Market overview

Across the UAE’s virtual-care stack, the wider telemedicine market generated USD ~ million in the prior year, while the UAE telemonitoring services market reached USD ~ million in the latest year—reflecting accelerating uptake of remote follow-ups, chronic-care check-ins, and continuous mental-health monitoring delivered through app-first, clinician-supervised pathways. Growth is underpinned by hospital groups and payers expanding “hospital-at-home” style pathways and by employers bundling digital health benefits to reduce avoidable utilization.

Within the UAE, Dubai and Abu Dhabi dominate adoption because they concentrate large multi-specialty hospital systems, premium outpatient networks, and health-insurance administration scale—making it easier to operationalize telemonitoring pathways (triage, scheduling, care teams, escalation protocols) and integrate device/app data into clinical workflows. Regionally, the UAE’s role as a GCC clinical and medical-tourism hub further pulls demand into these two emirate-level ecosystems, where regulators, providers, and payers are most capable of scaling digital care models.

Market segmentation

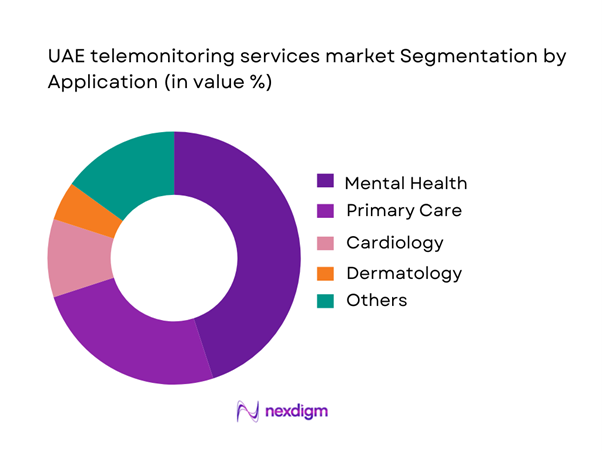

By application

Mental health leads because telemonitoring fits the care model: high-frequency touchpoints, symptom tracking, medication adherence support, and structured therapy programs can be delivered with less dependence on in-person capacity. In the UAE, employer-sponsored wellbeing programs and insurer-led prevention initiatives increasingly include digital mental health, which accelerates subscriptions and repeat utilization. Mental-health telemonitoring also scales effectively in urban hubs where private providers and large hospital networks can staff multilingual clinical teams and maintain escalation protocols for risk cases. Additionally, the stigma barrier is lower with app-based engagement and discreet follow-ups, supporting continuity of care and higher retention—key mechanics that sustain revenue concentration in this application segment.

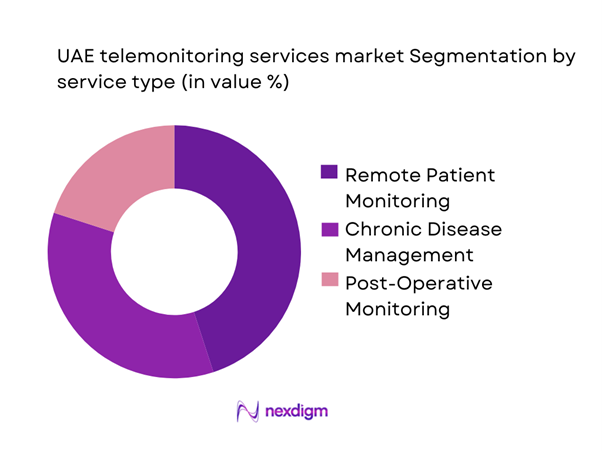

By service type

Remote Patient Monitoring (RPM) is structurally the most scalable service line because it can be standardized across conditions (hypertension, diabetes, respiratory, post-discharge), device kits, and monitoring protocols—then deployed across payer and provider portfolios. RPM also has clearer ROI mechanics: earlier deterioration detection, fewer avoidable ED visits, and shorter post-discharge complication cycles—making it easier for insurers and hospital groups to justify program budgets. In the UAE, RPM is further strengthened by strong smartphone penetration and the ability of leading provider groups to run centralized command centers (nurse-led monitoring + physician escalation). This operational leverage concentrates revenue into RPM relative to narrower programs that focus only on chronic disease coaching or post-op windows.

Competitive landscape

The UAE telemonitoring services market is shaped by a mix of large integrated provider groups (able to embed telemonitoring into care pathways), insurer/TPA ecosystems (able to drive utilization through benefits design), and global medtech/digital platforms that provide devices, connectivity, and monitoring software. The competitive dynamic typically centers on integration depth (EMR/claims), clinical governance, and ability to run escalation workflows at scale.

| Company | Est. Year | HQ | UAE Coverage Model | Core Telemonitoring Use-Cases | Device/Data Stack Breadth | Clinical Governance & Escalation | Integration Depth (EMR/Claims/Booking) | Primary Buyer Channel |

| PureHealth / SEHA ecosystem | 2006 | Abu Dhabi, UAE | ~ | ~ | ~ | ~ | ~ | ~ |

| M42 (digital health + care delivery) | 2022 | Abu Dhabi, UAE | ~ | ~ | ~ | ~ | ~ | ~ |

| Mediclinic Middle East | 1983 | Dubai, UAE (regional) | ~ | ~ | ~ | ~ | ~ | ~ |

| Burjeel Holdings | 2007 | Abu Dhabi, UAE | ~ | ~ | ~ | ~ | ~ | ~ |

| Aster DM Healthcare | 1987 | Dubai, UAE (regional) | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Telemonitoring Services Market Analysis

Growth Drivers

Chronic Disease Burden Management

The UAE’s chronic-disease load is structurally high relative to its resident base, keeping continuous monitoring in demand for diabetes, hypertension, and cardiometabolic care pathways. Reports indicate ~ adults and ~ adults living with diabetes in the UAE’s latest country profile, which translates into sustained device utilization, care-plan adherence tooling, and escalation protocols in telemonitoring programs. Macroeconomic capacity supports scale-up: reported GDP of USD ~ billion and GDP per capita of USD ~ underpin payer/provider ability to fund longitudinal monitoring models. Population scale also matters for caseload planning: reported population of ~ reinforces why chronic-disease cohorts are operationally large even before accounting for episodic risk spikes.

Hospital Capacity Optimization

Telemonitoring is increasingly positioned as a throughput tool—reducing avoidable admissions, smoothing discharge timing, and prioritizing high-acuity beds for complex cases. System capacity signals show why: reported ~ inpatient beds, ~ hospitals, ~ medical centers, and ~ pharmacies operating in the emirate illustrate both the scale and coordination burden that remote monitoring helps manage across fragmented provider networks. Dubai’s delivery footprint is similarly dense; reports indicate ~ licensed healthcare facilities in Dubai, including ~ hospitals, which increases the value of centralized monitoring dashboards and standardized escalation criteria across multiple sites. On the macro side, reported GDP (current prices) of USD ~ billion aligns with continued infrastructure investment that makes hospital-at-home and monitoring-linked discharge programs financially and operationally feasible for large groups.

Challenges

Licensing and Scope-of-Practice Constraints

Licensing and clinical scope remain complex because the UAE’s care delivery spans multiple emirate regulators and facility types and telemonitoring often blends medical decision-making with device operations and data interpretation. Telehealth standards emphasize minimum requirements for licensed physicians and facilities, which can raise compliance overhead for multi-emirate operators trying to standardize telemonitoring pathways across Dubai, Abu Dhabi, and the Northern Emirates. Scale amplifies the issue: Dubai alone has ~ licensed healthcare facilities, meaning even small rule differences can create large implementation burdens when rolling out uniform remote monitoring protocols and staffing models. Workforce licensing volume is also material—national reporting shows medical doctors rising from ~ to ~ over the referenced period, underscoring why mobility, credentialing, and supervision rules directly affect telemonitoring staffing at scale.

Clinical Liability and Risk Ownership

Telemonitoring shifts clinical risk from episodic encounters to continuous oversight, raising hard questions: who owns alert fatigue, missed escalations, device malfunction interpretation, and “non-response” timelines. Telehealth standards explicitly focus on safe, high-quality telehealth provision within licensed facilities—signaling that regulators expect formal governance, documentation, and clinician accountability even when monitoring is partially automated. At the delivery scale, the footprint of ~ hospitals and ~ inpatient beds implies large multi-provider ecosystems where responsibility can fragment across hospitals, home-care providers, and monitoring vendors unless contracts and SOPs are explicit. Macro capacity does not remove risk: GDP per capita of USD ~ supports rapid adoption of connected tools but also increases expectations for service reliability and documentation quality—making liability frameworks and medical-legal defensibility a core barrier to faster telemonitoring expansion.

Opportunities

Value-Based Care Enablement

Telemonitoring creates a measurable bridge from volume-based encounters to outcomes-focused contracting because it produces continuous adherence signals, early deterioration flags, and post-discharge stability evidence—useful for payers and large provider groups in care redesign. Sector-wide standardization through HIE standards for EMR data capture supports outcome measurement, risk stratification, and longitudinal tracking—prerequisites for value-based models that reward prevention and avoided utilization. The ecosystem’s operational scale is sufficient to operationalize such models: a footprint that includes ~ hospitals and ~ inpatient beds enables pathway-based contracting where telemonitoring can reduce readmissions and stabilize high-risk cohorts. Macro capacity supports payer/provider experimentation: reported GDP of USD ~ billion and GDP per capita of USD ~ typically correlate with higher managed-care sophistication, analytics adoption, and willingness to fund remote monitoring as a quality lever rather than a “nice-to-have.”

AI-enabled Clinical Triage

AI-assisted triage is a high-impact opportunity because telemonitoring streams are noisy; algorithms can prioritize actionable alerts (e.g., sustained BP elevation, arrhythmia signals, oxygen desaturation patterns) and reduce clinician load by filtering false positives. Updated telehealth standards and data protection/confidentiality policies set the governance baseline for secure digital health delivery—an enabling layer for deploying AI models responsibly within regulated care settings rather than consumer-only apps. Interoperability readiness is improving through initiatives explicitly designed for meaningful, real-time health information exchange, which increases the availability of structured data inputs needed for clinically useful AI triage and workflow integration. The opportunity is reinforced by the system’s staffing and facility scale—~ licensed workforce and a multi-thousand facility ecosystem—because AI triage value increases when monitoring programs expand and alert volumes rise.

Future outlook

UAE telemonitoring services are expected to expand as providers push “virtual-first” follow-ups, payers tighten utilization management, and employers continue bundling digital health benefits. The strongest growth will likely come from programs that can prove clinical outcomes with structured protocols, automate outreach through app + nurse workflows, and integrate device data into clinician decisioning. Scale will favor players with interoperable platforms, multilingual care teams, and robust governance for safety escalation and patient privacy.

Major players

- PureHealth / SEHA ecosystem

- M42

- Dubai Health

- Mediclinic Middle East

- Burjeel Holdings

- Aster DM Healthcare

- NMC Healthcare

- VPS Healthcare / Medeor

- Cleveland Clinic Abu Dhabi

- Thumbay Group

- Philips

- GE HealthCare

- Abbott

- Medtronic

Key target audience

- Hospital groups & integrated delivery networks

- Health insurers & TPAs

- Home healthcare providers & hospital-at-home operators

- Digital health platform providers

- Medical device OEMs

- Telecom operators & IoT connectivity providers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research methodology

Step 1: Identification of Key Variables

We map the UAE telemonitoring ecosystem across providers, payers, regulators, and platform/device vendors. Desk research compiles policy signals, care-delivery models, and reimbursement/benefit design patterns. We define key variables such as pathway coverage, escalation governance, interoperability depth, and channel economics.

Step 2: Market Analysis and Construction

We compile historical market direction using credible published datasets and triangulate with UAE-specific adoption indicators (provider program footprints, payer initiatives, and enterprise benefits). We structure the market by application and service-line pathways, linking utilization mechanics (touchpoints, retention) to revenue formation.

Step 3: Hypothesis Validation and Expert Consultation

We validate assumptions through structured expert interviews (clinical operations leaders, payer innovation heads, platform product owners, and device-channel partners). These discussions verify workflow realities—monitoring cadence, staffing ratios, escalation thresholds, and integration constraints—refining the market narrative.

Step 4: Research Synthesis and Final Output

We synthesize findings into segment-level insights, competitive positioning, and adoption roadmaps. Where open-access datasets limit full segment-share disclosure, we preserve auditability by using only published values and clearly flagging non-disclosed splits, while still delivering decision-useful dominance logic.

- Executive Summary

- Research Methodology (Market Definitions & Service Boundaries, Telemonitoring vs Telehealth vs RPM Assumptions, Abbreviations, Market Engineering & Sizing Approach, Triangulation Framework, Primary Interviews, Secondary Research Stack, Data Validation Logic, Key Limitations & Confidence Levels, Ethical and Privacy Considerations)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Chronic Disease Burden Management

Hospital Capacity Optimization

Hospital-at-Home Adoption

Patient Convenience and Access Demand

Digital Health Policy Enablement - Challenges

Licensing and Scope-of-Practice Constraints

Clinical Liability and Risk Ownership

Data Privacy and Hosting Constraints

Integration with Legacy HIS and EMR Systems

Monitoring Workforce Availability - Opportunities

Value-Based Care Enablement

AI-enabled Clinical Triage

Payer-led Readmission Reduction Programs

Maternal and Elderly Care Monitoring Expansion

Cross-Emirate Program Replication - Trends

Multi-parameter Wearables

Passive and Continuous Monitoring

Remote Monitoring Bundled with Home Diagnostics

Arabic-first User Experience Design

Hybrid Virtual and Physical Care Models - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Service Volumes, 2019–2024

- By Average Service Realization, 2019–2024

- By Fleet Type (in Value %)

Managed Telemonitoring Programs

Platform-as-a-Service

Device and Platform Bundles

Clinical Monitoring-as-a-Service

Hospital-at-Home Monitoring - By Application (in Value %)

Chronic Disease Monitoring

Post-Acute and Discharge Monitoring

Maternal and Neonatal Risk Monitoring

Cardiac Monitoring

Respiratory Monitoring

Diabetes and CGM-led Monitoring - By Technology Architecture (in Value %)

Wearable-based Monitoring

Multi-parameter Monitoring Hubs

ECG Patch-based Monitoring

CGM-led Monitoring

App-led Monitoring with Device Add-ons - By Connectivity Type (in Value %)

Bluetooth-to-App

Cellular SIM-enabled

Wi-Fi Hub-based

Hybrid Connectivity

Edge-to-Cloud Architecture - By End-Use Industry (in Value %)

Hospitals and Health Systems

Home Healthcare Providers

Insurance Companies and TPAs

Government Healthcare Programs

Corporate and Employer Wellness - By Region (in Value %)

Dubai

Abu Dhabi

Northern Emirates

- Market Share Perspective

- Cross Comparison Parameters (Clinical Protocol Coverage Depth, Device and Sensor Portfolio Breadth, Interoperability Readiness, Data Privacy and PDPL Compliance, Alerting and Triage Sophistication, Monitoring Desk SLA and Staffing Model, Payer Integration Readiness, Cybersecurity Controls)

- Competitive Benchmarking

- Partnership and Ecosystem Mapping

- SWOT Analysis of Key Players

- Regulatory Positioning Comparison

- Company Profiles

PureHealth / SEHA

Cleveland Clinic Abu Dhabi

Burjeel Holdings

NMC Healthcare

Mediclinic Middle East

Aster DM Healthcare

Saudi German Health

American Hospital Dubai

Al Zahra Hospital

King’s College Hospital London Dubai

TruDoc 24×7

Okadoc

Philips

Medtronic

- Demand & Utilization Patterns

- Budget Ownership & Procurement

- Buying Criteria

- Patient Experience & Adherence

- Decision Journey

- By Value, 2025–2030

- By Service Volumes, 2025–2030

- By Average Service Realization, 2025–2030