Market Overview

As of 2024, the UAE smart construction market is valued at USD 10.4 billion, with a growing CAGR of 5.4% from 2024 to 2030. This market has seen robust growth driven by factors such as substantial government investments in infrastructure and technological advancements, which enhance project efficiency and sustainability. The increasing adoption of smart technologies, such as Building Information Modelling (BIM) and Internet of Things (IoT) applications, has played a pivotal role in transforming traditional construction methodologies into more efficient and productive processes.

Dominant cities within the UAE smart construction market include Dubai and Abu Dhabi, primarily due to their aggressive urbanization efforts and strategic initiatives to bolster smart infrastructure. Dubai’s commitment to becoming a global hub for smart technologies is evidenced by projects such as the Dubai Smart City initiative and comprehensive regulatory frameworks encouraging innovation. Abu Dhabi’s extensive investments in mega infrastructure projects and a clear focus on sustainability and energy efficiency drive similar demand for smart construction practices.

Market Segmentation

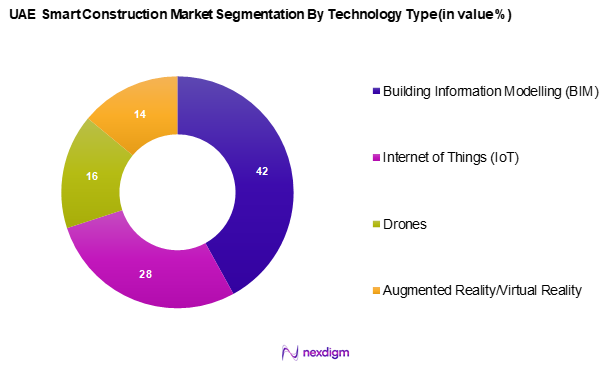

By Technology Type

The UAE smart construction market is segmented into Building Information Modeling (BIM), Internet of Things (IoT), Drones, and Augmented Reality/Virtual Reality (AR/VR). Among these, Building Information Modeling (BIM) currently dominates the market share, representing 42% of the total market in 2024. BIM’s dominance stems from its potential to enhance collaboration among stakeholders, improve accuracy in construction planning, and reduce project timelines and costs. It allows for comprehensive visualization of building projects from the design phase through construction and maintenance, making it an invaluable tool for contractors and developers in the UAE’s competitive landscape.

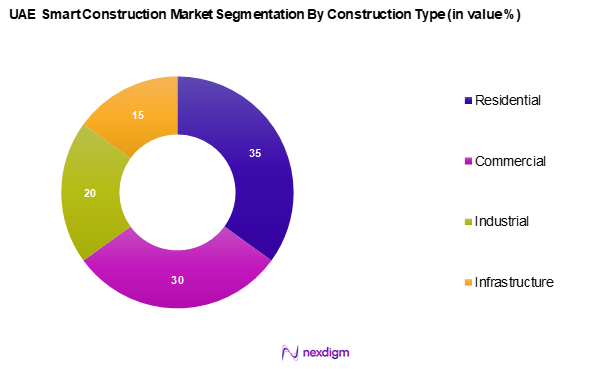

By Construction Type

The UAE smart construction market is segmented into residential, commercial, industrial, and infrastructure. The residential sector leads this segment with a market share of 35% in 2024. This dominance is attributed to the burgeoning population in cities like Dubai and Abu Dhabi, coupled with increasing demand for high-quality housing solutions. Smart technologies are increasingly integrated into residential projects for enhanced energy efficiency, security, and convenience, catering to the rising expectations of technologically savvy consumers who prioritize smart living environments.

Competitive Landscape

The UAE Smart Construction market is dominated by a few major players, including prominent local firms and international giants. This concentration reflects the critical influence of these key companies in advancing innovative construction solutions and setting industry standards.

| Company Name | Establishment Year | Headquarters | Annual Revenue (USD Mn) | Key Technology Domains | Market Presence Strategy | Market

Share (%) |

| Emaar Properties | 1997 | Dubai, UAE | – | – | – | – |

| Arabtec Construction | 1975 | Abu Dhabi, UAE | – | – | – | – |

| ALEC Engineering and Contracting | 1999 | Dubai, UAE | – | – | – | – |

| DAMAC Properties | 2002 | Dubai, UAE | – | – | – | – |

| KEO International Consultants | 1964 | Abu Dhabi, UAE | – | – | – | – |

UAE Smart Construction Market Analysis

Growth Drivers

Investment in Infrastructure

Investment in infrastructure is a significant growth driver for the UAE Smart Construction Market. The UAE government allocated approximately AED 50 billion (USD 13.6 billion) for its infrastructure projects in the 2023 budget. Enhanced transportation networks, such as roads and bridges, are being prioritized to facilitate economic growth and tourism, which contributes around USD 38 billion to the UAE’s GDP. As the population is expected to rise, developing smart infrastructure is crucial to accommodate the increasing demand for residential and commercial spaces. The forward-looking infrastructure policy underpins a robust growth trajectory for smart construction technologies.

Government Initiatives and Policies

The UAE government has been pro-active in promoting smart construction through initiatives like the UAE Vision 2021 and the Dubai Smart City Strategy, which aims to transform the emirate into a global hub for innovation. Additionally, the establishment of the National Smart Government initiative reflects a commitment to improving efficiencies across various sectors, including construction. Such proactive policies foster an environment ideal for the implementation of advanced technologies and smart construction practices, reinforcing the ongoing demand for innovative building solutions.

Market Challenges

High Initial Investment

The adoption of smart construction technologies often requires substantial upfront capital, which can be a deterrent—especially for small and medium-sized enterprises. Implementing tools like Building Information Modelling (BIM), advanced machinery, and integrated software systems involves significant financial commitments. Additionally, the pace of technological evolution demands continuous upgrades and employee training. This need for ongoing investment can strain operational budgets and slow down widespread adoption across the sector.

Skill Gap in Workforce

Despite a sizable workforce in the construction industry, there is a notable shortage of professionals skilled in using emerging technologies such as robotics, artificial intelligence, and smart sensors. While the industry is evolving rapidly, current vocational and technical training programs are not keeping pace with the demands for digital proficiency. This skills mismatch limits the sector’s ability to fully leverage the potential of smart construction practices, thereby creating operational bottlenecks and dependency on external expertise.

Opportunities

Sustainable Construction Practices

Sustainable construction practices present a lucrative opportunity in the UAE Smart Construction Market. In 2023, the UAE has seen an increase in green building developments, with over 3,200 LEED-certified buildings. The government’s commitment to sustainability is evident through its UAE Green Building Council, which aims to reduce the carbon footprint of construction projects by 30% by the end of 2025. The rising emphasis on eco-friendly construction solutions resonates well with a market increasingly focused on conserving resources, thereby driving demand for sustainable materials and technologies in the construction sector.

Integration of Smart Technologies

The growing integration of smart technologies into construction processes is opening up new avenues for market expansion. Innovations in the Internet of Things (IoT), artificial intelligence, and automation are being embraced to improve productivity, safety, and decision-making on construction sites. As awareness grows regarding the benefits of digital construction—including reduced costs, improved timelines, and higher quality control—market participants are increasingly prioritizing technological adoption, which bodes well for long-term growth.

Future Outlook

Over the coming years, the UAE smart construction market is poised for significant growth, propelled by consistent government support for infrastructure development, advancements in smart technologies, and an increasing consumer inclination toward sustainable and efficient construction practices. The integration of smart solutions is expected to enhance productivity and efficiency in project execution, leading to a more resilient construction sector adaptable to future challenges.

Major Players

- Emaar Properties

- Arabtec Construction

- ALEC Engineering and Contracting

- DAMAC Properties

- KEO International Consultants

- Multiplex

- Shapoorji Pallonji Group

- Turner Construction Company

- Al-Futtaim Engineering

- FAMCO (Al-Futtaim Auto & Machinery Co.)

- Khansaheb Civil Engineering

- HLG Contracting

- Al Kaber Group

- Brookfield Multiplex

- Laing O’Rourke

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies

- UAE Ministry of Infrastructure Development

- Dubai Municipality

- Abu Dhabi Department of Municipalities and Transport

- Real Estate Development Companies

- Construction Contractors

- Urban Planners and Architects

- Smart Technology Providers

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves constructing an ecosystem map encompassing major stakeholders within the UAE smart construction market. Extensive desk research is employed utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The objective is to identify and define the critical variables that influence market dynamics, including trends, technological advancements, and economic factors.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the UAE smart construction market is compiled and analyzed. This includes evaluating market penetration rates, the ratio of technology solutions to construction projects, and revenue generation. A thorough assessment of service quality and customer satisfaction statistics will also be conducted to ensure reliability and accuracy in the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of firms in construction and technology sectors. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple smart construction technology providers and contractors to gather detailed insights into product segments, sales performance, consumer preferences, and other relevant factors. This interaction serves to verify and complement statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the UAE Smart Construction Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Investment in Infrastructure

Government Initiatives and Policies - Market Challenges

High Initial Investment

Skill Gap in Workforce - Opportunities

Sustainable Construction Practices

Integration of Smart Technologies - Trends

Increasing Adoption of Green Building Solutions

Rise in Smart City Projects - Government Regulations

Building Codes and Standards

Safety Regulations

Environmental Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Project Cost, 2019-2024

- By Technology Type (In Value %)

Building Information Modeling (BIM)

– 3D Modeling & Visualization

– 4D Simulation (Time-based Scheduling)

– 5D Modeling (Cost Estimation Integration)

– BIM for Facility and Asset Management

Internet of Things (IoT)

– Smart Sensors and Monitoring

– Real-time Equipment Tracking

– Energy and Utility Monitoring

– Predictive Maintenance

Drones

– Aerial Site Surveying

– Safety Inspections

– Progress Monitoring

– Volume Measurement

Augmented Reality/Virtual Reality (AR/VR)

– AR for On-Site Guidance

– VR for Design Simulation

– Training Simulations

– Virtual Walkthroughs - By Construction Type (In Value %)

Residential

– Villas

– High-Rise Apartments

– Gated Communities

– Mixed-Use Developments

Commercial

– Office Towers

– Shopping Malls

– Hotels and Hospitality Complexes

– Exhibition and Convention Centers

Industrial

– Warehouses

– Manufacturing Plants

– Data Centers

– Logistics Hubs

Infrastructure

– Roads and Bridges

– Airports

– Rail and Metro Systems

– Smart Utilities - By End User Sector (In Value %)

Government

– Smart City Projects

– Public Infrastructure

– Municipal Housing Initiatives

Private Developers

– Luxury Real Estate

– Commercial Mixed-Use Projects

– Business Parks

Contractors

– General Contractors

– Specialized Construction Firms

– EPC Contractors

Construction Consultants

– Engineering & Architectural Firms

– Project Management Consultants

– Cost Estimation and BIM Service Providers - By Region (In Value %)

Abu Dhabi

Dubai

Sharjah

Ajman

Ras Al Khaimah - By Project Size (In Value %)

Small-scale Projects

– Individual Villas

– Small Commercial Buildings

– Community Amenities

Medium-scale Projects

– Mid-rise Residential or Office Buildings

– Logistics Facilities

– Institutional Buildings (e.g., schools, clinics)

Large-scale Projects

– Urban Development Masterplans

– Airports, Ports, and Major Infrastructure

– Mega Smart City Projects

- Market Share of Major Players on the Basis of Value/Volume

Market Share of Major Players by Type of Technology Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Technology Segment, Distribution Channels, Unique Value Offerings)

- SWOT Analysis of Major Players

- Pricing Analysis of Smart Construction Technologies

- Detailed Profiles of Major Companies

Damac Properties

Emaar Properties

Turner Construction Company

Arabtec Construction

ALEC Engineering and Contracting

Khansaheb Civil Engineering

Shapoorji Pallonji Group

Multiplex

Brookfield Multiplex

Laing O’Rourke

Mr. Al Kaber Group

Al-Futtaim Engineering

HLG Contracting

FAMCO (Al-Futtaim Auto & Machinery Co.)

KEO International Consultants

- Market Demand and Utilization

- Budget Allocations and Financial Insights

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Points Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Pricing Trends, 2025-2030