Market Overview

The UAE smart blood pressure monitors market is valued at USD ~ million, based on consolidation of historical sales data across retail pharmacies, e-commerce platforms, medical device distributors, and institutional procurement. This valuation aligns with regional medical device assessments and supported by UAE blood pressure monitoring device revenues reported across GCC healthcare device segments. The market expansion is driven by rising hypertension prevalence, growing adoption of connected home-health devices, increasing penetration of wearable ecosystems, and wider acceptance of remote patient monitoring solutions by private healthcare providers.

Dubai and Abu Dhabi dominate the UAE smart blood pressure monitors market due to their advanced healthcare infrastructure, higher disposable incomes, and faster adoption of digital health technologies. These cities host the largest concentration of private hospitals, specialty clinics, and pharmacy chains, enabling quicker diffusion of connected medical devices. Additionally, strong e-commerce logistics, higher smartwatch penetration, and employer-led wellness initiatives in these emirates further reinforce demand, positioning them as primary consumption and innovation hubs within the national market.

Market Segmentation

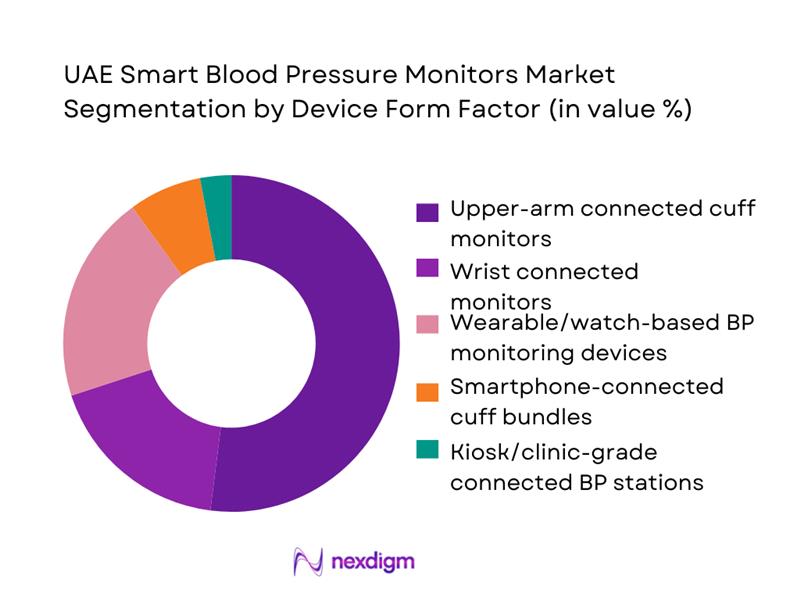

By Device Form Factor

The UAE smart blood pressure monitors market is segmented by device form factor into upper-arm connected cuff monitors, wrist connected monitors, wearable/watch-based BP monitoring devices, smartphone-connected cuff bundles, and kiosk/clinic-grade connected BP stations. Among these, upper-arm connected cuff monitors hold the dominant market share. Their leadership is primarily driven by higher clinical acceptance, better perceived accuracy, and widespread recommendation by physicians and pharmacists for home monitoring. Upper-arm monitors are commonly used for hypertension diagnosis follow-ups and medication titration, making them the default choice for households with chronic patients.

In addition, upper-arm monitors are more compatible with insurance-supported remote patient monitoring programs and clinic-driven chronic care pathways. Their ability to support multi-user profiles, larger cuff sizes, and app-based data sharing further strengthens their adoption in family households. While wearables are gaining momentum, upper-arm devices remain the preferred “reference” device for accuracy and long-term monitoring, sustaining their leadership across UAE pharmacy and online retail channels.

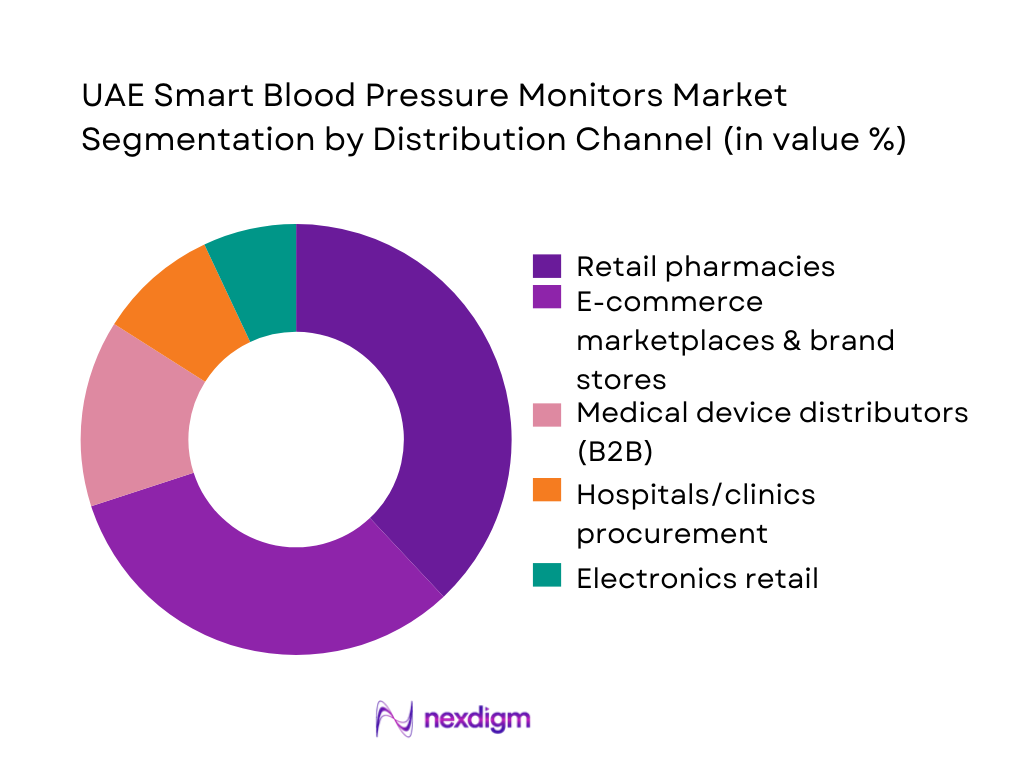

By Distribution Channel

Based on distribution channel, the market is segmented into retail pharmacies, e-commerce platforms, medical device distributors (B2B), hospitals/clinics procurement, and electronics retail. Retail pharmacies account for the largest share of sales in the UAE smart blood pressure monitors market. Their dominance is supported by strong consumer trust, pharmacist-led recommendations, and immediate product availability for newly diagnosed hypertension patients. Pharmacies often serve as the first point of contact following a physician consultation, enabling higher conversion rates for clinically validated devices.

Moreover, leading pharmacy chains in the UAE operate integrated online-to-offline models, allowing consumers to compare prices digitally while retaining in-store advisory support. This hybrid approach strengthens pharmacy channel performance against pure e-commerce. Institutional procurement and hospital-led purchases are also increasing, driven by RPM programs, but these remain secondary to pharmacy-led consumer demand.

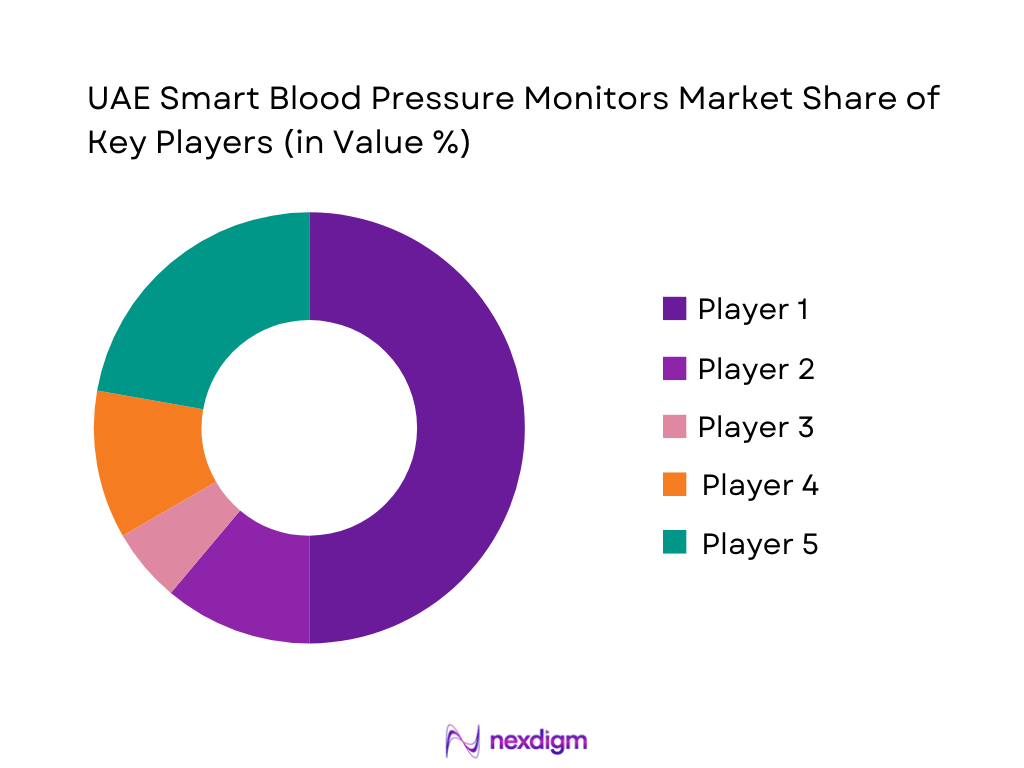

Competitive Landscape

The UAE smart blood pressure monitors market is moderately consolidated, with a combination of global medical device manufacturers and consumer electronics brands competing through differentiated technology, brand trust, and channel reach. Established healthcare brands such as Omron and Philips benefit from long-standing clinical credibility, while wearable-centric players like Huawei and Samsung leverage their broader ecosystem penetration. This competitive mix highlights the growing convergence of medical-grade devices and consumer health technology within the UAE market.

| Company | Year Established | Headquarters | Core Product Focus | Connectivity Strength | Channel Presence | Brand Positioning | App Ecosystem | Clinical Validation |

| Omron Healthcare | 1933 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Philips | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| Withings | 2008 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Huawei | 1987 | China | ~ | ~ | ~ | ~ | ~ | ~ |

| Samsung Electronics | 1969 | South Korea | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Smart Blood Pressure Monitors Market Analysis

Growth Drivers

Hypertension Burden

The UAE’s chronic-disease monitoring need is structurally supported by a large resident base and high longevity, which increases the number of people living long enough to require ongoing blood-pressure tracking at home. The UAE population is ~ and net migration is ~, sustaining a large addressable base that continuously refreshes through inflows of working-age residents and families. Life expectancy is ~ (total), implying longer exposure to cardiometabolic risk and longer monitoring cycles once diagnosed. From a macro capacity perspective, GDP is USD ~ billion and GDP per capita is USD ~, enabling higher baseline spend on chronic-disease devices and self-care routines in urban centers. These macro fundamentals translate into higher routine purchase frequency for home BP devices (initial purchase, replacement, second-device for family members) and larger recurring usage footprints (daily readings, trend tracking, medication titration), which directly benefits connected monitor adoption in the UAE retail and e-commerce channels.

RPM/Telehealth Uptake

Remote monitoring adoption is reinforced by the UAE’s scale of connected infrastructure and sustained economic capacity. The UAE records GDP of USD ~ billion and GDP per capita of USD ~, which supports investment in digitally enabled care pathways by private providers and insurers, including home monitoring programs that depend on device-to-app connectivity. The population base of ~ creates sufficient volumes for providers to operationalize RPM workflows (enrollment, clinician review, escalation) across chronic cohorts in high-density emirates. Mobile connectivity depth is evidenced by ~ active mobile subscriptions, providing the practical backbone for app-based readings upload, reminders, and physician sharing features that characterize smart BP monitors. In parallel, the UAE’s role as a high-mobility hub (business travel, expatriate movement, and intra-emirate commuting) increases the utility of cloud-enabled readings accessible across locations, making RPM-ready devices more valuable for continuity of care than offline monitors. These conditions collectively increase provider willingness to recommend connected BP devices and increase consumer willingness to purchase “shareable” monitors aligned with teleconsult use cases.

Challenges

Accuracy Perception & Validation

Accuracy concerns become a demand barrier when consumers and clinicians are unsure whether connected devices match clinical-grade measurement expectations. The UAE’s advanced healthcare environment—supported by GDP per capita of USD ~—increases consumer exposure to specialist care, which can also raise expectations for validation and measurement reliability. With a population of ~, scale amplifies the impact of inconsistent performance or perceived inaccuracies because negative experiences spread quickly through pharmacy recommendations and digital reviews. Additionally, high device penetration and digital engagement indicated by ~ active mobile subscriptions can accelerate reputational swings for brands when users compare readings between clinic devices and home monitors and share feedback online. This challenge directly affects purchase decisions in the UAE, where many buyers actively seek clinically validated upper-arm monitors and may avoid newer form factors (wrist, wearable-derived BP features) when validation messaging is unclear, delaying adoption of newer smart models until confidence improves.

Data Privacy/Consent

Smart BP monitors generate health data that can be shared with family members, care teams, or cloud platforms, raising consent and privacy concerns—especially in connected environments. The UAE’s digital intensity is reflected by ~ active mobile subscriptions, which increases the number of individuals who routinely use app-linked services and therefore encounter privacy permission flows (Bluetooth pairing, cloud sync, sharing dashboards). The UAE’s GDP of USD ~ billion and GDP per capita of USD ~ support a mature digital services economy, which also raises consumer sensitivity to where health data is stored and how it is used, particularly when apps request multiple permissions or integrate with third-party analytics. Population scale of ~ increases the diversity of user comfort levels, including expatriate communities with differing expectations and risk perceptions around sharing health records. As a result, privacy concerns can reduce app engagement even after device purchase (users disable sharing, avoid cloud sync), weakening the “smart” value proposition and limiting provider uptake for RPM-linked deployments.

Opportunities

Provider-Integrated RPM Bundles

Provider-integrated RPM bundles are a high-potential opportunity because the UAE has both the economic capacity and the digital infrastructure to operationalize device-led chronic monitoring at scale—without relying on future forecasts. The UAE’s GDP is USD ~ billion and GDP per capita is USD ~, supporting private-sector investment in digitally enabled care pathways, including subscription-based monitoring services bundled with clinician review and escalation protocols. Connectivity readiness is reinforced by ~ active mobile subscriptions, enabling app-based intake, alerts, and remote sharing that are essential for provider dashboards and care-team workflows. The UAE’s ~ population and ~ net migration create recurring enrollment volumes from newly diagnosed patients, medication-adjustment cohorts, and expatriates who prefer portable health records across moves. In practical terms, providers can use RPM bundles to standardize hypertension management (home readings + structured follow-ups), increase adherence monitoring, and reduce variability in patient self-reporting—making connected BP monitors not just a retail product but an embedded component of care delivery.

Arabic UX & Patient Coaching

Arabic-first user experience and patient coaching is a market-specific opportunity because sustained BP control depends on correct cuff placement, measurement timing, and consistent logging—behaviors that improve with localized guidance rather than only device availability. The UAE’s population base of ~ includes a large Arabic-speaking cohort alongside expatriates, and the scale itself makes language-aligned coaching a high-leverage adoption driver. The UAE’s net migration of ~ also implies linguistic diversity and frequent device handovers or household changes, where simplified onboarding and multilingual support reduce drop-off after purchase. Digital deliverability is strong: ~ active mobile subscriptions provide the channel for in-app coaching modules, reminders, video guidance, and clinician-message prompts that can increase correct usage and reduce misreadings. The macro capacity—GDP per capita of USD ~—supports higher adoption of value-added services bundled into apps (education modules, guided measurement routines, medication reminders) that increase device stickiness and improve long-term engagement, directly strengthening the connected monitor category in the UAE.

Future Outlook

Over the next five years, the UAE smart blood pressure monitors market is expected to witness steady growth driven by increasing chronic disease monitoring, rising digital health awareness, and deeper integration of connected devices into remote care pathways. Wearable-enabled BP monitoring, cloud-based analytics, and provider-linked RPM solutions will shape product innovation. Expansion beyond Dubai and Abu Dhabi into Sharjah and Northern Emirates will be supported by e-commerce penetration and price-tier diversification.

Major Players

- Omron Healthcare

- Koninklijke Philips N.V.

- Withings

- iHealth Labs

- A&D Medical

- Beurer

- Xiaomi

- Huawei

- Garmin

- Fitbit (Google)

- Microlife

- Qardio

- Abbott

- Samsung Electronics

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Government and regulatory bodies

- Government and regulatory bodies

- Heads of procurement

- Heads of digital health and remote patient monitoring programs

- Heads of pharmacy retail chains and healthcare retail networks

- Product and category heads

Research Methodology

Step 1: Identification of Key Variables

The study begins with ecosystem mapping covering manufacturers, distributors, pharmacies, e-commerce platforms, healthcare providers, and regulators in the UAE smart blood pressure monitors market. Extensive secondary research is conducted using industry databases, regulatory publications, and company disclosures to identify key demand and supply variables.

Step 2: Market Analysis and Construction

Historical sales data is analyzed across channels to estimate unit volumes, pricing bands, and revenue contribution. A bottom-up approach is adopted by aggregating SKU-level sales, which is then validated through top-down healthcare device spending benchmarks to ensure consistency.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions and trends are validated through structured interviews with distributors, pharmacists, clinicians, and digital health professionals. These interactions provide insights into adoption drivers, pricing sensitivity, and technology preferences within the UAE healthcare ecosystem.

Step 4: Research Synthesis and Final Output

All data points are triangulated and synthesized to produce a validated market model. Findings are reviewed against regulatory frameworks and competitive developments to ensure accuracy, relevance, and strategic usefulness for stakeholders.

- Executive Summary

- Research Methodology (Market Definition, Inclusion–Exclusion Criteria, Assumptions & Abbreviations, Market Sizing Approach, Top-Down Device Spend Validation, Primary Research Mix, Data Triangulation & Confidence Scoring, Validation Standards, Limitations & Sensitivity Checks)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Hypertension Burden

RPM/Telehealth Uptake

Premiumization & Wellness Spend

Device–App Ecosystem Lock-in

Insurance/Employer Wellness - Challenges

Accuracy Perception & Validation

Data Privacy/Consent

Price Sensitivity Outside Tier-1 Cities

Counterfeit/Parallel Imports

Fragmented After-Sales - Opportunities

Provider-Integrated RPM Bundles

Arabic UX & Patient Coaching

Hypertension Screening Camps

Subscription Analytics

Bundled Chronic Care Pathways - Trends

Wearables + BP Features

AI-Enabled Insights

Interoperability with EHR/RPM Platforms

Omni-Channel Fulfilment

Smart Cuff Innovation - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Selling Price / Price Band Mix, 2019–2024

- By Device Form Factor (in Value %)

Upper-Arm Connected Cuff Monitors

Wrist Connected Monitors

Wearable/Watch-Based BP Monitoring Devices

Smartphone-Connected Cuff + App Ecosystem Bundles

Kiosk/Clinic-Grade Connected BP Stations - By Connectivity & Data Pathway (in Value %)

Bluetooth-to-App

Wi-Fi/Cloud Sync

API/Platform-Integrated RPM

Multi-User Household Profiles

Offline-to-Connected Hybrid Models - By Measurement Technology & Validation (in Value %)

Oscillometric (Consumer Clinical-Validation Claims)

Inflation Measurement & Motion-Tolerance Enhancements

Arrhythmia Detection / AFib Flagging

Cuff Fit Range & Accuracy Impacts

Calibration / QA & Post-Market Surveillance Readiness - By Distribution Channel (in Value %)

Retail Pharmacies

E-Commerce Marketplaces & Brand Stores

Medical Device Distributors

Hospitals/Clinics Procurement

Electronics Retail - By Region (in Value %)

Dubai

Abu Dhabi

Sharjah

Northern Emirates Cluster

- Market Share of Major Players

- Cross Comparison Parameters (Accuracy/Validation Tier, App Experience & Arabic Support, Cloud/RPM Integration, UAE Channel Footprint, After-Sales & Warranty Model, Data Privacy/Consent Handling, ASP & Promo Intensity, Product Portfolio Breadth)

- SWOT Analysis of Major Players

- Pricing Analysis

- Detailed Profiles of Major Companies

Omron Healthcare

Koninklijke Philips N.V.

Withings

iHealth Labs

A&D Medical

Beurer

Xiaomi

Huawei

Garmin

Fitbit (Google)

Microlife

Qardio

Abbott

Samsung Electronics

- Patient Cohorts & Self-Monitoring Behavior

- Provider RPM Adoption Readiness

- Buying Triggers: Diagnosis/Medication Titration/Screening

- Budget Anchors & Price Elasticity

- Feature Priorities: Accuracy–Ease–Sharing, Decision Journey by Channel

- By Value, 2025–2030

- By Volume, 2025–2030

- By ASP / Price Band Shift, 2025–2030