Market Overview

The UAE telehealth services market (telemedicine-focused) is valued at USD ~ million, rising from USD ~ million in the prior year, reflecting sustained normalization of virtual care beyond pandemic-era surge and deeper integration into provider workflows. Growth is being pulled by regulator-backed digital health adoption, payer/provider push for access and efficiency, and scaled use-cases such as primary care triage, chronic care follow-ups, behavioral health, and remote patient monitoring. Telehealth is also being institutionalized through government-led digital health programs and partnerships supporting smart healthcare services.

Dubai and Abu Dhabi dominate UAE telehealth adoption because they concentrate the country’s largest hospital networks, specialist capacity, insured expat population density, and digitally enabled regulators and health authorities. Dubai benefits from large-scale public initiatives and provider ecosystems under the Dubai Health Authority’s digital transformation priorities, while Abu Dhabi leads on integrated networks and structured payer-provider systems supporting remote triage, teleconsultations, and monitoring pathways. These hubs also host the strongest platform partnerships, app-led appointment ecosystems, and enterprise rollouts across employer and insurer channels.

Market Segmentation

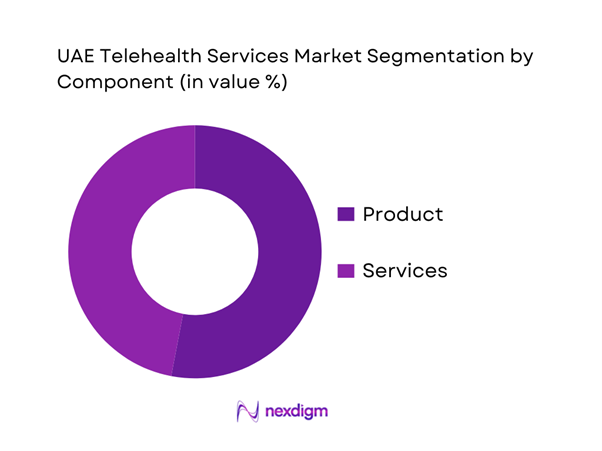

By Component

UAE telehealth services (telemedicine) market segmentation by component includes Product (platforms, software, devices and enabling tech bundles) and Services (tele-consulting, tele-monitoring, tele-education and managed clinical services). Recently, Product dominates because UAE rollouts are frequently “platform-first”: providers and payers prioritize scalable scheduling + video/voice + eRx + payments + integration layers that can be deployed across multi-facility networks. Product-led adoption also aligns with regulator expectations around standardized workflows, audit trails, clinical governance, and cybersecurity controls. Once platforms are embedded, services scale faster—but spend concentration often remains anchored in platform licensing, integration, and enterprise deployments across hospital groups, insurers, and government programs.

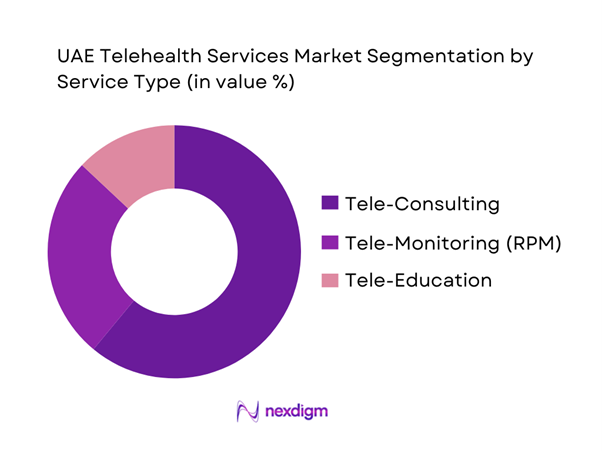

By Service Type

UAE telehealth services can be segmented by service type into Tele-Consulting, Tele-Monitoring (RPM), and Tele-Education (patient education, provider training modules, and digital enablement). Recently, Tele-Consulting typically dominates because it is the fastest-to-scale pathway for access: it supports primary care triage, follow-ups, repeat prescriptions, second opinions, and specialty routing without the operational complexity of connected-device logistics. It also fits UAE’s high smartphone usage behavior and the provider reality of multi-site networks seeking to reduce low-acuity in-person load while maintaining clinical oversight. In parallel, Tele-Monitoring is accelerating through chronic disease pathways and government-backed remote care initiatives, but requires device provisioning, protocol design, and longitudinal care teams—slower to scale than consultations.

Competitive Landscape

The UAE telehealth services market is moderately consolidated around a mix of (a) local-first telehealth platforms, (b) hospital-network and insurer-backed virtual care, and (c) global telemedicine enablers supporting enterprise deployments. Dubai- and Abu Dhabi-centric ecosystems shape competitive positioning: vendors win through regulatory readiness (DHA/DOH/MOHAP alignment), Arabic/English clinical coverage, insurer integration, eRx enablement, and enterprise-grade interoperability with hospital HIS/EHR stacks.

| Company | Est. Year | HQ | UAE Coverage Model | Core Modalities | Clinical Network Approach | Integration Depth (Scheduling / eRx / Payments / EHR) | Payer / Employer Channel Strength | Differentiation Lever |

| Okadoc | 2017/2018 | Dubai, UAE | ~ | ~ | ~ | ~ | ~ | ~ |

| TruDoc 24×7 | 2011 | Dubai, UAE | ~ | ~ | ~ | ~ | ~ | ~ |

| SEHA / PureHealth ecosystem | — | Abu Dhabi, UAE | ~ | ~ | ~ | ~ | ~ | ~ |

| Altibbi (regional platform with UAE base) | 2008 | Dubai, UAE (regional operations) | ~ | ~ | ~ | ~ | ~ | ~ |

| Teladoc Health | 2002 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Telehealth Services Market Analysis

Growth Drivers

Specialist access optimization and appointment lead-time compression

The UAE’s specialist-access pressure is structurally linked to a fast-growing, highly mobile resident base and high absolute care demand concentrated in Dubai and Abu Dhabi. The population is ~ and GDP is USD ~, which supports sustained capacity expansion and private-sector utilization intensity. The care “pull” shows up in national utilization volumes: total hospital attendances reached ~, with ~ in Dubai and ~ in Abu Dhabi; emergency department visits reached ~. Telehealth becomes a practical access equalizer when specialist schedules are tight because it replaces travel-and-wait cycles with remote triage, follow-up, and e-consults—especially in high-volume emirates where clinic throughput and parking/traffic friction are real constraints. Federal programs also directly expand specialist availability: MoHAP/EHS’s international telemedicine pathway is delivered via ~ hospitals, enabling cross-border specialist input without physical travel for the specialist.

Insurer and TPA benefit embedding and virtual-first steering

Dubai’s payer rails are already operating at “mass scale,” which makes telehealth benefit embedding and virtual-first steering operationally feasible (benefit design, prior authorization logic, claims edits, and post-visit documentation). Dubai’s Health Insurance Corporation reports ~ individuals under the health insurance umbrella, with access to ~ insurance packages. On the transaction side, the e-claims ecosystem processed value exceeding AED ~ and Dubai recorded ~ health insurance claims. This volume creates strong incentives to shift eligible low-acuity encounters to telehealth to reduce avoidable in-person claims, stabilize outpatient utilization, and improve provider slot availability for higher-complexity cases. The same digital claims infrastructure also raises expectations for compliant clinical documentation, coding, and prescription workflows—conditions that “reward” platforms/providers who can produce audit-ready teleconsult notes and integration-ready claim artifacts. With UAE GDP at USD ~, the employer/insurer focus on productivity and utilization governance stays high, reinforcing virtual-first pathways for routine follow-ups and medication refills.

Challenges

Cross-jurisdiction licensing and privileging complexity

Telehealth operators in the UAE navigate a multi-regulator environment that increases compliance workload when care crosses emirate boundaries or when a platform serves multiple provider groups. Dubai alone has thousands of licensed facilities (nationally, health facilities reached ~ in the latest MoHAP statistical annual report), and the largest care volumes sit in Abu Dhabi and Dubai—where separate regulatory expectations apply to facility licensing, clinical governance, and telehealth practice. Dubai’s regulator has explicitly formalized telehealth standards and updated regulatory requirements via circularized versions, reinforcing that providers must align with jurisdiction-specific rules when delivering continuity of care outside their home emirate. This creates real friction for provider credentialing, clinical privileging, malpractice coverage alignment, and operational approvals—particularly for hub-and-spoke tele-specialty models that rely on specialists supporting multiple sites. The compliance load is intensified by the scale of insured lives and claims: Dubai’s system covers ~ people and processed ~ claims, which increases audit probability and pushes platforms to maintain strict governance. Macro context (population ~) implies continuous cross-border mobility across emirates, making “where care occurs” a recurring compliance question.

Reimbursement frictions and documentation standards

Reimbursement is not just about coverage; it’s about claim acceptability, documentation completeness, clinical coding discipline, and post-payment audit readiness—areas where telehealth can face tighter scrutiny if workflows are not standardized. Dubai’s insurance system processed transactions exceeding AED ~ and recorded ~ health insurance claims, which indicates a high-volume, rules-driven adjudication environment. In the same ecosystem, electronic prescriptions reached ~ in the first half of a recent year, highlighting how tightly payment and clinical actions are tied to digital records. For telehealth, any gaps—missing consent language, incomplete clinical notes, unclear medical necessity for remote care, weak follow-up closure—can trigger denials, rework, and delayed provider payments. This matters because national utilization is extremely high: hospital attendances at ~ and government health center visitors exceeding ~; payers will continue to push documentation discipline as volumes rise. The macroeconomic base (GDP USD ~) supports advanced payer analytics and fraud/waste/abuse controls, raising the bar for telehealth billing integrity and audit trails across TPAs and insurers.

Opportunities

Virtual chronic care program bundles

A high-volume care system creates space for chronic-care bundling models that package virtual consultations, remote monitoring check-ins, medication adherence support, and lab/imaging coordination into structured pathways—without relying on future projections. National utilization data already indicates the scale of repeatable demand: hospital attendances at ~ and government health center visitors exceeding ~ reflect continuous follow-up needs that chronic programs can absorb. Dubai’s digital payer and prescription rails strengthen bundling feasibility: ~ claims and AED ~ processed through the electronic insurance portal show that reimbursement and utilization management can be operationalized at scale, while ~ electronic prescriptions in a half-year window demonstrate the practicality of digital medication workflows—critical for hypertension, dyslipidemia, asthma, and diabetes-related care routines (even without citing prevalence statistics). Interoperability readiness further enables longitudinal chronic programs: NABIDH has ~ patient records across ~ facilities, supporting continuity across providers. With GDP at USD ~ and GDP per capita at USD ~, employers and payers have strong incentives to fund programs that reduce avoidable visits and stabilize productivity—making chronic-care bundles a near-term growth lever for telehealth services.

Mental health service expansion

Mental health is structurally suited to telehealth because care delivery is conversation-led, follow-up intensive, and often benefits from discreet access pathways—conditions that match app-based scheduling and virtual continuity. The UAE’s scale indicators support market readiness: population ~, mobile subscribers ~, and high absolute healthcare contact volumes (hospital attendances ~) indicate both reach and recurring care engagement. Abu Dhabi’s ecosystem is also visibly building service capacity and platforms: the Malaffi operator’s parent ecosystem announced a mental health platform initiative (Nafas) with a provider partner, signaling that integrated digital mental health pathways are moving from concept to operational rollouts. Telehealth can also relieve front-door congestion by shifting appropriate behavioral health visits away from crowded outpatient settings and enabling faster access to qualified clinicians, especially in Dubai and Abu Dhabi where overall visit volumes are highest. Macro strength (GDP USD ~) supports payer coverage experimentation and employer-sponsored mental health offerings, while the national emphasis on regulated digital health and data protection frameworks increases consumer confidence in using virtual mental health services for ongoing support.

Future Outlook

Over the next planning cycle, UAE telehealth services are expected to expand from “convenience access” into protocolized care pathways—chronic disease RPM, mental health programs, post-acute follow-ups, and specialty virtual clinics—supported by stronger integration into hospital information systems and payer authorization flows. Continued digital health policy focus, platform consolidation, and enterprise buying by hospital groups and insurers will push vendors toward measurable outcomes, governance, and interoperability. Market winners will be those that operationalize telehealth at scale: clinical workforce models, multilingual coverage, compliant data handling, and seamless patient journeys across virtual-to-physical care.

Major Players

- Okadoc

- TruDoc 24×7

- SEHA

- PureHealth

- Altibbi

- Dubai Health Authority – Doctor for Every Citizen initiative

- Department of Health – Abu Dhabi

- Aster DM Healthcare

- NMC Healthcare

- Mediclinic Middle East

- VPS Healthcare / Burjeel Holdings

- Saudi German Hospital UAE

- Cleveland Clinic Abu Dhabi

- Teladoc Health

Key Target Audience

- Hospital Groups & Integrated Delivery Networks

- Private Specialty Clinics & Multi-specialty Polyclinic Chains

- Health Insurers & TPAs

- Government and Regulatory Bodies

- Employer Groups / Corporate Benefits Buyers

- Telehealth Platform Operators & Digital Health App Providers

- Pharmacy Networks & eRx-Enabled Dispensing Chains

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

We construct a UAE telehealth ecosystem map covering regulators, payers, provider networks, platform vendors, and enabling ICT layers. Desk research consolidates definitions, care models (teleconsult/RPM), licensing pathways, and reimbursement structures to define the variables driving adoption and monetization.

Step 2: Market Analysis and Construction

We compile historical revenue signals and operating metrics across provider networks, platform deployments, and payer programs, aligning them to UAE-specific care pathways and channel routes (public programs, insurer-led access, employer plans). We validate the component structure (product vs services) and the monetization logic across enterprise and consumer funnels.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses through CATIs with hospital digital transformation leaders, telehealth operations heads, insurer utilization teams, platform product leaders, and compliance officers. Inputs focus on clinical workflow design, adoption constraints, integration depth, and unit economics by service line.

Step 4: Research Synthesis and Final Output

We triangulate findings across published market sizing, regulator program references, and operator interviews to finalize segmentation logic, competitive benchmarking, and forward pathways. Outputs emphasize deployment-ready insights: governance, interoperability, workforce design, and go-to-market routes for UAE buyers.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Evolution and Genesis

- UAE Healthcare Digitization Context

- Value Chain and Stakeholder Map

- Growth Drivers

Specialist access optimization and appointment lead-time compression

Insurer and TPA benefit embedding and virtual-first steering

Hospital capacity smoothing and OPD decongestion

Employer healthcare cost management and productivity protection

HIE and EMR interoperability readiness - Challenges

Cross-jurisdiction licensing and privileging complexity

Reimbursement frictions and documentation standards

Patient trust and clinical appropriateness boundaries

Data privacy, hosting, and cybersecurity requirements

Last-mile service closure gaps - Opportunities

Virtual chronic care program bundles

Mental health service expansion

Women’s health and pediatrics continuity clinics

Emirate-specific partnership models

AI-assisted triage and documentation - Trends

Hospital-led virtual clinics as always-on service lines

Insurer-led navigation and tele-triage layers

Scaling of asynchronous care models

Integration-first procurement strategies

Outcomes-linked contracting pilots - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Revenue, 2019–2024

- By Encounter Volumes, 2019–2024

- By Care Model Split, 2019–2024

- By Visit Type Split, 2019–2024

- By Service Line Split, 2019–2024

- By Application (in Value %)

Virtual primary care

Virtual specialty consults

Tele-mental health

Remote Patient Monitoring services

Tele-triage and nurse advice lines - By Technology Architecture (in Value %)

Video consultation

Voice consultation

Chat-based consultation

Store-and-forward

Hybrid tele plus in-person pathways - By End-Use Industry (in Value %)

Individuals and families

Insurers and TPAs

Hospitals and clinics

Employers

Government programs - By Connectivity Type (in Value %)

Platform-integrated telehealth ecosystems

Standalone teleconsult platforms

EMR-native virtual care modules

Payer-embedded telehealth tools

Pharmacy-led telehealth integrations - By Region (in Value %)

Dubai

Abu Dhabi

Sharjah

Ajman

Northern Emirates

- Market Structure and Positioning Map

Competitive Intensity and Moats - Cross Comparison Parameters (licensing coverage, HIE integration readiness, provider network depth, time-to-consult SLA, eRx and pharmacy delivery closure rate, payer and TPA integration readiness, RPM capability, data privacy and cybersecurity posture)

- Benchmarking Matrix

- SWOT Analysis of Key Players

- Partnership and Ecosystem Analysis

- Competitive Strategies

- Company Profiles

TruDoc 24×7

Okadoc

Altibbi

Mediclinic Middle East

Aster DM Healthcare

NMC Healthcare

Burjeel Holdings

Saudi German Health UAE

Medcare

American Hospital Dubai

SEHA

PureHealth

International SOS

Life Pharmacy

- Buyer Personas

- Procurement and Decision Process

- Budget Ownership and Spend Logic

- Adoption Frictions and Experience Drivers

- KPI Expectations by Buyer Type

- By Revenue, 2025–2030

- By Encounter Volumes, 2025–2030

- By Care Model Split, 2025–2030

- By Visit Type Split, 2025–2030

- By Service Line Split, 2025–2030