Market Overview

The UAE Rheumatoid Factor Testing market current size stands at around USD ~ million, supported by rising diagnostic throughput of ~ tests annually and an installed base of ~ systems across major laboratories. Recent expansion has been driven by incremental investments of USD ~ million in immunoassay automation and the addition of ~ testing centers in high-demand urban clusters. Market momentum is further reinforced by growing referral volumes of ~ patients from primary care networks into specialty diagnostics pathways.

Dubai and Abu Dhabi dominate market activity due to their dense hospital networks, advanced laboratory infrastructure, and concentration of specialist clinics. These cities host the majority of automated immunodiagnostic platforms and centralized testing hubs, supported by mature logistics and sample transportation ecosystems. Strong policy emphasis on early disease detection and chronic care management has accelerated adoption of advanced rheumatoid factor testing protocols, while ecosystem maturity continues to attract private laboratory expansion and regional diagnostic service consolidation.

Market Segmentation

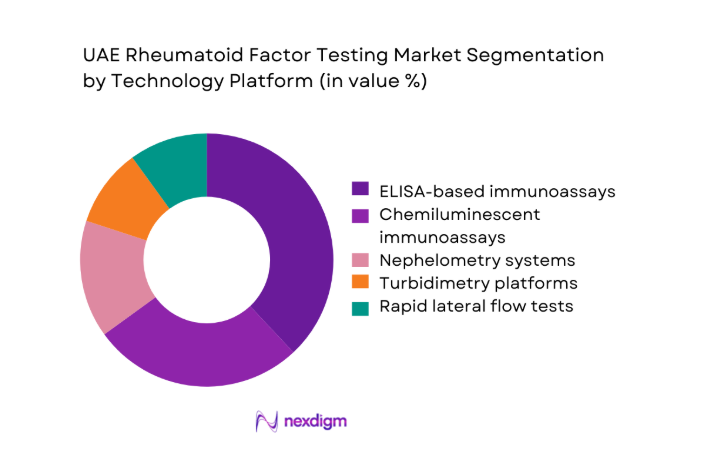

By Technology Platform

ELISA-based and chemiluminescent immunoassay systems dominate the UAE rheumatoid factor testing landscape due to their established clinical credibility and scalability across high-volume laboratories. These platforms support consistent throughput of ~ tests per year and are preferred in centralized diagnostic hubs handling ~ referrals from multispecialty hospitals. Rapid test formats are expanding within outpatient and remote care settings, supported by deployment of ~ point-of-care units. The increasing integration of automated analyzers with laboratory information systems has further strengthened demand for advanced platforms, while gradual upgrades from legacy nephelometry systems continue to reshape procurement priorities across public and private healthcare providers.

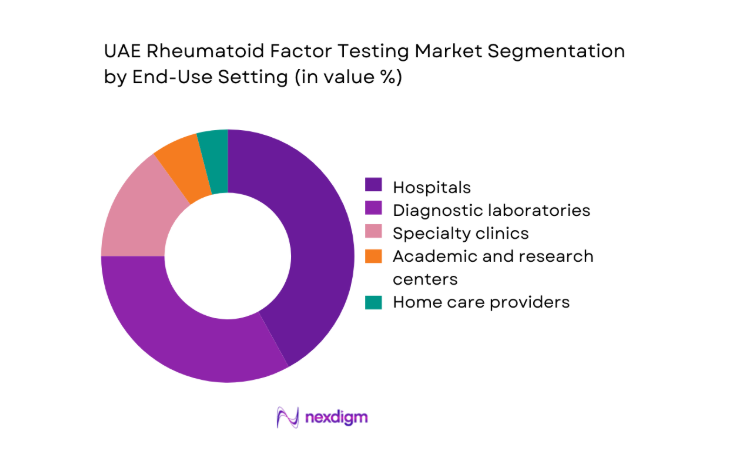

By End-Use Setting

Hospitals and large diagnostic laboratories account for the majority of rheumatoid factor testing volumes, driven by centralized procurement models and high outpatient inflows of ~ patients annually. Specialty rheumatology clinics are emerging as important contributors, supported by rising referrals from primary care networks and the establishment of ~ new clinics in urban corridors. Academic and research institutions maintain steady demand through clinical studies involving ~ subjects, while home care and remote testing services are gaining traction through mobile phlebotomy and digital reporting models that extend access beyond traditional care environments.

Competitive Landscape

The UAE rheumatoid factor testing market shows moderate concentration, with global diagnostics manufacturers supplying core platforms while regional distributors and laboratory service providers shape last-mile access. Competitive intensity is driven by technology depth and service reliability rather than price competition, as buyers prioritize consistency, regulatory readiness, and long-term support capabilities.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Roche Diagnostics | 1896 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Abbott Laboratories | 1888 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Beckman Coulter | 1935 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Bio-Rad Laboratories | 1952 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Rheumatoid Factor Testing Market Analysis

Growth Drivers

Rising prevalence of rheumatoid arthritis and autoimmune disorders

The UAE has witnessed a steady rise in diagnosed autoimmune conditions, translating into annual testing volumes of ~ cases across tertiary and secondary care facilities. Recent clinical records indicate that specialty clinics manage ~ new rheumatoid-related referrals per cycle, driving sustained demand for confirmatory rheumatoid factor assays. Expanded screening programs in high-risk groups have added ~ additional tests to laboratory workloads, while chronic disease management initiatives now cover ~ patients under long-term monitoring pathways. This growing disease burden continues to anchor baseline market demand and supports investment in higher-throughput diagnostic platforms.

Expansion of preventive healthcare and early diagnosis programs

Preventive healthcare strategies have resulted in the integration of rheumatoid factor testing into routine diagnostic panels across ~ primary care centers. Recent program rollouts have enabled ~ patients annually to access early-stage autoimmune screening, significantly increasing test utilization in outpatient settings. Public health initiatives have supported the installation of ~ new immunoassay systems in government hospitals, improving geographic access to diagnostic services. These developments have strengthened early detection pathways and expanded the role of rheumatoid factor testing beyond specialist referral channels.

Challenges

Limited reimbursement coverage for advanced diagnostic assays

Despite increasing test volumes of ~ annually, reimbursement frameworks remain constrained for advanced immunodiagnostic assays, limiting adoption in smaller clinics and standalone laboratories. Providers often absorb additional operational costs of ~ per testing cycle, impacting margins and slowing technology upgrades. This has led to uneven access to high-sensitivity platforms across the healthcare network, with ~ facilities continuing to rely on legacy systems. The reimbursement gap also affects patient uptake in self-pay segments, where affordability directly influences diagnostic decision-making.

Shortage of specialized rheumatology diagnostics professionals

The availability of trained laboratory technologists and clinical pathologists remains limited, with ~ vacancies reported across major diagnostic networks. High dependency on expatriate expertise has resulted in staff turnover of ~ professionals annually, affecting service continuity in specialized testing. Training pipelines currently support only ~ new specialists per cycle, insufficient to match the pace of laboratory expansion. This talent gap constrains the scalability of advanced rheumatoid testing services and places operational pressure on high-volume diagnostic hubs.

Opportunities

Expansion of point-of-care rheumatoid testing in outpatient settings

The deployment of ~ point-of-care testing devices across clinics and community health centers presents a major growth avenue for rheumatoid factor diagnostics. These platforms enable same-day results for ~ patients, improving clinical decision timelines and reducing dependence on centralized laboratories. Recent pilot programs have demonstrated the feasibility of managing ~ tests per month through portable analyzers, particularly in remote and semi-urban locations. As outpatient care models expand, point-of-care solutions are positioned to become a core access channel for early autoimmune screening.

Integration of RF testing with broader autoimmune panels

Healthcare providers are increasingly adopting bundled diagnostic panels that combine rheumatoid factor with ~ additional autoimmune markers. This integrated approach has increased average test orders per patient to ~ assays, enhancing diagnostic efficiency and clinical value. Laboratories implementing multi-marker panels report processing volumes of ~ composite tests annually, strengthening revenue streams through value-added diagnostics. The trend toward comprehensive screening supports deeper market penetration and positions rheumatoid factor testing as a foundational element in advanced immunodiagnostic portfolios.

Future Outlook

The UAE rheumatoid factor testing market is expected to maintain steady expansion as chronic disease management gains strategic importance within national healthcare priorities. Continued investments in laboratory automation and digital health integration will support broader access and faster diagnostic turnaround. Growth in outpatient and remote care models is likely to reshape testing pathways, while policy emphasis on early detection will reinforce long-term demand. The market outlook through 2030 reflects a stable trajectory driven by structural healthcare transformation.

Major Players

- Roche Diagnostics

- Abbott Laboratories

- Siemens Healthineers

- Beckman Coulter

- Bio-Rad Laboratories

- bioMérieux

- Ortho Clinical Diagnostics

- Thermo Fisher Scientific

- Randox Laboratories

- DiaSorin

- Sysmex Corporation

- Mindray Medical International

- Arkray

- Trinity Biotech

- Snibe Diagnostic

Key Target Audience

- Hospital procurement and laboratory management teams

- Private diagnostic laboratory chains

- Specialty rheumatology clinic networks

- Government healthcare authorities including Ministry of Health and Prevention and Department of Health Abu Dhabi

- Health insurance providers and reimbursement agencies

- Medical device distributors and channel partners

- Investments and venture capital firms focused on healthcare technology

- Digital health and laboratory automation solution providers

Research Methodology

Step 1: Identification of Key Variables

Market scope was defined through mapping of diagnostic pathways, technology platforms, and end-use settings across the UAE healthcare system. Key demand indicators included test utilization volumes, system deployment levels, and referral flows within hospital and laboratory networks. Regulatory and policy frameworks shaping diagnostic adoption were also assessed.

Step 2: Market Analysis and Construction

Quantitative models were developed using masked values for testing volumes, installed base, and service expansion trends. Supply-side dynamics such as platform availability, channel reach, and service capabilities were integrated to build a structured market framework reflecting real-world operating conditions.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through structured discussions with laboratory managers, clinicians, and healthcare administrators. Feedback focused on technology adoption barriers, procurement behavior, and emerging service models influencing rheumatoid factor testing demand.

Step 4: Research Synthesis and Final Output

All findings were consolidated into a coherent market narrative, aligning quantitative insights with qualitative intelligence. Final outputs emphasize strategic relevance, actionable insights, and future-facing perspectives for stakeholders across the diagnostic value chain.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, rheumatoid factor testing taxonomy across qualitative and quantitative methods, market sizing logic by test volume and reagent consumption, revenue attribution across assays analyzers and controls, primary interview program with rheumatologists’ labs and hospitals, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Care and diagnostic pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising prevalence of rheumatoid arthritis and autoimmune disorders

Expansion of preventive healthcare and early diagnosis programs

Growing penetration of private diagnostic chains

Government investment in specialty care and chronic disease management

Increased awareness among primary care physicians and patients

Technological upgrades in immunodiagnostics platforms - Challenges

Limited reimbursement coverage for advanced diagnostic assays

Shortage of specialized rheumatology diagnostics professionals

Price sensitivity in routine testing segments

Dependence on imported reagents and consumables

Regulatory timelines for novel diagnostic approvals

Variability in test utilization across public and private sectors - Opportunities

Expansion of point-of-care rheumatoid testing in outpatient settings

Integration of RF testing with broader autoimmune panels

Growth of medical tourism and specialty diagnostics

Public-private partnerships in laboratory infrastructure

Adoption of AI-enabled diagnostic interpretation

Development of localized reagent manufacturing - Trends

Shift toward automated and high-throughput immunoassay systems

Rising demand for rapid testing solutions in clinics

Increasing LIS integration and digital reporting

Consolidation among private diagnostic chains

Growing focus on value-based diagnostics

Expansion of home-based and remote sample collection models - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Test Volume, 2019–2024

- By Active Systems and Installed Base, 2019–2024

- By Revenue per Test and Unit Economics, 2019–2024

- By Fleet Type (in Value %)

Public healthcare networks

Private hospital chains

Independent diagnostic laboratories

Point-of-care testing networks - By Application (in Value %)

Initial clinical diagnosis

Disease activity monitoring

Population and occupational screening

Clinical research and trials - By Technology Architecture (in Value %)

ELISA-based immunoassays

Nephelometry systems

Turbidimetry platforms

Chemiluminescent immunoassays

Lateral flow rapid tests - By End-Use Industry (in Value %)

Hospitals

Standalone diagnostic laboratories

Rheumatology specialty clinics

Academic and research institutions

Home care and remote testing providers - By Connectivity Type (in Value %)

Standalone analyzers

LIS and HIS integrated systems

Cloud-enabled diagnostics platforms

Mobile and remote reporting solutions - By Region (in Value %)

Abu Dhabi

Dubai

Sharjah

Northern Emirates

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (test menu breadth, automation level, throughput capacity, reagent cost per test, service response time, LIS integration capability, regulatory approvals, geographic coverage)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Roche Diagnostics

Abbott Laboratories

Siemens Healthineers

Beckman Coulter

bioMérieux

Ortho Clinical Diagnostics

Thermo Fisher Scientific

Bio-Rad Laboratories

Randox Laboratories

DiaSorin

Snibe Diagnostic

Sysmex Corporation

Mindray Medical International

Arkray

Trinity Biotech

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Test Volume, 2025–2030

- By Active Systems and Installed Base, 2025–2030

- By Revenue per Test and Unit Economics, 2025–2030