Market Overview

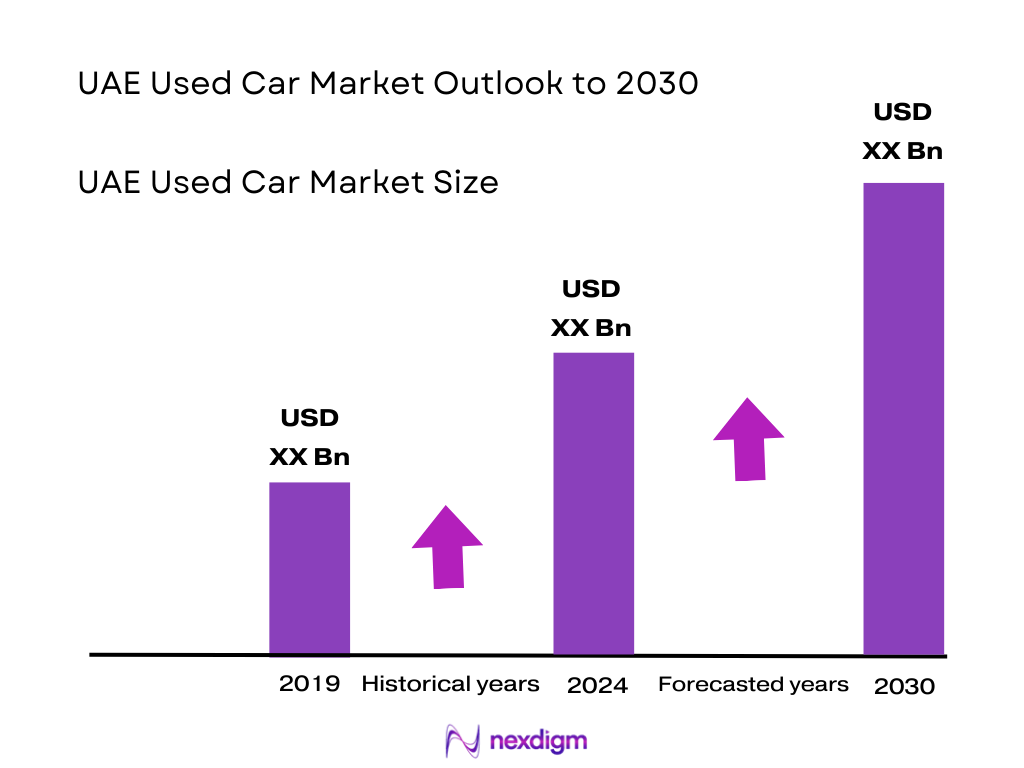

The UAE used car market is valued at USD 20.55 billion, based on recent industry research; this valuation reflects a five-year historical analysis that captures robust demand driven by high vehicle turnover, strong residual values, and a growing ecosystem of organized retail channels. A complementary source corroborates this, citing a valuation of USD 20.91 billion. The convergence of supply—particularly nearly-new off-lease inventory—and rising consumer demand for affordable, nearly-new mobility has underpinned this market size.

The UAE’s used car market is dominated by key urban centers known for expatriate density and trade infrastructure, especially Dubai and Abu Dhabi. Dubai leads due to its status as a regional trade and tourism hub, advanced digital platforms, and high volumes of residual vehicles moving across emirates. Abu Dhabi’s strong economic base and infrastructure robustness further reinforce its dominance, while Sharjah is gaining fast as a cost‑sensitive market with dense dealership clusters and a middle‑income buyer base.

The most credible projection shows the used car market expanding from USD 20.55 billion to USD 35.78 billion by 2030, representing a compound annual growth rate (CAGR) of 11.73 %. This robust growth underscores the market’s resilience and upward trajectory over the coming years.

Market Segmentation

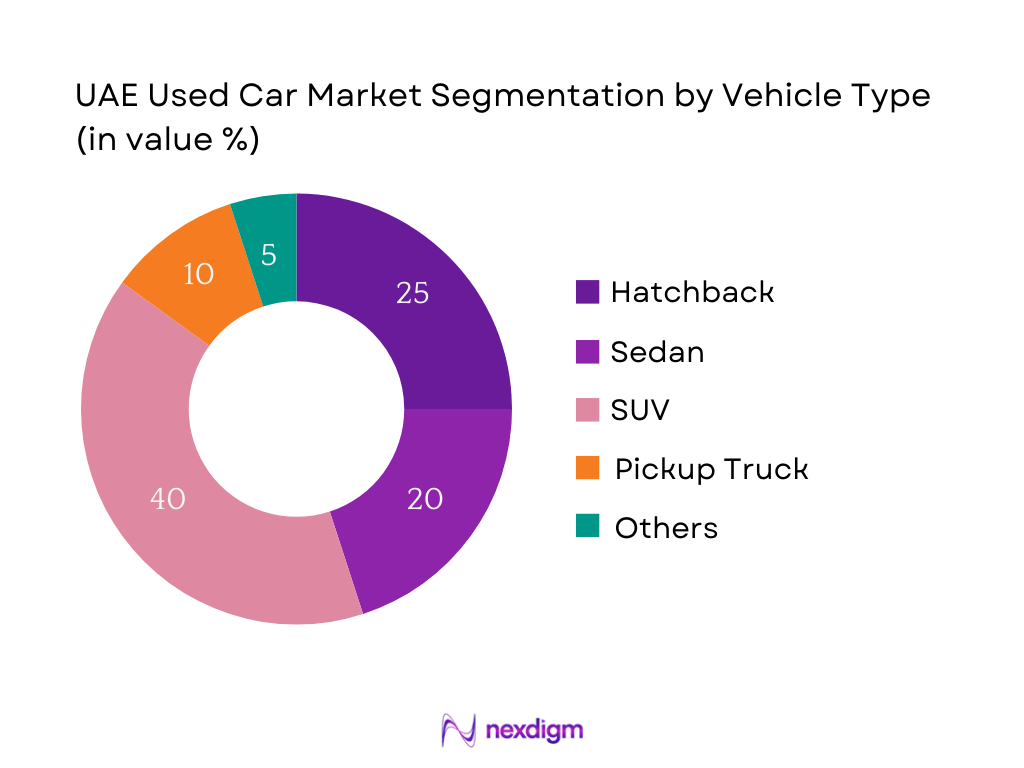

By Vehicle Type

The SUV segment dominates, commanding the largest share owing to its versatility, family appeal, off‑road capability, and suitability for diverse road conditions across urban and inter‑emirate contexts. Higher ground clearance, spacious interiors, and strong resale demand have reinforced SUV dominance in the market.

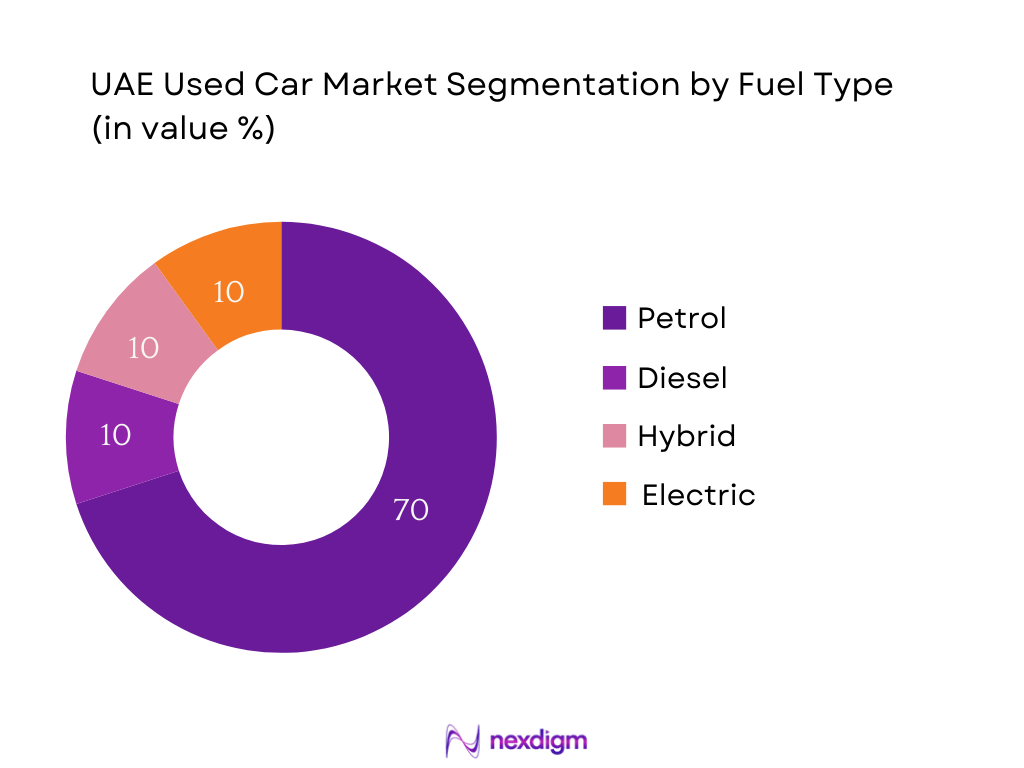

By Fuel Type

The petrol segment leads the market, with widespread fuel availability, lower maintenance costs, and strong consumer familiarity—particularly among everyday buyers—cementing its leading position. Petrol cars also offer better affordability compared to alternative fuel types, reinforcing dominance in the used segment.

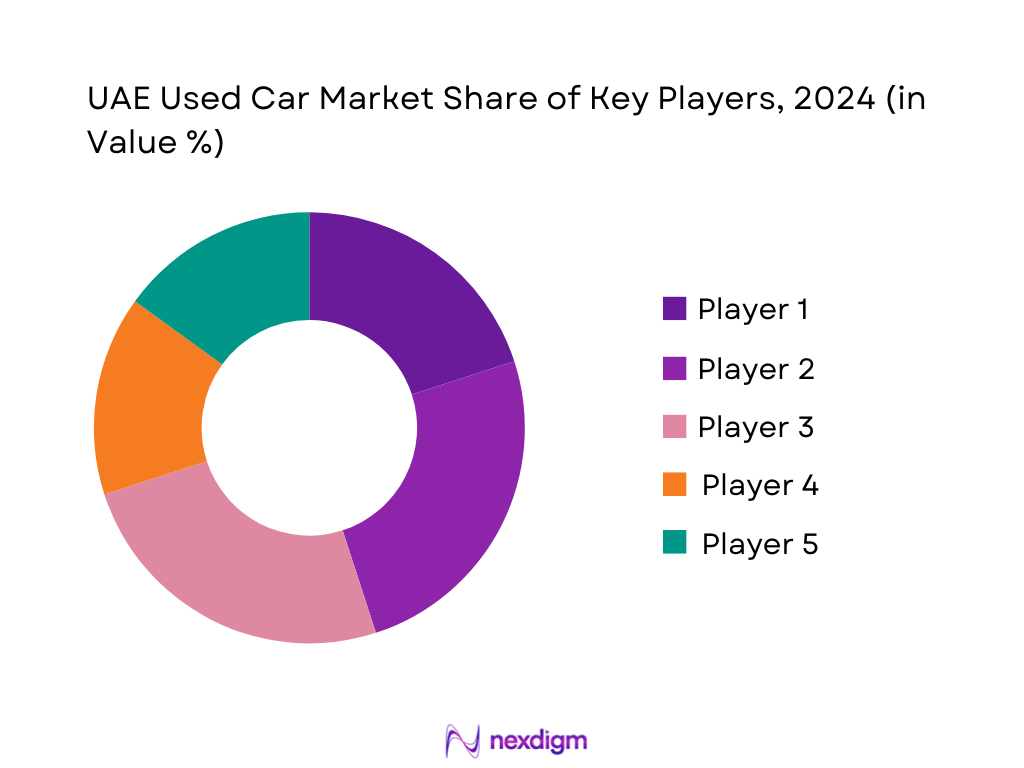

Competitive Landscape

The UAE used car market is increasingly consolidated around a mix of organized dealer groups and digital marketplaces, reflecting shifting consumer preferences toward convenience, certification, and financing ease.

| Player | Establishment Year | Headquarters | Stock Size (Used Inventory) | Digital/Online Presence | Certification/Warranty Programs | Financing Tie‑ups | Inspection Network | Export Capabilities |

| Al‑Futtaim Automall | — | Dubai | — | — | — | — | — | — |

| CarSwitch | — | UAE (Dubai area) | — | — | — | — | — | — |

| Dubizzle Cars | — | UAE (Dubai area) | — | — | — | — | — | — |

| CARS24 UAE | — | UAE (online hub) | — | — | — | — | — | — |

| YallaMotor | — | UAE (online hub) | — | — | — | — | — | — |

UAE Used Car Market Analysis

Growth Drivers

Expats Driving Vehicle Turnover

The UAE’s expatriate population grew markedly from approximately 9.0 million in 2023 to around 11.06 million in 2024, out of a total population of 12.50 million—expats now comprise nearly 88.5% of residents. This continuous inflow and turnover of expatriates, many on short- to mid-term work or residency contracts, leads to sustained demand in the used car segment—both for inbound buyers and returning sellers. In parallel, Dubai’s population reached about 3.81 million by December 2024, with expats comprising nearly 87%, further emphasizing urban concentration of mobility demand. The sheer demographic scale and mobility pattern mean that vehicle stock refresh cycles are accelerated, fueling consistent turnover of used vehicles across regions like emirates with high expat concentrations.

Traffic Congestion and Vehicle Utilization Patterns

The UAE’s population surge—from 344,513 in 1971 to approximately 9.59 million in 2024—has placed substantial pressure on urban infrastructure. As a result, daily commuters in congested cities like Dubai and Abu Dhabi spend up to 20 hours per week stuck in traffic. This high utilization and associated wear-and-tear accelerate the replacement cycle, driving higher turnover in the used car market. Moreover, Dubai now hosts about 1.44 million registered vehicles, with 0.98 million in Abu Dhabi and 0.46 million in Sharjah, highlighting the dense concentration of vehicles and the corresponding demand for secondary market supply as older vehicles are traded in. The cumulative effect of prolonged traffic exposure on vehicle condition and ownership patterns supports regular mid-life vehicle replacement, reinforcing the used car market’s growth indicators.

Market Challenges

Compliance with Import Regulations (LHD Only)

Stringent UAE automotive import rules require that only left-hand drive (LHD) vehicles are eligible for registration, with right-hand drive imports generally prohibited except under approved classic-car exemptions. Moreover, imported vehicles must not be older than 10 years, unless special permits are secured, and they must adhere to Euro 6 emission standards—complex documentation such as Certificates of Conformity, shipping documents, and translated invoices are mandatory. These stringent criteria narrow the pool of import-eligible used vehicles, heighten logistical complexity, and increase time-to-market for import transactions. Furthermore, the extensive paperwork and regulatory clearance process deter price-sensitive traders and limit supply diversity—restricting access to specific models or vehicles popular in right-hand drive markets.

Urban Density and Congestion Impacting Inspection Logistics

High traffic and vehicle volumes—1.44 million in Dubai and 0.98 million in Abu Dhabi—exert operational strain on inspection and certification centers, particularly surrounding RTA hubs. As tens of thousands of vehicles queue for periodic inspection, certification, and registration services, processing times extend, causing delays in used-car transactions. This friction in verifying vehicle condition can deter buyers and sellers, inhibiting market fluidity. Additionally, prolonged congestion contributes to structural wear on vehicles, complicating accurate assessment during inspection. The urban density-induced delay thus represents a systemic challenge in maintaining timely and transparent resale operations and regulatory compliance.

Emerging Opportunities

Strong Trade and Macro Stability Enhancing New Resale Models

While not specific to market size, the UAE’s macroeconomic resilience is evident from its foreign exchange reserves equating to 5.7 months of import coverage in September 2024, demonstrating strong liquidity buffers. This financial stability, paired with the country’s continuing diversification efforts, creates a conducive environment for innovative automotive retail models. Technology-enabled resale options—such as EV resale platforms—can thrive, supported by resilient consumer purchasing power and institutional confidence in the financial ecosystem. Retained liquidity and import stability bolster support services and finance availability, encouraging experimentation with subscription-based resale models or asset-light ownership formats.

Digital Infrastructure and Vehicle Density Supporting Subscription Services

With UAE roadway congestion forcing commuters to endure up to 20 hours of weekly traffic, high-use secondary vehicle demand is evident. This context elevates appeal for mobility flex models such as subscriptions or EV fleets: those seeking flexible, low-commitment transport solutions can circumvent long ownership cycles. Additionally, the enormous stock of vehicles—millions across major emirates—creates a ready supply base for subscription platforms, including EV-infused fleets that tap into global trends toward clean mobility. Urban population rise to 9.59 million (2024), coupled with tech adoption and the pursuit of hassle-free ownership, positions the UAE as fertile ground for the roll-out and scaling of next‑generation used‑car consumption models.

Future Outlook

Over the forecast period, the UAE used car market is expected to continue its strong growth trajectory, propelled by expanding digital penetration, growing organized retail networks, and sustained expatriate-driven demand. Certification programs and financing innovations will further elevate consumer confidence and raise average transaction prices. Meanwhile, evolving fuel dynamics—particularly electrification—will open new niches, while platform consolidation and transparency initiatives will enhance market efficiency and liquidity.

Major Players

- Al‑Futtaim Automall

- CarSwitch

- Dubizzle Cars

- CARS24 UAE

- YallaMotor

- Al Naboodah Automobiles

- Al Tayer Motors

- Arabian Automobiles Co

- com

- com

- Alba Trading Fzc

- Souq Al Haraj

- Kargal Motors

- Sun City Motors

- The Elite Cars

Key Target Audience

- Auto dealership groups and franchise managers

- Used car digital platform operators

- Automotive retail chains decision‑makers

- Vehicle financing companies

- Insurance underwriting divisions (auto line)

- Ministry of Economy (UAE)

- Department of Transport – RTA (Dubai)

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The process initiates with constructing an ecosystem map encompassing key stakeholders across the UAE used car value chain—dealers, platforms, financiers, regulators—utilizing secondary data from industry databases, regulatory filings, and developer insights to identify purchase triggers, segmentation variables, and market drivers.

Step 2: Market Analysis and Construction

Historical data—from 2019 to 2024—on market size, volumes, vehicle age profiles, and transaction channels is compiled and analyzed. Metrics such as average transaction value and vehicle-type mix are assessed to validate revenue estimations and segmentation breakdowns.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on growth drivers, market segmentation dominance, and channel shifts are tested via telephone and virtual interviews with market experts including dealership executives, platform heads, and RTA officials. These insights verify assumptions about consumer behavior and platform performance.

Step 4: Research Synthesis and Final Output

The final stage involves engaging with leading dealerships and digital platforms to cross-check quantitative outputs. Sales data, certification yield rates, financing adoption, and inspection throughput are obtained to validate bottom-up estimates and ensure a comprehensive, credible market analysis.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Industry Expert Interviews, Primary Research Design, Limitations, Future Assumptions)

- Definition and Market Scope

- Evolution of Used Car Ecosystem in UAE

- Timeline of Major Milestones in the UAE Used Car Sector

- Vehicle Ownership Lifecycle and Replacement Trends

- Supply Chain and Value Chain Mapping (Used Car Value Recovery Chain)

- Key Growth Drivers (e.g., Expats Driving Vehicle Turnover, Import of Left-Hand Drive Models)

- Key Market Challenges (e.g., Title Fraud, Non-uniform Quality Checks)

- Emerging Opportunities (e.g., EV Resale Platforms, Subscription-Based Resale)

- Consumer Trends (e.g., Shift Towards Financing Used Cars, Premium Used Vehicle Demand)

- Government Regulations (e.g., RTA Guidelines, Export/Import Compliance)

- SWOT Analysis

- Stakeholder Ecosystem Mapping (Buyers, Sellers, Financiers, Inspection Agencies)

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Transaction Price, 2019-2024

- By Vehicle Age Bracket, 2019-2024

- By Certified vs. Non-Certified Used Vehicles, 2019-2024

- By Vehicle Type (In Value %)

Hatchback

Sedan

SUV

Pickup Truck

Luxury Car - By Fuel Type (In Value %)

Petrol

Diesel

Hybrid

Electric - By Vehicle Age (In Value %)

Less than 2 Years

2–4 Years

4–6 Years

More than 6 Years - By Sales Channel (In Value %)

Organized Dealer Network

Online Used Car Platforms

Unorganized Dealers

OEM-Certified Pre-Owned Programs

Direct C2C Sales - By Region (In Value %)

Dubai

Abu Dhabi

Sharjah

Northern Emirates

- Market Share Analysis (Value/Volume) of Leading Players

Market Share by Sales Channel Type (Online vs. Offline) - Cross Comparison Parameters (Company Overview, Used Vehicle Stock Size, Digital Presence & App Downloads, Certification Models, Warranty Offerings, Inspection Points, Export Capability, Financing Tie-ups)

- SWOT Analysis of Major Players

- Price Band Comparison by Vehicle Type for Key Players

- Detailed Company Profiles

Al‑Futtaim Automall

CarSwitch

Dubizzle Cars

CARS24 UAE

YallaMotor

Al Naboodah Automobiles

Al Tayer Motors

Arabian Automobiles Co

SellAnyCar.com

OpenSooq.com

Alba Trading Fzc

Souq Al Haraj

Kargal Motors

Sun City Motors

The Elite Cars

- Buyer Profile Mapping (By Age, Nationality, Income Group)

- Purchase Intent Triggers & Barriers

- Pre-Purchase Information Sources

- Usage Purpose Analysis (Personal, Commercial, Ride-Hailing)

- Financed vs. Outright Purchase Ratios

- Vehicle Disposition Behavior

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030

- By Vehicle Age Bracket, 2025-2030

- By Certified vs. Non-Certified Vehicles, 2025-2030