Market Overview

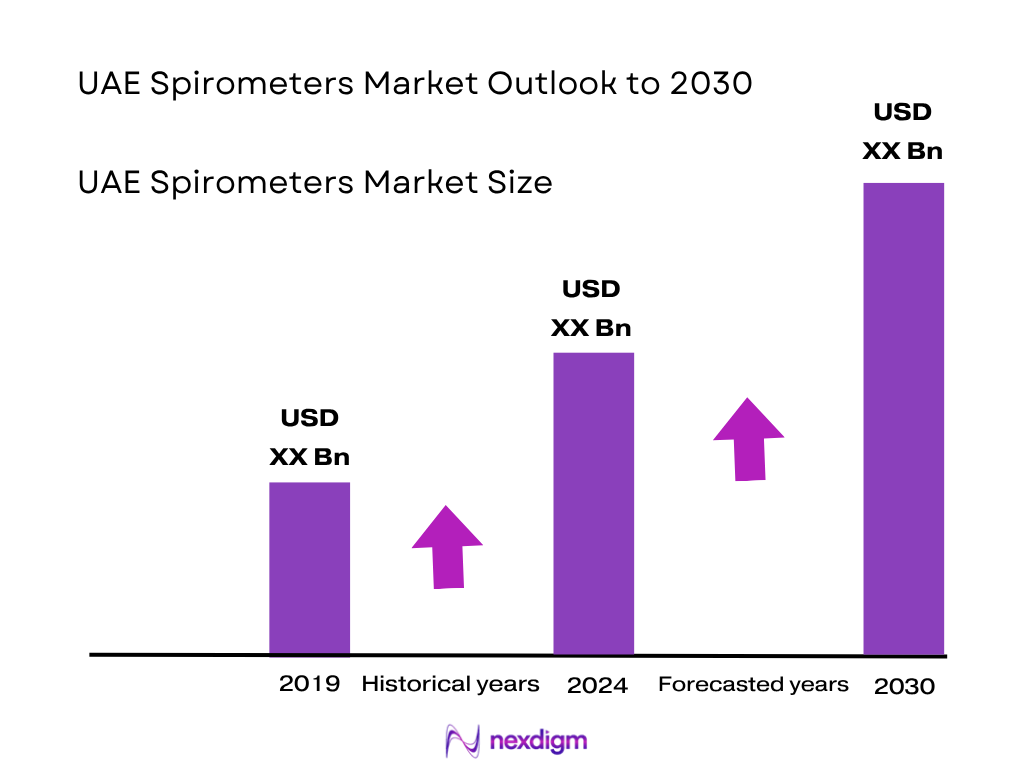

The UAE spirometers market is part of the broader UAE respiratory care devices market, which is valued at USD ~ million in 2024. Growth in spirometry device adoption is being driven by rising prevalence of chronic respiratory diseases (such as asthma and COPD), the push for remote diagnostics/home-care, and advanced pulmonary function test investment in both public and private healthcare settings.

Key urban centres such as Abu Dhabi and Dubai dominate this market region because of superior healthcare infrastructure, high per-capita medical device spend, policy-led digital healthcare initiatives and strong presence of tertiary hospitals and diagnostic centres. For example, one report notes Abu Dhabi has emerged as the dominant region in the broader respiratory-care devices market in UAE.

Market Segmentation

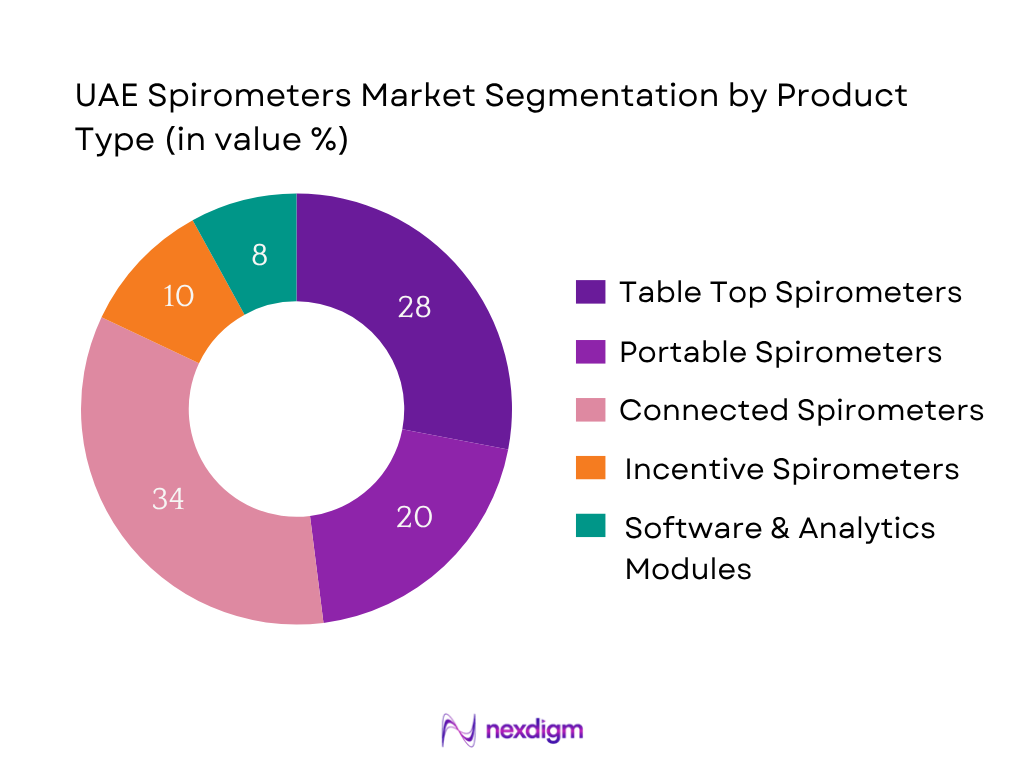

By Product Type

The market is segmented by product type into: Table-top spirometers; Hand-held/portable spirometers; Wireless/Connected spirometers; Incentive spirometers (home/post-operative); Software & analytics modules linked to spirometry equipment. In this segmentation, Wireless/Connected spirometers dominate the market share (approx. 34% in 2024) because of rising demand for remote monitoring, patient mobility, and integration with hospital EMR systems and telehealth platforms.

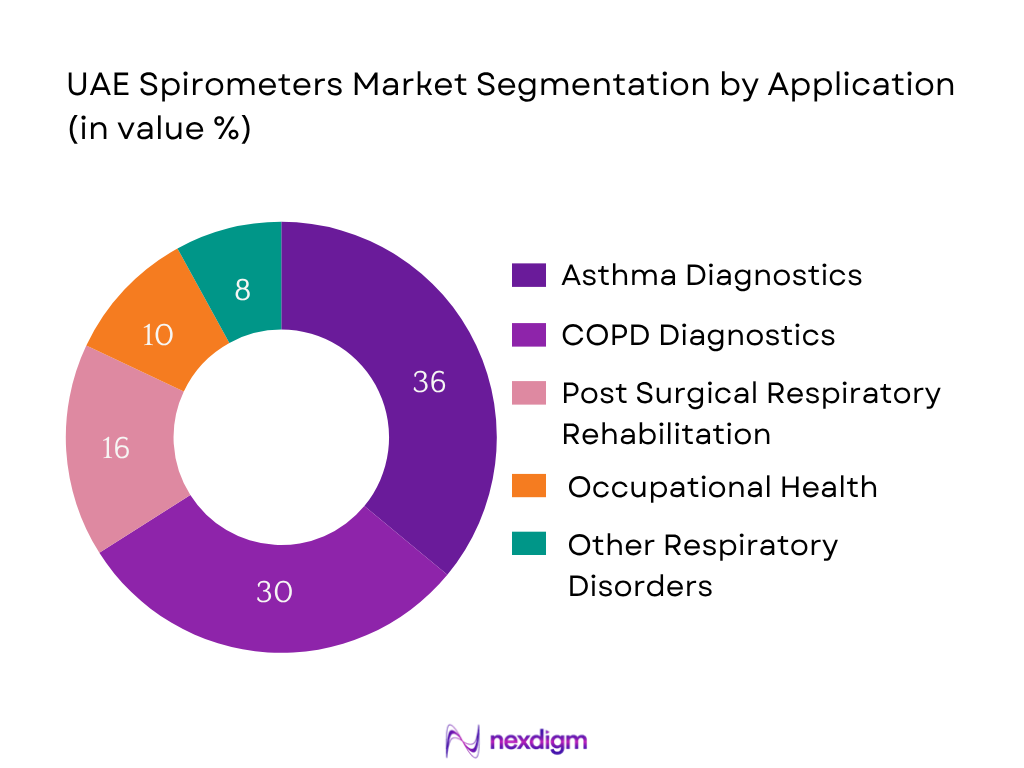

By Application

The market is segmented by application into: COPD diagnostics & monitoring; Asthma diagnostics & monitoring; Post-surgical respiratory rehabilitation/home-care; Occupational health / lung-function screening; Other respiratory disorders (restrictive, cystic-fibrosis, etc). In this segmentation, Asthma diagnostics & monitoring hold the dominant share (approx. 36% in 2024) because asthma prevalence in UAE is high, diagnostic awareness is strong, and spirometry is often used in routine asthma management and monitoring programmes.

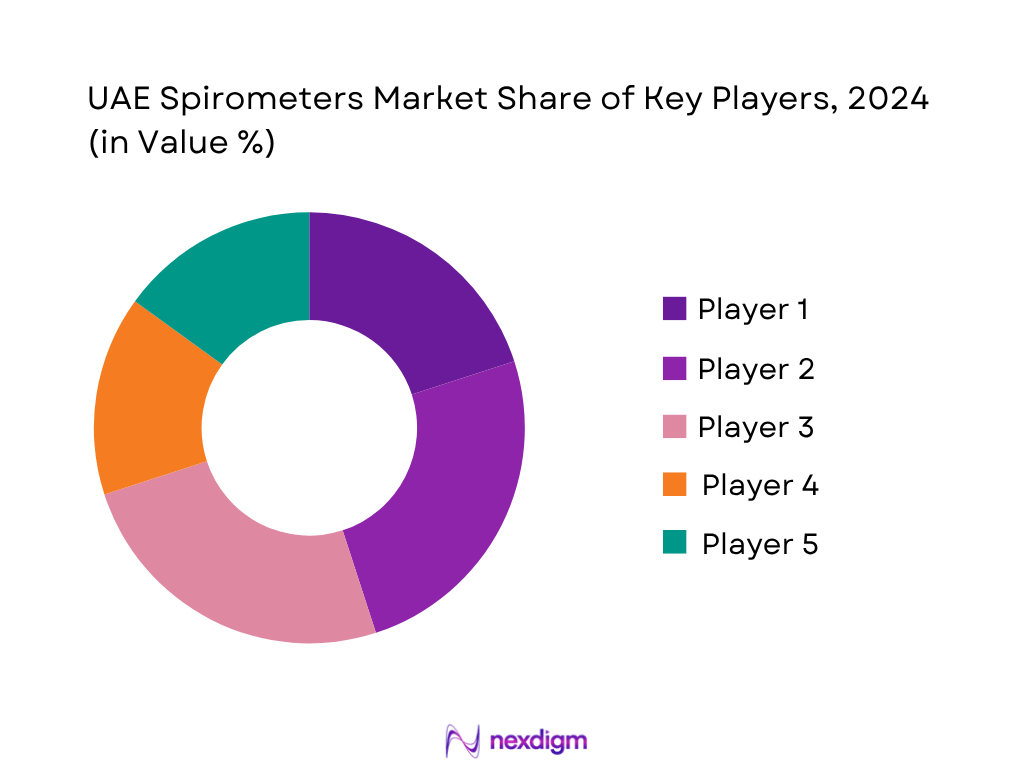

Competitive Landscape

The UAE spirometers equipment market features a moderate number of global and regional players with focus on advanced diagnostics, connectivity and after-sales service in the Gulf region. Consolidation and distribution partnerships are increasingly important given import dependency and regulatory requirements in UAE.

| Company | Year of Establishment | Headquarters | Product Portfolio for Spirometry | Distribution & Service Coverage in UAE | Certifications & Local Registration | Recent UAE-specific Launch/Partnership | After-sales/Calibration Network in UAE |

| MIR Medical International Research S.p.A. | 1974 | Italy | – | – | – | – | – |

| NDD Medizintechnik AG | 1989 | Switzerland | – | – | – | – | – |

| Vyaire Medical Inc. | 2018 (spinoff) | USA | – | – | – | – | – |

| Vitalograph Ltd. | 1981 | UK | – | – | – | – | – |

| Cosmed Srl | 1980 | Italy | – | – | – | – | – |

UAE Spirometers Equipment Market Analysis

Growth Driver

Respiratory disease burden

Studies indicate adult asthma prevalence in the UAE general population at 7.4% in one sample. In children, asthma prevalence reaches up to 13.6% in a school-based study. Prevalence of COPD was reported between 3.7% and 5.3% in one recent study in the UAE. This disease burden translates into sustained demand for spirometry services, creating continuous replacement and upgrade cycles for spirometer equipment in both public and private healthcare settings.

Home-care trends

The UAE’s healthcare system is increasingly embracing remote monitoring and tele-health frameworks. With nearly 11 million people in 2024, managing chronic conditions at home is cost-effective for providers. Urbanisation and high smartphone penetration support portable and wireless spirometer devices in the home-care context. The high rate of asthma among children and ongoing monitoring requirements for adults means home-care spirometry is becoming a part of patient care pathways—presenting a strong driver for handheld and connected spirometer equipment adoption.

Market Challenge

Cost of devices

While macro-economic indicators show the UAE is high income (GDP per capita US$49,377.60 in 2024) the premium nature of advanced spirometer devices (with wireless/connected capabilities) means higher initial capital outlay for healthcare providers. Import reliance adds logistics and compliance overheads—creating a barrier especially in mid-tier clinics and home-care providers. This cost structure slows uptake in smaller diagnostic centres despite pressure to upgrade equipment.

Import dependency

The UAE remains heavily reliant on imported medical equipment and requires robust supply-chain management to ensure availability and service support. With the UAE population at 10.88 million in 2024 and strong healthcare infrastructure, any disruption in import logistics—customs, freight, distributor stock—can have direct impact on equipment availability and lead times. This import dependency thus poses a significant risk to consistent supply of spirometers, their consumables and calibration services.

Opportunity

Connected / wireless spirometers

With nearly 10.88 million people and 88% urbanisation in the UAE, there is a strong infrastructure base for connected-health devices. As healthcare systems move towards smart hospitals and remote monitoring, wireless/connected spirometers offering Bluetooth, cloud-analytics and mobile integration present a strong growth pathway. These devices enable faster diagnostics, data aggregation and patient monitoring outside traditional lab settings—making them highly suited for UAE’s digitally enabled healthcare ecosystem.

Remote monitoring

The high prevalence of asthma and respiratory illness (with adult asthma ~7.4% and child asthma ~13.6%) underlines the need for frequent lung-function monitoring. Remote-enabled spirometers allow patients to self-test in home-care or ambulatory settings, with results automatically shared with clinicians. Such models reduce hospital visits, optimise workflows and fit well within UAE healthcare strategies emphasising tele-health and preventive diagnostics—thereby offering vendors a strong opportunity to supply equipment plus connected data-services.

Future Outlook

Over the forecast period the UAE spirometers equipment market is expected to deliver robust growth driven by increasing healthcare expenditure, focus on non-communicable disease screening (especially respiratory), penetration of home-care and remote monitoring devices, and digitalisation of pulmonary diagnostic workflows. As hospitals and ambulatory clinics modernise pulmonary function labs and as corporate health/occupational screening expands, demand for both advanced table-top and portable/connected spirometers will rise. Key growth will be seen in wireless/connected devices, software-analytics add-ons, and home-care incentive spirometers, while service and calibration infrastructure will become a more important differentiator for vendors.

Major Players

- MIR Medical International Research S.p.A.

- NDD Medizintechnik AG

- Vyaire Medical Inc.

- Vitalograph Ltd.

- Cosmed Srl

- SCHILLER AG

- CareFusion Corporation (BD)

- Smiths Medical (ICU Medical Inc.)

- Contec Medical Systems Co. Ltd.

- SDI Diagnostics Inc.

- KoKo PFT Systems (Clinical Instruments Inc.)

- Bionet Co. Ltd.

- Labtech Ltd.

- Medical Equipment Trading LLC (UAE distributor)

- Arab HealthCare Supply LLC (UAE regional importer & distributor)

Key Target Audience

- Hospital procurement departments (public & private healthcare systems)

- Diagnostic centre owners / chain operators (Pulmonary Function Test labs)

- Home-care device providers & respiratory therapy companies

- Occupational health & corporate wellness providers

- Medical device distributors and local importers in UAE & GCC

- Investors and venture capital firms focusing on med-tech and health-devices in MENA

- Government and regulatory bodies (e.g., Ministry of Health & Prevention – UAE; Dubai Health Authority)

- Strategic business development teams of spirometer/device manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing an ecosystem map of major stakeholders in the UAE spirometer equipment market—manufacturers, importers/distributors, hospitals/diagnostic centres, calibration service providers. Extensive desk research was done using secondary sources such as published industry-reports, regulatory databases, company annual reports and import-statistics.

Step 2: Market Analysis and Construction

Historical data on device installs, import volumes (estimated via trade data), hospital PFT lab counts and equipment replacement cycles in UAE were compiled. Volume and value trends were constructed using bottom-up estimates (units × average selling price) and triangulated with top-down category data (respiratory care devices) to ensure consistency.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses (e.g., growth of wireless spirometers, home-care uptake) were validated by conducting interviews with industry practitioners—device distributors in UAE, pulmonary function lab managers in private and public hospitals, service/maintenance providers. These insights helped refine assumptions on adoption rates, service/network requirements and pricing dynamics.

Step 4: Research Synthesis and Final Output

The final phase entailed integration of all data into forecast models, segmentation tables and competitive landscape frameworks. Field-verified insights from UAE stakeholders were cross-checked with global benchmarks (e.g., global spirometer market growth) to align the UAE-specific projections and ensure that sizing, growth rates and value forecasts were robust and realistic.

- Executive Summary

- Research Methodology (Market definitions and underlying assumptions, Abbreviations and glossary of terms, Market sizing approach (value and volume) specific to the UAE spirometer equipment market, Data triangulation and consolidation research approach (secondary sources, primary interviews – UAE hospitals/diagnostic centres), Understanding market potential via in-depth industry interviews, Limitations and caveats, Forecasting assumptions)

- Definition & Scope

- Industry Genesis

- Timeline of Major Developments

- Supply-chain and Value-chain Analysis

- Business Cycle

- Growth Drivers

Device adoption

Respiratory disease burden

Home-care trends - Market Challenges

Cost of devices

Reimbursement/regulation

Import dependency - Opportunities

Connected/wireless spirometers

Remote monitoring

Corporate screening - Trends

Digital spirometry

Telehealth integration

Rental vs purchase models - Regulatory & Reimbursement Landscape

MOHAP device registration

Import duties

OEM certification - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- Market Size by Value (AED / USD), 2019-2024

- Market Size by Volume (units sold), 2019-2024

- Average Selling Price (ASP) per unit, 2019-2024

- By Product Type (value %)

Table-top Spirometers

Hand-held / Portable Spirometers

Wireless / Connected Spirometers

Incentive Spirometers (for post-operative/home care)

Software/Analytics Sub-ordinate to Spirometry Equipment - By Technology (value %)

Volume-measurement Spirometers

Peak-flow Measurement Spirometers

Flow-capacitance / Turbine Spirometers - By Application (value %)

COPD (Chronic Obstructive Pulmonary Disease) diagnostics & monitoring

Asthma diagnostics & monitoring

Post-surgical respiratory rehabilitation/home care

Occupational health (lung-function screening)

Others (e.g., cystic fibrosis, restrictive lung diseases) - By End-User (value %)

Hospitals (public & private)

Diagnostic Centres / Pulmonary Function Test (PFT) Labs

Home Care & Ambulatory Clinics

Occupational Health & Corporate Wellness Programmes

Research Institutes / Academic Hospitals - By Geography within UAE (value %)

Dubai & Northern Emirates

Abu Dhabi & Western Region

Sharjah & Eastern Region

Home-care/Remote (nationwide)

- Market Share of Major Players (by value/volume, base year)

- Cross Comparison Parameters (Company overview; Business strategy; Recent developments; Strengths; Weaknesses; Products/portfolios for spirometers; Revenues from spirometry equipment; Number of touchpoints (sales/distribution in UAE); After-sales & service coverage; Distributor network; Price points (ASP); Device certification/local registration status)

- Detailed Profiles of Major Companies

MIR Medical International Research S.p.A.

NDD Medizintechnik AG

Vyaire Medical Inc.

Vitalograph Ltd.

Cosmed Srl

SCHILLER AG

CareFusion Corporation (BD)

Smiths Medical

Contec Medical Systems Co. Ltd.

SDI Diagnostics Inc.

KoKo PFT Systems

Bionet Co. Ltd.

Labtech Ltd.

Medical Equipment Trading LLC

Arab HealthCare Supply LLC

- Demand and Utilisation Patterns

- Purchasing Power and Budget Allocation

- Regulatory / Compliance Requirements for End-Users

- Needs, Preferences & Pain Points

- Decision-making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By ASP, 2025-2030