Market Overview

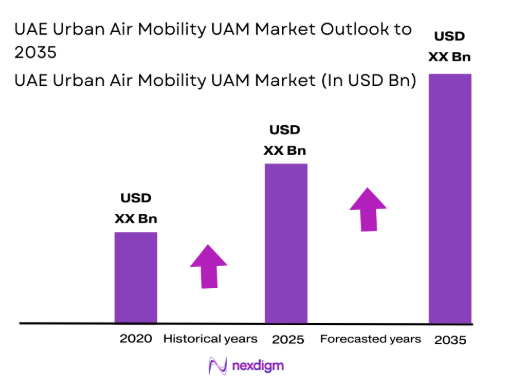

The UAE Urban Air Mobility UAM market current size stands at around USD ~ million, supported by early-stage deployment, regulatory pilots, and infrastructure readiness. The market recorded steady operational testing volumes during 2024 and 2025, supported by multiple demonstration corridors and controlled flight trials. Fleet induction numbers increased during this period, with multiple platforms undergoing certification and localized integration. Demand indicators reflected rising interest from mobility operators, logistics firms, and public sector stakeholders. Technology readiness improved with higher autonomous flight reliability and system integration. Investment activity remained focused on platform validation and airspace readiness rather than large-scale commercialization.

Dubai and Abu Dhabi dominate market activity due to advanced aviation infrastructure, strong regulatory coordination, and smart mobility mandates. These cities benefit from integrated urban planning frameworks supporting vertiport deployment and multimodal connectivity. Demand concentration is driven by premium urban travel, tourism flows, and government-led innovation initiatives. The presence of testing corridors, supportive civil aviation authorities, and public-private collaboration accelerates ecosystem maturity. Northern Emirates are gradually developing supporting infrastructure but remain secondary markets. Policy consistency and urban density continue shaping regional adoption patterns.

Market Segmentation

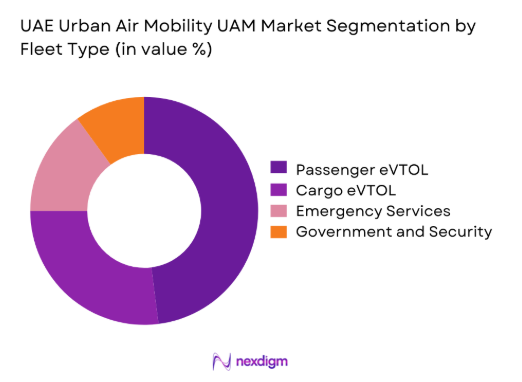

By Fleet Type

Passenger eVTOL platforms currently dominate fleet development due to strong alignment with urban mobility objectives and tourism-led demand. Cargo and logistics platforms are gaining traction for time-sensitive deliveries, particularly in medical and high-value shipments. Emergency and surveillance variants are increasingly evaluated by public agencies for rapid response use cases. Fleet diversification is supported by ongoing certification progress and improvements in battery endurance. Operational testing in controlled environments continues to refine fleet deployment strategies, while hybrid-use platforms are emerging to support both cargo and passenger operations efficiently.

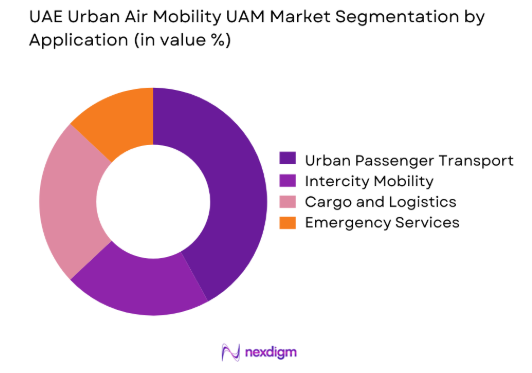

By Application

Urban passenger mobility represents the most active application segment, driven by congestion mitigation goals and premium travel demand. Intercity connections are developing gradually as range capabilities improve. Logistics applications benefit from time-critical delivery requirements and controlled routing advantages. Emergency response usage is expanding through pilot programs linked to healthcare and disaster management. Application diversification is supported by evolving airspace frameworks and digital traffic management systems. Public acceptance and operational reliability remain key factors influencing application prioritization across the market.

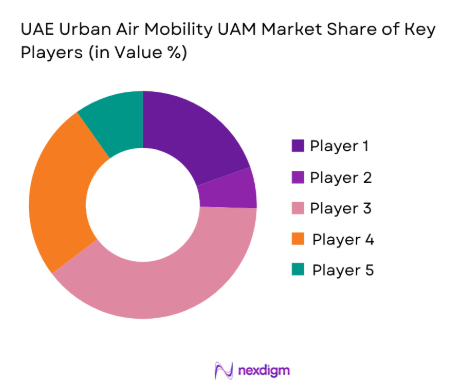

Competitive Landscape

The UAE Urban Air Mobility market features a concentrated competitive structure with a limited number of technology developers and platform operators. Market participants focus on regulatory alignment, fleet readiness, and operational partnerships rather than price competition. Competitive positioning is shaped by certification progress, ecosystem integration, and government collaboration capabilities. Strategic alliances with infrastructure providers and aviation authorities play a decisive role in market access and scalability.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Joby Aviation | 2009 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Volocopter | 2011 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| EHang | 2014 | China | ~ | ~ | ~ | ~ | ~ | ~ |

| Archer Aviation | 2018 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Lilium | 2015 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Urban Air Mobility UAM Market Analysis

Growth Drivers

Rapid urbanization and congestion mitigation initiatives

Urban density levels increased significantly during 2024 and 2025, intensifying demand for alternative mobility solutions. City planners prioritized aerial transport to reduce surface congestion and travel time inefficiencies. Policy frameworks increasingly favored vertical mobility integration within smart city architectures. Government-backed pilot corridors expanded across metropolitan districts to validate operational feasibility. Public acceptance improved through demonstration flights and controlled passenger trials. Infrastructure investments focused on vertiports and air traffic management systems. Digital mobility platforms enabled smoother integration with existing transport networks. Demand from tourism and premium mobility segments strengthened adoption momentum. Urban sustainability goals reinforced support for low-emission aviation technologies. These combined factors accelerated early-stage market expansion.

Government-backed smart mobility and sustainability programs

National mobility strategies emphasized innovation-led transportation models to support long-term urban development. Sustainability targets encouraged adoption of electric aviation platforms across major cities. Regulatory bodies streamlined certification pathways for urban air mobility platforms. Public sector funding supported research programs and infrastructure readiness. Policy alignment between aviation authorities and urban planners improved implementation speed. Smart city initiatives integrated aerial mobility within multimodal transport planning. Testbed programs enabled continuous evaluation of safety and operational performance. Government-backed pilots enhanced investor confidence across the ecosystem. Long-term decarbonization goals further strengthened institutional commitment. These programs collectively enabled structured market progression.

Challenges

Regulatory approval and airspace integration complexity

Airspace integration remains complex due to coexistence with conventional aviation operations. Regulatory frameworks require extensive safety validation before commercial deployment. Certification timelines remain uncertain across different operational use cases. Coordination between civil aviation authorities and urban planners requires continuous alignment. Air traffic management systems require upgrades to accommodate low-altitude operations. Standardization across platforms remains limited due to evolving technologies. Regulatory harmonization across emirates presents additional administrative challenges. Testing restrictions slow operational scalability. Compliance costs increase entry barriers for new operators. These factors collectively constrain rapid market expansion.

High capital expenditure and infrastructure costs

Vertiport development requires significant upfront infrastructure investment. Specialized charging and maintenance facilities increase operational complexity. Fleet acquisition costs remain elevated due to limited production scale. Insurance and certification expenses add to financial burden. Infrastructure localization requirements increase project complexity. Financing remains dependent on long-term return assumptions. Limited economies of scale affect cost optimization. High initial capital requirements slow market penetration. Public-private partnerships remain essential for viability. These cost pressures influence deployment timelines and commercial strategies.

Opportunities

Commercial passenger air taxi services

Urban air taxi services present significant potential for premium passenger mobility. Travel time reduction remains a strong value proposition in dense urban environments. High-income commuter segments demonstrate early adoption interest. Tourism-driven mobility demand supports service scalability. Integration with existing transport hubs enhances route viability. Digital booking platforms improve customer accessibility and service transparency. Demonstration flights have increased consumer confidence in safety standards. Government endorsement accelerates commercialization readiness. Expansion across high-traffic corridors remains feasible. These factors position passenger air taxis as a primary growth avenue.

Integration with smart city mobility platforms

Urban digitization initiatives create opportunities for seamless mobility integration. Data-driven traffic management enhances operational efficiency and safety. Smart infrastructure enables optimized route planning and energy usage. Cross-platform integration improves user experience and service reliability. Mobility-as-a-service models support multimodal connectivity. Government investment in smart systems accelerates deployment timelines. Real-time data analytics improves operational decision-making. Urban planning alignment enhances scalability potential. Technology convergence strengthens long-term ecosystem sustainability. This integration supports sustained market development.

Future Outlook

The UAE Urban Air Mobility market is expected to transition from pilot deployments to early commercialization during the coming decade. Regulatory clarity, infrastructure readiness, and public acceptance will shape adoption momentum. Continued investment in smart city ecosystems will support operational scalability. Collaboration between aviation authorities and private operators will remain critical. Technological advancements in autonomy and energy efficiency will further enhance market viability.

Major Players

- Joby Aviation

- Volocopter

- EHang

- Archer Aviation

- Lilium

- Airbus Urban Mobility

- Wisk Aero

- Hyundai Motor Group

- Embraer Eve

- Skyports

- Ferrovial Vertiports

- ADASI

- Falcon Aviation

- Dubai Aerospace Enterprise

- Boeing NeXt

Key Target Audience

- Urban mobility service operators

- Logistics and cargo service providers

- Government and regulatory bodies including GCAA and DCAA

- Smart city development authorities

- Infrastructure developers and vertiport operators

- Aerospace manufacturers and integrators

- Investments and venture capital firms

- Public transportation authorities

Research Methodology

Step 1: Identification of Key Variables

Market variables were identified through analysis of regulatory frameworks, fleet deployment activity, and operational readiness indicators. Emphasis was placed on technology maturity, infrastructure availability, and policy alignment. Demand drivers and adoption constraints were mapped across urban mobility segments.

Step 2: Market Analysis and Construction

Data points were analyzed using a bottom-up approach focusing on fleet deployment, operational pilots, and infrastructure readiness. Segmentation logic was applied across fleet types and applications. Market structure was evaluated using ecosystem participation and deployment models.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert consultations with aviation specialists, urban planners, and mobility operators. Assumptions were cross-verified using regulatory documentation and operational benchmarks. Feedback loops refined demand assumptions and deployment timelines.

Step 4: Research Synthesis and Final Output

All insights were consolidated through triangulation of qualitative and quantitative indicators. Market narratives were structured to reflect realistic adoption pathways. Final outputs were aligned with industry dynamics and policy-driven development trends.

- Executive Summary

- Research Methodology (Market Definitions and scope alignment for UAE urban air mobility, platform and service taxonomy development for UAM ecosystem, bottom-up fleet and operations-based market sizing approach, revenue attribution across vehicle manufacturing and service layers, primary interviews with regulators operators and OEMs, data triangulation using aviation authority and infrastructure datasets)

- Definition and Scope

- Market evolution

- Usage and operational pathways

- Ecosystem structure

- Supply chain and service delivery framework

- Regulatory and airspace governance environment

- Growth Drivers

Rapid urbanization and congestion mitigation initiatives

Government-backed smart mobility and sustainability programs

Advancements in electric propulsion and autonomy

Strategic investments in vertiport infrastructure

Tourism-driven demand for premium air mobility - Challenges

Regulatory approval and airspace integration complexity

High capital expenditure and infrastructure costs

Battery range and payload limitations

Public safety and acceptance concerns

Limited operational scalability in early stages - Opportunities

Commercial passenger air taxi services

Integration with smart city mobility platforms

Cargo and medical logistics optimization

Public-private partnerships for infrastructure development

Export of UAM operational models to regional markets - Trends

Adoption of autonomous flight control systems

Development of vertiport networks

Integration with multimodal transport ecosystems

Increased testing and pilot programs

Rising collaboration between OEMs and regulators - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Passenger eVTOL

Cargo and logistics eVTOL

Emergency and medical air mobility

Government and security platforms - By Application (in Value %)

Urban passenger transport

Intercity air mobility

Cargo and last-mile logistics

Emergency response and surveillance - By Technology Architecture (in Value %)

Electric vertical takeoff and landing

Hybrid-electric propulsion

Autonomous flight systems

Piloted and remotely operated systems - By End-Use Industry (in Value %)

Urban transportation

Logistics and delivery

Tourism and hospitality

Public safety and defense - By Connectivity Type (in Value %)

5G-enabled systems

Satellite-linked navigation

Ground-based communication networks

Hybrid connectivity systems - By Region (in Value %)

Dubai

Abu Dhabi

Sharjah

Northern Emirates

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (fleet capability, technology readiness, regulatory alignment, regional presence, service portfolio, partnership network, scalability, pricing strategy)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Porter’s Five Forces

- Detailed Profiles of Major Companies

Joby Aviation

Volocopter

EHang

Archer Aviation

Lilium

Wisk Aero

Hyundai Motor Group

Airbus Urban Mobility

Boeing NeXt

Embraer Eve

Skyports

Ferrovial Vertiports

ADASI

Falcon Aviation

Dubai Aerospace Enterprise

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035