Market Overview

The UAE Respiratory Rate Monitors Equipment market current size stands at around USD ~ million, reflecting sustained demand across acute care and perioperative settings driven by modernization of patient monitoring infrastructure and rising acuity in hospital case mixes. Procurement is shaped by replacement of legacy bedside monitors, expansion of step-down units, and integration with centralized monitoring platforms. Service contracts, interoperability requirements, and clinical training programs influence vendor selection, while lifecycle management practices anchor long-term utilization within hospital networks.

Demand concentration is strongest in Abu Dhabi and Dubai due to dense tertiary care clusters, advanced ICU capacity, and higher penetration of digital hospital programs. Northern Emirates show growing uptake aligned with public hospital upgrades and private network expansions. Ecosystem maturity varies by emirate, reflecting distributor footprint, service coverage, and biomedical engineering capacity. Policy frameworks emphasizing patient safety, device interoperability, and continuity of care support adoption across acute, ambulatory, and homecare pathways.

Market Segmentation

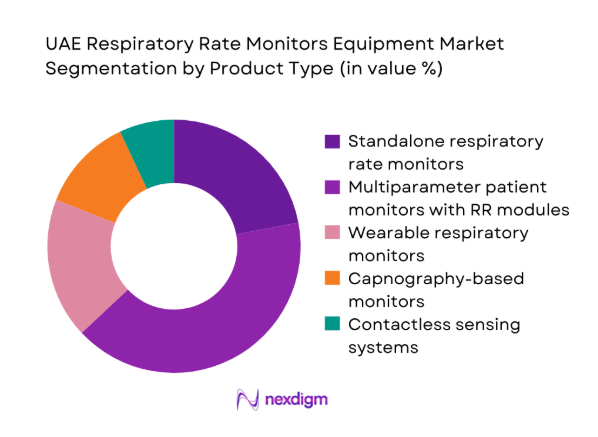

By Product Type

Standalone and multiparameter systems dominate procurement decisions as hospitals prioritize continuous monitoring across ICU, operating rooms, and step-down wards. Multiparameter platforms are favored due to consolidation of vital sign streams into centralized stations, reducing alarm fatigue and enabling early warning protocols. Wearable and contactless devices show faster uptake in post-acute and homecare settings where mobility and infection control are critical. Capnography-based solutions remain concentrated in anesthesia and emergency workflows. Technology selection reflects clinical acuity, interoperability with existing monitors, and lifecycle serviceability within hospital biomedical teams.

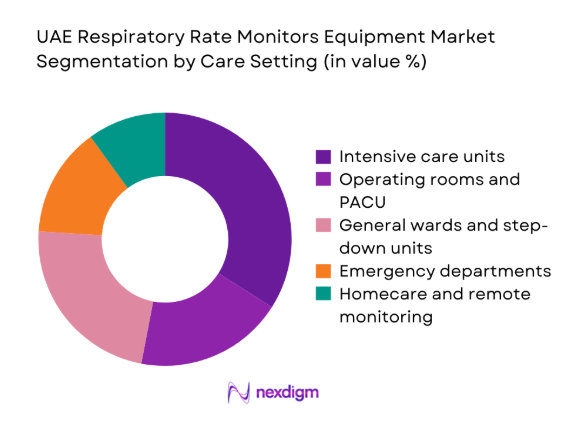

By Care Setting

Acute care settings lead demand due to higher monitoring intensity, staffing models, and compliance with patient safety protocols. ICUs and operating rooms prioritize continuous respiratory surveillance integrated with alarms and documentation systems. General wards adopt step-down monitoring to detect deterioration earlier, supported by centralized telemetry. Emergency departments require rapid triage and short-cycle monitoring. Homecare adoption is rising as chronic respiratory management and post-discharge monitoring expand, supported by remote connectivity and service models. Allocation across settings reflects acuity mix, bed capacity growth, and digital workflow maturity.

Competitive Landscape

The competitive environment features global technology providers supported by local distribution partners and service integrators. Differentiation centers on clinical reliability, integration with hospital IT, service responsiveness, and regulatory readiness. Tender-driven procurement emphasizes lifecycle support and training coverage alongside device performance.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Philips Healthcare | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| GE HealthCare | 1994 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Medtronic | 1949 | Ireland | ~ | ~ | ~ | ~ | ~ | ~ |

| Masimo | 1989 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Dräger | 1889 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Respiratory Rate Monitors Equipment Market Analysis

Growth Drivers

Rising ICU bed capacity and critical care infrastructure expansion

ICU capacity expanded across tertiary hospitals, with new beds commissioned in Abu Dhabi and Dubai during 2023 and 2024 to support higher acuity case mixes. Emergency admissions rose by 214000 in 2024 across public networks, increasing demand for continuous respiratory surveillance in triage and stabilization bays. Operating room throughput increased by 68000 procedures in 2023, driving perioperative monitoring utilization. Hospital digital transformation programs added 146 centralized monitoring stations in 2024, strengthening real-time respiratory surveillance. National patient safety initiatives emphasized early deterioration detection protocols, reinforcing continuous respiratory rate monitoring across critical pathways.

Increasing burden of respiratory disorders and post-COVID monitoring protocols

Respiratory-related admissions in tertiary facilities increased by 39200 in 2023 and 41800 in 2024, driven by chronic obstructive conditions, asthma exacerbations, and post-infectious complications. Post-discharge follow-up clinics recorded 126000 respiratory assessments in 2024, elevating monitoring intensity beyond acute settings. Emergency department presentations for dyspnea rose by 17400 in 2023, reinforcing triage monitoring needs. Clinical pathways standardized continuous respiratory surveillance for high-risk cohorts across 58 hospital wards in 2024. Institutional protocols expanded monitoring coverage to step-down units, increasing utilization of respiratory rate monitoring capabilities across care transitions.

Challenges

High capital costs of advanced multiparameter monitors

Capital planning cycles in public hospitals lengthened during 2023 and 2024 as equipment refresh programs competed with imaging and surgical upgrades. Biomedical departments reported 312 deferred replacements of bedside monitors in 2024 due to competing capital priorities. Operating theaters added 27 new rooms in 2023, stretching capital allocation across anesthesia workstations and monitoring upgrades. Procurement committees increased scrutiny on total lifecycle ownership metrics across 64 tenders in 2024, slowing award timelines. Facility expansions in secondary hospitals prioritized bed capacity over device refresh, delaying modernization of respiratory monitoring platforms despite clinical need pressures.

Lengthy procurement cycles in public sector tenders

Public tender cycles averaged 214 days in 2024 across major hospital networks, delaying deployment of updated monitoring technologies. Compliance documentation requirements expanded to 19 mandatory files per bid in 2023, increasing administrative burden for procurement teams. Bid evaluation committees reviewed 142 technical submissions in 2024 for monitoring upgrades, extending approval timelines. Contract award appeals occurred in 11 instances during 2023, pausing project execution. Installation schedules slipped by 68 days on average due to site readiness constraints, delaying clinical access to updated respiratory monitoring capabilities in high-acuity wards.

Opportunities

Expansion of step-down unit monitoring protocols in private hospitals

Private hospital networks expanded step-down capacity by 186 beds in 2023 and 214 beds in 2024 to manage post-ICU transitions. Clinical governance committees standardized early warning protocols across 41 wards in 2024, increasing continuous respiratory surveillance adoption. Nurse-to-patient ratios improved by 1.2 points in monitored wards, enabling sustained device utilization. Central monitoring hubs added 23 new stations in 2023, extending respiratory telemetry coverage. Accreditation cycles in 2024 reinforced continuous monitoring criteria for high-risk patients, supporting broader deployment of respiratory rate monitoring across post-acute care pathways.

Growing demand for wearable and contactless respiratory monitoring solutions

Homecare enrollments for chronic respiratory management increased by 16800 patients in 2023 and 19300 in 2024 across major provider networks. Post-discharge programs integrated remote monitoring protocols across 26 clinics in 2024, extending respiratory surveillance beyond inpatient settings. Infection control committees expanded contactless monitoring pilots across 9 neonatal units in 2023. Remote care coordinators handled 74000 follow-up interactions in 2024, reinforcing need for continuous respiratory data streams. Digital health roadmaps approved in 2023 prioritized wearable integration into care pathways, enabling scalable monitoring adoption across ambulatory and homecare environments.

Future Outlook

The market trajectory reflects sustained modernization of acute care monitoring, deeper integration with digital hospital platforms, and expanding post-acute surveillance. Adoption will broaden across step-down and homecare pathways as protocols mature and interoperability improves. Regulatory emphasis on patient safety and continuity of care will continue to shape procurement priorities and service models.

Major Players

- Philips Healthcare

- GE HealthCare

- Medtronic

- Masimo

- Dräger

- Nihon Kohden

- Mindray

- Spacelabs Healthcare

- Schiller

- Nonin Medical

- Fukuda Denshi

- Welch Allyn

- Edan Instruments

- Contec Medical Systems

- Becton Dickinson

Key Target Audience

- Public hospital procurement authorities in Abu Dhabi and Dubai health systems

- Private hospital networks and specialty care providers

- Home healthcare service operators and remote monitoring programs

- Medical device distributors and authorized channel partners

- Biomedical engineering and clinical technology management teams

- Investments and venture capital firms

- Government and regulatory bodies including MOHAP, DHA, and DoH Abu Dhabi

- Digital health platform integrators and health IT providers

Research Methodology

Step 1: Identification of Key Variables

Clinical use-cases, care settings, technology modalities, interoperability needs, and service requirements were defined to structure the assessment framework. Regulatory pathways, procurement mechanisms, and channel structures were mapped to contextualize adoption dynamics. Installed base maturity and replacement cycles informed utilization patterns.

Step 2: Market Analysis and Construction

Demand drivers across ICU, perioperative, ward, and homecare pathways were analyzed to construct utilization scenarios. Ecosystem roles across OEMs, distributors, and service partners were mapped to identify access points. Policy and accreditation requirements were aligned with clinical workflow integration.

Step 3: Hypothesis Validation and Expert Consultation

Clinical operations leaders and biomedical managers validated workflow integration assumptions and utilization constraints. Procurement specialists reviewed tender dynamics and evaluation criteria shaping vendor selection. Service managers assessed deployment readiness and post-installation performance requirements.

Step 4: Research Synthesis and Final Output

Findings were synthesized into segment-level narratives aligned with care pathways and technology modalities. Constraints and enablers were stress-tested against institutional indicators and policy direction. Implications were consolidated into actionable insights for stakeholders across the ecosystem.

- Executive Summary

- Research Methodology (Market Definitions and clinical use-cases for respiratory rate monitoring devices, Primary interviews with ICU clinicians biomedical engineers and hospital procurement heads across UAE, Analysis of UAE hospital procurement tenders and GPO purchase data for patient monitoring equipment, Distributor and OEM shipment tracking for bedside and wearable respiratory monitors in UAE, Regulatory and standards review with MOHAP DHA and DoH Abu Dhabi device registries

- Definition and Scope

- Market evolution

- Clinical usage pathways across acute care step-down and homecare

- Ecosystem structure of OEMs distributors integrators and care providers

- Supply chain and channel structure

- Regulatory environment and device approval pathways in UAE

- Growth Drivers

Rising ICU bed capacity and critical care infrastructure expansion

Increasing burden of respiratory disorders and post-COVID monitoring protocols

Adoption of continuous vital signs monitoring in general wards

Government investments in digital health and smart hospital initiatives

Growth of homecare and remote patient monitoring programs

Technology upgrades toward multiparameter and wireless monitoring systems - Challenges

High capital costs of advanced multiparameter monitors

Lengthy procurement cycles in public sector tenders

Interoperability issues with existing hospital IT and EMR systems

Shortage of trained biomedical and clinical staff for device utilization

Regulatory compliance and registration timelines with UAE authorities

Price sensitivity and budget constraints in mid-tier private hospitals - Opportunities

Expansion of step-down unit monitoring protocols in private hospitals

Growing demand for wearable and contactless respiratory monitoring solutions

Localization of distribution and after-sales service capabilities

Integration with remote patient monitoring platforms for homecare

Replacement demand for aging installed base in legacy hospitals

Public-private partnerships for ICU capacity expansion - Trends

Shift toward wireless and wearable respiratory monitoring

Integration of respiratory rate data into centralized patient monitoring platforms

Adoption of contactless sensing in neonatal and infectious disease wards

Bundling of respiratory rate monitoring with multiparameter systems

Increased emphasis on early warning score systems and continuous monitoring

Service contracts and managed equipment services gaining traction - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Product Type (in Value %)

Standalone respiratory rate monitors

Multiparameter patient monitors with respiratory rate modules

Wearable respiratory rate monitoring devices

Capnography-based respiratory rate monitors

Acoustic and impedance-based respiratory monitors - By Technology (in Value %)

Impedance pneumography

Capnography

Acoustic respiration monitoring

Radar and contactless sensing

Photoplethysmography-derived respiration - By Care Setting (in Value %)

Intensive care units

Operating rooms and PACU

General wards and step-down units

Emergency departments

Homecare and remote patient monitoring - By End User (in Value %)

Public hospitals

Private hospitals

Ambulatory surgical centers

Home healthcare providers

Defense and government medical facilities - By Distribution Channel (in Value %)

Direct OEM sales

Authorized medical device distributors

Group purchasing organizations

Tender-based government procurement

E-commerce and digital procurement platforms

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Product portfolio breadth, Local service footprint, Pricing competitiveness, Regulatory approvals in UAE, Integration with hospital IT systems, Warranty and AMC coverage, Distributor network strength, Clinical training and support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Philips Healthcare

GE HealthCare

Medtronic

Masimo

Dräger

Nihon Kohden

Mindray

Fukuda Denshi

Spacelabs Healthcare

Nonin Medical

Schiller

Becton Dickinson

Contec Medical Systems

Edan Instruments

Welch Allyn

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Volume, 2025–2030

- By Installed Base, 2025–2030

- By Average Selling Price, 2025–2030