Market Overview

The UAE RPM market is valued at USD ~ million, supported by a transition toward hospital-at-home models, post-acute discharge monitoring, and chronic disease pathways that require continuous vitals capture and clinician escalation workflows. In the immediately preceding year, the RPM devices layer alone generated USD ~ million, indicating a clear shift from standalone device purchases to integrated programs and platform deployments. This “systems + services” pull-through is strengthened by payer/provider focus on reducing avoidable admissions and improving longitudinal monitoring.

Dubai and Abu Dhabi dominate RPM adoption due to their concentration of large hospital groups, specialty care capacity, and stronger digital-health execution maturity. These emirates also benefit from deeper ecosystem enablement—health information exchange and interoperability programs, higher density of private healthcare providers, and faster institutional procurement cycles for connected care. Northern Emirates are increasingly active as RPM scales into homecare and outpatient follow-ups, but large, multi-facility networks in Dubai and Abu Dhabi continue to anchor enterprise-wide RPM rollouts.

Market Segmentation

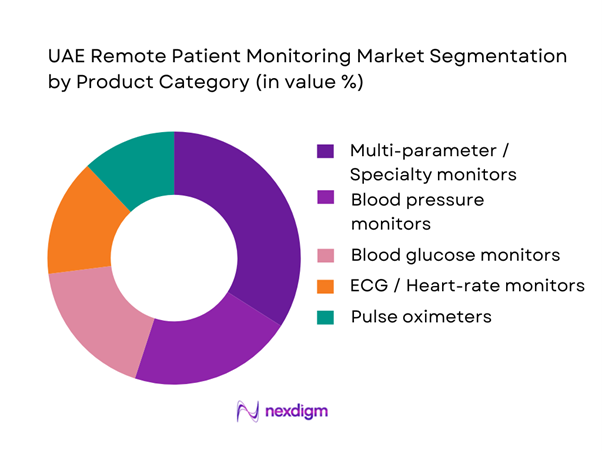

By Product Category

The UAE RPM market is segmented by product category into blood pressure monitors, pulse oximeters, ECG/heart-rate monitors, blood glucose monitors, and multi-parameter/specialty monitors (e.g., capnography, spirometry, fetal monitoring). While consumer-grade devices support broad screening, multi-parameter/specialty monitors dominate in enterprise RPM programs because they are embedded in clinician protocols (cardio-metabolic pathways, post-discharge surveillance, high-risk maternal monitoring) and integrate more reliably into provider dashboards and escalation rules. As UAE providers prioritize medically validated data and workflow-grade alerts, specialty monitors gain preference in procurement and program design over single-metric tools.

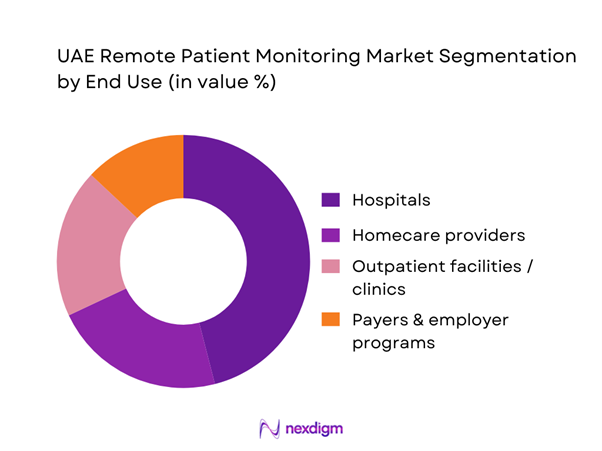

By End User

The UAE RPM market is segmented by end user into hospitals, outpatient facilities, homecare providers, and payer/employer programs (corporate health and chronic care bundles). Hospitals dominate RPM adoption because the strongest ROI is realized when monitoring is tied to acute-to-home transitions—shortening length of stay, reducing readmissions, and enabling earlier discharge for stable but high-risk patients. Large hospitals also control the clinical governance required for RPM (protocols, escalation, clinical oversight) and have the IT capacity to integrate RPM into EMR/HIE and scheduling/triage workflows. As a result, hospitals act as “program owners,” with homecare and outpatient settings frequently operating as extensions of hospital-led pathways.

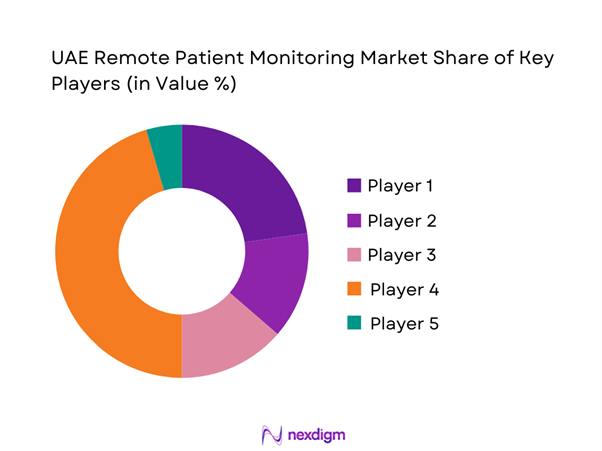

Competitive Landscape

The UAE RPM market is competitive and increasingly enterprise-driven: global device and patient-monitoring incumbents supply clinical-grade hardware and analytics, while local provider groups and regional digital-health platforms drive deployments through hospital networks, homecare arms, and payer partnerships. Vendor selection is increasingly decided by clinical validity, interoperability readiness, data hosting/compliance posture, and the ability to support protocolized RPM pathways (cardio-metabolic, post-surgical, maternal risk, COPD/asthma).

| Company | Est. Year | HQ | UAE Presence Model | Core RPM Focus | Interoperability Readiness | Deployment Model | Channel Strength | Differentiation Lever |

| Philips | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| GE HealthCare | 1994 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Abbott | 1888 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Medtronic | 1949 | Ireland/USA ops | ~ | ~ | ~ | ~ | ~ | ~ |

| Masimo | 1989 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Remote Patient Monitoring Market Analysis

Growth Drivers

Chronic Disease Burden

The UAE’s care model is increasingly shaped by high-touch chronic pathways that benefit from continuous at-home vitals capture and longitudinal trend review. Population scale is a first-order demand driver: the UAE population moved from ~ to ~ residents, expanding the addressable pool for cardiometabolic monitoring across primary, specialty, and post-acute care settings. Alongside this, the economy’s capacity to fund structured chronic programs is supported by GDP of USD ~ billion and GDP per capita of USD ~, enabling payers/providers to justify investments in chronic risk reduction and avoidable utilization management. In Dubai, the clinical data foundation for multi-morbidity management is reinforced by NABIDH unifying ~ million patient records and connecting ~ healthcare facilities, which reduces fragmentation when RPM patients move between clinics, labs, pharmacies, and hospitals. Chronic-disease care demand is also evidenced by government-led screening throughput: MOHAP’s community screening initiatives have reached ~ participants (scale signals clinical pipeline and follow-on monitoring needs for elevated BP/glucose risk flags).

Hospital Bed Optimization Pressure

UAE providers are under constant pressure to keep beds available for high-acuity episodes while shifting stable monitoring to home or step-down. System capacity and throughput are amplified by population growth from ~ to ~, which mechanically raises emergency and inpatient volumes even before acuity-mix shifts. The ability to expand physical infrastructure is not unlimited; therefore, RPM is increasingly positioned as a “capacity multiplier” for chronic decompensation prevention (CHF/COPD/diabetes), post-discharge follow-up, and early deterioration detection. Financing ability exists—GDP of USD ~ billion provides fiscal headroom for public-sector digitization and for private systems to scale hybrid care models. On the data backbone side, Dubai’s NABIDH scale—~ million unified records across ~ facilities—creates the interoperability prerequisite for discharge-to-home pathways, where RPM alerts must route to the right clinician team and where medication histories and lab trends must be visible outside the discharging hospital. Abu Dhabi’s HIE directionality similarly supports bed optimization: Malaffi’s platform goal of connecting ~ public/private providers underpins cross-facility continuity needed for “virtual ward” escalation pathways.

Challenges

Licensure and Approval Friction

RPM is regulated under telehealth/telemonitoring frameworks, and licensing requirements can slow market conversion from pilots to scaled services. Dubai Health Authority’s telehealth standards explicitly define telemonitoring/remote patient monitoring as remote collection and tracking of clinical data (vitals/symptoms) for chronic or acute conditions, which implies that RPM programs must align with defined clinical/operational requirements rather than being deployed as “devices-only.” Quality reporting expectations further reinforce governance burden: Abu Dhabi’s DOH has mandated telehealth-related quality indicator reporting through its Jawda guidance, adding a compliance layer for providers running telehealth/RPM services. As the population expanded from ~ to ~, demand rises faster than regulatory throughput, creating a practical bottleneck for new entrants seeking approvals and for incumbents expanding across emirates with slightly different regulatory pathways. While macro capacity exists (GDP USD ~ billion), approvals still require documentation, clinical governance, and audits—raising time-to-revenue and increasing the advantage of players already embedded in DHA/DOH ecosystems.

Clinical Governance and Liability

RPM shifts clinical responsibility into continuous oversight—raising governance questions around escalation thresholds, response SLAs, and medico-legal accountability when readings are abnormal but not acted upon. Dubai’s DHA telehealth standards formalize telemonitoring as continuous oversight enabling “timely intervention,” which operationally implies defined response workflows, accountable clinicians, and audit trails. In parallel, Dubai’s health data protection and confidentiality policy introduces structured obligations for entities and processors (including maintaining records of processing activities and ensuring appropriate organizational security measures), which increases governance overhead for RPM vendors and provider partners handling protected health information. System scale compounds governance load: NABIDH’s ~ million unified records across ~ facilities illustrates how many endpoints may need standardized RPM policies, credentialing, and role-based access to avoid unsafe variability across the ecosystem. GDP per capita of USD ~ supports investment into governance tooling (clinical protocols, audit systems, legal review), but liability frameworks still require careful alignment across payers, providers, and homecare operators.

Opportunities

Hospital-at-Home Scaling

Hospital-at-home is a high-leverage opportunity because it converts RPM from a “device program” into a full alternative site of care with measurable capacity impact. Abu Dhabi’s home healthcare base already shows operational readiness: ~ accredited providers delivering services to ~ beneficiaries, including respiratory therapy and home haemodialysis—capabilities that align with higher-acuity home pathways when combined with RPM and rapid escalation protocols. The UAE’s population growth from ~ to ~ increases pressure for flexible capacity solutions that keep hospitals focused on procedures and high-acuity care while stable patients are managed at home. Interoperability maturity supports this transition: Dubai’s NABIDH unifies ~ million records and connects ~ facilities, enabling hospital-at-home clinicians to access history, medications, and prior investigations during remote oversight and escalation decision-making. Macro capacity (GDP USD ~ billion) supports investments in command centers, home-visit logistics, and compliant device provisioning—making hospital-at-home a realistic scaling lane rather than a pilot-only model.

AI Triage and Risk Stratification

AI-enabled triage can turn RPM data streams into prioritized, actionable worklists—reducing alarm fatigue, improving response times, and enabling larger monitored cohorts per nurse/clinician. The UAE already demonstrates large-scale digital measurement infrastructure: TDRA benchmarking covered ~ km of roads and conducted ~ voice calls per operator network—evidence of a mature, measured digital environment that can support always-on monitoring and the data throughput needed for algorithmic triage layers. Clinically, the HIE foundations in Dubai make it feasible to enrich RPM models with prior history, comorbidities, meds, and labs—improving risk stratification accuracy compared with device-only signals. The scale of mobile adoption supports caregiver-linked escalation and patient coaching via apps/SMS/voice, improving the closure loop after AI flags a risk. With GDP per capita of USD ~, providers and payers can fund the required governance (model validation, clinical oversight, audit trails) to deploy AI triage responsibly within UAE data and clinical safety requirements.

Future Outlook

The UAE RPM market is expected to expand through three reinforcing shifts: care migration from inpatient to home/outpatient pathways, digitization of chronic disease management with protocolized monitoring and escalation, and platformization—RPM integrated into broader remote healthcare offerings where virtual visits, e-prescriptions, and monitoring are bundled. RPM is also positioned as a fast-growing services segment within remote healthcare in the UAE, indicating stronger “program adoption” beyond device sales alone.

Major Players

- Philips

- GE HealthCare

- Abbott

- Medtronic

- Masimo

- OMRON

- F. Hoffmann-La Roche

- Dräger

- Mindray

- Nihon Kohden

- Boston Scientific

- Johnson & Johnson

- Honeywell

- BIOTRONIK

Key Target Audience

- Hospital groups & integrated delivery networks

- Home healthcare providers and post-acute care operators

- Health insurers, TPAs, and payer program managers

- Government and regulatory bodies

- Digital health platform operators and virtual-care aggregators

- Medical device distributors, systems integrators, and managed service providers

- Corporate health buyers

- Investments and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

We map the UAE RPM ecosystem across providers, payers, device OEMs, distributors, and platform vendors, then define core variables such as care-setting adoption, device category mix, and interoperability constraints. Secondary research is run across syndicated databases, regulatory publications, and industry disclosures to lock market boundaries and definitions.

Step 2: Market Analysis and Construction

We compile historical market signals (device shipments/procurement, enterprise program rollouts, and RPM scope evolution into systems) and align them to revenue pools. The market is constructed by segmenting revenue into product and end-user layers consistent with syndicated RPM scopes and UAE care delivery realities.

Step 3: Hypothesis Validation and Expert Consultation

We validate assumptions via expert interviews (CATI/virtual) with UAE healthcare procurement leaders, provider digital transformation teams, distributors, and OEM channel managers. Inputs are used to confirm product mix logic, care-setting dominance, and deployment barriers (integration, compliance, workflow).

Step 4: Research Synthesis and Final Output

Findings are triangulated using a bottom-up build (program deployments and device mix) and top-down anchoring to published market totals from credible syndicated sources, followed by consistency checks and normalization across segments for a decision-ready output.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Scope Boundaries, Inclusion and Exclusion Criteria, Currency and Inflation Treatment, Data Validation and Triangulation Logic, Primary Interview Map, KOL Interview Guides, Demand-Side vs Supply-Side Weighting, Bottom-Up Build, Top-Down Build, Sensitivity and Scenario Framework, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- RPM Care Pathways Landscape

- Healthcare System Context

- RPM Service Delivery Operating Models

- Growth Drivers

Chronic Disease Burden

Hospital Bed Optimization Pressure

Nurse Triage Capacity Constraints

Homecare Expansion

Digital Health Adoption

Health Information Exchange Enablement - Challenges

Licensure and Approval Friction

Clinical Governance and Liability

Alert Fatigue

Data Privacy and Hosting Constraints

Integration Complexity

Patient Adherence Drop-offs - Opportunities

Hospital-at-Home Scaling

AI Triage and Risk Stratification

High-Risk Cohort Programs

Neonatal and Pediatric Home Protocols

Employer Chronic Care Programs - Trends

Device to Platform Bundling

Multiparameter Wearables

Virtual Wards

Patient Engagement Applications

API and FHIR-Led Integration Strategies - Regulatory and Policy Landscape

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- By Value, 2019–2024

- Installed Base and Active Monitoring Programs, 2019–2024

- Service Revenue Mix and Average Realization, 2019–2024

- By Application (in Value %)

Cardiology

Diabetes

Respiratory

Post-surgical and Post-discharge Monitoring

Maternal, Neonatal and Pediatrics - By Technology Architecture (in Value %)

Connected Blood Pressure Monitors

Continuous Glucose Monitoring Systems

Pulse Oximeters and Multiparameter Wearables

ECG Patches and Holter Alternatives

Weight Scales and Fluid Status Monitoring - By Connectivity Type (in Value %)

Bluetooth to Smartphone

Cellular Enabled Devices

Wi-Fi Hubs and Home Gateways

Hybrid and Multi-Link Models - By End-Use Industry (in Value %)

Government Health Systems and Public Providers

Private Hospital Groups

Homecare Providers

Insurers and TPAs

Employers and Corporate Health Programs - By Region (in Value %)

Abu Dhabi

Dubai

Sharjah and Northern Emirates

Multi-Emirate National Coverage

- Competitive Landscape Structure

- Cross Comparison Parameters (Device Portfolio Breadth and Clinical-Grade Coverage, Integration Depth with EMR and HIE Workflows, Alert Triage and Clinical Escalation Engine Maturity, Data Hosting and Audit Log Readiness, Program Operations Capability, Multi-Emirate Deployment and Home Logistics Strength, Clinical Evidence and Outcomes Reporting Tooling, Commercial Model Flexibility)

- SWOT of Major Players

- Pricing and Commercial Packaging Benchmark

- Detailed Profiles of Major Companies

PureHealth

M42

SEHA

Cleveland Clinic Abu Dhabi

Mediclinic Middle East

Amana Healthcare

Philips

Medtronic

Abbott

Dexcom

GE HealthCare

Oracle Health

InterSystems

NMC Healthcare

- Demand and Utilization Patterns

- Decision-Making Unit and Buying Center

- Patient Journey and Experience Mapping

- Pain Points and Unmet Needs

- Success Metrics and KPI Framework

- By Value, 2025–2030

- Installed Base and Active Monitoring Programs, 2025–2030

- Service Revenue Mix and Average Realization, 2025–2030