Market Overview

The UAE Pulse Oximeters Equipment market current size stands at around USD ~ million, reflecting sustained institutional demand across acute care and home monitoring settings driven by expanding clinical protocols for oxygen saturation tracking. Procurement volumes remain anchored in public hospital networks, private tertiary facilities, and emergency medical services. Device replacement cycles, sensor replenishment, and multi-parameter monitoring integration continue to underpin baseline demand, while regulatory alignment supports standardized device deployment across care settings nationwide.

Demand concentration is strongest in Abu Dhabi and Dubai due to higher tertiary care capacity, ICU density, and advanced emergency response infrastructure. These emirates host mature distributor ecosystems, centralized procurement bodies, and higher adoption of connected care platforms. Northern emirates show growing uptake aligned with hospital upgrades and ambulance network expansion. Policy emphasis on digital health, critical care resilience, and home healthcare integration further shapes purchasing priorities across government and private providers.

Market Segmentation

By Product Type

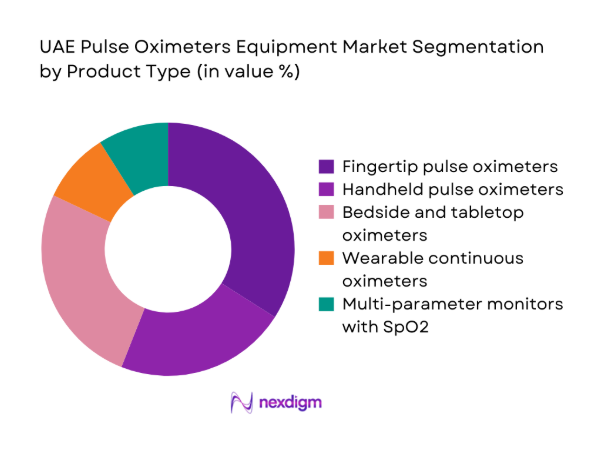

Fingertip and handheld pulse oximeters dominate routine monitoring in wards, outpatient clinics, and homecare due to portability and rapid deployment, while bedside and tabletop systems anchor continuous monitoring in ICUs and operating rooms. Multi-parameter monitors integrating SpO2 are preferred in high-acuity environments for workflow efficiency and interoperability with electronic records. Wearable continuous oximetry is gaining traction in chronic disease management and post-discharge monitoring, supported by remote care pathways. Procurement favors clinically validated devices with motion tolerance, neonatal accuracy, and durable sensor ecosystems, reflecting demand across diverse care settings and acuity levels.

By End User

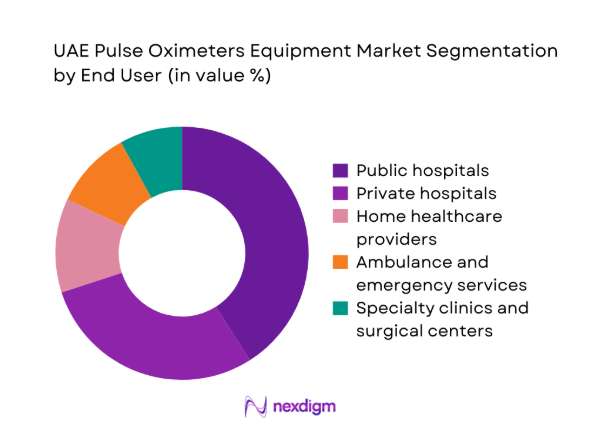

Public hospitals account for a substantial share due to centralized procurement, ICU bed concentration, and standardized monitoring protocols. Private hospitals prioritize premium devices with integration capabilities to support surgical and critical care workflows. Home healthcare providers increasingly deploy portable and wearable oximetry for chronic respiratory and cardiac patients. Ambulance and emergency services require ruggedized, rapid-read devices for pre-hospital triage, while specialty clinics emphasize portability and infection control. Purchasing behavior varies by care pathway maturity, reimbursement practices, and service-level agreements for calibration and sensor supply continuity.

Competitive Landscape

The competitive environment features a mix of global device manufacturers and regionally entrenched distributors, with differentiation driven by clinical accuracy, sensor ecosystems, service coverage, and regulatory readiness. Channel partnerships and service capability shape procurement outcomes across public tenders and private hospital networks.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Masimo | 1989 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Nihon Kohden | 1976 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Dräger | 1949 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Mindray | 1981 | China | ~ | ~ | ~ | ~ | ~ | ~ |

| Nonin Medical | 1984 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Pulse Oximeters Equipment Market Analysis

Growth Drivers

Rising burden of chronic respiratory and cardiovascular diseases

Chronic respiratory and cardiovascular disease prevalence in the UAE has increased alongside urbanization and sedentary lifestyles, intensifying routine oxygen saturation monitoring across care pathways. In 2023, hospital admissions linked to chronic respiratory conditions exceeded 42000 across tertiary facilities, while emergency presentations for cardiac-related hypoxemia rose by 1800 incidents compared with 2022. Clinical guidelines issued in 2024 expanded SpO2 monitoring frequency in inpatient wards and post-discharge follow-up programs. Ambulance response protocols in 2025 mandated continuous oximetry during transport for high-risk cases, increasing device utilization cycles and sensor turnover. Expansion of home healthcare visits to 310000 annually further institutionalized monitoring.

High ICU bed capacity expansion across tertiary hospitals

ICU capacity expansion across tertiary hospitals has structurally increased continuous monitoring needs. Between 2022 and 2024, accredited ICU beds increased by 620 across major emirates, with step-down units adding 410 monitored beds. Clinical safety standards updated in 2024 require uninterrupted SpO2 tracking for ventilated patients and perioperative recovery units. Biomedical engineering departments reported calibration cycles of 90 days for bedside oximetry systems, elevating maintenance throughput. In 2025, emergency preparedness drills mandated deployment of 120 mobile monitors per tertiary cluster, reinforcing installed base utilization and staff training requirements. These institutional upgrades sustain device demand intensity across acute care pathways.

Challenges

Price sensitivity in government tenders and bulk procurement

Public procurement frameworks emphasize cost containment and standardized specifications, constraining device differentiation in tenders. In 2023, centralized tenders aggregated orders across 7 hospital networks, compressing supplier margins and extending award cycles to 210 days. Technical compliance audits in 2024 disqualified 18 submissions due to documentation gaps, increasing re-tender frequency and procurement delays. Hospital biomedical teams report average device service life targets of 60 months, stretching replacement cycles and slowing refresh rates. Payment clearance timelines of 120 days in 2025 elevated working capital pressure for distributors, limiting inventory breadth and slowing deployment of advanced monitoring features in public facilities.

Regulatory approval timelines and compliance documentation burden

Regulatory pathways require device registration, conformity assessments, and local representation, extending time to market. In 2022, average dossier review cycles spanned 150 days for monitoring devices, with post-market surveillance plans reviewed annually. Updated cybersecurity and interoperability requirements in 2024 added 12 documentation modules for connected oximetry, increasing compliance workload for vendors and importers. Customs clearance inspections in 2025 introduced batch-level verification for sensor consumables, adding 14 days to inbound logistics. These procedural layers delay product refresh, constrain portfolio breadth, and complicate rapid adoption of motion-tolerant and neonatal-optimized technologies across hospitals and emergency services.

Opportunities

Integration with remote patient monitoring and telehealth platforms

Remote monitoring adoption has accelerated as providers expand virtual care pathways. In 2023, teleconsultation encounters exceeded 180000 across public systems, with 64000 involving respiratory follow-ups. Protocols issued in 2024 require SpO2 data integration into electronic records for home-managed chronic patients, increasing device connectivity requirements. By 2025, 52 primary care centers piloted Bluetooth-enabled oximetry linked to clinician dashboards, reducing avoidable admissions by 1400 cases annually. National digital health interoperability standards mandate device data exchange, creating demand for connected oximetry platforms, cloud-ready firmware, and secure device management services supporting continuous monitoring beyond hospital walls.

Adoption of wearable SpO2 devices for chronic disease management

Wearable SpO2 adoption aligns with long-term management of chronic respiratory and cardiac conditions. In 2023, outpatient pulmonary programs enrolled 22000 patients in remote monitoring pathways, with 7800 requiring continuous nocturnal oximetry. Sleep disorder screening initiatives in 2024 expanded to 36 clinics, incorporating wearable oximetry for home assessments and follow-up. By 2025, community nursing visits reached 190000 annually, creating demand for lightweight, rechargeable devices with week-long battery endurance. Policy frameworks promoting aging-in-place encourage continuous monitoring to prevent exacerbations, positioning wearable oximetry as a scalable adjunct to homecare and post-discharge management.

Future Outlook

Through 2030, the market is expected to advance with deeper integration of connected monitoring, broader homecare adoption, and stricter clinical protocols for continuous SpO2 tracking. Policy emphasis on digital health and critical care resilience will shape procurement standards. Regional capacity upgrades and emergency preparedness will sustain institutional demand. Vendor differentiation will increasingly hinge on interoperability, service coverage, and clinical validation.

Major Players

- Masimo

- Philips Healthcare

- Medtronic

- GE HealthCare

- Nihon Kohden

- Mindray

- Nonin Medical

- Smiths Medical

- Dräger

- Contec Medical Systems

- Edan Instruments

- BPL Medical Technologies

- Schiller

- Heal Force

- Viatom

Key Target Audience

- Public hospital procurement departments

- Private hospital chains and specialty clinics

- Ambulance and emergency medical service providers

- Home healthcare service providers

- Medical device distributors and channel partners

- Healthcare IT and digital health platform operators

- Investments and venture capital firms

- Government and regulatory bodies with agency names

Research Methodology

Step 1: Identification of Key Variables

Clinical use cases, care settings, device categories, and regulatory constraints were mapped across acute care, emergency response, and homecare pathways. Demand drivers linked to ICU capacity, emergency protocols, and chronic disease management were defined. Channel structures and service expectations were scoped to frame procurement dynamics and replacement cycles.

Step 2: Market Analysis and Construction

Care pathway mapping and installed base logic were applied to construct utilization flows across hospitals, ambulances, and homecare programs. Device lifecycle assumptions and maintenance cycles were incorporated. Policy initiatives, digital health interoperability requirements, and compliance frameworks informed scenario construction.

Step 3: Hypothesis Validation and Expert Consultation

Clinical engineering workflows, procurement practices, and regulatory processes were validated through structured consultations with hospital operations leaders, biomedical teams, and compliance specialists. Feedback loops refined assumptions on device integration, service models, and deployment constraints across care settings.

Step 4: Research Synthesis and Final Output

Insights were synthesized into coherent narratives covering demand drivers, constraints, and opportunity pathways. Cross-validation ensured internal consistency across segmentation, competitive dynamics, and outlook framing. Findings were structured to support strategic planning, procurement optimization, and portfolio positioning decisions.

- Executive Summary

- Research Methodology (Market Definitions and clinical use cases in UAE care settings, Primary research with hospital biomedical engineers and procurement heads, Distributor and tender data triangulation across public and private hospitals, Import-export and customs data analysis for oximetry devices, Regulatory and compliance review with MOHAP and DHA frameworks, Installed base mapping across ICUs, wards, and homecare providers)

- Definition and Scope

- Market evolution

- Usage and care pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising burden of chronic respiratory and cardiovascular diseases

High ICU bed capacity expansion across tertiary hospitals

Post-pandemic emphasis on continuous oxygen saturation monitoring

Government investment in smart hospitals and connected care

Growth of home healthcare services for elderly and chronic patients

Expansion of emergency and ambulance infrastructure - Challenges

Price sensitivity in government tenders and bulk procurement

Regulatory approval timelines and compliance documentation burden

Intense competition from low-cost imports and parallel traders

Maintenance, calibration, and sensor replacement costs

Interoperability issues with hospital IT and monitoring systems

Limited clinical differentiation among commoditized devices - Opportunities

Integration with remote patient monitoring and telehealth platforms

Adoption of wearable SpO2 devices for chronic disease management

Demand for neonatal and pediatric-specific oximetry solutions

Premiumization through motion-tolerant and low-perfusion technologies

Private hospital expansion in tier-2 emirates

Service contracts and long-term device management programs - Trends

Shift toward continuous and wearable oximetry monitoring

Bundling of SpO2 with multi-parameter patient monitoring systems

Preference for disposable and single-patient-use sensors

Growing adoption of wireless and Bluetooth-enabled oximeters

Increased demand for neonatal and ICU-grade accuracy standards

Vendor-led clinical training and biomedical engineering support - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Product Type (in Value %)

Handheld pulse oximeters

Fingertip pulse oximeters

Tabletop and bedside pulse oximeters

Wearable and continuous monitoring oximeters

Multi-parameter patient monitors with SpO2 - By Technology (in Value %)

Transmission oximetry

Reflectance oximetry

Motion-tolerant signal processing

Masimo SET and equivalent proprietary algorithms - By Application Setting (in Value %)

Hospital inpatient monitoring

ICU and critical care

Emergency and transport care

Homecare monitoring

Ambulatory and outpatient clinics - By End User (in Value %)

Public hospitals

Private hospitals

Specialty clinics and surgical centers

Home healthcare providers

Ambulance and emergency medical services - By Distribution Channel (in Value %)

Direct sales to hospitals

Local medical device distributors

Government tenders and centralized procurement

Online and retail medical equipment channels

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (product accuracy and clinical validation, price competitiveness and tender pricing, distribution network coverage in UAE, after-sales service and calibration support, sensor ecosystem and consumables portfolio, regulatory approvals and compliance readiness, integration with patient monitoring platforms, brand reputation among clinicians and biomedical teams)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Masimo

Philips Healthcare

Medtronic

GE HealthCare

Nihon Kohden

Mindray

Nonin Medical

Smiths Medical

Dräger

Contec Medical Systems

Edan Instruments

BPL Medical Technologies

Schiller

Heal Force

Viatom

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030