Market Overview

The UAE Teletherapy market (tele-counseling/tele-psychology delivered via digital platforms, typically supported by mental-health apps and regulated telehealth workflows) generated USD ~ million in revenue in 2024, and is projected to reach USD ~ million by the end of the forecast window. Demand is being pulled by higher telehealth utilization and “digital-first” care pathways—Dubai alone recorded nearly ~ telehealth consultations in the prior year, creating a larger funnel for virtual mental-health touchpoints and follow-on therapy programs.

Dubai and Abu Dhabi dominate UAE teletherapy adoption because they combine (a) the densest concentration of licensed providers and multi-specialty hospital networks, (b) payer-backed access channels, and (c) the most mature telehealth governance. Dubai’s scaling of virtual care is visible in operational KPIs such as ~ electronic prescriptions issued in the prior year, indicating deep workflow digitization that supports repeatable therapy journeys. Abu Dhabi’s edge is its network-led telemedicine capability, including an established telemedicine center model supporting population access.

Market Segmentation

By Platform Type

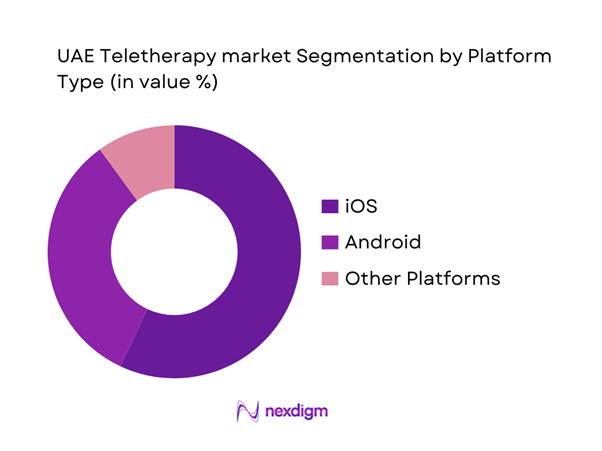

UAE Teletherapy market is segmented by platform type into iOS, Android, and Other Platforms. Recently, iOS has a dominant market share under platform segmentation because the UAE’s teletherapy user base skews toward premium smartphones, expatriate professionals, and employer-sponsored digital health benefits—segments that tend to adopt subscription-based wellness and therapy apps earlier. iOS is noted as the largest revenue-generating platform with a ~ revenue share. iOS dominance is reinforced by stronger payment propensity for in-app subscriptions, higher device longevity (supporting retention), and smoother integration with wearables and Apple Health workflows that many therapy apps use for mood/sleep/activity inputs, improving personalization and engagement.

By Core Application Cluster

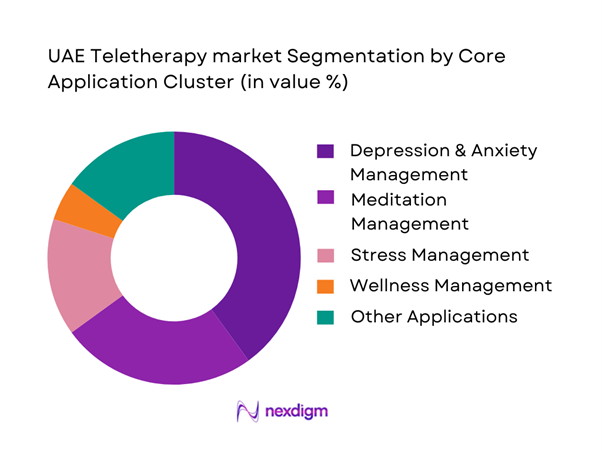

UAE Teletherapy market is segmented by application cluster into Depression & Anxiety Management, Meditation Management, Stress Management, Wellness Management, and Other Applications. In practice, depression & anxiety management tends to dominate the “teletherapy-adjacent” revenue pool because these are the most common entry points for seeking therapy and for structured digital programs that convert into paid sessions (CBT modules, therapist matching, follow-ups). These application clusters act as the primary segmentation backbone for UAE mental health apps—an important demand proxy for teletherapy discovery, triage, and engagement. The dominance mechanism is funnel economics: symptom checkers, guided content, and chat-based support reduce barriers to first use, while regulated telehealth workflows and clinical escalation routes enable conversion to licensed therapy when severity flags appear.

Competitive Landscape

The UAE Teletherapy market is moderately consolidated at the enterprise channel (insurer/corporate/provider-network-led virtual care) while remaining fragmented in B2C discovery (apps and therapist marketplaces). Leadership typically comes from players that can combine: licensed clinician networks, Arabic/English coverage, scheduling + payments, and payer/employer contracts—while operating within DHA/DoH/MoHAP telehealth standards and UAE data protection expectations. DHA’s telehealth standards formalize minimum requirements around consent, prescribing governance, and service delivery controls—raising the bar for compliant teletherapy journeys.

| Company | Est. Year | HQ | UAE Coverage Model | Core Teletherapy Modalities | Clinician Network Model | Integration Depth (Scheduling / Payments / eRx / EHR) | Primary Buyer Channel | Compliance Posture (DHA / PDPL alignment) |

| Okadoc | 2017/2018 | Dubai, UAE | ~ | ~ | ~ | ~ | ~ | ~ |

| TruDoc 24×7 | 2011 | Dubai, UAE | ~ | ~ | ~ | ~ | ~ | ~ |

| PureHealth / SEHA ecosystem (incl. ADTC) | — | Abu Dhabi, UAE | ~ | ~ | ~ | ~ | ~ | ~ |

| Teladoc Health | 2002 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Cleveland Clinic Abu Dhabi (Virtual Visits) | — | Abu Dhabi, UAE | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Teletherapy Market Dynamics and Performance Analytics

Growth Drivers

Digital Health Policy Enablement

The UAE’s teletherapy adoption is being accelerated by regulator-led standardization of mental-health and telehealth delivery, which reduces provider uncertainty and unlocks scalable “virtual-first” care models. Dubai’s regulator has issued Standards for Mental Health Services that explicitly include counselling and therapy across inpatient and outpatient settings and require providers to be licensed via the DHA Sheryan platform, creating a clearer compliance pathway for facility onboarding and service expansion. In Abu Dhabi, the Department of Health’s Jawda program requires quarterly reporting on telehealth performance indicators, pushing providers to operationalize measurable access and outcomes rather than treating teletherapy as an informal add-on. This policy infrastructure is supported by high economic capacity and digital readiness: the UAE’s GDP is USD ~ billion and GDP per capita is USD ~, enabling payers, employers, and providers to fund compliant platforms, clinician training, and governance workflows. These frameworks also align with the UAE’s mental-health governance maturity, where the latest country profile records a stand-alone law for mental health and a nation-wide digital health records system, which improves continuity of care and referral coordination—two friction points that commonly limit teletherapy scale-up.

Mental Health Demand Gap

Teletherapy demand in the UAE is anchored in measurable service utilization and workforce capacity constraints that make “in-person only” models hard to scale at speed—especially in high-density emirates. The country profile reports ~ outpatient visits per ~ population to hospital-attached mental-health outpatient facilities, alongside ~ total psychiatric hospital admissions, signaling sustained clinical throughput that must be absorbed across care settings. At the same time, the reported workforce density highlights supply-side tightness: psychiatrists, psychologists, and total mental health workers a mix that often creates bottlenecks in psychotherapy appointment availability, follow-up cadence, and bilingual matching. The demand gap is amplified by macro fundamentals that increase service-seeking and detection: a large, economically active population with high urban concentration and high purchasing capacity. Independent digital-demography reporting puts the UAE population at ~ million with ~ million internet users, which expands addressable reach for remote therapy triage, screening, and continuity programs. On the macroeconomic side, the UAE’s scale (USD ~ billion GDP) supports more employer-sponsored and insurer-structured care pathways that bring previously unmet mental-health needs into formal channels, increasing teletherapy volumes without relying on speculative assumptions.

Challenges

Clinical Outcome Validation

A core friction point in UAE teletherapy scale-up is the need to evidence clinical outcomes in a regulator-aligned way, especially as payers and health authorities increasingly push “measurable quality” rather than simple access. Abu Dhabi has formalized telehealth quality measurement through Jawda guidance that defines telehealth indicators and requires structured reporting by operating facilities, which raises the bar for validated outcomes, documentation, and auditability for teletherapy providers. On the mental-health system side, the country profile confirms a nation-wide digital health records system and unique service user identifiers, which makes longitudinal measurement feasible but also increases expectations for standardized clinical coding, follow-up capture, and interoperability. The same profile quantifies service utilization intensity (e.g., ~ outpatient visits per ~ at hospital-attached outpatient mental-health facilities), which is precisely the kind of throughput where outcome tracking, re-attendance rates, and discharge follow-up become operationally critical. The validation challenge is also supply-linked: the UAE’s workforce composition includes mental health nurses and other mental health workers, which often implies multi-disciplinary pathways where outcomes depend on coordinated care—not only a single therapist session. From a macro lens, the UAE’s high-income profile (USD ~ GDP per capita) increases payer and employer willingness to fund therapy, but it also heightens scrutiny: procurement teams and payers are more likely to demand evidence packages before expanding coverage. As a result, outcome validation is not merely a clinical issue; it is a commercialization requirement in the UAE, shaping contracting cycles, network credentialing, and renewal decisions for teletherapy providers operating under regulated facility frameworks.

Cultural Stigma Sensitivity

Cultural sensitivity remains a practical barrier because teletherapy is not only a clinical service—it is an interaction shaped by privacy expectations, family dynamics, and perceived social risk. The country profile indicates that the UAE has a specific anti-stigma strategy and confirms the existence of both school-based and work-related mental health programmes, reflecting that mental-health normalization is an active policy focus rather than a solved problem. At a system level, the UAE’s mental-health law and standards environment is maturing, which increases service availability but also requires careful handling of consent, confidentiality, and safeguarding. Demand-side sensitivity is amplified by the UAE’s highly connected environment: ~ million internet users on a population base of ~ million means digital behaviors are pervasive, yet privacy concerns can be heightened when sessions occur at home in shared living settings or within employer-linked benefit programs. From a macroeconomic standpoint, the UAE’s high income level (USD ~ GDP per capita) supports broader access to therapy, but stigma can still delay first contact—pushing consumers toward anonymous chat-based entry points, culturally adapted onboarding, and Arabic-language options that feel “safe.” In practice, providers must design for stigma sensitivity through discrete app branding, neutral appointment descriptors, robust privacy controls, and therapist training in culturally competent care. This challenge is especially relevant in multi-generational households and among certain expat communities where therapy norms vary. The UAE’s policy signals show momentum, but the market success of teletherapy still depends on trust-building features that reduce perceived reputational risk while meeting regulator expectations for documentation and safeguarding.

Opportunities

Insurance-Reimbursed Teletherapy

A major growth opportunity is the expansion of insurance-reimbursed teletherapy pathways, because reimbursement converts teletherapy from discretionary out-of-pocket spending into a scaled channel via payers, TPAs, and employer schemes. The UAE’s regulatory structure already positions payers inside the compliance perimeter, which is a direct foundation for broader reimbursement integration. The country profile also indicates that mental-health treatment is included in publicly funded financial protection schemes for conditions such as depression and anxiety, signaling policy legitimacy for coverage discussions even when benefit design varies by scheme. Macro capacity supports payer expansion: USD ~ billion GDP and USD ~ GDP per capita create fiscal space and commercial insurance maturity that can support structured provider networks, outcomes-based contracting, and digital care add-ons. On the demand side, service utilization is already high enough to justify payer attention; the profile reports ~ outpatient visits per ~ at hospital-attached outpatient mental-health facilities and recorded inpatient admissions, demonstrating that mental health is not a “low volume” category. The operational opportunity for insurers is clear: teletherapy can reduce friction in access, improve chronic disease co-management, and standardize provider performance via telehealth KPIs. For teletherapy providers, the market unlock is to build payer-ready products so insurers can reimburse confidently and scale across corporate books.

Arabic-Language Therapy Expansion

Arabic-language teletherapy is a high-impact opportunity because it directly addresses trust, stigma, and therapeutic alliance—key determinants of utilization and retention—while also supporting government anti-stigma and workplace program goals. The country profile confirms the UAE has a specific anti-stigma strategy and operating mental-health promotion programs, which creates a strong institutional context for expanding culturally aligned therapy delivery in Arabic across employer and public channels. Service volumes already justify localization: the UAE records ~ outpatient visits per ~ at hospital-attached outpatient mental-health outpatient facilities, indicating substantial system load where language-matched triage and therapy can improve early engagement and reduce escalation. Digital access supports scalable distribution: ~ million internet users on a population base of ~ million means Arabic therapy can be delivered via video, voice, and secure messaging across emirates without depending on clinic footprint expansion. Macro fundamentals reinforce commercial viability: USD ~ GDP per capita supports willingness to pay for premium counseling and therapy, while enabling employers and payers to fund bilingual access packages. On the supply side, workforce mix matters: the profile reports psychologists and psychiatrists; in a multilingual market, Arabic-capable therapist availability can be a binding constraint, making Arabic network-building a decisive differentiator for teletherapy platforms. Practically, the strongest go-to-market is to pair Arabic therapy expansion with regulated facility partnerships, culturally adapted onboarding, and discreet access features—so Arabic-speaking users can start therapy in a trusted environment and stay engaged over time.

Future Outlook

Over the next five years, the UAE Teletherapy market is expected to expand on the back of three compounding forces: higher patient comfort with virtual consults and repeat digital engagement, stronger payer and employer interest in mental-health cost management and faster access pathways, and tightening of standards that favors compliant, integrated platforms over informal or grey providers. DHA’s telehealth standards and KPI reporting frameworks make virtual care more auditable and scalable, which supports recurring therapy models rather than one-off consultations.

Major Players

- Okadoc

- TruDoc 24×7

- PureHealth / SEHA ecosystem

- Abu Dhabi Telemedicine Centre

- Teladoc Health

- Cleveland Clinic Abu Dhabi

- Mediclinic Middle East

- NMC Healthcare

- Aster DM Healthcare

- Philips

- GE HealthCare

- Oracle

- Zoom

- BetterHelp

Key Target Audience

- CEOs or Strategy Heads at Teletherapy and Digital Mental Health Platforms

- Chief Medical Officers or Clinical Governance Heads

- Heads of Behavioral Health or Psychiatry Departments at Provider Networks

- Directors of Digital Health or Virtual Care Programs

- Insurance Product Heads and Network Management Teams

- HR Benefits and Total Rewards Leaders

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

We construct the UAE teletherapy ecosystem map including platforms, provider networks, payers, regulators, and employer buyers. Desk research anchors the regulatory perimeter using telehealth standards and policy requirements, plus market databooks for sizing baselines.

Step 2: Market Analysis and Construction

We compile historical adoption signals including telehealth utilization KPIs, eRx enablement, and digital workflow maturity and align them with addressable teletherapy revenue pools. We also map the compliance-to-monetization linkage.

Step 3: Hypothesis Validation and Expert Consultation

We validate demand and supply hypotheses through expert interviews with platform operators, provider executives, insurer network heads, and licensed clinicians, focusing on conversion rates, utilization frequency, and enterprise procurement criteria.

Step 4: Research Synthesis and Final Output

We triangulate findings across top-down benchmarks and bottom-up operator inputs. Final outputs are stress-tested against UAE-specific regulatory requirements and operating realities in Dubai and Abu Dhabi care pathways.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Teletherapy Scope Delineation, Inclusion–Exclusion Criteria, Abbreviations, Market Engineering Framework, Top-Down Demand Estimation, Bottom-Up Revenue Modeling, Primary Stakeholder Interview Coverage, Secondary Validation Sources, Data Triangulation Logic, Bias Mitigation, Limitations and Forward Assumptions)

- Definition and Scope

- Evolution of Teletherapy within UAE Healthcare Digitalization

- Alignment with National Mental Health & Digital Health Frameworks

- Care Delivery Continuum Shift

- Teletherapy Value Chain and Service Architecture

- Growth Drivers

Digital Health Policy Enablement

Mental Health Demand Gap

Employer Absenteeism Cost Pressure

Smartphone Penetration

Expat Population Therapy Adoption - Challenges

Clinical Outcome Validation

Cultural Stigma Sensitivity

Therapist Licensing Portability

Data Localization Constraints

Long-Term Engagement Retention - Opportunities

Insurance-Reimbursed Teletherapy

Arabic-Language Therapy Expansion

Employer Preventive Mental Health Programs

Women-Focused Therapy Services - Trends

AI-Assisted Therapy Triage

Hybrid Care Pathways

Corporate Mental Health Dashboards

Outcome-Based Pricing - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Session Volume, 2019–2024

- By Platform Monetization Models, 2019–2024

- By Fleet Type (in Value %)

Cognitive Behavioral Therapy

Psychodynamic Therapy

Behavioral Therapy

Family and Couples Therapy

Trauma and PTSD Therapy - By Application (in Value %)

Anxiety Disorders

Depression and Mood Disorders

Stress and Burnout

Workplace Mental Health

Child and Adolescent Therapy - By Technology Architecture (in Value %)

Video-Based Therapy

Audio-Only Therapy

Text-Based and Chat Therapy

Hybrid and Asynchronous Models - By Connectivity Type (in Value %)

Independent Teletherapy Platforms

Hospital-Owned Digital Therapy Platforms

Insurer-Integrated Teletherapy Solutions

Employer-Sponsored Platforms

Marketplace Aggregator Models - By End-Use Industry (in Value %)

Individual Consumers

Employers and Corporate Wellness Programs

Insurance Companies and TPAs

Hospitals and Clinics

Educational Institutions - By Region (in Value %)

Dubai

Abu Dhabi

Sharjah

Northern Emirates

- Market Share Analysis by Platform Type

- Cross Comparison Parameters (Clinical Modalities Coverage, Therapist Network Depth, Licensing Jurisdiction Coverage, Insurance Integration Capability, Data Residency Compliance, Enterprise Wellness Penetration, AI and Analytics Maturity, Patient Retention Metrics)

- Strategic Positioning Matrix

- SWOT Analysis of Key Players

- Pricing and Monetization Models Analysis

- Detailed Company Profiles

Okadoc

TruDoc 24×7

Cura Healthcare

Altibbi

Vezeeta

MindTales

Shezlong

BetterHelp (UAE users)

Talkspace (UAE users)

Nafs Psychological Services

Maudsley Health Abu Dhabi Digital Services

Aster Telehealth

Mediclinic Virtual Care

PureHealth Digital Platforms

- Therapy Demand Patterns and Utilization Frequency

- Budget Ownership and Payment Pathways

- Buyer Expectations and Outcome Benchmarks

- Decision-Making Criteria and Vendor Selection Logic

- Pain Point and Drop-Off Analysis Across User Cohorts

- By Value, 2025–2030

- By Session Volume, 2025–2030

- By End-User Adoption, 2025–2030