Market Overview

In 2024, the UAE telemedicine market generated revenue of USD ~ million, reflecting strong normalization of virtual care as a paid channel across private providers and platform-led care models. In the base year, the broader UAE telehealth market is valued at USD ~ million, supported by payer willingness to reimburse defined teleconsultation pathways, large-hospital digital front doors, and employer-funded virtual primary care packages. The expansion is reinforced by hybrid care redesign—triage-to-virtual first, eRx, diagnostics routing, and follow-up care—reducing avoidable in-person load while maintaining continuity.

Within the UAE, Dubai and Abu Dhabi dominate teleconsultation services because they concentrate multi-specialty hospital groups, insurer networks, and regulator-enabled digital health programs that accelerate virtual visit adoption across primary care, dermatology, mental health, and chronic follow-ups. These emirates also host the largest employer bases and higher volumes of insured expatriate populations, which increases demand for faster access and multilingual virtual care. Cross-border influence is visible through UAE-based platforms serving GCC residents and expatriate corridors, but the demand center remains Dubai–Abu Dhabi due to deeper provider density, stronger digital payment readiness, and higher provider-platform integration maturity.

Market Segmentation

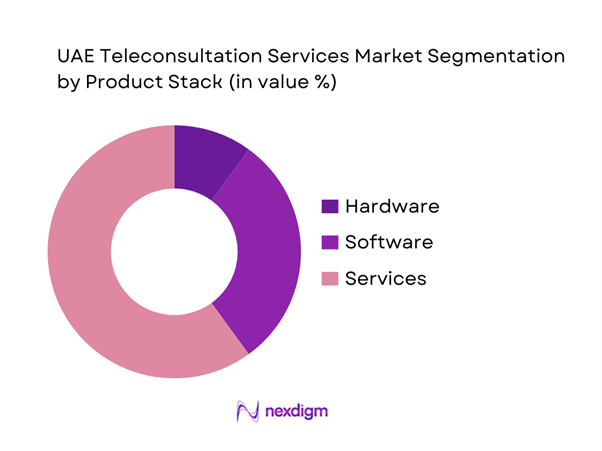

By Product Stack

Services lead because the UAE’s teleconsultation market is still fundamentally a care-delivery business, not only a technology licensing story. Large hospital groups and platform-operator models monetize through specialist time, bundled virtual primary care, employer contracts, and insurer-backed virtual pathways. This naturally weights spend toward service execution: appointment handling, clinician availability management, multilingual call-center support, e-prescription handoffs, and referral routing into in-person care when required. In addition, employers and payers increasingly buy outcomes-linked care programs (virtual GP + chronic follow-ups + mental health), where “services” capture the majority of value. Software growth is accelerating as providers standardize on integrated patient apps and interoperable EMR-connected workflows, but the billable unit in teleconsultation remains the consult episode and the surrounding care-navigation services.

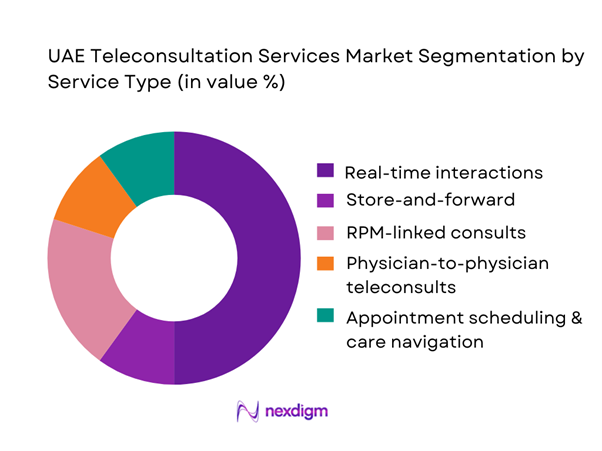

By Service Type

In the UAE, real-time teleconsultation (video/voice/chat) tends to dominate the service mix because it best matches the country’s immediate-access expectations—rapid GP consults, pediatrics advice, dermatology triage, and follow-up visits. Provider groups also prefer synchronous consults because they map cleanly to appointment-based operations and reimbursement logic (time-slot, clinician availability, documented SOAP notes, and eRx issuance). For a highly insured, mobile-first population, real-time interactions reduce friction: patients can access care without travel, and providers can resolve a high share of low-to-medium acuity cases while directing diagnostics or in-person escalation when needed. Asynchronous store-and-forward is growing in image-led specialties (skin, radiology review), but real-time remains the default because it supports richer history-taking, faster clinical closure, and higher patient confidence—especially for multi-lingual, expatriate-heavy patient cohorts.

Competitive Landscape

The UAE teleconsultation services market is consolidating around hospital-led virtual clinics and platform operators that can combine clinician supply, insurance connectivity, eRx, and integrated scheduling. This structure favors groups with strong UAE provider networks, regulator-compliant operations, and the ability to bundle teleconsults with diagnostics, pharmacy delivery, and in-person follow-ups.

| Company | Est. Year | HQ | UAE Coverage Focus | Teleconsult Modalities | Specialty Depth | EMR/Interoperability | Insurance/TPA Connectivity | eRx + Pharmacy Fulfilment | Differentiation Lever |

| PureHealth / SEHA (virtual care ecosystem) | — | UAE | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Mediclinic Middle East | — | UAE | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| NMC Healthcare | — | UAE | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Aster DM Healthcare (UAE ops) | — | UAE / regional | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Okadoc (platform) | — | UAE | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Teleconsultation Services Market Analysis

Growth Drivers

DHA and MOHAP Telehealth Enablement

Dubai’s teleconsultation growth is structurally supported by DHA’s telehealth governance stack—Telehealth Policy, Standards for Telehealth Services, and KPI reporting guidance—creating defined requirements around clinical accountability, consent, documentation, prescribing controls, and performance reporting. This regulatory clarity is being deployed in a high-capacity health economy: the UAE’s GDP is USD ~ billion and GDP per capita is USD ~, supporting sustained health system digitization and provider investment in compliant virtual-care operations. In Dubai, the scale of the regulated provider base is large enough to operationalize telehealth standards at system level—~ DHA-licensed healthcare facilities and ~ DHA-licensed healthcare professionals are recorded in the most recent licensing snapshots, enabling rapid rollout of standardized virtual workflows across clinics, hospitals, and home-health operators. These numbers matter for teleconsultation because licensing and inspection systems reduce onboarding friction for new service configurations, while KPI reporting frameworks push providers to compete on service quality rather than only on appointment availability. The result is a market where compliance-led operationalization makes teleconsultation scalable across multi-specialty networks, not just as a pilot service.

Smartphone-First Care Behaviors

Teleconsultation demand in the UAE is amplified by a smartphone-first consumption environment that supports instant access care journeys without physical travel. A key hard signal of this readiness is the country’s mobile connectivity base, which exceeds total population, indicating a connectivity footprint that comfortably supports multi-device households and heavy app usage at scale. On the macro side, the same environment is underpinned by the UAE’s high-income profile—GDP per capita at USD ~—which supports frequent use of paid digital services and sustained provider investment in mobile UX, multilingual support, and virtual waiting-room stability. For teleconsultation operators, this translates into higher completion rates for remote onboarding, identity verification, and pre-consult intake. It also reduces operational leakage, as patients can upload documents and receive e-prescriptions on-device, enabling providers to close more episodes within a single interaction and reduce rework. In practice, the smartphone channel becomes the front door that makes virtual triage economically viable for hospitals, insurer platforms, and employer health programs.

Challenges

Licensing and Privileging Complexity

Teleconsultation in the UAE is constrained by licensing, privileging, and inspection requirements that vary by emirate regulator and provider type, making rapid scaling across jurisdictions operationally intensive. Dubai’s licensed ecosystem alone shows the complexity in absolute numbers, with thousands of licensed healthcare facilities and tens of thousands of licensed healthcare professionals across multiple clinical categories, each requiring appropriate credentialing and compliance alignment for telehealth scope of practice. The same regulatory framework references centralized licensing and inspection systems, illustrating the governance infrastructure providers must navigate when launching or expanding teleconsultation service lines. The macroeconomic environment increases the pace of new facility formation, supported by a high national GDP, which can further increase the number of entities needing alignment to telehealth policies and reporting expectations. For teleconsultation operators, this becomes a real constraint, as adding clinicians across specialties and languages is not only a recruitment problem but a regulated privileging workflow challenge that can slow network expansion.

Cross-Jurisdiction Compliance

Cross-emirate expansion is challenging because teleconsultation must align with different regulator frameworks and different health information exchange environments, which raises compliance workload for identity, consent, data handling, and clinical documentation. Dubai’s health information exchange reports unifying millions of patient records and connecting thousands of healthcare facilities, indicating a large, governed data environment with defined security and professional engagement requirements. In Abu Dhabi, a similarly scaled but distinct health information exchange supports billions of clinical records and tens of thousands of authorized users across thousands of facilities. For teleconsultation providers operating across both ecosystems, compliance is not abstract, as integration must be implemented and audited separately and operational workflows must match each authority’s expectations. Macroeconomic scale reinforces why this matters, as teleconsultation demand is naturally multi-emirate, but compliance fragmentation can slow unified service design. This is why cross-jurisdiction readiness becomes a competitive capability for operators seeking to deliver safer and more continuous care.

Opportunities

Integrated eRx to Doorstep Journeys

A high-growth opportunity is end-to-end integration of teleconsultation with e-prescribing and last-mile medication fulfillment, turning the consult into a complete care episode rather than a standalone interaction. Telehealth standards explicitly reference prescribing governance aligned with national drug lists and consent-driven treatment planning, which supports safe eRx workflows that can be operationalized at scale when integrated with licensed pharmacies. Dubai’s licensed ecosystem contains thousands of facilities including pharmacies, medical labs, and imaging centers, creating the physical fulfillment and diagnostics backbone required to convert teleconsults into doorstep delivery experiences. On the demand side, insurer ecosystems make this commercially scalable, with millions of insured individuals and large volumes of electronic insurance transactions enabling e-claims-ready eRx fulfillment inside payer pathways. Macro capacity supports further integration investment, enabling broad adoption of app-based healthcare consumption. The near-term growth lever is current infrastructure readiness, as regulation exists, pharmacy networks are licensed, insurer rails are digital, and teleconsultation can be packaged with fulfillment SLAs to improve adherence and reduce drop-offs after prescribing.

Home Diagnostics Enablement

Home diagnostics paired with teleconsultation is a strong expansion opportunity because it closes the virtual-to-physical evidence gap by enabling labs and basic diagnostics without clinic visits, improving clinical confidence and reducing unnecessary escalations. Dubai’s licensed ecosystem already contains a large base of diagnostic and home-care adjacencies, with medical labs, imaging centers, and home healthcare agencies appearing as defined licensed facility categories, indicating existing regulated channels that can be partnered into teleconsult workflows. Interoperability infrastructure further enables this, as health information exchanges unify millions of patient records and connect thousands of facilities, supporting routing of lab results and diagnostic records back into clinician-accessible longitudinal history. In Abu Dhabi, similar system-wide capacity exists to operationalize diagnostics data exchange. Macroeconomic readiness is strong, with a high national GDP and population scale supporting demand for convenience-led care and the investment needed for logistics, phlebotomy networks, and digital result delivery. The growth pathway is to use current infrastructure to build integrated packages that improve resolution rates while keeping patient experience friction low.

Future Outlook

Over the next planning cycle, UAE teleconsultation services are expected to expand through hybrid care redesign, insurer-backed virtual pathways, and deeper platform integration into hospital EMRs and claims ecosystems. The market is likely to shift from teleconsult as convenience to teleconsult as default front door, especially in primary care, dermatology, mental health, and chronic follow-ups. Growth will also come from enterprise virtual care contracts, multilingual access models, and the continued expansion of home-based diagnostics and ePharmacy-linked consult journeys.

Major Players

- PureHealth / SEHA

- Mediclinic Middle East

- NMC Healthcare

- Aster DM Healthcare

- Burjeel Holdings / VPS Healthcare

- M42

- Dubai Health

- Al Zahra Hospital

- Saudi German Hospital

- Thumbay Hospital

- King’s College Hospital London – Dubai

- Cleveland Clinic Abu Dhabi

- Okadoc

- Altibbi

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Health insurance companies and managed care operators

- Third-party administrators and claims administrators

- Hospital groups and integrated delivery networks

- Specialty clinic networks

- Employer groups and corporate benefits owners

- Pharmacy and last-mile healthcare logistics operators

Research Methodology

Step 1: Identification of Key Variables

We build an ecosystem map of UAE teleconsultation stakeholders—providers, platforms, payers, TPAs, regulators, and enabling tech vendors. This is supported by structured desk research across credible market datasets, regulatory publications, and provider disclosures to define revenue drivers, utilization levers, and operating constraints.

Step 2: Market Analysis and Construction

We compile historical and base-year indicators across virtual visit adoption, provider capacity allocation, payer reimbursement logic, and digital channel penetration. We then construct a market model aligned to service monetization and platform enablement spend.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses through expert consultations with hospital administrators, insurer and TPA leaders, telehealth operators, and clinician group leads. Inputs focus on demand mix, specialty utilization, regulatory compliance workflows, and operational KPIs.

Step 4: Research Synthesis and Final Output

We synthesize primary insights with secondary benchmarks to finalize segmentation logic, competitor positioning, and future scenario assumptions. Cross-checks are performed for consistency across care pathways to ensure decision-grade outputs.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Scope Boundary Conditions, Inclusion/Exclusion Criteria, Abbreviations, Market Sizing Approach, Top-Down & Bottom-Up Estimation Logic, Triangulation Framework, Primary Interview Program Design, Stakeholder Coverage Matrix, Validation via Regulatory/Claims/Provider Signals, Data Quality Scoring, Limitations and Forward-Looking Considerations)

- Definition and Scope

- Market Genesis and Evolution of Virtual Care Models

- Teleconsultation Care Pathway Map

- Business Cycle and Demand Seasonality

- UAE Digital Health Ecosystem Context

- Growth Drivers

DHA and MOHAP Telehealth Enablement

Smartphone-First Care Behaviors

Provider Capacity Optimization

Insurer Virtual Front Door Adoption

Chronic Disease Burden - Challenges

Licensing and Privileging Complexity

Cross-Jurisdiction Compliance

Clinical Risk and Misdiagnosis Concerns

Reimbursement Variability

Fragmented EMR and HIE Interoperability - Opportunities

Integrated eRx to Doorstep Journeys

Home Diagnostics Enablement

Remote Monitoring and Teleconsult Bundles

Arabic-First Specialty Telecare

Insurer Chronic Care Pathways - Trends

Shift to Hybrid Care Pathways

Same-Day Consultation SLA Competition

Employer-Embedded Telehealth

Teledermatology Expansion

Telepsychiatry Normalization - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Consultation Volumes, 2019–2024

- By Average Realized Fee per Consult, 2019–2024

- By Specialty Mix Contribution, 2019–2024

- By Channel Mix, 2019–2024

- By Consultation Modality (in Value %)

Video Consultation

Voice Consultation

Chat / Asynchronous Consultation

Hybrid Teleconsultation - By Medical Specialty (in Value %)

General Practice / Family Medicine

Pediatrics

Dermatology

Psychiatry / Psychology

Gynecology / Women’s Health - By Care Setting / Provider Type (in Value %)

Hospital & Hospital Network Teleclinics

Polyclinics / Medical Centers

Standalone Digital-First Telehealth Platforms

Pharmacy-Adjacent / eRx Fulfillment-Led Models

Government / Public Health System Virtual Care - By Payer & Payment Model (in Value %)

Self-Pay

Private Insurance Reimbursed

Corporate / Employer Sponsored Plans

Government Coverage

Subscription / Bundled Packages - By Platform Architecture (in Value %)

Provider-Owned App with Integrated EMR

Marketplace Aggregator Platforms

Insurer or TPA-Led Virtual Care Platforms

Government or Semi-Government Platforms

White-Label Telehealth Stacks - By Patient Cohort (in Value %)

Nationals

Expat Residents

Chronic Disease Follow-up Patients

Mental Health Continuity Patients

Travel and Visitor Consultations - By Region (in Value %)

Abu Dhabi

Dubai

Sharjah

Northern Emirates

- Market Share Assessment

Competitive Positioning Matrix - Cross Comparison Parameters (Regulatory Licensing and Privileging Readiness, DHA and MOHAP Compliance Depth, Health Data Residency and Security Posture, EMR and HIE Interoperability Readiness, eRx and Pharmacy Fulfillment Integration, Payer and TPA Claims Integration, Clinician Network Depth, Service Quality KPIs)

- Partnership and Ecosystem Analysis

- SWOT Analysis of Key Players

- Pricing and Offering Benchmark

- Recent Developments Tracker

- Detailed Profiles of Major Companies

Okadoc

Altibbi

Vezeeta

PureHealth / SEHA

Cleveland Clinic Abu Dhabi

Mediclinic Middle East

NMC Healthcare

Aster DM Healthcare

Burjeel Holdings

VPS Healthcare / LLH Hospitals

Thumbay Hospital Network

King’s College Hospital London Dubai

Al-Futtaim Health

Emirates Health Services

- Demand and Utilization Behavior

- Patient Decision-Making Journey

- Provider Adoption and Workflow Fit

- Payer and Employer Buying Criteria

- Pain Points and Unmet Needs

- By Value, 2025–2030

- By Consultation Volumes, 2025–2030

- By Average Realized Fee per Consult, 2025–2030

- By Specialty Mix Contribution, 2025–2030

- By Channel Mix, 2025–2030