Market Overview

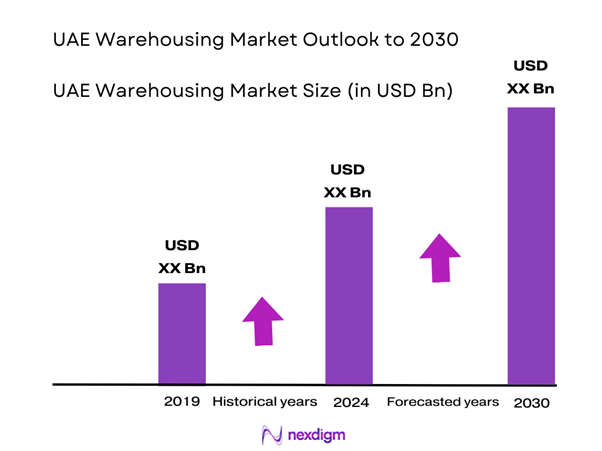

The UAE warehousing market is valued at USD 3.02 billion in 2024 with an approximated compound annual growth rate (CAGR) of 4.6% from 2024-2030, showcasing a robust growth trajectory fueled by the burgeoning e-commerce sector, which demands efficient logistics solutions. The market is primarily driven by factors such as rapid urbanization, an increase in consumer spending, and the government’s initiatives to invest in logistics infrastructure.

Dubai and Abu Dhabi dominate the UAE warehousing market due to their strategic geographical locations and well-developed infrastructure, acting as logistical hubs for the MENA region. The presence of numerous free zones and logistics parks enhances operational efficiency and attracts foreign investment. Additionally, the commitment to supporting e-commerce businesses, coupled with governmental policies favoring trade, ensures sustained growth and prominence in these cities within the warehousing sector.

Third-party logistics (3PL) services in the UAE are expanding rapidly, driven by businesses seeking efficiency and cost savings. In 2022, the 3PL market was projected to reach USD 30 billion, showcasing a robust demand for outsourced logistics services. A significant influx of SMEs is opting for 3PL solutions to leverage specialized logistics expertise while minimizing operational overheads. This trend encourages warehousing facilities to evolve, offering customizable storage and distribution solutions to meet specific industry requirements, ultimately enhancing supply chain effectiveness and driving market growth.

Market Segmentation

By Warehouse Type

The UAE warehousing market is segmented by warehouse type into public warehouses, private warehouses, automated warehouses, and climate-controlled warehouses. Currently, public warehouses represent a significant portion of the market share, owing to their flexibility in accommodating various businesses without the need for long-term commitments. As companies increasingly seek cost-effective solutions to manage their inventory, public warehouses have seen heightened demand. Furthermore, their ability to provide scalable solutions for start-ups and established firms alike enhances their attractiveness in a rapidly evolving market.

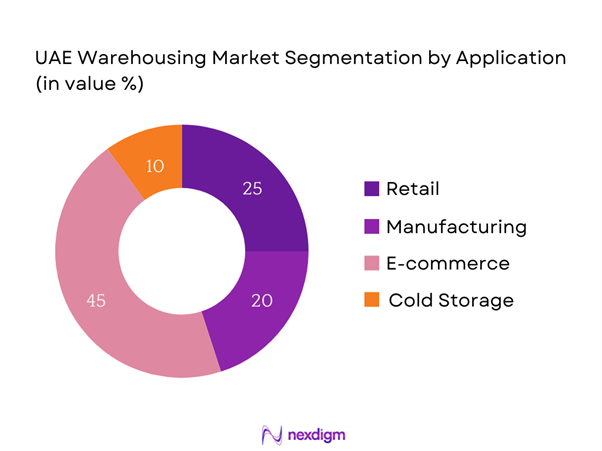

By Application

The market is further segmented by application into retail, manufacturing, e-commerce, and cold storage. The e-commerce segment is currently the dominant player in the UAE warehousing market due to the exponential growth of online shopping, especially post-pandemic. The rise of a digitally savvy consumer base has pushed retailers to optimize their logistics and supply chain, leading to increased investment in warehousing solutions that support quick order fulfillment and efficient inventory management. As e-commerce continues to thrive, this segment is expected to maintain its leading position.

Competitive Landscape

The UAE warehousing market is consolidated, with a few key players dominating the landscape. Major companies such as Agility Logistics, DHL Supply Chain, and Aramex lead the market due to their strong logistical networks, innovative technology integration, and extensive service offerings.

| Company | Year Established | Headquarters | Market Share (%) | Number of Warehouses | Key Services Offered | Distribution Networks |

| Agility Logistics | 1979 | Safat, Kuwait | – | – | – | – |

| DHL Supply Chain | 1969 | Bonn, Germany | – | – | – | – |

| Aramex | 1982 | Dubai, UAE | – | – | – | – |

| Kuehne + Nagel | 1890 | Schindellegi, Switzerland | – | – | – | – |

| DB Schenker | 1872 | Essen, Germany | – | – | – | – |

UAE Warehousing Market Analysis

Growth Drivers

Rapid Urbanization

The UAE has experienced remarkable urbanization, with 89% of its population living in urban areas according to World Bank data. In 2023, the urban population’s density reached approximately 648 people per square kilometer. This swift urban development necessitates more advanced logistics infrastructure, thereby driving growth in the warehousing sector. The ongoing expansion of cities like Dubai and Abu Dhabi, alongside infrastructure projects such as the Dubai South development, further highlight the urgent need for efficient warehousing as industries adapt to accommodate increasing urban logistics demands.

Growth in E-commerce

E-commerce in the UAE has surged significantly, expected to generate USD 27 billion in 2023, driven by increased internet penetration rates exceeding 99%. This boom in online shopping is prompting businesses to enhance their logistics capacities, leading to a greater focus on warehousing solutions capable of meeting heightened demand. As consumers increasingly favor online purchasing, the growing e-commerce market creates further opportunities for warehousing facilities to cater to rapid order fulfillment. The boost in online sales channels is accelerating the need for sophisticated warehousing strategies that support quick inventory turnover.

Market Challenges

High Operational Costs

Despite the market’s growth, high operational costs challenge the UAE warehousing sector. Operational expenses have risen by approximately 25% since 2022, driven mainly by rising energy prices, labor costs, and supply chain disparities caused by geopolitical tensions. These factors compel logistics companies to optimize their operations, focusing on cost efficiencies to remain competitive. Managing these intensified operational demands while ensuring profitability becomes a central challenge as players in the warehousing market strive to implement innovative solutions amid escalating expenses.

Regulatory Compliance

The UAE’s logistics and warehousing industry is governed by stringent regulations, which can create complexities for businesses. Regulations concerning health and safety standards, taxation policies, and environmental guidelines are evolving rapidly to meet international norms. Compliance costs have increased notably; businesses may incur expenses upwards of AED 5 million annually to adhere to various local regulations and licensing requirements. These challenges can hinder operational flexibility and escalate costs, thus impacting overall market growth potential.

Opportunities

Investment in Infrastructure

Investment in logistics infrastructure presents significant opportunities for the UAE warehousing market. In 2023, the government allocated AED 700 million to support infrastructure projects, aiming to enhance transportation networks and logistics facilities nationwide. Major projects like the expansion of Dubai’s Warehousing Complex are indicative of this trend, as they aim to provide cutting-edge facilities to support growing logistics needs. Such investments not only bolster the warehousing sector but also create job opportunities and drive economic diversification, ultimately enhancing the market’s prospects.

Expansion of Cold Chain Logistics

The surge in demand for temperature-sensitive goods underscores the growing need for cold chain logistics. The UAE’s food and pharmaceutical sectors have intensified their reliance on cold chain solutions, with an estimated requirement increase of 30% annually for specialized storage. In 2023, the establishment of a new cold storage facility capable of accommodating 1,000 tons of product in Dubai reflects immediate market needs. The continuous advancements in monitoring technologies and infrastructure will bolster cold chain capabilities, positioning the market for future growth amidst rising consumer expectations.

Future Outlook

Over the next few years, the UAE warehousing market is expected to witness substantial growth, driven by advancements in technology, the rise of e-commerce, and government initiatives to enhance logistics infrastructure. As companies continue to invest in automation and innovative solutions to cater to evolving consumer demands, the market is poised for transformation. The integration of smart technologies such as IoT and AI in warehouse operations will further optimize supply chains, ensuring efficiency and reducing operational costs.

Major Players

- Agility Logistics

- DHL Supply Chain

- Aramex

- Kuehne + Nagel

- DB Schenker

- Emirates Logistics

- GAC Group

- XPO Logistics

- CEVA Logistics

- Al-Futtaim Logistics

- Saudi Arabian Logistics

- FedEx Logistics

- Janel Group

- Maersk Logistics

- Panalpina

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Economy, Federal Transport Authority)

- Logistics and Supply Chain Management Companies

- E-commerce Businesses

- Retail Chains

- Real Estate Developers (specializing in logistics and warehousing)

- Technology Providers (offering logistics and warehouse management solutions)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the UAE warehousing market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the UAE warehousing market. This includes assessing market penetration, the ratio of warehouse types to service providers, and resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple warehousing operators and service providers to acquire detailed insights into product segments, service performance, customer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the UAE warehousing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rapid Urbanization

Growth in E-commerce

Increasing Demand for Third-Party Logistics - Market Challenges

High Operational Costs

Regulatory Compliance - Opportunities

Investment in Infrastructure

Expansion of Cold Chain Logistics - Trends

Rise of Automation

Shift Towards Sustainable Warehousing - Government Regulation

Licensing and Permits

Safety and Health Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Warehouse Type (In Value %)

Public Warehouses

– Short-Term Storage Services

– Pay-Per-Use Racking

– Shared Inventory Spaces

Private Warehouses

– Dedicated Warehousing for Large Enterprises

– Long-Term Leases with Custom Layouts

– On-Premise Inventory Management

Automated Warehouses

– AS/RS (Automated Storage & Retrieval Systems)

– Conveyor Systems & Sortation

– Robotic Picking and Palletizing

Climate-Controlled Warehouses

– Temperature-Controlled (15°C to 25°C) for Electronics, Cosmetics

– Refrigerated (2°C to 8°C) for F&B and Pharmaceuticals

– Frozen Storage (Below -18°C) for Meat and Perishables - By Application (In Value %)

Retail

– Apparel and Fashion Warehousing

– Electronics Storage and Distribution

– Bulk Goods for Hypermarkets

Manufacturing

– Raw Material Storage

– Finished Goods Dispatch Centers

– Just-in-Time Component Storage

E-commerce

– Fulfillment Centers for B2C Orders

– Return Management Zones

– Multi-client Shared Warehousing

Cold Storage

– Food & Beverage Storage

– Vaccine and Biopharma Storage

– High-Value Cold Chain Packaging Areas - By Distribution Channel (In Value %)

Direct Sales

– Manufacturer-Owned Warehousing Contracts

– In-house Fleet Integration with Storage

– Facility Leasing via Direct Bids

Online Platforms

– Digital Warehousing Aggregators

– Instant Space Booking Solutions

– Platform-Based 3PL Partnerships

Distributors

– FMCG Distribution Centers

– Electronics and Appliance Stockists

– Auto Parts & Lubricant Warehousing - By Region (In Value %)

Abu Dhabi

Dubai

Sharjah

Other Emirates - By Technology Leveraged (In Value %)

RFID (Radio-Frequency Identification)

– Real-Time Inventory Tracking

– Automated Check-In/Check-Out Systems

– Smart Pallet Management

IoT Solutions

– Temperature and Humidity Monitoring Sensors

– Predictive Maintenance for Equipment

– Remote Asset Management Platforms

Warehouse Management Systems (WMS)

– Order Accuracy Enhancement

– Slotting and Inventory Optimization

– Labor Management and KPI Reporting

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Warehouse Type Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Warehouse Type, Number of Locations, Distribution Channels, Number of Clients, Margins, Capacity, Unique Value Offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Agility Logistics

DHL Supply Chain

Emirates Logistics

Aramex

Barloworld Logisitcs

Kuehne + Nagel

DB Schenker

GAC Group

Kühne + Nagel

CEVA Logistics

Al-Futtaim Logistics

Saudi Arabian Logistics

DB Schenker

Yusen Logistics

Exel Supply Chain

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030