Market Overview

The UAE TENS Units Devices market current size stands at around USD ~ million, supported by steady institutional procurement and expanding homecare adoption across pain management pathways. The market reflects a diversified device mix spanning portable units, wearable patches, and clinic-grade systems, with purchasing influenced by clinician preference, patient compliance, and availability through regulated medical device channels. Distribution depth across pharmacies, specialized distributors, and digital commerce platforms sustains accessibility, while service support and regulatory clearance shape vendor participation and portfolio breadth.

Demand concentration is highest in Dubai and Abu Dhabi due to dense healthcare infrastructure, advanced rehabilitation networks, and higher penetration of private physiotherapy chains. These cities benefit from mature clinical referral ecosystems, specialist pain clinics, and sports medicine centers embedded within hospital networks. Sharjah and the Northern Emirates show accelerating uptake driven by expanding outpatient facilities, improved last-mile distribution, and growing homecare orientation supported by digital retail logistics and device registration frameworks.

Market Segmentation

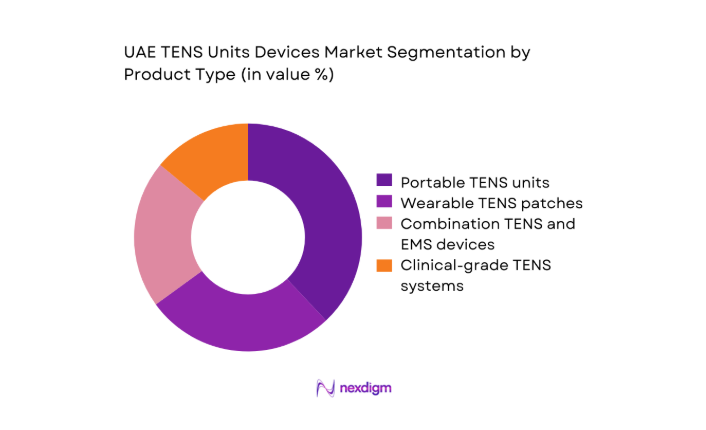

By Product Type

Portable and wearable TENS formats dominate purchasing behavior due to convenience, adherence advantages, and suitability for home-based pain management across chronic and post-injury care pathways. Compact devices align with outpatient physiotherapy protocols and self-use routines, enabling continuity between clinic sessions and home recovery. Combination formats that integrate neuromuscular stimulation are increasingly specified by rehabilitation providers seeking protocol versatility within limited device inventories. Clinical-grade systems remain concentrated within hospital departments and specialized pain clinics, where multi-channel configurations and clinician-led titration protocols are required. Retail channel merchandising and digital commerce further reinforce consumer preference for discreet, rechargeable form factors with simplified electrode replacement cycles and multilingual instructions.

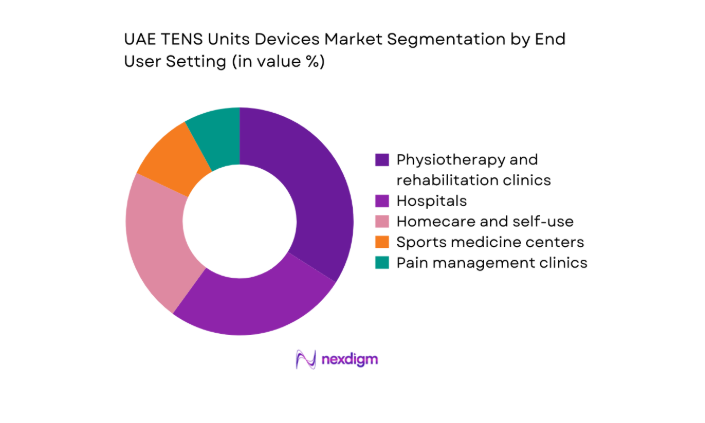

By End User Setting

Physiotherapy and rehabilitation clinics represent the primary utilization environment due to standardized care pathways integrating electrotherapy into routine musculoskeletal recovery programs. Hospitals account for protocolized usage within post-operative and pain management units, where supervised sessions and infection control standards guide device selection. Homecare and self-use continues to expand as patients transition from clinic-led therapy to maintenance regimens, supported by pharmacist guidance and digital purchasing channels. Sports medicine centers and pain clinics drive specialized demand tied to athlete recovery cycles and chronic pain caseloads. Procurement practices increasingly favor devices with durable consumables, rapid servicing, and training support to sustain utilization consistency across settings.

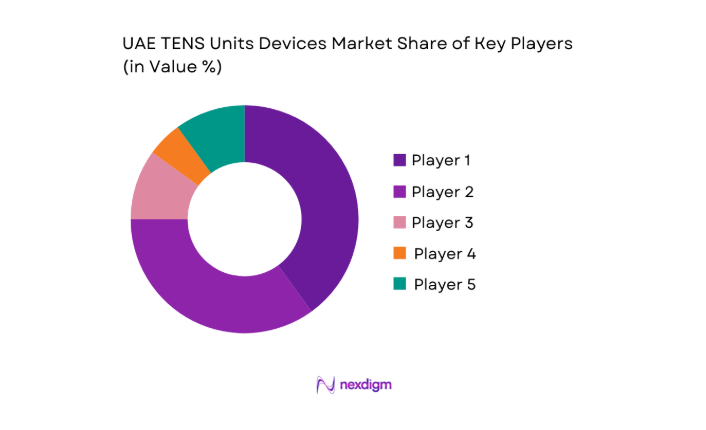

Competitive Landscape

The competitive environment is shaped by differentiated product portfolios, regulatory preparedness, and distribution partnerships across clinical and retail channels. Players compete on device reliability, service responsiveness, channel strength, and portfolio breadth aligned with outpatient rehabilitation and homecare use cases.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Omron Healthcare | 1933 | Kyoto, Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Beurer GmbH | 1919 | Ulm, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Chattanooga Group | 1947 | Hixson, US | ~ | ~ | ~ | ~ | ~ | ~ |

| TensCare | 1992 | Epsom, UK | ~ | ~ | ~ | ~ | ~ | ~ |

| Drive DeVilbiss Healthcare | 2000 | Port Washington, US | ~ | ~ | ~ | ~ | ~ | ~ |

UAE TENS Units Devices Market Analysis

Growth Drivers

Rising prevalence of chronic musculoskeletal pain and lifestyle disorders

Musculoskeletal conditions drive sustained utilization across outpatient rehabilitation networks. In 2023, 612 licensed physiotherapy facilities operated nationally, up from 548 in 2022, expanding therapy access points. Orthopedic outpatient visits exceeded 1,800,000 in 2024 across public and private providers, reflecting higher care-seeking behavior for back, neck, and joint pain. Workplace injury notifications reached 41,300 in 2023 under labor reporting systems, increasing referral volumes into rehabilitation pathways. Sports participation registrations across federations surpassed 96,000 in 2024, elevating demand for recovery modalities. Urban commuting patterns added 2,400 kilometers of annual vehicle travel per capita in 2023, correlating with sedentary strain patterns documented in clinical registries nationwide.

Increasing adoption of non-pharmacological pain management approaches

Clinical protocols increasingly emphasize adjunctive electrotherapy to limit reliance on analgesics. In 2024, 173 multidisciplinary pain clinics operated nationally, compared with 141 in 2022, expanding non-drug intervention capacity. National clinical guideline updates issued in 2023 referenced device-based modalities within conservative pain pathways across 6 specialty areas. Continuing medical education programs logged 1,260 clinician enrollments in rehabilitation technologies during 2024, up from 840 in 2022, improving protocol familiarity. Insurance preauthorization approvals for physiotherapy sessions reached 2,150,000 in 2024, reinforcing pathway continuity. Hospital day-surgery volumes exceeded 612,000 cases in 2023, increasing post-procedure rehabilitation referrals where adjunctive electrotherapy is routinely incorporated into standardized recovery protocols nationwide.

Challenges

Limited awareness of TENS efficacy among general consumers

Consumer understanding of electrotherapy remains uneven outside clinical settings. In 2023, only 418 retail pharmacies offered in-store guidance on device-based pain relief, compared with 612 physiotherapy facilities providing supervised instruction. Public health outreach events addressing musculoskeletal self-care totaled 74 in 2024 across emirates, insufficient relative to outpatient orthopedic visits exceeding 1,800,000. Digital health literacy programs reached 92,000 participants in 2023, leaving gaps in correct electrode placement and protocol adherence. Device returns related to improper usage logged 3,240 cases in 2024 through distributor service records. Multilingual instruction availability covered 6 languages, yet expatriate populations speak more than 20 languages, complicating standardized consumer education nationwide across retail channels.

Clinical skepticism and inconsistent prescribing by physicians

Adoption varies by specialty due to heterogeneous evidence familiarity. In 2022, only 38 rehabilitation departments documented standardized electrotherapy protocols, rising to 64 by 2024, indicating gradual but uneven institutionalization. Clinical audit participation across pain services reached 112 facilities in 2023, highlighting protocol variability in device selection and session frequency. Medical device training workshops accredited 420 physicians in 2024, compared with 290 in 2022, leaving coverage gaps across primary care networks. Referral rates from primary care into physiotherapy exceeded 1,120,000 in 2023, yet device recommendations were recorded in only 214,000 cases within referral documentation systems, reflecting conservative prescribing behavior and preference for traditional modalities.

Opportunities

Integration of TENS with digital health and mobile applications

Digital health infrastructure supports connected rehabilitation tools. National telehealth consultations exceeded 2,400,000 in 2024, up from 1,680,000 in 2022, expanding channels for remote therapy guidance. Mobile health application registrations surpassed 4,600,000 users in 2023 across wellness and chronic care platforms, enabling integration of usage reminders and session tracking. Interoperability frameworks adopted by 19 hospital networks in 2024 facilitate device data linkage to electronic records. Broadband household penetration reached 99 in 2023, supporting stable connectivity for companion applications. Remote patient monitoring pilots across 28 facilities in 2024 included neuromodulation adjuncts within rehabilitation bundles, validating scalable deployment across home-based recovery pathways nationwide.

Expansion into employer wellness and corporate health programs

Corporate wellness programs provide structured distribution channels. In 2023, 1,420 enterprises operated formal employee health initiatives, up from 1,060 in 2022, broadening access to preventive pain management tools. Occupational health clinics recorded 312,000 consultations in 2024, creating touchpoints for device introduction within ergonomic injury prevention programs. Workplace musculoskeletal risk assessments increased to 184,000 audits in 2023 across regulated sectors, highlighting unmet recovery support needs. Corporate insurance enrollments reached 5,200,000 covered employees in 2024, enabling bundled rehabilitation benefits. Onsite wellness participation events expanded to 2,740 sessions in 2024, creating scalable channels for guided adoption and ongoing utilization support.

Future Outlook

Through 2025–2030, device form factors are expected to continue shifting toward discreet wearables integrated with digital guidance tools. Urban rehabilitation networks will remain focal adoption hubs, while expanding homecare logistics will extend access beyond metropolitan centers. Regulatory streamlining and clinician training programs are likely to normalize protocol usage across specialties. Employer wellness channels and remote care models will further embed device-based adjunct therapies within conservative pain management pathways nationwide.

Major Players

- Omron Healthcare

- Beurer GmbH

- Chattanooga Group

- TensCare

- Drive DeVilbiss Healthcare

- Verity Medical

- iReliev

- Neurotech

- HealthmateForever

- Trumedic

- Zynex Medical

- Bluetens

- Naipo

- Med-Fit

- Beurer Medical

Key Target Audience

- Hospital procurement departments

- Physiotherapy and rehabilitation clinic networks

- Homecare service providers

- Sports medicine and performance centers

- Retail pharmacy chains

- Medical device distributors and importers

- Investments and venture capital firms

- Government and regulatory bodies with agency names

Research Methodology

Step 1: Identification of Key Variables

Core variables were mapped across device modalities, clinical applications, care settings, and channel structures, alongside regulatory clearance pathways and service requirements. Utilization contexts were defined for outpatient rehabilitation, hospital pain services, and homecare adoption. Demand drivers and operational constraints were framed through healthcare delivery workflows.

Step 2: Market Analysis and Construction

Segment structures were constructed by product formats and end user settings, aligning device features with care pathways and procurement practices. Channel dynamics were assessed across hospital tenders, distributor networks, pharmacy retail, and digital commerce. Ecosystem interactions between clinicians, payers, and service partners were integrated into analytical frameworks.

Step 3: Hypothesis Validation and Expert Consultation

Clinical workflows, adoption barriers, and protocol usage patterns were validated through structured consultations with rehabilitation practitioners and device service teams. Regulatory processes and device registration pathways were reviewed with compliance specialists. Channel performance assumptions were cross-checked with distributor operations teams and service engineers.

Step 4: Research Synthesis and Final Output

Findings were synthesized into coherent narratives linking demand drivers, adoption constraints, and opportunity pathways. Segment insights were stress-tested for internal consistency across care settings and channels. Final outputs were structured to support strategic planning, channel prioritization, and product positioning decisions.

- Executive Summary

- Research Methodology (Market Definitions and classification of TENS modalities, Primary interviews with UAE physiotherapists and pain specialists, Hospital and clinic procurement data analysis, Distributor and pharmacy channel audits)

- Definition and Scope

- Market evolution

- Usage and care pathways

- Ecosystem structure

- Supply chain and channel structure

- Growth Drivers

Rising prevalence of chronic musculoskeletal pain and lifestyle disorders

Increasing adoption of non-pharmacological pain management approaches

Growth of physiotherapy and rehabilitation clinics in urban centers - Challenges

Limited awareness of TENS efficacy among general consumers

Clinical skepticism and inconsistent prescribing by physicians

Price sensitivity in retail and homecare segments - Opportunities

Integration of TENS with digital health and mobile applications

Expansion into employer wellness and corporate health programs

Partnerships with physiotherapy chains and sports academies - Trends

Shift toward wearable and discreet TENS form factors

Growing demand for rechargeable and wireless devices - Government Regulations

- SWOT Analysis

- Porter’s Five Forces Analysis

- By Value, 2019–2024

- By Shipment Volume, 2019–2024

- By Active Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Product Type (in Value %)

Portable TENS units

Wearable TENS patches

Combination TENS and EMS devices

Clinical-grade TENS systems - By Modality and Technology (in Value %)

Conventional TENS

Acupuncture-like TENS

Burst TENS

Smartphone-connected TENS - By Application (in Value %)

Chronic musculoskeletal pain

Post-operative pain management

Sports injury and rehabilitation

Neuropathic pain

Labor pain management - By End User Setting (in Value %)

Hospitals

Physiotherapy and rehabilitation clinics

Homecare and self-use

Sports medicine centers

Pain management clinics - By Distribution Channel (in Value %)

Hospital procurement and tenders

Medical device distributors

Retail pharmacies

- Market share of major players

- Cross Comparison Parameters (Product portfolio breadth, Device technology and connectivity, Regulatory approvals in UAE, Pricing and margin positioning, Distribution network coverage, After-sales service and warranties, Brand recognition among clinicians, Local partnerships and representation)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Omron Healthcare

Beurer GmbH

iReliev

Chattanooga Group

Med-Fit

Beurer Medical

TensCare

Neurotech

HealthmateForever

Verity Medical

Drive DeVilbiss Healthcare

Trumedic

Zynex Medical

Bluetens

Naipo

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- By Value, 2025–2030

- By Shipment Volume, 2025–2030

- By Active Installed Base, 2025–2030

- By Average Selling Price, 2025–2030