Market Overview

The UAE Virtual Consultations Market is valued at USD ~ million, reflecting its growing role as a core access channel within the country’s healthcare delivery system. Virtual consultations have become structurally important as providers seek to manage rising outpatient volumes, optimize clinician utilization, and extend access beyond physical facilities. Demand is driven by a combination of patient convenience, insurer acceptance of remote consultations, and provider efforts to improve continuity of care across primary, specialty, and follow-up services. The market supports both episodic consultations and longitudinal care management, positioning virtual consultations as an embedded service layer rather than a standalone digital add-on within the healthcare ecosystem.

Within the UAE, Dubai and Abu Dhabi dominate virtual consultation adoption due to their concentration of large hospital groups, specialist physicians, and digitally mature healthcare infrastructure. These emirates lead in platform deployment, insurer integration, and regulatory implementation, enabling faster scaling of virtual services. On the supply and technology side, global healthcare technology leaders from the United States and Europe influence platform architectures, clinical protocols, and interoperability standards used in the UAE. Their dominance is driven by established telehealth expertise, enterprise-grade security frameworks, and proven clinical workflow designs that local providers adopt to meet regulatory and quality expectations.

Market Segmentation

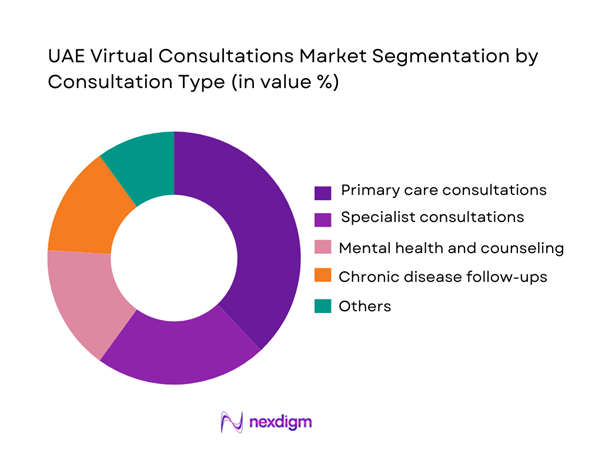

By Consultation Type

Primary care consultations dominate the UAE Virtual Consultations Market as they serve as the first point of contact for a broad range of patient needs, including acute minor illnesses, medication refills, and preventive advice. Their dominance is reinforced by high frequency of use, shorter consultation durations, and strong insurer acceptance, making them cost-efficient for providers and payers. Primary care virtual visits also act as gateways to specialist referrals, embedding them deeply into patient care pathways. Hospitals and clinics leverage primary care virtual consultations to decongest outpatient departments and improve appointment availability. Additionally, patient familiarity and trust in remote primary care interactions support sustained demand across both public and private healthcare settings.

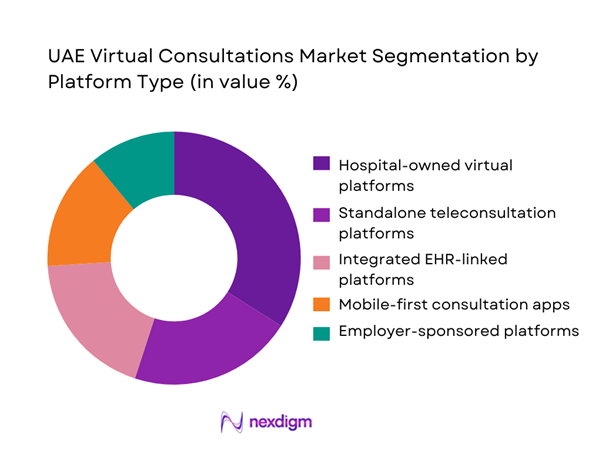

By Platform Type

Hospital-owned virtual platforms hold a dominant position as they are tightly integrated with existing clinical systems, physician rosters, and patient records. These platforms enable seamless continuity between in-person and virtual care, which is critical for clinical quality and regulatory compliance. Hospitals prioritize owned platforms to retain patient relationships, control data governance, and align virtual services with broader care strategies. Integration with appointment scheduling, billing, and electronic medical records enhances operational efficiency and physician adoption. As major hospital groups continue to expand digital front doors, hospital-owned platforms maintain a structural advantage over standalone solutions in the UAE market.

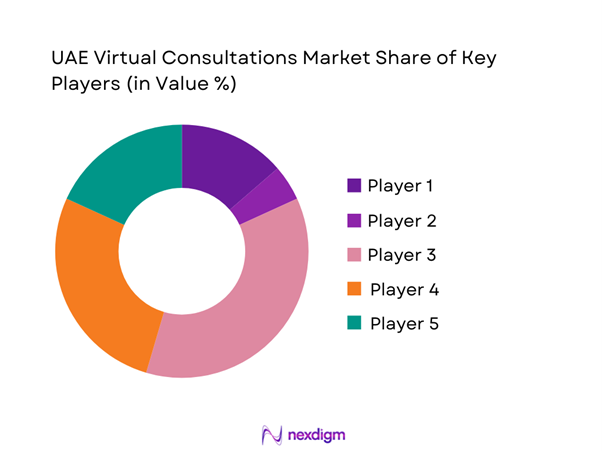

Competitive Landscape

The UAE VIRTUAL CONSULTATIONS MARKET market is dominated by a few major players, including PureHealth and global or regional brands like Teladoc Health, Amwell, and Aster Digital Health. This consolidation highlights the significant influence of these key companies.

| Company | Est. Year | HQ | UAE Licensing Footprint | Core Virtual Consult Model | Specialty Breadth | Insurance / TPA Integration | eRx + Pharmacy Linkage | Care Escalation Pathway | Data & Compliance Posture |

| PureHealth (incl. SEHA ecosystem) | 2006 | Abu Dhabi | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Dubai Health | 2023 | Dubai | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Mediclinic Middle East | 1983 | UAE / regional ops | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| NMC Healthcare | 1974 | UAE | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Okadoc | 2018 | Dubai | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Virtual Consultations Market Analysis

Growth Drivers

Healthcare digitalization initiatives

Government-led healthcare digitalization initiatives across the UAE are a core driver accelerating virtual consultation adoption. National and emirate-level programs prioritize interoperable health information systems, unified patient records, and digital access points that support remote care delivery. As hospitals and clinics upgrade EHRs, scheduling platforms, and secure data exchange frameworks, virtual consultations become embedded within standard clinical workflows rather than operating as standalone services. This institutional readiness lowers implementation friction, improves care continuity, and builds patient confidence in digital interactions. Over time, these initiatives normalize virtual consultations as a routine access channel, encouraging long-term provider commitment and sustained utilization.

Rising outpatient demand pressures

Outpatient demand continues to intensify due to population growth, chronic disease prevalence, and higher healthcare utilization expectations. Physical clinics face appointment backlogs, clinician time constraints, and infrastructure limitations. Virtual consultations help providers manage this pressure by diverting suitable cases away from in-person settings without compromising clinical oversight. Routine follow-ups, medication reviews, and minor acute issues can be handled remotely, freeing physical capacity for higher-acuity care. This demand rebalancing improves throughput, shortens waiting times, and enhances patient experience. As operational benefits become measurable, healthcare organizations increasingly view virtual consultations as a structural solution to outpatient capacity challenges.

Challenges

Clinical quality standardization

Maintaining consistent clinical quality across virtual consultations is a persistent challenge for UAE providers. Differences in consultation protocols, documentation depth, and physician experience can lead to variability in care outcomes. Unlike in-person settings, virtual environments require clearer guidelines for assessment, escalation, and follow-up to ensure patient safety. Establishing standardized clinical pathways, audit mechanisms, and quality benchmarks adds operational complexity and requires sustained governance oversight. Providers must invest in training, peer review processes, and performance monitoring to reduce variability, which can slow scaling efforts and increase administrative demands across multi-site healthcare networks.

Physician adoption and workflow alignment

Physician adoption remains uneven when virtual consultations are perceived as disruptive to established clinical routines. If scheduling, documentation, or prescribing systems are poorly integrated, clinicians may experience additional administrative workload and fragmented workflows. This can reduce efficiency and create resistance to sustained usage. Successful adoption requires thoughtful workflow redesign that aligns virtual consultations with existing care pathways, minimizes duplicate data entry, and preserves clinical autonomy. Training and change management are equally important to build confidence in virtual care delivery. Without alignment of incentives and processes, utilization may remain superficial despite technical readiness.

Opportunities

Expansion into specialty care

Virtual consultations create strong opportunities for expansion into specialty care segments where ongoing follow-ups, care coordination, and advisory interactions are common. Specialties such as mental health, dermatology, endocrinology, and cardiology are well suited to virtual engagement for follow-ups and second opinions. By extending virtual access to specialists, providers can reduce wait times, optimize specialist utilization, and improve continuity of care. Specialty expansion also supports service differentiation and strengthens referral ecosystems. As clinicians and patients grow comfortable with digital interactions, virtual specialty care becomes a scalable avenue for both clinical impact and service portfolio enhancement.

Remote monitoring integration

The integration of virtual consultations with remote patient monitoring represents a significant opportunity to evolve toward continuous care models. Monitoring devices generate real-time clinical data that can inform timely virtual interventions, reducing the need for reactive in-person visits. This approach is particularly valuable for chronic disease management, post-discharge follow-up, and elderly care. When combined effectively, monitoring and virtual consultations enable proactive decision-making and better clinical outcomes. Providers that invest in integrated care pathways can enhance care quality while aligning with emerging value-based healthcare models that emphasize prevention, continuity, and outcome-driven delivery.

Future Outlook

The UAE Virtual Consultations Market is expected to evolve toward fully integrated hybrid care models where virtual and in-person services are seamlessly combined. Strategic focus will shift toward specialty depth, data-driven care coordination, and outcome accountability, positioning virtual consultations as a permanent and scalable component of the national healthcare system.

Major Players

- PureHealth

- SEHA Virtual Care

- Mediclinic Middle East

- Aster Digital Health

- NMC Virtual Care

- Cleveland Clinic Abu Dhabi

- HealthHub Clinics

- Okadoc

- Vezeeta

- Altibbi

- Teladoc Health

- Amwell

- TruDoc 24×7

- Emirates Hospital (EHG)

Key Target Audience

- Hospitals and integrated health systems

- Specialty clinics

- Health insurers and payers

- Employer healthcare program managers

- Digital health platform providers

- Healthcare IT vendors

- Investments and venture capitalist firms

- Government and regulatory bodies (UAE-specific)

Research Methodology

Step 1: Identification of Key Variables

Demand drivers, care settings, consultation types, and platform models were identified to frame the market. Regulatory and operational variables were also considered.

Step 2: Market Analysis and Construction

Market structure was analyzed across service mix, delivery models, and end users. Logical revenue attribution frameworks were applied.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through expert consultations with healthcare administrators, clinicians, and digital health specialists. Assumptions were stress-tested.

Step 4: Research Synthesis and Final Output

Findings were synthesized into a cohesive market narrative, ensuring consistency, clarity, and client-ready analytical rigor.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Virtual Consultation Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- UAE Healthcare Service Delivery Architecture

- Growth Drivers

Healthcare digitalization initiatives

Rising outpatient demand pressures

Chronic disease management needs

Physician capacity optimization

Patient preference for convenience

Insurer-supported virtual care models - Challenges

Clinical quality standardization

Physician adoption and workflow alignment

Reimbursement clarity

Data privacy and cybersecurity concerns

Complex integration with legacy systems - Opportunities

Expansion into specialty care

Remote monitoring integration

Employer-led preventive care programs

Cross-emirate service scaling

AI-enabled clinical triage

Home healthcare linkage - Trends

Hybrid care pathway adoption

Platform consolidation

Increased insurer participation

Specialty-focused virtual clinics

Clinical decision support integration

Outcome-based virtual care models - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Revenue, 2019–2024

- By Consultation Volume, 2019–2024

- By Average Realized Fee, 2019–2024

- By Utilization Intensity, 2019–2024

- By Consultation Type (in Value %)

Primary care consultations

Specialist consultations

Mental health and counseling

Chronic disease follow-ups

Post-operative and rehabilitation check-ins - By Clinical Specialty (in Value %)

General medicine

Dermatology

Psychiatry and psychology

Pediatrics

Endocrinology and diabetes care

Women’s health - By Platform Type (in Value %)

Hospital-owned virtual platforms

Standalone teleconsultation platforms

Integrated EHR-linked platforms

Mobile-first consultation apps

Employer-sponsored platforms - By Delivery Model (in Value %)

Real-time video consultations

Audio-only consultations

Chat-based consultations

Asynchronous store-and-forward consultations - By End-Use Customer Type (in Value %)

Public hospitals and clinics

Private hospitals

Standalone specialty clinics

Corporate and employer programs

Individual self-pay patients - By Region (in Value %)

Abu Dhabi

Dubai

Sharjah

Northern Emirates

- Competition ecosystem overview

- Cross Comparison Parameters (platform scalability, clinical specialty coverage, integration with hospital systems, physician network depth, regulatory compliance readiness, data security architecture, insurer integration capability, patient experience design, pricing flexibility)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

PureHealth

SEHA Virtual Care

Cleveland Clinic Abu Dhabi

Mediclinic Middle East

Aster Digital Health

NMC Virtual Care

Malaffi-enabled platforms

HealthHub Clinics

Okadoc

Vezeeta

Altibbi

DOCSapp

Teladoc Health

Amwell

Practo

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Revenue, 2025–2030

- By Consultation Volume, 2025–2030

- By Average Realized Fee, 2025–2030

- By Utilization Intensity, 2025–2030