Market Overview

Explanation of Market Size and Drivers

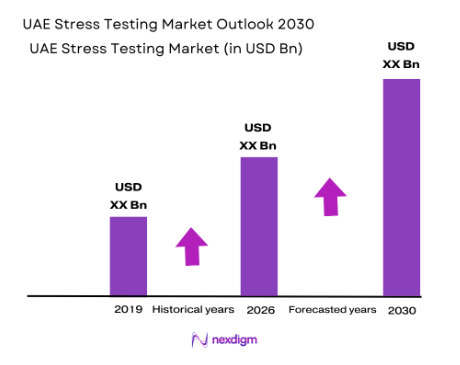

The UAE Stress Testing Market, valued at USD ~million in 2024, is driven by the growing need for banks and financial institutions to comply with regulatory requirements and manage systemic risks. The Central Bank of the UAE (CBUAE) mandates financial institutions to conduct regular stress tests to gauge their resilience against adverse economic conditions. Furthermore, the increasing complexity of market conditions and financial models, along with advancements in technology, have boosted the adoption of stress testing tools by banks. This growing adoption, coupled with the rapid digital transformation of the financial sector, is expected to propel the market forward.

Dominant Countries and Reasons for Market Dominance

Dubai and Abu Dhabi dominate the UAE Stress Testing Market due to their status as financial hubs for the Middle East. These cities are home to key institutions like the Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM), which are governed by robust regulatory frameworks. The concentration of large banks, fintech companies, and global financial firms in these regions has significantly increased the demand for comprehensive stress testing solutions. Additionally, government-backed initiatives aimed at enhancing the financial stability of these cities have accelerated the adoption of risk management tools, including stress testing solutions.

Market Segmentation

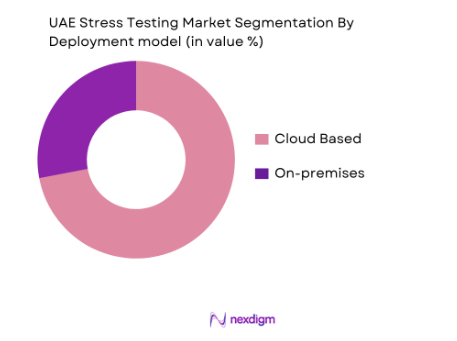

By Deployment Model

The UAE Stress Testing Market is segmented by deployment models into cloud-based and on-premises stress testing solutions. In 2024, cloud-based stress testing solutions are expected to dominate the market due to their scalability, cost-effectiveness, and ability to integrate with other cloud-based financial technologies. Cloud solutions offer high flexibility, enabling financial institutions to scale their stress testing operations quickly while ensuring compliance with regulations. The ability to process large volumes of data efficiently makes cloud solutions attractive to banks, especially those in the UAE’s competitive banking sector.

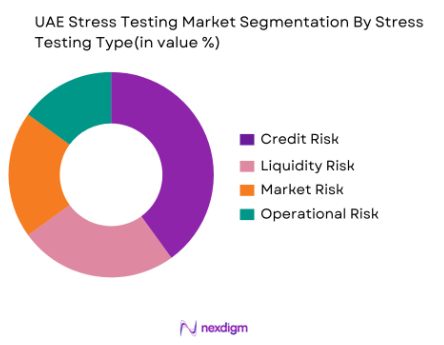

By Stress Testing Type

The market is also segmented by the type of stress testing, including credit risk, liquidity risk, market risk, and operational risk. Among these, credit risk stress testing holds the largest market share in 2024 due to its direct impact on the stability of financial institutions. As a result of the regulatory push for comprehensive risk management frameworks, especially after the implementation of Basel III standards, UAE banks focus significantly on assessing their exposure to credit risks, including potential defaults in loan portfolios, which drives the growth of this segment.

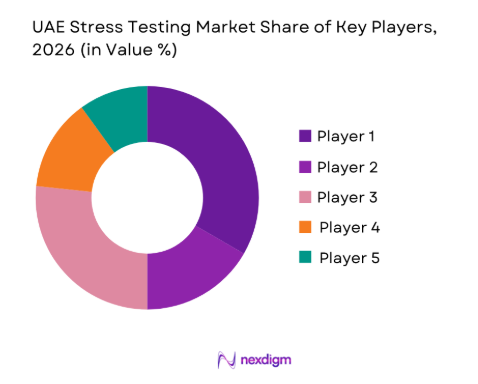

Competitive Landscape

The UAE Stress Testing Market is characterized by the presence of both local and global players offering a range of solutions. Major players include Moody’s Analytics, FIS Global, and SAS Institute, among others. The competition is driven by technological innovations, regulatory mandates, and the increasing need for real-time risk management solutions. These players have established a strong foothold by providing advanced stress testing platforms, integrating AI-driven analytics, and ensuring compliance with UAE’s regulatory frameworks.

| Company | Establishment Year | Headquarters | ~ | ~ | ~ | ~ |

| Moody’s Analytics | 1909 | New York, USA | ~ | ~ | ~ | ~ |

| FIS Global | 1968 | Jacksonville, USA | ~ | ~ | ~ | ~ |

| SAS Institute | 1976 | Cary, North Carolina | ~ | ~ | ~ | ~ |

| AxiomSL | 2000 | London, UK | ~ | ~ | ~ | ~ |

| Wolters Kluwer | 1836 | Alphen aan den Rijn | ~ | ~ | ~ | ~ |

UAE Stress Testing Market Analysis

Growth Drivers

Tightening Regulatory Mandates

The UAE’s banking sector has seen an increase in regulatory scrutiny, notably with the Central Bank of the UAE (CBUAE) enhancing macro‑prudential policies and stress testing requirements to safeguard financial stability. Comprehensive stress tests conducted in 2024 demonstrated that banks could absorb severe shocks while maintaining credit provision and capital buffers above required thresholds, reflecting a proactive regulatory environment focused on preventing systemic risks. The CBUAE also operationalised the UAE Financial Stability Council to coordinate systemic risk oversight, reinforcing the critical role of regulatory stress testing in risk mitigation. These regulatory imperatives push financial institutions to adopt advanced stress testing frameworks to ensure compliance and resilience.

Higher Capital Adequacy Scrutiny

Robust capital adequacy requirements in the UAE banking sector are central to financial stability and are closely linked with stress testing practices. According to the Central Bank of the UAE’s 2024 Financial Stability Report, the Capital Adequacy Ratio (CAR) held stable at 17.8%, with the Common Equity Tier‑1 (CET‑1) ratio at 14.7%, both levels well above minimum regulatory requirements. These figures demonstrate strict regulatory enforcement and high capital buffers that support resilience against economic volatility. Stress testing is indispensable under such capital frameworks because it validates the sufficiency of capital against potential asset quality shocks. With the UAE’s banking system expanding risk‑weighted assets by 11.7% in 2024, institutions must continuously refine stress testing methodologies to ensure compliant capital buffers.

Market Restraints

Skilled Talent Scarcity

The UAE financial sector’s rapid adoption of advanced stress testing frameworks and AI‑driven risk analytics has highlighted a shortage of specialised skills required to deploy and interpret these technologies effectively. As reported, the UAE faces notable talent gaps in high‑tech domains, particularly in analytics, cybersecurity, and data science, which are critical for robust stress testing. This gap constrains the ability of financial institutions to fully leverage modern risk frameworks, slowing integration of real‑time analytics into stress testing workflows. Skilled professionals capable of designing and validating stress scenarios against complex macroeconomic inputs are in high demand, but current supply levels lag behind institutional needs.

Data Fragmentation & Integration Barriers

Data fragmentation remains a structural challenge for the UAE’s stress testing and risk analytics ecosystem. Many financial institutions operate with siloed legacy systems that hinder seamless data integration, delaying efforts to centralise real‑time financial data for comprehensive risk assessments. Fragmented data architectures complicate the construction of stress scenarios that require harmonised datasets across credit, market, liquidity, and operational risk profiles. Additionally, stringent data privacy standards and regulatory requirements further restrict cross‑institutional data interoperability, increasing the operational burden for banks that must continually reconcile disparate sources to conduct accurate stress analysis.

Market Opportunities

Integration with Real‑Time Risk Analytics

Real‑time risk analytics presents a significant opportunity for the UAE Stress Testing Market by enabling continuous monitoring of financial stability indicators and instantaneous scenario simulations. With the UAE banking system’s strong domestic liquidity and macroeconomic resilience — supported by foreign reserve levels equal to 8.2 months of imports and robust banking sector liquidity — institutions have a solid foundation to implement real‑time risk engines that continuously feed data into stress testing models. Real‑time analytics enhance early warning systems for risks like loan default surges or liquidity shortages, thereby improving systemic risk oversight without waiting for periodic reviews. This integration also supports proactive regulatory compliance by aligning institutional stress testing outputs with evolving macroeconomic and financial conditions.

Cloud & AI‑Enhanced Scenario Generation

Cloud platforms and AI‑enhanced modelling tools represent a transformative opportunity for the UAE stress testing ecosystem by enabling scalable computing power and advanced predictive risk models. As financial institutions grow data volumes and complexity, cloud‑native environments can support elastic computing for large‑scale Monte Carlo simulations, liquidity stress scenarios, and systemic risk modelling. AI accelerates scenario generation by autonomously identifying patterns in historical stress outcomes and macroeconomic indicators, improving model robustness. With digital transformation high on the UAE’s financial agenda — including digital payment platforms and AI initiatives — leveraging cloud and AI technologies can significantly enhance the accuracy and efficiency of stress testing frameworks.

Future Outlook

Over the next five years, the UAE Stress Testing Market is expected to show substantial growth driven by an increase in regulatory requirements, advancements in AI and machine learning for risk modelling, and the rising importance of stress testing in the face of potential market disruptions. As the financial services sector embraces digital transformation, the demand for advanced stress testing solutions that can handle real-time data and provide instant risk assessment will further accelerate market growth. Moreover, the UAE government’s focus on enhancing financial stability will continue to be a key factor driving market adoption.

Major Players

- Moody’s Analytics

- FIS Global

- SAS Institute

- AxiomSL

- Wolters Kluwer

- IBM Risk Analytics

- Oracle Financial Services

- Murex

- Finastra

- Quantitative Risk Management

- BlackRock Aladdin

- Numerix

- RiskSpan

- MathWorks

- IHS Markit

Key Target Audience

- Banks and Financial Institutions

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies

- Insurance and Reinsurance Companies

- Private Equity Firms

- FinTech Companies and Startups

- Risk Management Consultants

- Treasury and Financial Risk Managers in Corporates

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying the key variables influencing the UAE Stress Testing Market, including regulatory requirements, technological advancements, and the financial stability of key institutions. This phase involves extensive desk research using secondary data sources like government reports, financial market publications, and industry databases.

Step 2: Market Analysis and Construction

In this phase, historical data related to market trends, adoption rates, and technological advancements are analysed. Financial reports and key industry publications are assessed to quantify market size and validate trends in stress testing solution adoption.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, including risk managers and regulators, are consulted through interviews and surveys to validate market hypotheses. This helps refine and confirm the market dynamics and growth projections, ensuring the findings are grounded in real-world insights.

Step 4: Research Synthesis and Final Output

Finally, the data is synthesized to provide a comprehensive view of the market, incorporating inputs from both primary research and secondary data. This step ensures the final report delivers actionable insights for market participants, including regulatory bodies and financial institutions.

- Executive Summary

- Research Methodology (Market definitions & assumptions,Geographic scope, Regulatory landscape mapping, Multi‑method research design, Primary & secondary data sources, Stress testing taxonomy & scenario identification, Limitations and data validation protocols, Forecasting models)

- Market Definition and Scope

- UAE Financial System Architecture

- UAE Stress Testing Ecosystem Genesis & Evolution

- Stress Testing Types & Models

- Value Chain & Service Delivery Model

- Regulatory & Compliance Architecture

- Growth Drivers

Tightening regulatory mandates

Higher capital adequacy scrutiny

Digital transformation & AI‑driven risk engines - Market Restraints

Skilled talent scarcity

Data fragmentation & integration barriers - Market Opportunities

Integration with real‑time risk analytics

Cloud & AI‑enhanced scenario generation - Market Trends

Adoption of multi‑scenario risk overlays

ESG & climate risk stress parameters

Regulatory harmonization between UAE & international Basel norms

- Market Size – By Value, 2019-2025

- Market Size – By Deployment Type, 2019-2025

- Market Size – By Solution vs Services Spend, 2019-2025

- Average Contract / License Value Benchmarks, 2019-2025

- Cost of Compliance & Stress Scenario Execution, 2019-2025

- By Deployment (In Value%)

Cloud‑Hosted Stress Testing Platforms

On‑Premises Risk Engines

Hybrid Stress Test Architectures - By Solution Type (In Value%)

Credit Risk Stress Testing

Liquidity Stress Testing

Market Risk Stress Testing

Operational & Cyber Stress Testing

Climate & ESG Stress Scenarios - By End‑User Industry (In Value%)

Banking & Financial Services

Insurance & Takaful

Capital Markets

FinTech / Digital Banks

Corporate Treasuries - By Institutional Segment (In Value%)

Large‑Scale Universal Banks

Regional & Local Banks

Non‑Bank Financial Institutions

Regulatory & Supervisory Bodies - By Organizational Adoption Stage (In Value%)

Early Adopters

Mainstream Implementers

Advanced Predictive Users

- Market Structure & Share Analysis

- Cross‑Comparison Parameters (Company Overview, Risk Engine Capabilities, Regulatory Compliance Support, AI/ML Stress Modelling Strength, Integration with Core Banking & Treasury Platforms, Cloud / On‑Premises Delivery Mix, Client Base, Pricing Model & Licensing Terms)

- SWOT Profiles of Leading Players

- ricing Benchmarking

- Porter’s Five Forces

- Key Players

Moody’s Analytics

SAS Institute

FIS Global

Oracle Financial Services

IBM Risk Analytics

AxiomSL

Murex

Finastra

Wolters Kluwer

MathWorks

Numerix

QRM Software

Quantitative Risk Management

BlackRock Aladdin

RiskSpan

- Regulatory Compliance Awareness

- Preference for Scalable and Customizable Solutions

- Adoption of Technology-Driven Solutions

- Cost Sensitivity and ROI Focus

- Future Market Size – Value & Growth Trajectories, 2026-30

- Adoption Rate Projections by End‑User, 2026-2030

- Evolution of Stress Scenarios & Risk Parameters, 2026-2030

- Impact of FinTech & Digital Bank Stress Engines, 2026-2030