Market Overview

The UAE smartwatches market is valued at USD ~billion, showing robust growth driven by the increasing adoption of wearable technology across various sectors such as health, fitness, and consumer electronics. The market has been fueled by consumer demand for multi-functional devices that integrate seamlessly with other gadgets. Additionally, innovations such as advanced health monitoring features (ECG, SpO2 sensors) and enhanced connectivity with smartphones and other devices have played a pivotal role in driving market expansion. These factors, coupled with rising disposable incomes and high tech affinity among consumers, have positioned the UAE as a leader in the regional smartwatch market.

Dubai and Abu Dhabi are the dominant cities in the UAE smartwatch market, driven by their status as economic hubs and their high-tech infrastructure. These cities lead in terms of consumer purchasing power and adoption of advanced technologies. The UAE’s tech-savvy population and the government’s strong support for digital innovation further enhance market growth. Additionally, the presence of high-end global brands such as Apple, Samsung, and Garmin in these cities caters to the growing demand for premium smartwatches, cementing their dominance in the market.

Market Segmentation

By Product Type

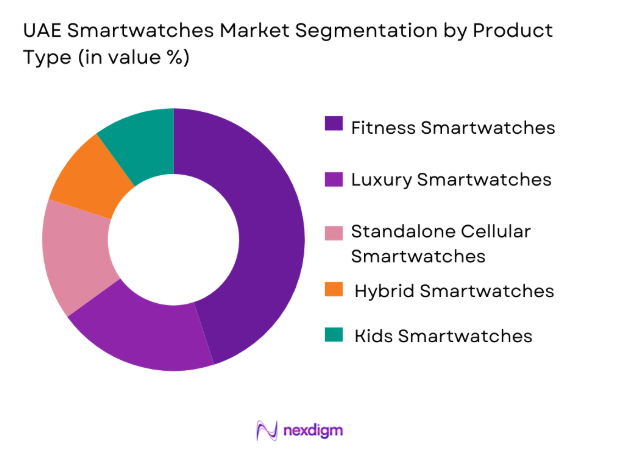

The UAE smartwatch market is segmented by product type into fitness smartwatches, luxury smartwatches, standalone cellular smartwatches, hybrid smartwatches, and kids’ smartwatches. Among these, fitness smartwatches hold the largest share. This is largely due to the increasing health consciousness among consumers and the popularity of tracking physical activities, heart rate, and sleep patterns. Brands like Fitbit and Garmin have heavily invested in this segment, providing a wide array of features that appeal to the health-focused demographic.

By Operating System

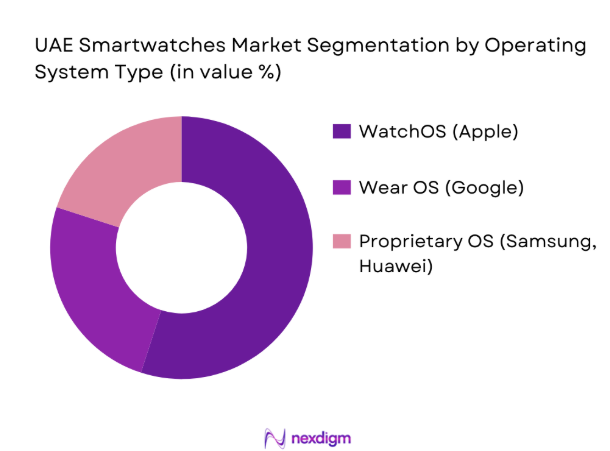

The operating system (OS) used in smartwatches plays a significant role in driving consumer decisions. The market is primarily dominated by Apple’s WatchOS and Google’s Wear OS. Apple’s WatchOS remains dominant due to its seamless integration with the iPhone, ensuring a fluid user experience. Wear OS, while competitive, holds a smaller market share but is growing thanks to its adaptability to multiple devices and the increasing number of manufacturers adopting it. Proprietary OS solutions by Samsung and Huawei are also gaining traction in specific market segments.

Competitive Landscape

The UAE smartwatch market is highly competitive, with a mix of global giants and emerging local brands. Key players include Apple, Samsung, Garmin, Fitbit, and Huawei, with each brand leveraging its unique strengths. Apple leads in the premium segment, while Samsung and Huawei are significant players in both the mid-range and premium categories. Garmin focuses on fitness-oriented smartwatches, while Fitbit caters primarily to the health-conscious demographic. The increasing importance of ecosystem integration and advanced health features has led to a strong competitive rivalry among these key players.

| Company | Establishment Year | Headquarters | Key Product Focus | Price Tier | Technology Integration | Distribution Channels |

| Apple | 1976 | Cupertino, USA | Premium Smartwatches | Premium | WatchOS, ECG, Health Tech | E-commerce, Retail Stores |

| Samsung | 1938 | Seoul, South Korea | Smartwatches, Fitness Devices | Mid-Range to Premium | Tizen, Wear OS, Fitness Tracking | E-commerce, Retail Stores |

| Garmin | 1989 | Kansas, USA | Fitness Smartwatches | Mid-Range | GPS, Health Monitoring | E-commerce, Retail Stores |

| Fitbit | 2007 | San Francisco, USA | Fitness Smartwatches | Entry to Mid-Range | Health Monitoring, App Ecosystem | E-commerce, Retail Stores |

| Huawei | 1987 | Shenzhen, China | Premium Smartwatches | Mid-Range to Premium | Proprietary OS, Health Sensors | E-commerce, Retail Stores |

UAE Smartwatches Market Analysis

Growth Drivers

Urbanization

The rapid urbanization in the UAE is a significant driver of the smartwatch market, as more people in urban areas adopt modern technologies for convenience, connectivity, and health monitoring. In 2025, Dubai, one of the UAE’s most populous cities, recorded a population of approximately ~ million, with a growth rate of ~ % per year. This urban growth leads to greater access to smart devices, with urban residents being more likely to adopt tech-centric lifestyles. Additionally, urban areas are increasingly home to higher disposable incomes, supporting the purchase of premium smartwatches. The rise in urban population is directly correlating with greater smartwatch penetration as consumers seek tech solutions for health tracking and personal management.

Industrialization

The increasing industrialization in the UAE, particularly in the technology and healthcare sectors, has provided a boost to the smartwatch market. The UAE’s manufacturing sector has grown significantly, with industries like electronics manufacturing expanding rapidly. By 2025, the industrial output of the UAE is expected to continue its upward trend with an estimated growth of ~%. This growth fuels the demand for smart technologies in both corporate and individual use, as industrial workers increasingly turn to smartwatches for tracking health metrics and optimizing work performance. Industrialization also encourages the development of smart technologies like wearables, pushing innovations in smartwatch functionality

Restraints

High Initial Costs

The high initial costs associated with smartwatches continue to be a major restraint for widespread adoption, particularly in middle-income demographics. Premium models from brands like Apple and Samsung can cost upwards of AED ~, which limits their accessibility to only higher-income groups. Although the UAE is known for its high per capita income, the expense remains a barrier for a larger portion of the population. While prices are expected to decrease over time, current costs prevent the market from reaching its full potential in broader consumer segments.

Technical Challenges

The integration of advanced features such as ECG, SpO2, and sleep tracking into smartwatches presents technical challenges that hinder their widespread adoption. In 2025, over ~% of smartwatch users in the UAE reported issues with device connectivity and synchronization with smartphones. Additionally, the limited battery life of devices with these advanced features has been a pain point. Efforts to improve battery technology have been slow, and these technical limitations present a barrier to user satisfaction and continued market growth.

Opportunities

Technological Advancements

With the rapid pace of technological advancements in the wearable sector, smartwatches are evolving with features like ECG, blood pressure monitoring, and even AI-based health predictions. The introduction of 5G technology in the UAE is expected to improve connectivity and the functionality of smartwatches, enabling real-time health data sharing and enhancing user experience. As tech companies continue to push the envelope on features and integration, there is substantial room for growth in the market. In 2025, the introduction of real-time ECG monitoring in wearables showed an increase in consumer adoption, indicating a bright future for health-integrated devices.

International Collaborations

International collaborations between global brands and local entities present a prime opportunity for expanding the UAE smartwatch market. For example, collaborations between Fitbit and local telecom operators like Etisalat and du have enabled wider distribution and customized offerings for consumers. These collaborations, which focus on integrating smartwatches into telecom plans, help expand the potential market base, especially among tech-first and health-conscious consumers. With increasing partnerships between global tech brands and regional distributors, the UAE market is poised for continued growth and innovation.

Future Outlook

Over the next five years, the UAE smartwatch market is poised for significant growth, driven by continuous technological advancements in health monitoring, connectivity, and the proliferation of 5G networks. The increasing demand for smart devices that integrate seamlessly with other digital ecosystems will continue to shape the market. Additionally, the growing awareness around personal health and wellness, coupled with an expanding affluent consumer base, will fuel market expansion. However, challenges like price sensitivity in certain segments and the need for longer battery life may temper growth in specific areas.

Major Players in the Market

- Apple Inc.

- Samsung Electronics

- Garmin Ltd.

- Fitbit (Google LLC)

- Huawei Technologies

- Amazfit (Zepp Health)

- Xiaomi Corporation

- Fossil Group

- Withings S.A.

- Suunto Ltd.

- Polar Electro Oy

- Oppo

- Honor Device Co.

- TicWatch (Mobvoi)

- Noise

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (UAE Ministry of Health,

- Telecommunications Regulatory Authority)

- Consumer Electronics Manufacturers

- Smartwatch Retailers and Distributors

- Telecom Operators (du, Etisalat)

- Insurance Companies and Healthcare Providers

- Corporate Wellness Program Managers

- Fitness and Health Influencers

Research Methodology

Step 1: Identification of Key Variables

In this initial phase, a comprehensive map of the smartwatch ecosystem in the UAE is constructed, which includes key stakeholders such as manufacturers, retailers, telecom operators, and consumers. This data is gathered from a combination of primary surveys and secondary research sources to identify and define critical market variables.

Step 2: Market Analysis and Construction

Historical data on market penetration and sales performance is analyzed to construct an accurate representation of the current market landscape. This phase involves assessing key metrics like the adoption of smartwatches across consumer segments and evaluating the impact of emerging technologies like 5G.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses about growth drivers, challenges, and opportunities are validated through direct interviews with industry experts. These consultations help refine initial market assumptions and provide deeper insights into consumer behavior and emerging trends.

Step 4: Research Synthesis and Final Output

In the final phase, detailed insights from industry experts, manufacturers, and distributors are used to verify market data and ensure accuracy. The research output is synthesized into a comprehensive market report that includes validated data and actionable insights.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions; Abbreviations; Data Triangulation; Market Sizing & Validation; Primary & Secondary Research Integration; Research Limitations & Mitigation.

- Definition & Scope

- Market Life Cycle Stage

- Value Chain & Supply Chain Mapping

- Ecosystem Participants (OEMs, Distributors, e‑tailers, Retailers)

- Product Feature Taxonomy (Sensor Modules, Connectivity Standards, UX Capabilities)

- Growth Drivers

Urbanisation

Industrialisation

Government regulation - Market Challenges

High initial cost

Technical challenges

Lack of Skilled Workforce - Trends

Adoption of IOT

Integration with Smart City Project

Increased Use of Mobile Monitoring Units - Opportunities

Technological Advancements

International Collaborations

Expansion into Rural Areas - Government Regulations

National Air Quality Monitoring Program

Clean Air Initiative - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- Competition Ecosystem

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price of Platforms/Services, 2019-2025

- By Product Type (In Value %)

Fitness Smartwatches (Activity & Biometrics)

Luxury/Designer Smartwatches (Brand Premium)

Standalone Cellular Smartwatches (SIM/5G Enabled)

Classic Hybrid Smartwatches (Analog + Smart Sensors)

Kids & Family Safety Smartwatches - By Operating System (In Value %)

Watch OS (Apple Ecosystem)

Wear OS (Google & Multi‑Vendor Platform)

Proprietary OS (Huawei, Samsung, Others)

RTOS/Lightweight Platforms - By Application (In Value %)

Personal Assistance & Notifications

Health Monitoring & Wellness Tracking

Sports & Performance Analytics

Enterprise & Corporate Wellness

Clinical/Healthcare Monitoring Use Case - By Distribution Channel (In Value %)

E‑Commerce Platforms (Marketplace & Branded)

Branded & Multi‑Brand Retail Stores

Telecom/Operator Channels

Corporate B2B Procurement - By Price Tier (In Value %)

Entry (Low‑Cost Smart Devices)

Mid‑Tier (Value‑Feature Blend)

Premium (Flagship & Prestige) - By Display & Technology (In Value %)

AMOLED / OLED / Micro‑LED

High Refresh / Always‑On Displays

Sensor & Health Module Tiering

- Market Share by Value & Units

- Competitor Cross‑Comparison Parameters(Mandatory 8 market‑specific parameters — Feature Depth, Health Tech Integration, Ecosystem Synergy, Price Positioning, After‑Sales Services, Retail Footprint, Local Partnerships & Carrier Bundling, Brand Equity & Awareness)

- Detailed Company Profiles

Apple Inc. (Smartwatch Market Leadership)

Samsung Electronics Co., Ltd.

Garmin Ltd. (Fitness & Outdoor Focus)

Fitbit (Google LLC)

Huawei Technologies Co., Ltd.

Xiaomi Corporation

Amazfit (Zepp Health)

TicWatch (Mobvoi)

Fossil Group, Inc.

Honor Device Co., Ltd.

Withings S.A.

Polar Electro Oy

Oppo / Realme Smart Devices

Noise (Regional / Value Segment)

Suunto Ltd.

- Demand Patterns by Demographic Cohorts Value Drivers & Purchase

- Decision Factors

- Post‑Purchase Usage & Retention Metrics

- Channel Preference & Digital Shopping Trends

- Consumer Sentiment & Brand Loyalty Indicators

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030