Market Overview

The UAE Whole Exome Sequencing market current size stands at around USD ~ million, supported by test volumes of ~ units in clinical and research settings and active system installations of ~ systems across major hospitals and laboratories. In recent periods, diagnostic throughput expanded from ~ tests to ~ tests annually, while average revenue per test stabilized near USD ~. Capital inflows of USD ~ million strengthened laboratory automation, bioinformatics capacity, and clinician training programs.

Market activity is concentrated in Abu Dhabi and Dubai, driven by advanced tertiary hospitals, national genomics programs, and dense clusters of diagnostic laboratories. These cities benefit from integrated care pathways, centralized procurement, and mature reimbursement frameworks that accelerate adoption of complex genetic tests. Strong public–private partnerships, sovereign-backed life sciences initiatives, and a policy environment prioritizing precision medicine further reinforce ecosystem maturity, enabling faster translation of sequencing technologies from research to routine clinical practice.

Market Segmentation

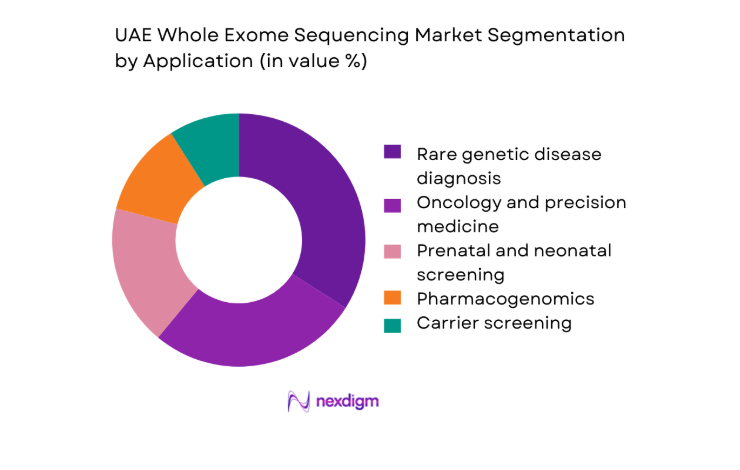

By Application

Clinical diagnostics dominates application demand due to rising utilization in rare disease identification, oncology profiling, and prenatal risk assessment. Hospitals increasingly rely on comprehensive exome-level insights to reduce diagnostic odysseys and improve therapeutic targeting. Research and translational medicine also contribute steadily, supported by national biobanking efforts and population genomics programs. Pharmacogenomics adoption is strengthening within specialty clinics as clinicians seek actionable genetic markers for drug response optimization. The convergence of improved clinician awareness, expanding reimbursement coverage, and streamlined laboratory workflows continues to elevate the role of application-driven uptake in shaping overall market structure.

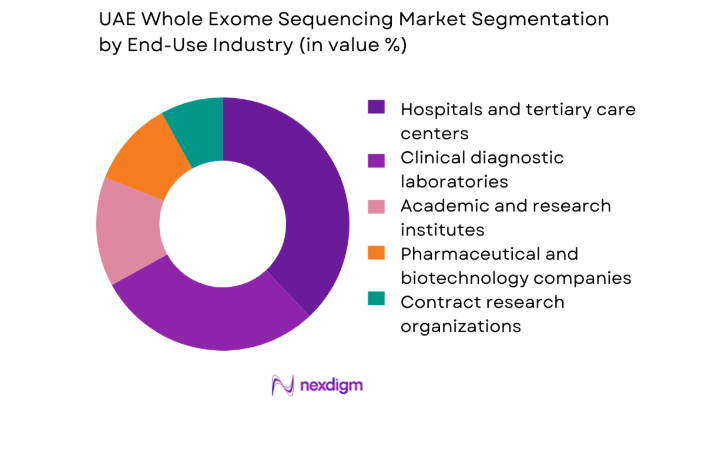

By End-Use Industry

Hospitals and tertiary care centers represent the largest end-use segment, reflecting their role as primary access points for advanced diagnostics and multidisciplinary care teams. Clinical laboratories follow closely, leveraging centralized testing models and high-throughput platforms to serve both public and private healthcare networks. Academic and translational research institutes maintain consistent demand through population studies and clinical trials. Pharmaceutical and biotechnology companies increasingly integrate sequencing into companion diagnostics and biomarker discovery, while contract research organizations expand service offerings for regional and international sponsors.

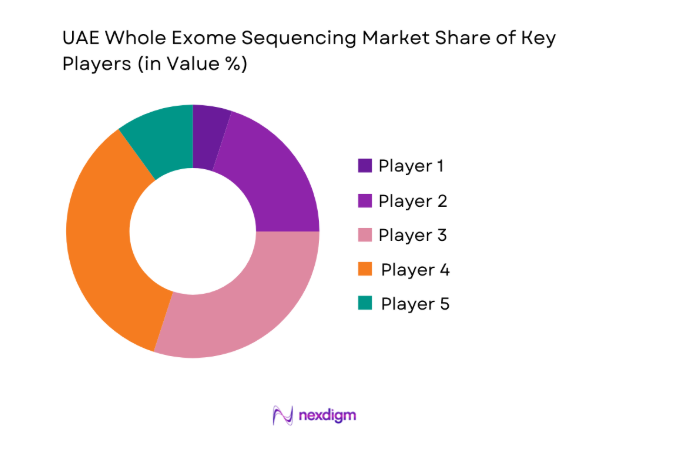

Competitive Landscape

The UAE Whole Exome Sequencing market shows moderate concentration, with a mix of global technology providers and specialized genomics service firms shaping platform availability and testing standards. Competitive dynamics center on technology depth, local service infrastructure, and alignment with national healthcare strategies, creating a landscape where a limited number of players exert strong influence over procurement and long-term partnerships.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Illumina | 1998 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Thermo Fisher Scientific | 1956 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Roche Diagnostics | 1896 | Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| BGI Genomics | 1999 | China | ~ | ~ | ~ | ~ | ~ | ~ |

| QIAGEN | 1984 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

UAE Whole Exome Sequencing Market Analysis

Growth Drivers

Rising prevalence of rare genetic disorders and inherited diseases

Clinical demand has accelerated as annual diagnostic referrals increased from ~ cases to ~ cases, driving test volumes from ~ units to ~ units across tertiary centers. Specialized clinics expanded sequencing capacity by ~ systems to address complex phenotypes requiring comprehensive variant detection. Public health programs allocated USD ~ million toward rare disease pathways, supporting earlier intervention and reducing long-term treatment burdens. This structural rise in patient identification and referral intensity continues to anchor sustained utilization of exome sequencing in routine care.

National genomics initiatives and precision medicine strategies

Government-backed genomics platforms expanded sequencing throughput from ~ tests to ~ tests, supported by infrastructure investments of USD ~ million in centralized laboratories and data platforms. Integration with national health records enabled longitudinal analysis across ~ patient profiles, improving diagnostic accuracy and care coordination. These initiatives increased institutional adoption of advanced sequencing workflows, standardizing clinical pathways and accelerating clinician confidence in genomic-guided decision-making.

Challenges

High capital cost of sequencing platforms and laboratory setup

Initial laboratory deployment requires investments of USD ~ million per facility, covering instrumentation, bioinformatics infrastructure, and quality systems. Annual operational outlays of USD ~ million for reagents and maintenance place pressure on smaller providers, limiting geographic expansion. System acquisition cycles of ~ months further delay market entry for new laboratories, constraining overall service availability despite rising clinical demand.

Shortage of skilled genomic scientists and bioinformaticians

The workforce gap remains evident, with only ~ specialists supporting sequencing operations across major centers. Training programs graduate ~ professionals annually, insufficient to match growing test volumes of ~ units. Institutions allocate USD ~ million toward international recruitment and upskilling, yet onboarding timelines of ~ months slow capacity ramp-up and affect turnaround times for complex analyses.

Opportunities

Integration of WES into national newborn and rare disease screening programs

Pilot screening initiatives processed ~ samples annually, demonstrating feasibility for scaled deployment across ~ births each year. Program expansion could channel USD ~ million into standardized testing pathways, improving early diagnosis and long-term care efficiency. Infrastructure readiness across ~ hospitals positions the system to absorb higher screening volumes without proportional increases in per-test resource intensity.

Development of local genomic reference databases for Arab populations

Population genomics projects have sequenced ~ individuals, generating region-specific variant datasets that enhance clinical interpretation accuracy. Continued investment of USD ~ million into biobanking and data governance can expand coverage to ~ participants, strengthening diagnostic yield and positioning the UAE as a regional hub for ethnically relevant genomic insights.

Future Outlook

The UAE Whole Exome Sequencing market is expected to deepen its role in routine diagnostics as precision medicine becomes embedded across care pathways. Continued alignment between healthcare policy, digital health infrastructure, and life sciences investment will support broader access to advanced genetic testing. Collaboration between public institutions and private innovators is likely to accelerate platform localization, workforce development, and data integration, reinforcing long-term sustainability and clinical impact through 2030 and beyond.

Major Players

- Illumina

- Thermo Fisher Scientific

- Roche Diagnostics

- QIAGEN

- BGI Genomics

- Agilent Technologies

- Oxford Nanopore Technologies

- Pacific Biosciences

- Twist Bioscience

- SOPHiA Genetics

- Revvity

- Eurofins Genomics

- Centogene

- G42 Healthcare

- Pure Health

Key Target Audience

- Public and private hospital networks

- Independent diagnostic laboratories

- Pharmaceutical and biotechnology companies

- Contract research organizations

- Health insurance providers

- Investments and venture capital firms

- Ministry of Health and Prevention

- Department of Health Abu Dhabi

Research Methodology

Step 1: Identification of Key Variables

Defined core market parameters including clinical demand drivers, technology adoption patterns, and regulatory alignment factors. Mapped stakeholder groups across healthcare providers, laboratories, and policy bodies. Established baseline metrics for capacity, utilization, and service coverage to frame subsequent analysis.

Step 2: Market Analysis and Construction

Synthesized qualitative and quantitative inputs to structure the market across applications and end-use industries. Assessed infrastructure readiness, procurement dynamics, and reimbursement environments. Built scenario frameworks to capture varying adoption trajectories and institutional investment behaviors.

Step 3: Hypothesis Validation and Expert Consultation

Engaged domain specialists across clinical genetics, laboratory management, and health policy to validate assumptions. Cross-checked operational realities including workforce availability, data governance practices, and integration challenges within existing care systems.

Step 4: Research Synthesis and Final Output

Integrated validated insights into a coherent market narrative supported by structured segmentation and competitive mapping. Ensured consistency in assumptions, terminology, and analytical rigor to deliver a publication-ready strategic assessment.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, whole exome sequencing service taxonomy across clinical and research use, market sizing logic by test volume and sequencing throughput, revenue attribution across library prep sequencing and bioinformatics services, primary interview program with genetic labs hospitals and research centers, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution

- Clinical care and research usage pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising prevalence of rare genetic disorders and inherited diseases

National genomics initiatives and precision medicine strategies

Expansion of advanced diagnostic infrastructure in tertiary hospitals

Growing adoption of NGS-based oncology and prenatal testing

Increasing investments by government and sovereign funds in life sciences

Improving reimbursement and coverage for advanced genetic tests - Challenges

High capital cost of sequencing platforms and laboratory setup

Shortage of skilled genomic scientists and bioinformaticians

Data privacy, consent management, and genomic data governance concerns

Limited local manufacturing and dependence on imported reagents

Complex regulatory pathways for advanced molecular diagnostics

Uneven awareness among clinicians about WES clinical utility - Opportunities

Integration of WES into national newborn and rare disease screening programs

Development of local genomic reference databases for Arab populations

Public-private partnerships in genomic medicine and biobanking

Expansion of clinical trials and companion diagnostics in oncology

Growth of medical tourism for advanced genetic testing services

Adoption of AI-driven variant interpretation and decision support - Trends

Shift from research-focused to routine clinical adoption of WES

Increasing use of cloud-based bioinformatics and data sharing platforms

Bundling of WES with targeted panels and whole genome sequencing

Rising role of population genomics and preventive healthcare

Standardization of laboratory workflows and accreditation

Consolidation among diagnostic service providers - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2019–2024

- By Test Volume, 2019–2024

- By Active Sequencing Systems, 2019–2024

- By Revenue per Test, 2019–2024

- By Fleet Type (in Value %)

Public hospitals and government laboratories

Private hospital networks

Independent diagnostic laboratories

Academic and research institutes

Biotechnology companies and CROs - By Application (in Value %)

Rare genetic disease diagnosis

Oncology and precision medicine

Prenatal and neonatal screening

Pharmacogenomics

Carrier screening and inherited disorder testing - By Technology Architecture (in Value %)

Short-read NGS platforms

Long-read sequencing platforms

Hybrid capture-based WES workflows

Amplicon-based exome sequencing workflows - By End-Use Industry (in Value %)

Hospitals and tertiary care centers

Clinical diagnostic laboratories

Academic and translational research institutes

Pharmaceutical and biotechnology companies

Contract research organizations - By Connectivity Type (in Value %)

On-premise sequencing and analysis

Cloud-based bioinformatics platforms

Hybrid deployment models

Standalone offline systems - By Region (in Value %)

Abu Dhabi

Dubai

Sharjah

Northern Emirates

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (sequencing accuracy, turnaround time, test menu breadth, bioinformatics capability, data security compliance, local service support, pricing flexibility, partnership ecosystem)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Illumina

Thermo Fisher Scientific

Agilent Technologies

QIAGEN

Roche Diagnostics

BGI Genomics

Pacific Biosciences

Oxford Nanopore Technologies

Twist Bioscience

SOPHiA Genetics

Revvity

Eurofins Genomics

Centogene

G42 Healthcare

Pure Health

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2025–2030

- By Test Volume, 2025–2030

- By Active Sequencing Systems, 2025–2030

- By Revenue per Test, 2025–2030