Market Overview

The UAE smart clothing market is valued at USD ~ million, supported by a strong step-up from the preceding-year level of ~USD ~ million based on the same published historical series. Demand is primarily driven by premium-activewear consumption in organized retail, fast adoption of connected fitness/health ecosystems, and enterprise-led use cases (corporate wellness, professional sports performance, and early-stage remote monitoring garments). The market’s revenue build is influenced by higher ASP smart garments, app-led engagement, and multi-channel availability.

Within the UAE, Dubai typically leads demand because it concentrates premium malls, cross-border tourist shopping, and high-intensity fitness and lifestyle consumption, while Abu Dhabi remains a strong node for institutional adoption (sports academies, hospitals, and government-linked procurement). On the supply side, the market is shaped by technology and materials leadership from the U.S. and Europe (clinical/consumer wearables ecosystems and premium brands) and Japan/Taiwan (advanced textile and component capability), which accelerates product availability, partnerships, and performance fabric innovation in the UAE.

UAE Smart Clothing Market Segmentation

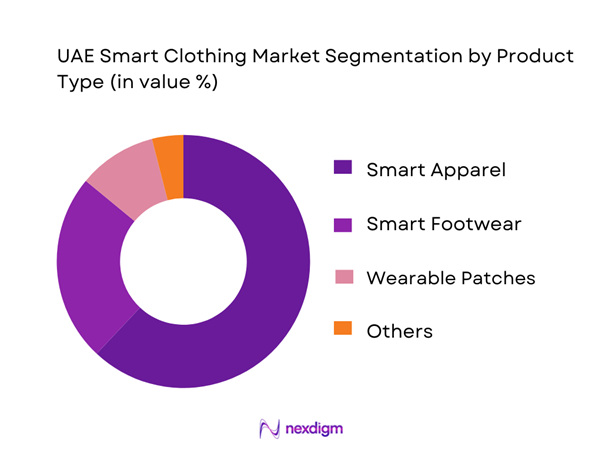

By Product Type

The UAE smart clothing market is segmented by product type into smart apparel, smart footwear, wearable patches, and others. Recently, smart apparel holds a dominant market share under product type segmentation because it is the most scalable “first purchase” category: consumers can adopt biometric capture (motion/IMU, respiration/temperature-ready garments) without changing routines, while brands can launch multiple SKUs (tops, base layers, socks-adjacent apparel) across gender/size ladders. In the UAE, apparel also benefits from premium activewear retailing, gifting/occasion buying, and higher willingness to pay for comfort + functionality, making apparel the strongest revenue and unit engine.

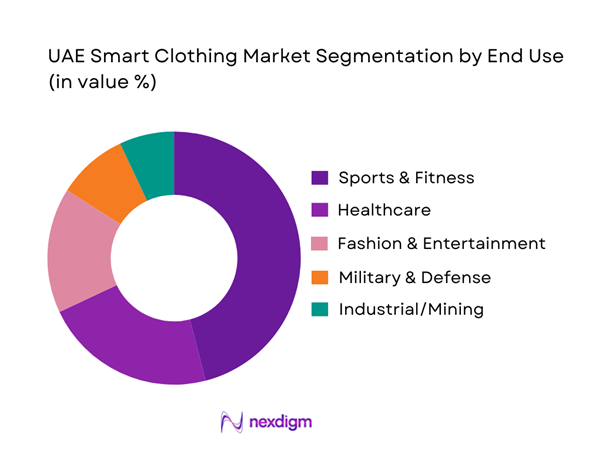

By End Use

The UAE smart clothing market is segmented by end use into sports & fitness, healthcare, fashion & entertainment, military & defense, and industrial/mining. Recently, sports & fitness dominates the market share because the UAE’s smart clothing adoption is currently most frictionless in performance contexts—users accept app pairing, training dashboards, and subscription-like engagement when it improves outcomes (coaching, recovery, form correction). Gyms, boutique studios, sports clubs, and academies also drive repeat trials through structured programs and community challenges. This ecosystem makes sports & fitness the fastest conversion funnel for smart garments compared with clinical pathways, which require stronger validation, procurement cycles, and compliance readiness.

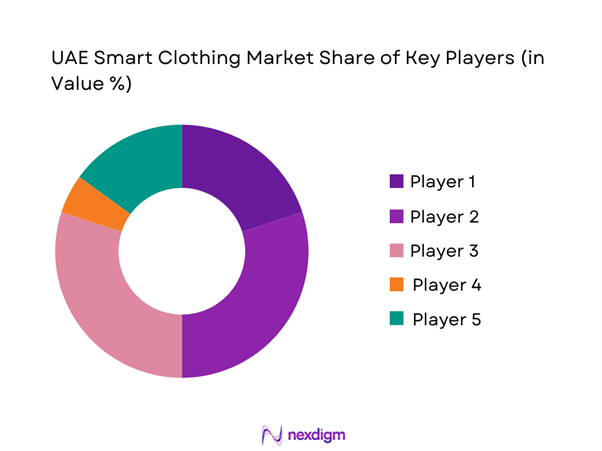

Competitive Landscape

The UAE smart clothing market is moderately consolidated around a set of global smart-textile specialists and wearable-led brands, while UAE go-to-market execution is typically distributor/retailer-led (premium sports retail, marketplaces, and selective B2B deployments). Competitive advantage is shaped by sensor stack depth, washability/durability credibility, app + analytics strength, and enterprise deployment capability (sizing logistics, onboarding, and support).

| Company | Establishment Year | Headquarters | Core Smart-Clothing Focus | Sensor / Material Stack Strength | Primary Use-Case | App / Ecosystem Maturity | Typical UAE Route-to-Market | Differentiation Lever |

| Sensoria | 2010 | Redmond, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Siren Care | 2015–2016 | San Francisco, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Wearable X | 2013 | New York, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| MYZONE | 2011 | UK (Nottingham / Douglas) | ~ | ~ | ~ | ~ | ~ | ~ |

| AiQ Smart Clothing | 2009–2010 | Taipei, Taiwan | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Smart Clothing Market Analysis

Growth Drivers

Connected fitness adoption

UAE’s connected fitness pull is structurally supported by high digital readiness and purchasing power. The IMF lists UAE GDP (current prices) at USD ~ billion and real GDP growth at ~, creating a high-consumption environment for premium activewear and connected ecosystems. On the access side, the World Bank reports internet users at ~ per ~ people, enabling always-on apps that make smart garments “usable” after purchase rather than one-time novelty. TDRA reports ~ mobile subscriptions, which supports syncing, coaching, and continuous garment-linked telemetry. Finally, UAE’s scale is meaningful: resident population at ~ persons (with ~ males and ~ females), which matters for size-laddered apparel distribution and repeat purchase behavior in sportswear categories. Together, these macro and digital indicators reinforce why connected fitness is a primary adoption gateway for smart clothing in the UAE—consumers have the connectivity, device density, and income backdrop needed to sustain app-led usage cycles (training, recovery, and goal tracking) that keep smart garments “in rotation,” not in drawers.

Performance analytics culture

Smart clothing demand accelerates when “training = data,” and the UAE is structurally positioned for this because its economy and digital rails support high-frequency app usage, upgrades, and accessory/garment experimentation. UAE GDP (current prices) at USD ~ billion underpins premium discretionary spending needed for sensor-integrated apparel and coaching ecosystems. Internet users at ~ per ~ people enable always-on performance dashboards, cloud sync, and video + telemetry co-analysis in training routines. On the healthcare-tech side of “analytics culture,” the UAE’s national medical record infrastructure includes ~ billion medical records for ~ million patients, accessible by over ~ health service providers in ~ medical facilities, indicating national-scale data exchange that spills over into consumer comfort with app-based tracking and performance data flows. Population scale at ~ persons supports broad participation across gyms, clubs, and academies that monetize measurable outcomes. These numbers collectively support why performance analytics culture is a real, UAE-specific growth driver for smart clothing.

Challenges

Washability and durability perception

Washability and durability are gating issues for UAE smart clothing because the environment (heat, sweat load, frequent laundering) raises real-world failure risk for conductive yarns, sensor encapsulation, and connectors. The UAE’s macro context matters: GDP at USD ~ billion supports premium purchasing, but it also raises consumer expectations for reliability and service—durability failures in premium goods translate directly into returns, reputational damage, and channel delisting risk. Internet users at ~ per ~ people amplify durability skepticism as negative experiences spread rapidly through digital channels. Climate/UV reality reinforces frequent wash cycles, with UV index levels reaching “~+” across multiple months, increasing garment cleaning frequency and stress on sensor integration. Population at ~ persons adds channel pressure, meaning even a modest defect or return rate can overload after-sales if brands do not build local replacement logistics. This makes durability perception a primary UAE challenge.

Battery safety concerns

Battery safety is a structural challenge for smart clothing in the UAE because garments add complexity through heat exposure, sweat, wash cycles, and compression that stress battery modules and connectors. GDP at USD ~ billion supports high device adoption but also drives strict expectations around product safety and compliance in premium retail and institutional procurement. Internet users at ~ per ~ people increase reliance on always-connected devices while amplifying the impact of safety incidents on category trust. National health record infrastructure includes ~ billion records for ~ million patients across ~ facilities, implying formal scrutiny when garments are positioned for regulated use. Population scale of ~ persons increases absolute incident probability unless strict battery management systems are implemented. This makes battery safety a persistent friction point in the UAE market.

Opportunities

Clinical-grade RPM garments

Clinical-grade RPM garments are a high-upside opportunity in the UAE because the health data and provider connectivity foundation is already operating at national scale. The national health record platform includes ~ billion medical records for ~ million patients, accessible to over ~ health service providers in ~ medical facilities, providing the operational prerequisites for RPM programs. GDP at USD ~ billion supports healthcare investment appetite across public and private systems, enabling premium clinically positioned connected garments within care pathways. Internet users at ~ per ~ people support remote onboarding, clinician dashboards, and patient app adherence. Population at ~ persons indicates institutional program volumes that justify standardized clinical-grade deployment models. This environment creates immediate readiness for clinically validated garments to move beyond pilots into structured RPM pathways.

Smart industrial safety uniforms

Smart industrial safety uniforms represent a strong opportunity in the UAE because enterprise digitization prerequisites—connectivity, device density, and centralized data systems—are already in place. GDP at USD ~ billion supports the capex and opex capacity needed for uniform-scale rollouts covering procurement, onboarding, replacements, and supervision. Internet users at ~ per ~ people enable real-time dashboards, incident workflows, and compliance training for frontline teams. Mobile subscriptions at ~ signal high device availability for workforce operations and safety workflow digitization. The presence of structured national datasets across security and traffic domains reflects an institutional orientation toward measurement and enforcement. With ~ persons nationally (and ~ million in Abu Dhabi), the UAE has concentrated workforce clusters that can justify standardized connected-uniform programs, especially for heat, UV, and fatigue risk management.

Future Outlook

The UAE smart clothing market is expected to expand rapidly as performance wear shifts from “tracking devices” to “tracking garments,” and as enterprise buyers operationalize smart uniforms and workforce wellness programs. Growth will be supported by deeper app ecosystems, improved washability and battery safety designs, and broader UAE retail penetration. Healthcare use cases should scale as validation improves and as remote monitoring models become more structured. Overall, product differentiation will increasingly depend on durability, analytics, and deployment capability—not just sensors.

Major Players

- Under Armour

- Ralph Lauren

- Sensoria

- Siren Care

- Wearable X

- MYZONE

- AiQ Smart Clothing

- Toray Industries

- DuPont

- Hexoskin

- Myontec

- Vulpés Electronics GmbH

- Owlet Baby Care

- Xenoma

Key Target Audience

- Smart apparel and activewear brands

- Large sports retailers and omni-channel retail groups

- Sports academies and performance institutes

- Hospital groups, clinics, and homecare networks

- Corporate HR and enterprise wellness buyers

- Industrial safety and PPE procurement teams

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We begin by building a UAE smart clothing ecosystem map covering brands, textile enablers, importers/distributors, retailers, gyms, hospitals, and enterprise buyers. Desk research is supported by structured data capture of product catalogs, channel presence, and compliance requirements. This step defines the variables that govern adoption: sensor stack, durability, app dependency, and enterprise readiness.

Step 2: Market Analysis and Construction

Historical market reconstruction is performed using a hybrid approach: mapping UAE sell-through by channel (offline/online), triangulating SKU presence and pricing ladders, and aligning use-case adoption across sports, healthcare, and uniforms. This phase also checks replacement drivers (fit/returns, warranty behavior) and identifies where revenue concentrates by product type and end use.

Step 3: Hypothesis Validation and Expert Consultation

We validate market hypotheses via expert interviews with distributors, category managers, gym operators, sports performance practitioners, and institutional procurement stakeholders. CATI and virtual interviews capture operational insights on buyer criteria, margins, returns, and adoption friction. The outcome refines assumptions around segment dominance, channel pathways, and barriers to scale.

Step 4: Research Synthesis and Final Output

We consolidate findings through triangulation and finalize the market model, ensuring alignment between demand signals and supply capability. Competitive benchmarking is completed across product performance, ecosystem strength, and UAE channel execution. Final outputs include segment shares, competitor positioning, and a go-to-market roadmap.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Assumptions, Abbreviations, Data Triangulation, Top-Down & Bottom-Up Sizing, Primary Interviews, Expert Panels, Device and Garment Benchmarking, Sensitivity Analysis, Limitations)

- Definition and Scope

- Market Genesis and Evolution

- UAE Demand Centers and Adoption Context

- Smart Clothing Use-Case Map

- Growth Drivers

Connected fitness adoption

Performance analytics culture

Heat and UV utility features

Workplace safety digitization

Remote patient monitoring demand - Challenges

Washability and durability perception

Battery safety concerns

Sensor calibration and accuracy trust

Sizing and return complexity

Regulatory and claim substantiation barriers - Opportunities

Clinical-grade RPM garments

Smart industrial safety uniforms

Hospitality and aviation uniform upgrades

Enterprise wellness bundling

Private-label opportunities through UAE channels - Trends

AI-driven coaching and analytics

Subscription-based insights - Regulatory & Policy Landscape

- Stakeholder & Ecosystem Analysis

- SWOT Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Selling Price, 2019–2024

- By Price Band, 2019–2024

- Imports vs Local Assembly Contribution, 2019–2024

- By Fleet Type (in Value %)

Smart shirts and biometric tops

Smart socks

Smart leggings and innerwear

Smart jackets

Smart PPE and uniforms - By Application (in Value %)

Sports performance and professional training

Gyms and fitness chains

Clinical and hospital monitoring

Home healthcare and rehabilitation

Industrial and construction safety - By Technology Architecture (in Value %)

ECG and heart-rate sensing

Respiration monitoring

Temperature sensing

Motion and IMU-based sensing

Pressure and plantar sensing - By Connectivity Type (in Value %)

Bluetooth-only garments

Smartphone-tethered cloud garments

Standalone hub-connected garments

Enterprise dashboard–enabled garments

API-enabled integration garments - By End-Use Industry (in Value %)

Consumer retail buyers

Enterprise wellness programs

Clinical and hospital procurement

Industrial and safety procurement

Sports teams and academies - By Region (in Value %)

Dubai

Abu Dhabi

Sharjah and Northern Emirates

- Competitive positioning matrix

Market share benchmarking - Cross Comparison Parameters (sensor stack depth and clinical readiness, washability rating and garment longevity, app and analytics maturity, data hosting and compliance controls, UAE channel strength, enterprise deployment capability, SKU ladder and size inclusivity, total cost of ownership levers)

- Competitive SWOT analysis

- Pricing benchmarking by SKU and bundle

- Distribution and partnership benchmarking

- Detailed Profiles of Major Companies

Under Armour

Ralph Lauren

Hexoskin

Sensoria

Siren Care

Google Jacquard

Levi’s

Myant

Wearable X

Xenoma

AiQ Smart Clothing

Toray

DuPont

Interactive Wear AG

Carvico

- Consumer demand and usage context

- Enterprise and institutional demand

- Buying criteria framework

- Procurement journey

- Pain-point analysis

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Selling Price, 2025–2030

- By Price Band, 2025–2030

- Imports vs Local Assembly Contribution, 2025–2030