Market Overview

The UAE Telehealth Platforms market is valued at USD ~ million in the latest year, reflecting platform-led revenues across virtual care software, services, and supporting telehealth infrastructure. The market’s expansion is anchored in platform-based monetization of virtual consultations, enterprise virtual-care contracts, and bundled digital health services such as e-prescriptions and follow-up care. Demand is structurally supported by high outpatient volumes, urban population density, and system-wide digitization of healthcare access. Telehealth platforms increasingly operate as revenue-generating care orchestration engines rather than standalone communication tools, making them integral to healthcare delivery economics.

Within the UAE, Dubai and Abu Dhabi dominate telehealth platform adoption due to concentration of large private hospital networks, insurer headquarters, and centralized procurement decision-making. Dubai leads in private-sector platform rollouts driven by multispecialty clinics, medical tourism, and digitally mature patient populations. Abu Dhabi dominates large-scale deployments through integrated health systems and government-backed digital care programs, enabling enterprise-wide adoption. Internationally developed clinical software architectures and global telehealth operating models influence platform design, but localization, compliance, and provider integration remain UAE-centric differentiators.

Market Segmentation

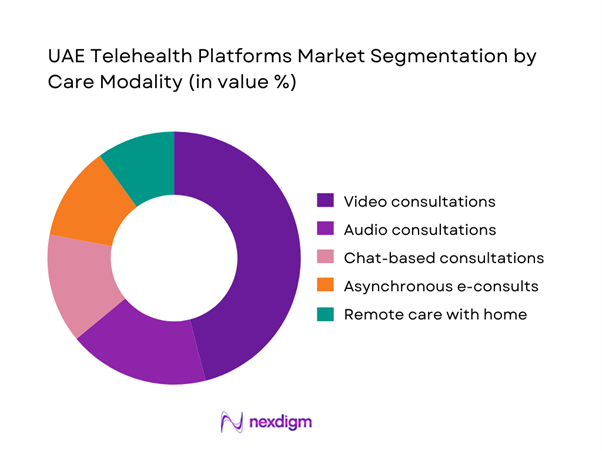

By Care Modality

The UAE Telehealth Platforms market is segmented by care modality into video consultations, audio consultations, chat-based consultations, asynchronous e-consults, and remote care with home services. Video consultations dominate this segmentation because they most closely replicate in-person clinical encounters, aligning with regulatory expectations, payer reimbursement logic, and clinician preferences. Providers rely on video to support diagnostic confidence, patient trust, and continuity of care, particularly for primary care, dermatology, and mental health. Video also enables better documentation, escalation, and medico-legal defensibility compared to audio or chat formats. As a result, hospitals and insurers preferentially structure virtual care pathways around video-first encounters.

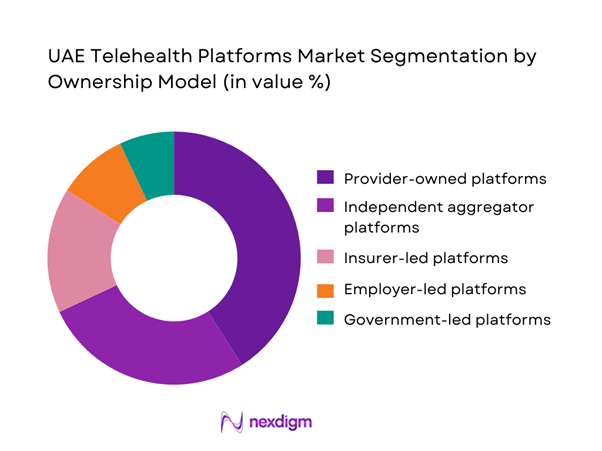

By Ownership Model

The market is segmented by platform ownership model into provider-owned platforms, independent aggregators, insurer-led platforms, employer-led platforms, and government-led platforms. Provider-owned platforms hold the dominant share because they are embedded directly into hospital and clinic workflows, ensuring patient retention, EHR continuity, and control over clinical quality. These platforms benefit from captive patient bases, integrated scheduling, and in-house clinician networks, making them more scalable and defensible than aggregator-led models. Providers also use telehealth as a strategic extension of outpatient capacity, reinforcing its role as a core service rather than an auxiliary channel.

Competitive Landscape

The UAE Telehealth Platforms market is dominated by a few major players, including Okadoc and global or regional brands like TruDoc, Mediclinic Middle East, and Aster Digital Health. This consolidation highlights the significant influence of these key companies.

| Company | Established | Headquarters | Primary Model | Core Modalities | Enterprise Integration Depth | Pharmacy / eRx Enablement | Lab / Home Services Enablement | Payer / TPA Contract Readiness | Localization & Access |

| Okadoc | 2018 | Dubai (Dubai Healthcare City) | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| TruDoc | 2011 | Dubai | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| HealthHub (Al-Futtaim) | 2019 | Dubai | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Aster / Medcare Ecosystem | 1987 | Dubai (Origin) | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Mediclinic Middle East | 2007 (UAE entry) | Dubai | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Telehealth Platforms Market Analysis

Growth Drivers

Regulatory enablement of virtual care

Regulatory enablement has been a foundational driver in embedding telehealth platforms into the UAE’s formal healthcare delivery system. Clear frameworks governing virtual consultations, physician licensing, patient consent, digital prescriptions, and medical record documentation have transformed telehealth from an experimental channel into a licensed and auditable mode of care. This clarity significantly reduces legal and operational uncertainty for hospitals, clinics, insurers, and employers, allowing telehealth platforms to be included in long-term procurement and service delivery strategies. Providers are increasingly confident in integrating telehealth into core workflows such as outpatient triage, follow-up consultations, and care coordination, rather than limiting it to pilot programs. For platform operators, regulatory certainty justifies deeper investments in cybersecurity, clinical governance tools, interoperability, and clinician management systems. Over time, this has repositioned telehealth as permanent healthcare infrastructure, enabling scalable deployments across large provider networks and insurer ecosystems while aligning digital care with national healthcare quality and safety expectations.

Payer reimbursement normalization

Normalization of reimbursement for virtual care has accelerated telehealth adoption by aligning it with existing insurance and benefits frameworks. When teleconsultations are treated as eligible, payable clinical encounters, insurers and third-party administrators are more willing to route patients toward digital-first pathways for primary care, follow-ups, and low-acuity conditions. This alignment improves utilization predictability for providers and supports stable clinician scheduling for virtual panels. Reimbursement clarity also strengthens enterprise purchasing confidence, particularly among employers and health plans that require predictable claims behavior and auditable service delivery. As telehealth becomes embedded in claims workflows, documentation standards, and utilization management protocols, platforms can scale operations without relying on ad-hoc payment arrangements or patient self-pay models. This shift directly impacts platform sustainability by supporting recurring contracts, consistent clinician engagement, and integration into insurer-led care navigation strategies, positioning telehealth as a mainstream access channel rather than a supplementary convenience offering.

Challenges

Cross-emirate regulatory alignment

Cross-emirate regulatory alignment remains a key challenge due to differences in licensing, approval processes, and operational requirements across healthcare jurisdictions within the UAE. Telehealth platforms operating at a national level must accommodate multiple regulatory interpretations related to provider credentialing, service scope, clinical documentation, and audit readiness. This complexity increases compliance overhead, as platforms need configurable workflows and governance logic to meet emirate-specific rules without fragmenting the user experience. For multi-emirate hospital groups and insurers, inconsistent requirements can slow expansion plans and complicate standardization of digital care pathways. From a platform perspective, additional engineering, legal, and compliance resources are required to manage parallel regulatory regimes, which can increase costs and extend deployment timelines. Until greater harmonization is achieved, scalable growth across emirates will continue to demand sophisticated compliance architecture and close coordination with provider and payer stakeholders.

Clinical quality and escalation management

Maintaining clinical quality while ensuring appropriate escalation to in-person care is a critical operational challenge for telehealth platforms. Virtual care improves access and convenience, but it also requires robust triage protocols, prescribing safeguards, and referral pathways to prevent delayed diagnosis or inappropriate treatment. Platforms must ensure that clinicians can quickly identify red-flag symptoms and route patients to physical facilities when needed, without creating friction or patient dissatisfaction. Inadequate escalation processes can undermine trust among providers, insurers, and regulators, particularly if adverse outcomes arise. Additionally, quality assurance expectations are increasing, requiring platforms to track response times, documentation completeness, referral follow-through, and clinical outcomes. Balancing speed, convenience, and safety demands continuous investment in clinical governance frameworks, specialist oversight, training, and decision-support tools. Failure to manage this balance effectively can limit payer participation and restrict platform adoption within enterprise healthcare ecosystems.

Opportunities

Virtual-first primary care models

Virtual-first primary care presents a significant opportunity, particularly for employers and insurers seeking reminders control over healthcare utilization while maintaining employee and member satisfaction. By positioning telehealth as the first point of clinical contact, platforms can triage routine cases, manage minor conditions, and coordinate follow-ups without immediately consuming physical clinic capacity. This approach supports reduced absenteeism, faster access to care, and more efficient use of healthcare resources. Telehealth platforms can integrate scheduling, clinician availability, digital prescriptions, and referral coordination into a single access layer that simplifies patient journeys. For corporate buyers, virtual-first models offer predictable access, reduced disruption to workdays, and improved care navigation. For providers, they enable better load balancing between virtual and in-person services. As virtual-first primary care becomes operationally mature, it strengthens platform relevance within employer benefits, insurer networks, and integrated provider delivery models.

Chronic disease management and longitudinal care

Chronic disease management represents a strong expansion opportunity by extending telehealth beyond episodic consultations into continuous, long-term care delivery. Many chronic conditions require frequent monitoring, medication adherence support, lifestyle counseling, and regular follow-ups, which can be effectively managed through structured virtual workflows. Telehealth platforms can integrate scheduled reviews, digital care plans, remote symptom tracking, and coordinated referrals into a single longitudinal framework. This approach increases patient engagement and reduces fragmentation of care while supporting providers in managing large patient cohorts more efficiently. For payers and employers, digitally enabled chronic care programs offer better visibility into care adherence and outcomes without relying solely on in-person visits. From a platform perspective, chronic disease management increases user stickiness, repeat utilization, and lifecycle engagement, positioning telehealth as an essential component of ongoing health management rather than a one-time access tool.

Future Outlook

The UAE Telehealth Platforms market will evolve into a core digital healthcare infrastructure layer, driven by deeper provider integration, payer-driven utilization management, and enterprise virtual-care models. Platforms that demonstrate measurable care outcomes, interoperability, and compliance scalability will consolidate market leadership, while standalone consultation apps will face commoditization pressure.

Major Players

- Okadoc

- TruDoc

- HealthHub by Al-Futtaim

- Mediclinic Middle East

- Aster Digital Health

- NMC Health Digital

- Burjeel Holdings

- SEHA Digital

- Dubai Health Virtual Care

- Emirates Health Services Telehealth

- Saudi German Hospital UAE Digital

- Zulekha Healthcare Digital

- VPS Healthcare Digital

- Cleveland Clinic Abu Dhabi Virtual Care

Key Target Audience

- Hospitals and integrated health systems

- Multispecialty clinic networks

- Health insurance companies

- Third-party administrators

- Corporate employers and HR departments

- Investments and venture capitalist firms

- Government and regulatory bodies

- Pharmacy and diagnostics network operators

Research Methodology

Step 1: Identification of Key Variables

This step maps all stakeholders within the UAE telehealth ecosystem and defines core variables such as care modality mix, ownership structures, and revenue drivers using structured desk research.

Step 2: Market Analysis and Construction

Historical usage patterns and revenue flows are analyzed to construct the market model, aligning utilization intensity with platform monetization mechanisms.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through expert consultations with providers, payers, and platform operators to ensure operational realism.

Step 4: Research Synthesis and Final Output

Insights are triangulated and synthesized into a cohesive, client-ready deliverable emphasizing decision-grade intelligence.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Telehealth Care-Continuum and Value-Chain Mapping

- Business Cycle and Demand Seasonality

- UAE Healthcare Service and Digital Delivery Architecture

- Growth Drivers

Regulatory enablement of virtual care

Payer reimbursement normalization

Provider digital front-door strategies

Urban healthcare capacity constraints

Enterprise demand for virtual primary care - Challenges

Cross-emirate regulatory alignment

Clinical quality and escalation risks

Data privacy and hosting compliance

Physician licensing and availability

User retention and platform switching - Opportunities

Virtual-first primary care models

Chronic disease digital management

Women’s and mental health platforms

Employer-led healthcare optimization

Integrated home diagnostics partnerships - Trends

- Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Revenue, 2019–2024

- By Consultation Volume, 2019–2024

- By Average Realization per Encounter, 2019–2024

- By Care Modality (in Value %)

Video consultations

Audio consultations

Chat-based consultations

Asynchronous e-consults

Remote care with home services - By Platform Ownership Model (in Value %)

Provider-owned platforms

Independent aggregator platforms

Insurer-led platforms

Employer-led platforms

Government-led platforms - By Technology / Platform Type (in Value %)

Standalone teleconsult platforms

Integrated EHR-linked platforms

AI-enabled triage platforms

Remote monitoring-enabled platforms

Super-app healthcare platforms - By Deployment / Delivery Model (in Value %)

B2B enterprise contracts

B2C direct-to-consumer

B2B2C via insurers/TPAs

Public sector deployment - By End-Use Customer Type (in Value %)

Hospitals and health systems

Clinics and polyclinics

Insurance companies

Corporate employers

Individual patients - By Region (in Value %)

Dubai

Abu Dhabi

Sharjah and Northern Emirates

- Competition ecosystem overview

- Cross Comparison Parameters (Regulatory licensing coverage, EHR integration depth, payer connectivity, pharmacy fulfilment integration, diagnostics integration, clinician network size, service uptime, localization capability)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Okadoc

TruDoc

HealthHub by Al-Futtaim

Mediclinic Middle East

Aster Digital Health

NMC Health Digital

Burjeel Holdings

SEHA Digital

Dubai Health Virtual Care

Emirates Health Services Telehealth

Saudi German Hospital UAE Digital

Zulekha Healthcare Digital

VPS Healthcare Digital

Cleveland Clinic Abu Dhabi Virtual Care

King’s College Hospital London Dubai Digital

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Revenue, 2025–2030

- By Consultation Volume, 2025–2030

- By Average Realization per Encounter, 2025–2030