)

OB GYN and antenatal care providers

Fetal medicine and ultrasound centers

Clinical genetics and counseling services

Hospital laboratories and pathology networks

Insurance and employer maternity benefit programs - By Region (in Value %)

Abu Dhabi

Dubai

Sharjah

Northern Emirates

Al Ain and inland corridors

- Competitive ecosystem structure across local labs international reference labs and hospital networks

- Positioning driven by turnaround time panel breadth and counseling integration

- Partnership models between OB GYN clinics fetal medicine centers and labs

- Cross Comparison Parameters (NIPT sensitivity and specificity performance, panel breadth for trisomies and microdeletions, turnaround time and sample logistics, local testing capability versus send out reliance, availability of genetic counseling support, reporting clarity and clinical actionability, data privacy and compliance posture, cost per test and reimbursement fit)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

M42

Pure Health

G42 Healthcare

Natera

Illumina

Thermo Fisher Scientific

BGI Genomics

Roche Diagnostics

Abbott

Centogene

Invitae

Fulgent Genetics

Myriad Genetics

GeneDx

Eurofins Genomics

- OB GYN ordering behavior and patient counseling workflows

- Lab selection criteria for turnaround time and reporting quality

- Payer coverage criteria and prior authorization dynamics

- Patient willingness to pay and preference drivers

- Total cost of ownership across testing counseling and follow up pathways

- By Value, 2025–2030

- By Test Volume, 2025–2030

- By Screening vs Diagnostic Testing Split, 2025–2030

- By Public vs Private Provider Revenue Split, 2025–2030