Market Overview

The UAE ventilators equipment market, with a recent baseline value of about USD ~ million and trending towards the forty-million-dollar mark, is shaped by robust macro fundamentals and high-acuity care needs. Population has climbed from roughly 10.6 million to over 11.0 million residents, supported by GDP of about USD ~ billion and health spending near USD 3,814 per person, signifying strong purchasing capacity for advanced ICU technologies. Combined with 170+ hospitals and more than 5,500 beds nationwide, the installed base of critical-care units continues to pull demand for both invasive and non-invasive ventilators.

Ventilator demand is concentrated in Abu Dhabi and Dubai, which together host the majority of the UAE’s population and tertiary facilities. SEHA alone operates 14 hospitals with over 3,385 beds in Abu Dhabi, including major ICUs and NICUs. Dubai adds high-volume government and private hospitals under Dubai Health Authority and large private groups, supported by aggressive infrastructure budgets and strong medical tourism flows. With over 80% of the UAE population clustered in Abu Dhabi, Dubai and Sharjah, these emirates naturally dominate ventilator installations, procurement cycles and technology upgrades.

Market Segmentation

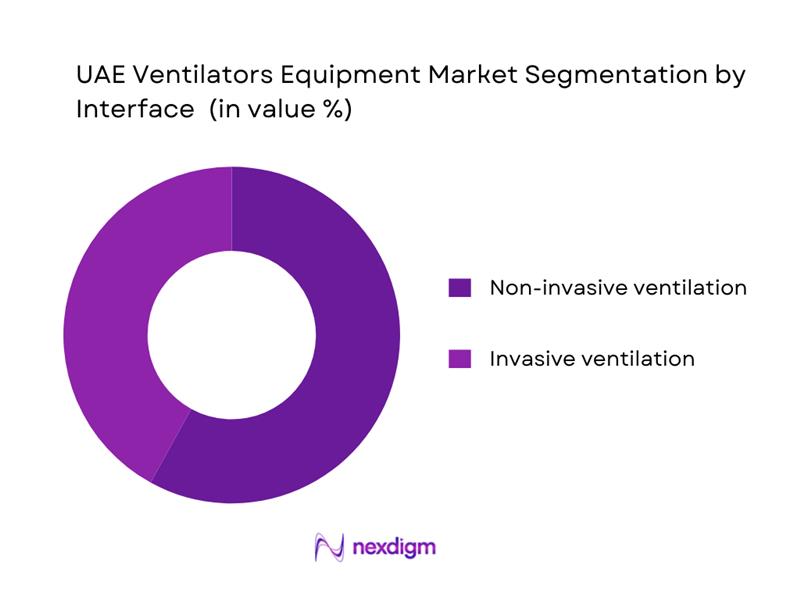

By Interface

The UAE ventilators equipment market is segmented into invasive ventilation and non-invasive ventilation. Non-invasive systems command the larger share, as hospitals increasingly prioritize reduced infection risk, shorter ICU stays and step-down care pathways for COPD, heart failure, and post-operative patients. Nexdigm notes non-invasive ventilation as the fastest-growing segment in the local market. High prevalence of lifestyle-linked respiratory and cardiac conditions, coupled with strong adoption of BiPAP and CPAP devices within respiratory care programs, reinforces this dominance. Non-invasive platforms also support homecare and ambulatory settings, aligning with UAE’s shift towards out-of-hospital chronic disease management.

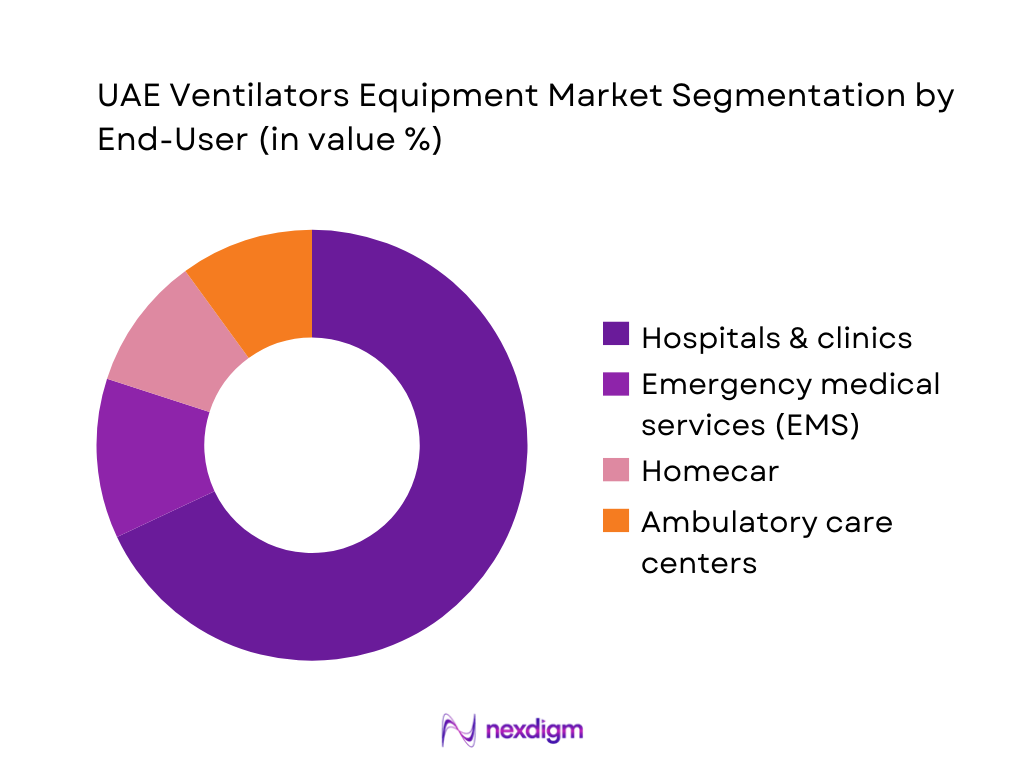

By End-User

The UAE ventilators equipment market is segmented into hospitals & clinics, ambulatory care centers, emergency medical services, and homecare. Hospitals & clinics hold the clear majority share, reflecting their role as epicenters for ICU, NICU, operating theatre and high-dependency care. National statistics show 172 hospitals and over 5,599 health centers across the UAE, with heavy concentration of ICU beds in large government and corporate facilities. Ventilators are mission-critical assets in these environments for acute respiratory failure, post-surgical ventilation, trauma and sepsis cases. EMS and homecare segments, while smaller, are expanding as portable ventilators, turbine-driven systems and long-term ventilation programs gain traction.

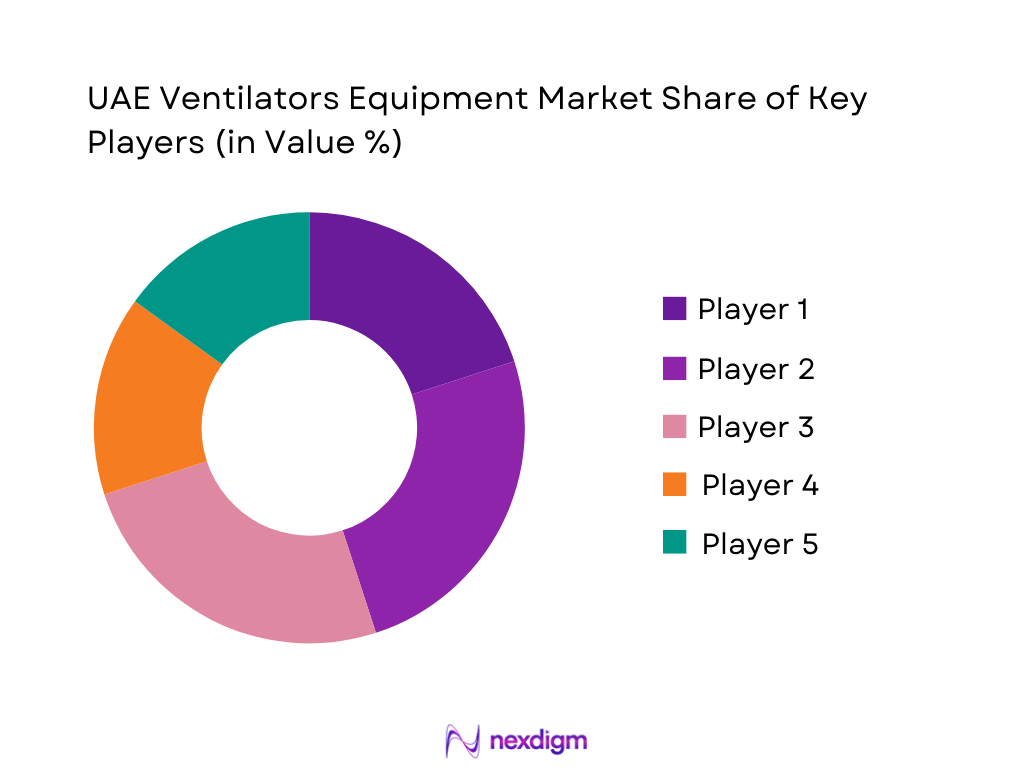

Competitive Landscape

The UAE ventilators equipment market is moderately consolidated, with multinational OEMs supplying high-end ICU and neonatal ventilators, complemented by regional distributors and niche innovators. Key players such as Philips, Medtronic, GE HealthCare, Hamilton Medical and Dräger operate through localized subsidiaries or regional hubs, often partnering with distributors like Atlas Medical, Gulf Drug and Gulf AED to reach public and private hospitals. Competition increasingly revolves around advanced modes (lung-protective strategies, non-invasive and high-flow), integration with hospital IT systems, and lifecycle service contracts.

| Company | Establishment Year | Global Headquarters | UAE / Regional Presence | Key Ventilator Portfolio (UAE-relevant) | Primary Interface Focus | Mobility Focus (ICU / Transport / Home) | Key Strengths in UAE Market |

| Philips Healthcare | 1891 | Amsterdam, Netherlands | ~ | ~ | ~ | ~ | ~ |

| Medtronic | 1949 | Dublin, Ireland | ~ | ~ | ~ | ~ | ~ |

| GE HealthCare | 1892 (GE legacy) | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Hamilton Medical | 1983 | Bonaduz, Switzerland | ~ | ~ | ~ | ~ | ~ |

| Drägerwerk AG & Co. | 1889 | Lübeck, Germany | ~ | ~ | ~ | ~ | ~ |

UAE Ventilators Equipment Market Analysis

Growth Drivers

Expansion of ICU, NICU, and HDU Bed Capacity

The UAE has rapidly expanded and upgraded acute-care infrastructure, directly lifting baseline ventilator demand. MOHAP’s Statistical Annual Report shows total hospital beds at 19,102 in the country, easing only slightly to 18,497 the next year, with 9,514 beds in the government sector and 8,983 in the private sector, indicating a sizable high-acuity base that increasingly uses ventilators as standard of care in ICU, NICU, and HDU settings. At the same time, the UAE population reached 10,678,556 residents, increasing pressure on critical-care capacity and reinforcing the need to maintain resilient bed-to-ventilator ratios across Abu Dhabi, Dubai, and the Northern Emirates.

Rising Burden of COPD, ARDS, and Post-Operative Respiratory Failure

Local epidemiology underscores sustained ventilator needs in tertiary hospitals. A health economics assessment of chronic obstructive pulmonary disease burden in Dubai cites UAE studies where COPD prevalence ranges from 1.9 to 12.9 of adults, reflecting significant under-diagnosed respiratory disease in high-risk groups such as smokers and individuals exposed to occupational dust and urban pollution. In Abu Dhabi, spirometry-based screening found COPD in 3.7 of people aged 40–80 years, a cohort at greatest risk for acute exacerbations requiring invasive or non-invasive ventilation. Alongside this, the national Statistical Annual Report records 101,088 live births and 11,514 deaths in one year, indicating a sizeable surgical and high-risk perinatal load where ARDS and post-operative respiratory failure are key ventilator indications.

Market Challenges

Capital Budget Constraints and High-End ICU Ventilator Pricing Pressure

Despite robust macro indicators, hospital-level budgets remain tightly managed and can delay capital-intensive ventilator refresh cycles. The UAE spent 2,314.75 USD per capita on health in one recent year, up from 2,249.96 USD the previous year, but this must fund a wide spectrum of priorities from oncology to primary care, not just critical-care devices. Health Spending per Capita. At the federal level, the 71.5 billion AED federal budget is balanced against revenues, meaning each emirate’s public hospital network must justify expensive ventilator upgrades against other infrastructure and staffing needs. With total beds in UAE hospitals at 18,497, splitting across government and private providers, capital committees often prioritize adding new beds or imaging units over replacing still-functional ventilators, reinforcing procurement cycles that favor aggressive price negotiation and bundled deals.

Shortage of Trained Respiratory Therapists and ICU Nurses

Ventilator utilization is constrained not only by device availability but also by skilled operators. International datasets show that the UAE has around 6.4 nurses and midwives per 1,000 people in the most recent pre-pandemic reporting year, compared with a global average of 3.8, but still below leading OECD systems that exceed 10 per 1,000. Population in the UAE has now reached 10,678,556, driven by continued inflows of expatriate residents and a high working-age share, increasing the critical-care workload that this nursing base must support. The National Health Workforce Accounts report also indicates that regulators are still harmonizing licensure and data systems across MOHAP, EHS, DOH Abu Dhabi, and Dubai Health, making it harder to forecast and deploy specialized cadres such as respiratory therapists at scale, which in turn limits adoption of sophisticated ventilation strategies.

Market Opportunities

Local Assembly, Testing, and Biomedical Services Opportunities

The scale of UAE’s health system and spending creates a strong base for localized ventilator assembly and advanced biomedical services. The population of 10,678,556 residents and the country’s high-income status, with GDP of ~ billion USD in constant terms, support sustained investment in high-tech healthcare clusters. Federal budgets channel tens of billions of dirhams annually into health and social development, while Dubai’s Health Accounts record current health expenditure per capita at 1,245 AED, plus 2,801 AED in PPP terms. These macro-numbers justify investments in local ventilator configuration, testing labs compliant with international standards, and multi-emirate biomedical service hubs that can maintain the installed base of more than 18,000 hospital beds with on-site calibration, thereby reducing downtime and import-related delays.

Tele-ICU, Remote Ventilator Monitoring, and Data-Driven Ventilation Protocols

The UAE’s rapid digital-health expansion is creating a fertile environment for tele-ICU platforms linked to ventilators. A qualitative study on UAE digital health transformation describes extensive adoption of telemedicine for remote clinical evaluation, e-prescriptions, and chronic-disease follow-up, emphasizing that digital platforms are now embedded in everyday care pathways. Dubai’s Virtual ICU pilot uses AI-powered analytics to monitor ICU patients in real time, aggregating data from bedside devices, including ventilators, into a central command center that can support multiple hospitals simultaneously. With health expenditure per capita above 2,300 USD and a financial population of 4,869,200 insured residents in Dubai alone, there is strong budgetary capacity for ventilator vendors that can offer connectivity, interoperability with hospital information systems, and remote-monitoring APIs as standard features.

Future Outlook

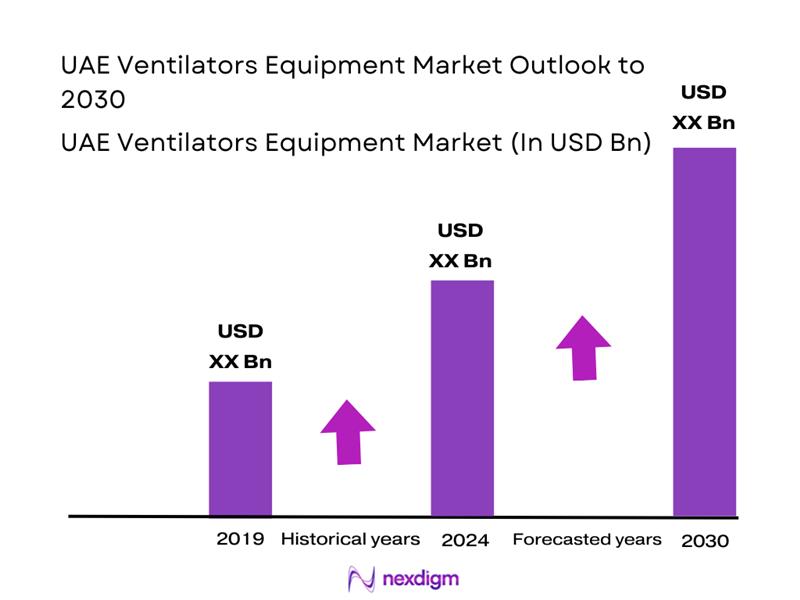

Over the next six years, the UAE ventilators equipment market is expected to maintain mid-single-digit to low-double-digit growth, broadly in line with regional ventilator trends in the Middle East & Africa. Based on extended modelling, the market is projected to expand from around USD ~ million in 2024 to roughly USD 56 million by 2030, reflecting a CAGR close to 6.2% over this period.Drivers will include continued ICU and NICU expansion in Abu Dhabi and Dubai, upgrades from basic invasive systems to advanced lung-protective and dual-mode platforms, strengthening EMS fleets with transport ventilators, and selective growth in home ventilation for chronic respiratory failure and neuromuscular conditions. Sustainability, energy-efficient devices and connectivity with electronic health records will increasingly influence procurement decisions, alongside vendor capability to provide comprehensive service, training and uptime guarantees.

Major Players

- Philips Healthcare UAE

- GE HealthCare UAE

- Medtronic UAE

- Hamilton Medical UAE

- Drägerwerk AG & Co. KGaA

- Getinge Group Middle East FZ-LLC

- Vyaire Medical

- Fisher & Paykel Healthcare

- Mindray Medical International

- Becton, Dickinson and Company

- ResMed UAE – home and non-invasive ventilation solutions

- Invacare

- Atlas Medical LLC

- Gulf Drug LLC

- Gulf AED

Key Target Audience

- C-level executives and strategy heads of ventilator and respiratory device manufacturers (global and regional).

- Hospital and health-system administrators in public and private sectors (MOHAP facilities, SEHA network, Dubai Health Authority hospitals).

- Departmental leaders in intensive care, anesthesia, emergency medicine, and neonatology responsible for capital equipment decisions.

- Emergency medical services (EMS) operators and ambulance fleet managers focused on transport ventilator procurement.

- Home healthcare and long-term care providers managing chronic ventilation and non-invasive respiratory support programs.

- Investments and venture capitalist firms (healthcare, medtech and infrastructure-focused funds evaluating UAE critical-care and respiratory segments).

- Government and regulatory bodies (Ministry of Health and Prevention, Department of Health – Abu Dhabi, Dubai Health Authority, Emirates Health Services) involved in standards, tenders and capacity planning.

- Health insurance companies and managed-care organizations assessing reimbursement frameworks for ICU stays, long-term ventilation and home NIV programs.

Research Methodology

Step 1: Identification of key variables

The initial phase involves mapping the ecosystem of the UAE ventilators equipment market across OEMs, distributors, public and private hospitals, EMS operators, and homecare providers. This step draws on extensive desk research using sources such as regional ventilator and respiratory-care reports, World Bank and WHO databases, and UAE government health statistics. Key variables include installed ICU/NICU capacity, ventilator density, procurement cycles, interface mix, and mobility preferences.

Step 2: Market analysis and construction

In this phase, historical and current data on ventilator revenues, volumes and installed base are compiled from published forecasts and country-level outlooks (e.g., UAE Ventilator Market, Middle East & Africa ventilator assessments, and global ventilator analyses). We align top-down estimates (per-capita spending, ICU bed base, respiratory disease burden) with bottom-up sizing (average device prices, replacement cycles, typical ventilator-to-bed ratios) to construct a coherent revenue view and 2024 baseline.

Step 3: Hypothesis validation and expert consultation

Market hypotheses on dominant interfaces, end-users, and growth drivers are tested through structured interviews and discussions with clinicians, biomedical engineers, procurement managers, and regional distributors. These interactions validate assumptions around non-invasive growth, portable ventilator uptake in EMS, neonatal ventilation demand and vendor selection criteria. Insights from regional events such as Arab Health and published case studies on local ventilator deployments further refine our segmentation and competitive mapping.

Step 4: Research synthesis and final output

Finally, we synthesize quantitative and qualitative evidence into a consolidated forecast, extending UAE ventilator projections to 2030 while cross-checking with regional and global ventilator growth benchmarks. Segment-wise revenue allocation is derived by triangulating interface mix, ICU vs transport vs homecare usage, and hospital vs non-hospital demand. The result is a validated market model for 2024, a 2024–2030 outlook, and detailed insights on competitive positioning, opportunity pockets and procurement trends in the UAE ventilators equipment market.

- Executive Summary

- Research Methodology Market Definitions and Assumptions, Abbreviations and Terminology, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Stakeholder Interviews, Primary Research Approach, Data Triangulation and Validation, Study Limitations and Future Scope.

- Definition and Scope

- Market Genesis and Evolution Across Care Settings

- Timeline of Major Ventilator Deployments and Policy Milestones

- Ventilator Demand Cycle and Replacement Lifecycle

- Supply Chain and Value Chain Structure (OEMs, Distributors, Service Providers)

- Regulatory and Approval Landscape (MOHAP, DHA, DOH, Free Zones)

- Reimbursement and Funding Environment (Public Budgets, Private Insurers, PPP Models)

- Growth Drivers

Expansion of ICU, NICU, and HDU Bed Capacity (Bed-to-Ventilator Ratios)

Rising Burden of COPD, ARDS, and Post-Operative Respiratory Failure

Government Investments in Emergency Preparedness and Pandemic Readiness

Growth of Homecare and Long-Term Ventilation for Chronic Conditions

Technological Advancements in Smart and Lung-Protective Ventilation - Market Challenges

Capital Budget Constraints and High-End ICU Ventilator Pricing Pressure

Shortage of Trained Respiratory Therapists and ICU Nurses

Service, Calibration, and Uptime Challenges Outside Major Cities

Tender-Driven Procurement and Preference for Lowest Bid

Import Dependence, Supply Chain Disruptions, and Lead Times - Opportunities

Local Assembly, Testing, and Biomedical Services Opportunities

Tele-ICU, Remote Ventilator Monitoring, and Data-Driven Ventilation Protocols

Rental, Pay-Per-Use, and Managed Equipment Service Models

Expansion in Day-Care Surgery, Step-Down Units, and Rehabilitation Centers

Integration of Ventilators with Hospital Command Centers and Analytics - Trends

Standardization of Lung-Protective Ventilation and Weaning Protocols

Adoption of Closed-Loop, AI-Supported Ventilation Modes

Preference for Multi-Mode Ventilators Compatible Across Interfaces

Shift Toward Low-Maintenance, Turbine-Based, and Battery-Backed Systems - Government Regulation and Policy

Device Registration, Licensing, and Vigilance Requirements (MOHAP, DHA, DOH)

Public Procurement, Central Tenders, and Framework Agreements

Quality, Safety, and Maintenance Compliance for Critical Care Devices

Infection Control, Reprocessing, and Consumable Use Norms - Market SWOT Analysis (Ventilator Ecosystem, UAE Context)

- Stakeholder Ecosystem (OEMs, Local Distributors, Hospitals, Regulators)

- Porter’s Five Forces Analysis (Buyer Power, Supplier Power, Threat of Substitutes)

- By Value, 2019-2024

- By Volume, 2019-2024

- By Ventilator Category, 2019-2024

- Installed Base by Care Setting, 2019-2024

- By Product Category (in Value %)

Critical Care / ICU Ventilators

Transport and Emergency Ventilators

Homecare and Long-Term Ventilators

High-Flow Nasal Cannula and Non-Invasive Respiratory Support Systems

Anesthesia Workstation Ventilation Used for Critical Care Surge Capacity - By Interface Type

Invasive Ventilation

Non-Invasive Ventilation

High-Flow Nasal Oxygen / Combination Respiratory Support - By Patient Type

Adult Ventilators

Pediatric Ventilators

Neonatal and NICU Ventilators - By Clinical Setting

Public Tertiary and Secondary Hospitals

Private Multispecialty Hospital Groups

Specialized Critical Care and Pulmonology Centers

Rehabilitation, Long-Term Care, and LTAC Units

Homecare Providers and DME Companies - By Technology and Mobility

Turbine-Based and Blower-Based Ventilators

Gas-Driven and Hybrid Ventilators

Stationary Versus Portable / Transport Ventilators

Connectivity-Enabled and Networked Ventilators

Ventilator Modes and Advanced Features

- Market Share of Major Players by Value and Volume

Market Share of Major Players by Ventilator Category

Market Share by Interface Mix - Cross Comparison Parameters (Company Overview, UAE Ventilator Installed Base and Share, Product Mix Across ICU / Transport / Homecare Ventilators, Interface Mix Across Invasive / Non-Invasive / HFNC, Connectivity and Digital Capabilities with HIS / EMR / Tele-ICU, Regulatory and Tender Participation Across MOHAP / DHA / DOH, Service and Maintenance Footprint and Uptime SLAs in UAE, Commercial Models and Financing Solutions for Hospitals and Homecare)

- SWOT Analysis of Major Players

- Pricing and Commercial Analysis by Key SKUs

- Detailed Profiles of Major Companies

Medtronic

Dräger

GE HealthCare

Philips Healthcare

Hamilton Medical

Getinge

Mindray Medical

Vyaire Medical

Fisher & Paykel Healthcare

Nihon Kohden

Zoll Medical

Smiths Medical

Air Liquide Medical Systems

Gulf Drug LLC

Leader Healthcare Group

- Public Sector Providers

- Private Hospital Groups

- Specialized Critical Care and Pulmonology Centers

- Rehabilitation, Long-Term Care, and Home Ventilation Providers

- Emergency Medical Services and Transport Providers

- By Value, 2025-2030

- By Volume, 2025-2030

- By Ventilator Category, 2025-2030

- Installed Base by Care Setting, 2025-2030