Market Overview

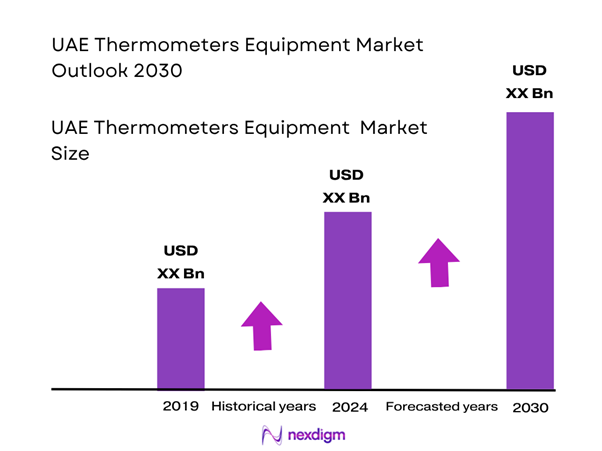

The UAE thermometers market is valued at USD ~ million in 2024, as reported by a country-specific analysis. This expansion is driven by rising healthcare infrastructure investment in the UAE, increasing demand for both medical and non-medical temperature-measuring devices (hospital clinics, homecare, industrial monitoring), and the shift away from mercury-based thermometers toward digital and infrared equivalents.

Key emirates such as Dubai and Abu Dhabi dominate the UAE thermometers equipment market owing to their concentration of healthcare facilities, high-end diagnostic clinics, and large import/distribution hubs. These cities have major hospitals, medical device procurement agencies, advanced industrial-monitoring needs, and high consumer wealth for home-use thermometers. Their role as trade and logistics hubs also supports faster deployment of new thermometer technologies, making them primary demand centres for thermometer.

Market Segmentation

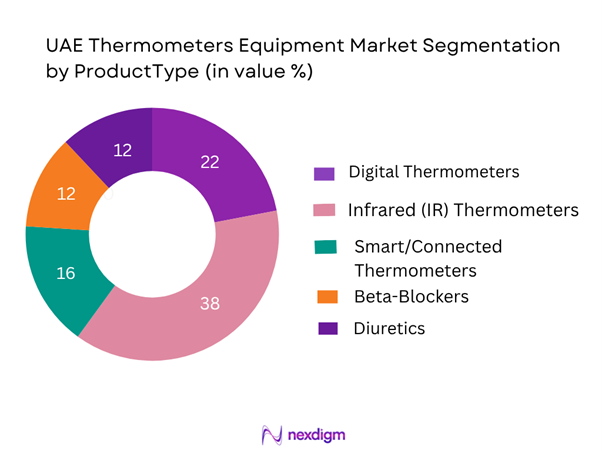

By Product Type

The UAE thermometers equipment market is segmented by product type into Digital Thermometers, Infrared (IR) Thermometers, Smart/Connected Thermometers, Mercury Thermometers, and Accessories/Probe Covers. In 2024, the Infrared (IR) Thermometers sub-segment dominates with approximately 38% market share. The dominance arises because IR devices appeal for non-contact measurement (vital during infection control & public-health screening) and are increasingly adopted in hospitals, schools, airports and industrial settings. Their ease of use and perception of safety versus contact-type thermometers make IR the preferred format for new purchases.

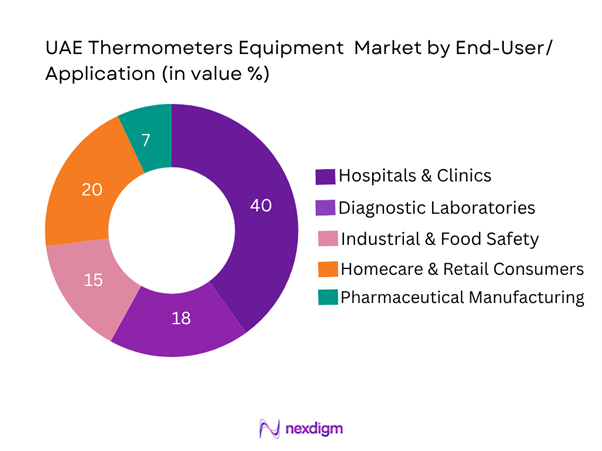

By End-User/Application

The market is segmented by end-user/application into Hospitals & Clinics, Diagnostic Laboratories, Industrial & Food Safety, Homecare & Retail Consumers, and Pharmaceutical Manufacturing. In 2024, Hospitals & Clinics hold the leading share at about 40%. The reason is that these institutions procure high-accuracy thermometer equipment (medical-grade digital, IR and smart devices) in volume for patient screening, post-operative monitoring and infection control. Their large procurement budgets, regulatory requirements and need for standardised equipment place them as the dominant end-user segment in the UAE thermometer equipment market.

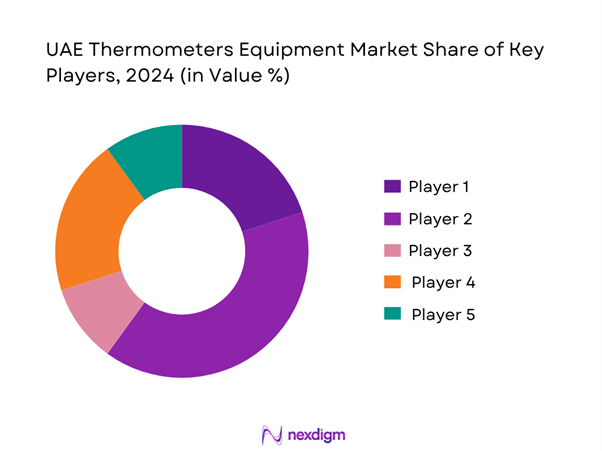

Competitive Landscape

The UAE thermometers equipment market features a mixture of global medical-device brands and regional distributors/importers active in the supply of digital, IR and smart thermometry devices. While no single company dominates fully, a handful of major players exert significant influence via supply agreements, service-calibration networks and regional logistics.

| Company | Establishment Year | Headquarters | Local Distribution Partner | Device Portfolio Focus (Thermometry) | Service & Calibration Network | Smart/IoT Feature Presence | Recent Regional Move |

| Omron Healthcare | 1933 | Kyoto, Japan | – | – | – | – | – |

| Braun GmbH | 1921 | Kronberg, Germany | – | – | – | – | – |

| Microlife Corporation | 1981 | Widnau, Switzerland | – | – | – | – | – |

| Terumo Corporation | 1921 | Tokyo, Japan | – | – | – | – | – |

| Extech Instruments | 1971 | Nashua, USA | – | – | – | – | – |

UAE Thermometers Equipment Market Analysis

Key Growth Drivers

Expanding Healthcare Infrastructure & Preventive Diagnostics Uptake

In the United Arab Emirates, health expenditure per capita reached approximately USD 2,315 in 2022, rising from USD 2,250 in 2021, indicating growing investment in healthcare infrastructure and diagnostics. As healthcare facilities upgrade and expand their medical-device portfolios, demand for accurate thermometer equipment in hospitals, clinics, and homecare settings increases. The development of new diagnostic centres and government-led preventive health programmes drives the adoption of digital, infrared and smart thermometers for patient screening and monitoring.

Rise in Industrial & Food Safety Temperature Monitoring Norms

The UAE’s diversified economy and large industrial base necessitate rigorous temperature-monitoring solutions across food processing, cold-chain logistics and manufacturing sectors. With industrial safety regulations and food-safety standards becoming stricter, companies increasingly procure thermometer equipment for compliant operations. Such adoption beyond the healthcare sector broadens the addressable market for thermometry devices in the UAE, enabling growth in both medical-grade and industrial-grade thermometer equipment.

Key Market Challenges

Import Dependence on Sensor Components and Calibration Instruments

The UAE’s medical-device sector heavily relies on imported sensor modules, calibration equipment and precision hardware. Because local manufacturing of key thermometer components remains minimal, disruptions in global supply chains or delays in customs clearance can impact device availability. This dependency on foreign-sourced parts increases lead-times and cost risk for suppliers of thermometer equipment within the UAE market, posing a challenge for market expansion.

Regulatory Barriers for Medical Device Licensing (MOHAP, ESMA)

In the UAE, thermometer equipment intended for clinical use must obtain registration and certification under regulatory authorities such as the Ministry of Health and Prevention (MOHAP) and Emirates Authority for Standardization & Metrology (ESMA). The registration process requires compliance documentation, device-listing, and calibration traceability. These requirements lengthen time to market and increase costs for thermometer-equipment suppliers, especially for smaller firms, thus restricting rapid device deployment in the UAE market.

Emerging Opportunities

Integration of IoT & AI in Smart Thermometers

Connected thermometer equipment with IoT integration and AI-powered analytics represent a major opportunity in the UAE market. With digital-health initiatives rising and tele-health adoption gaining traction, smart thermometers capable of remote monitoring, data logging and cloud analytics appeal to both institutional and home-care segments. Device manufacturers and service providers focusing on IoT-enabled thermometer equipment can capture the growing requirement for digital health-ecosystem integration in the UAE.

Expansion of School and Workplace Health Programs

Educational institutions and corporate offices in the UAE increasingly implement health-screening protocols to monitor employee/student wellness. Thermometer equipment deployment in schools, colleges and offices provides a new growth channel. As firms and institutions invest in wellness programmes and temperature-monitoring stations, the demand for reliable and easy-to-use thermometer devices suitable for high-traffic environments expands significantly.

Future Outlook

Over the forecast period, the UAE thermometers equipment market is expected to continue growing as healthcare investments rise, infection-control and public-health monitoring intensify, and IoT-enabled temperature measurement devices proliferate. Demand from home-monitoring, industrial safety monitoring, and food-chain compliance will drive diversification of product types. Additionally, rising government initiatives for smart health and digital hospital infrastructure in the UAE will stimulate adoption of connected and cloud-based thermometry solutions. Firms positioning themselves for calibration-service support, smart-device integration and regional distribution will be best placed to capture future growth.

Major Players

- Omron Healthcare

- Braun GmbH

- Microlife Corporation

- Terumo Corporation

- Extech Instruments

- 3M Company

- Welch Allyn (Hill-Rom)

- Medline Industries

- Rossmax International Ltd.

- Citizen Systems Japan Co., Ltd.

- Fluke Biomedical

- BPL Medical Technologies

- Beurer GmbH

- Vicks (RB)

- A&D Medical

Key Target Audience

- Medical device manufacturers and importers

- Institutional procurement departments (hospitals & clinics)

- Distribution & calibration service companies

- Investment and venture capitalist firms

- Retail pharmacy chains and e-commerce device platforms

- Industrial safety & food-safety equipment buyers

- Government and regulatory bodies (e.g., UAE Ministry of Health & Prevention – MOHAP)

- Healthcare technology integrators and hospital IT/biomed teams

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing an ecosystem map of the UAE thermometers equipment market, including variables such as product type (digital, IR, smart), end users (hospital, homecare, industrial), distribution channels, and service/calibration networks. Secondary sources like Grand View Research and mobility foresights were screened to define scope and product categories.

Step 2: Market Analysis and Construction

In this phase, historical data (e.g., the 2024 market value of USD 22.8 million) from published country-specific reports were collated and segmented by product type and end-user. Volume proxies, average unit prices, and distribution channel insights were modelled to build a bottom-up estimate aligned with market structure.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses regarding growth drivers (e.g., transition to non-contact/IR thermometers, increased homecare adoption) were validated through expert interviews with regional device distributors, hospital biomedical engineers and calibration service providers in the UAE. Their operational feedback refined assumptions about adoption rates and replacement cycles.

Step 4: Research Synthesis and Final Output

The final phase integrated desk research, expert insights and modelling to produce the comprehensive market report. The data were triangulated across multiple sources to ensure reliability, and the output was formatted for business-professional stakeholders with segmentation, competitive landscape, future outlook and actionable takeaways.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Historical Development

- Timeline of Major Product Introductions and Regulatory Shifts

- Industry Value Chain (Raw Material, Sensor Components, Assembly, Calibration, Distribution)

- Supply Chain Structure and Import-Export Analysis

- Key Growth Drivers

Expanding Healthcare Infrastructure & Preventive Diagnostics Uptake

Rise in Industrial & Food Safety Temperature Monitoring Norms

Growth in Smart and Connected Health Devices

Rising Population of Elderly and Pediatric Patients

Increasing Government Health Expenditure per Capita - Market Challenges

Import Dependence on Sensor Components and Calibration Instruments

Regulatory Barriers for Medical Device Licensing (MOHAP, ESMA)

Price Sensitivity and Commoditization of Digital Thermometers

Counterfeit Imports and Quality Assurance Issues

Short Product Replacement Cycles - Opportunities

Integration of IoT & AI in Smart Thermometers

Expansion of School and Workplace Health Programs

Investment in Local Assembly and Calibration Facilities

Growing Demand from Cold Chain Logistics and Pharma Storage

Smart Hospital Deployments under UAE Vision 2031 - Trends

Wireless Temperature Monitoring Adoption

Data Connectivity with EMR/EHR Systems

Preference for Non-Contact IR Devices in Infection Control

Rise of B2C E-commerce for Medical Devices - Government Regulation

MOHAP Medical Device Registration Requirements

ESMA Product Safety and Calibration Standards

Healthcare Import and Customs Clearance Procedures

Occupational Safety Regulations for Industrial Thermometers - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Unit Price, 2019-2024

- By Product Type (In Value %)

Digital Thermometers

Infrared (IR) Thermometers

Smart/Connected Thermometers

Mercury Thermometers

Disposable Probe Covers & Accessories - By Technology (In Value %)

Contact Thermometers (Electronic, Digital Probe, Ear)

Non-Contact Thermometers (Infrared, Thermal Imaging, Temporal Scanners)

IoT-Enabled and Cloud-Linked Temperature Devices

Wireless Sensor-Based Thermometry Systems - By End User (In Value %)

Hospitals & Clinics

Diagnostic Laboratories

Industrial & Food Safety Applications

Homecare & Retail Consumers

Pharmaceutical Manufacturing - By Distribution Channel (In Value %)

Hospital Supply Distributors

Retail Pharmacies

Online Marketplaces & E-Commerce

Direct Institutional Sales - By Region (In Value %)

Dubai

Abu Dhabi

Sharjah & Northern Emirates

Western Region

- Market Share of Major Players (By Value and Volume)

- Cross-Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, R&D Investments, Sensor Accuracy and Technology Capability, After-Sales and Calibration Network, Supply Chain & Distribution Strength, Local Manufacturing/Assembly Presence, Digital Integration and Smart Device Portfolio)

- SWOT Analysis of Major Players

Pricing Analysis by Product SKU (Digital, IR, Smart) - Detailed Profiles of Major Companies

Omron Healthcare

Braun GmbH

Microlife Corporation

Terumo Corporation

Fluke Biomedical

PCE Instruments

Extech Instruments

Rossmax International

Vicks Health Devices

Citizen Systems Japan

3M Healthcare

Medline Industries

BPL Medical Technologies

Philips Healthcare

Beurer GmbH

- Usage Volume by Institution Type

- Procurement & Tendering Process

- Maintenance & Calibration Requirements

- End-User Satisfaction Trends

- Purchase Decision Drivers

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Unit Price, 2025-2030