Market Overview

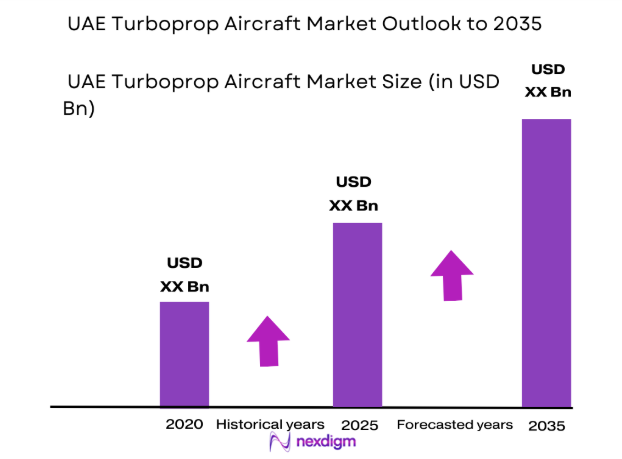

The UAE turboprop aircraft market has witnessed steady growth driven by increasing demand for regional connectivity, particularly for smaller aircraft used in shorter routes. As of a recent historical assessment, the market size is valued at USD ~ billion, with the market being propelled by the growing need for faster and more cost-efficient transportation options within the UAE and neighboring regions. The market’s expansion is also supported by technological advancements in aircraft propulsion systems, enabling improved fuel efficiency and operational costs. Strong investment in aviation infrastructure further supports the growth, ensuring a positive market trajectory in the coming years.

The UAE is a dominant player in the market due to its strategic location between Asia, Europe, and Africa, making it a global hub for air travel. Major airports like Dubai International and Abu Dhabi International serve as key hubs for both commercial and private aviation. The country’s proactive government policies, including investments in airport infrastructure and aviation services, have helped attract airlines and private operators to the region. Furthermore, the increasing demand for leisure travel and corporate aviation, coupled with a growing focus on defense and military spending, consolidates the UAE’s position as a leading player in the turboprop aircraft market.

Market Segmentation

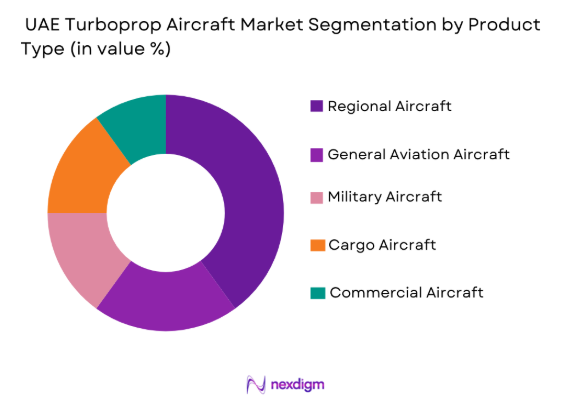

By Product Type

The UAE turboprop aircraft market is segmented by product type into regional aircraft, general aviation aircraft, military aircraft, cargo aircraft, and commercial aircraft. Recently, regional aircraft have a dominant market share due to the rising demand for efficient, smaller aircraft suited for short-distance travel within the UAE and surrounding areas. This is attributed to factors such as the need for more flexible travel options between secondary airports, coupled with cost-effective solutions for airlines operating in niche markets. Regional aircraft’s popularity is further driven by advancements in fuel efficiency, reduced operating costs, and the ability to access underserved regional airports that are vital to the UAE’s transport infrastructure.

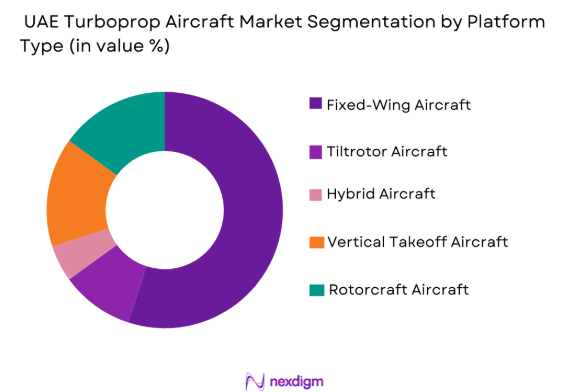

By Platform Type

The UAE turboprop aircraft market is segmented by platform type into fixed-wing aircraft, tiltrotor aircraft, hybrid aircraft, vertical takeoff aircraft, and rotorcraft aircraft. Fixed-wing aircraft dominate the market share due to their reliability, operational efficiency, and better fuel economy on longer regional routes. These aircraft are highly preferred for both commercial and military applications in the UAE, where efficiency, reliability, and speed are essential. Additionally, the robust support infrastructure available for fixed-wing aircraft in the UAE, such as airstrips and maintenance facilities, further drives their demand and market leadership.

Competitive Landscape

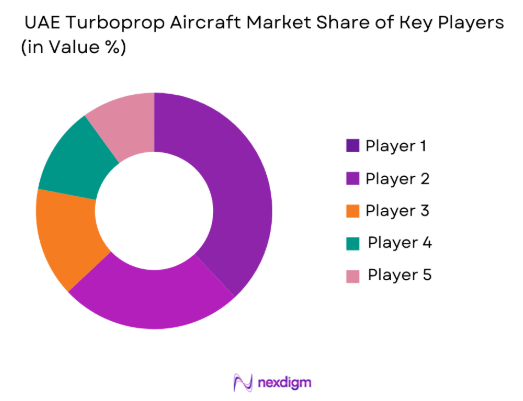

The competitive landscape of the UAE turboprop aircraft market is influenced by the consolidation of key players that offer a wide range of aircraft to cater to commercial, military, and cargo demands. Major players dominate the market due to their advanced technological capabilities, strong brand presence, and extensive service networks. The competition is marked by a focus on providing cost-effective, fuel-efficient, and versatile aircraft to meet diverse needs. Players are also engaged in strategic collaborations and innovations to strengthen their market position.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Bombardier Aviation | 1968 | Canada | ~ | ~ | ~ | ~ | ~ |

| ATR Aircraft | 1981 | France | ~ | ~ | ~ | ~ | ~ |

| Pilatus Aircraft | 1939 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| Cessna Aircraft | 1927 | USA | ~ | ~ | ~ | ~ | ~ |

| Beechcraft | 1932 | USA | ~ | ~ | ~ | ~ | ~ |

UAE Turboprop Aircraft Market Analysis

Growth Drivers

Technological Advancements

Technological advancements in turboprop engine technology have been a key driver of the UAE market. Improvements in engine efficiency, noise reduction, and fuel economy make turboprop aircraft an attractive choice for regional and general aviation. The rising demand for cost-effective travel solutions, coupled with the environmental benefits of these advanced engines, has propelled the growth of turboprop aircraft in the UAE. The increasing number of regional routes within the UAE and nearby countries further encourages airlines to adopt turboprop aircraft, ensuring that they can serve smaller airports that larger jets cannot access. The adoption of hybrid and electric propulsion technologies also presents future growth opportunities in this segment. Additionally, governments’ focus on reducing carbon emissions from the aviation sector contributes to the preference for these more efficient aircraft. Airlines operating on short regional routes are increasingly integrating advanced turboprop solutions to minimize operational costs while expanding their fleet capabilities.

Infrastructure Development

The rapid development of aviation infrastructure across the UAE has been another key driver of the turboprop aircraft market. The UAE government has invested heavily in improving and expanding airports, which has led to an increase in passenger and freight traffic, thereby fueling demand for more regional aircraft. The UAE’s robust infrastructure supports the growth of smaller airports, which are essential for operating turboprop aircraft. This infrastructural growth has encouraged private operators and smaller airlines to deploy turboprop aircraft on underserved routes, further driving demand. Additionally, the rise of low-cost carriers (LCCs) in the region is driving the adoption of turboprop aircraft, as these aircraft are often more cost-effective for LCCs to operate on shorter regional routes. The UAE’s efforts to build a connected, efficient, and sustainable transport network have contributed to the increasing penetration of turboprop aircraft in its aviation market.

Market Challenges

High Capital Investment

The initial capital investment required for purchasing turboprop aircraft remains a significant challenge for both established and emerging players in the UAE market. These aircraft can cost anywhere between USD 4 million and USD 40 million, depending on their specifications, which places a substantial financial burden on airlines and operators. Additionally, the cost of infrastructure development to support these aircraft, including specialized maintenance facilities, is another major barrier to entry. Despite the low operating costs of turboprop aircraft, the initial investment can deter smaller airlines or operators with limited access to funding, thus hindering the growth potential of the market. Furthermore, the competition from larger, more established jet aircraft, which offer higher capacities and longer ranges, presents an ongoing challenge for the turboprop segment in the UAE.

Operational Costs and Maintenance

Despite the fuel efficiency of turboprop aircraft, they still incur considerable operational and maintenance costs, particularly in older models. Routine maintenance and the need for spare parts can be expensive, especially for aircraft operating in harsh desert climates, which can accelerate wear and tear. The requirement for regular overhauls of engines and propellers also adds to the maintenance burden, making the cost of ownership relatively high for operators. Moreover, ensuring that maintenance and repair facilities are sufficiently equipped to handle turboprop aircraft poses logistical challenges for operators. The high maintenance costs associated with these aircraft can make them less attractive for small and medium-sized operators, limiting their market penetration.

Opportunities

Expansion of Regional Connectivity

There is a growing opportunity for the expansion of regional connectivity within the UAE and the broader GCC region. As the demand for shorter, more direct flights increases, turboprop aircraft are becoming a preferred choice due to their ability to operate on smaller, regional airports with limited infrastructure. Turboprop aircraft are better suited for connecting remote or underserved locations where larger jets cannot operate, thus increasing their potential to cater to a larger population and expanding regional tourism and business travel. Additionally, airlines seeking to provide services between smaller cities or those serving less-demanding routes are increasingly adopting turboprop aircraft to achieve a cost-efficient operation. This trend provides a considerable growth opportunity for turboprop aircraft manufacturers and operators in the UAE.

Innovation in Hybrid and Electric Aircraft

With growing environmental concerns, there is significant potential for innovation in hybrid and electric turboprop aircraft in the UAE. These technologies aim to reduce fuel consumption and carbon emissions, positioning turboprop aircraft as more sustainable and environmentally friendly options for regional and short-distance flights. Hybrid and electric propulsion systems also offer the potential for lower operational costs due to reduced fuel consumption, making them an attractive proposition for airlines operating on cost-sensitive routes. Furthermore, government initiatives aimed at reducing the carbon footprint of aviation further support the adoption of these innovative technologies. Companies that invest in hybrid and electric turboprop aircraft stand to benefit from the growing demand for eco-friendly aviation solutions in the UAE market.

Future Outlook

The UAE turboprop aircraft market is poised for continued growth over the next five years, driven by expanding regional air travel and technological innovations. With rising demand for fuel-efficient, cost-effective transportation options, the adoption of turboprop aircraft will continue to increase. Technological advancements, particularly in hybrid and electric aircraft, are expected to revolutionize the market, offering more sustainable solutions. Additionally, government support for aviation infrastructure and the expansion of low-cost carriers will further stimulate the market. Regulatory initiatives promoting environmentally friendly aviation technologies will likely shape the market dynamics and encourage further investment in the turboprop segment.

Major Players

- Bombardier Aviation

- ATR Aircraft

- Pilatus Aircraft

- Cessna Aircraft

- Beechcraft

- Textron Aviation

- Mitsubishi Aircraft Corporation

- Saab Group

- Daher Aerospace

- Viking Air

- Super Aviation

- Embraer

- Lockheed Martin

- General Dynamics

- Gulfstream Aerospace

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft leasing companies

- Aviation fleet operators

- Aircraft maintenance and service providers

- Regional airline operators

- Aviation infrastructure developers

- Military and defense agencies

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the key variables impacting the turboprop aircraft market, such as technological advancements, fuel efficiency, regulatory frameworks, and regional travel demand.

Step 2: Market Analysis and Construction

Comprehensive market analysis is conducted by evaluating historical market data, current trends, and growth projections to construct a robust and accurate market model.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultation is carried out to validate hypotheses and ensure the findings align with real-world conditions, focusing on industry trends, technological developments, and market constraints.

Step 4: Research Synthesis and Final Output

The research findings are synthesized to produce the final market report, ensuring the output is consistent, actionable, and based on reliable data sources for strategic decision-making.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Demand for Regional Air Connectivity

Advancements in Turboprop Engine Technology

Increase in Military & Defense Spending

Economic Growth Boosting Private Aircraft Demand

Government Investments in Aviation Infrastructure - Market Challenges

High Capital Expenditure in Aircraft Procurement

Regulatory Compliance and Certification Delays

Limited Availability of Skilled Workforce

Dependence on Oil Prices Impacting Affordability

Maintenance & Operational Costs for Older Aircraft - Market Opportunities

Expansion of Regional Aviation Networks

Development of Sustainable Aviation Technologies

Emerging Demand for Hybrid and Electric Aircraft - Trends

Growing Popularity of Fuel-Efficient Aircraft

Shift Toward Lightweight and Durable Materials

Integration of AI and Automation in Aircraft Systems

Increase in Shared Aviation and Air Taxi Services

Sustainability Efforts in Aircraft Design - Government Regulations & Defense Policy

Aviation Safety and Maintenance Regulations

Regulatory Support for Sustainable Aviation Initiatives

Defense Procurement and Export Control Policies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Regional Aircraft

General Aviation Aircraft

Military Aircraft

Cargo Aircraft

Commercial Aircraft - By Platform Type (In Value%)

Fixed-Wing Aircraft

Tiltrotor Aircraft

Hybrid Aircraft

Vertical Takeoff Aircraft

Rotorcraft Aircraft - By Fitment Type (In Value%)

OEM Aircraft

Aftermarket Aircraft

Upgraded Aircraft

Custom Aircraft

Refurbished Aircraft - By EndUser Segment (In Value%)

Commercial Airlines

Private Operators

Government & Defense

Freight & Logistics Companies

Aviation Maintenance & Support Providers - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Leasing & Rentals

Third-Party Distributors

OEM Distributors - By Material / Technology (in Value%)

Aluminum Alloy Materials

Composite Materials

Advanced Propulsion Technologies

Avionics & Navigation Systems

Aerodynamic Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Material / Technology, Engine Type, Aircraft Range, Cabin Capacity, Operational Costs)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Emirates SkyCargo

Abu Dhabi Aviation

FlyDubai

Gulfstream Aerospace

Bombardier Aviation

Airbus

Piaggio Aerospace

Textron Aviation

ATR Aircraft

Embraer

Cessna

Pilatus Aircraft

Sukhoi Civil Aircraft

Saab Group

Beechcraft

- Increasing Demand for Regional Connectivity in the UAE

- Military Modernization Programs Driving Aircraft Demand

- Rising Popularity of Private Jets Among Corporate Executives

- Expansion of Air Cargo Services in the UAE

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035