Market Overview

The UAE Zero Emission Aircraft Market is projected to reach USD ~ billion by recent historical assessments, driven by growing demand for sustainable air travel and government initiatives supporting green aviation technologies. This market is influenced by various factors including advancements in electric propulsion systems, increased investments in research and development, and favorable regulations aimed at reducing carbon emissions in aviation. The demand for cleaner and more efficient aviation solutions has been accelerating, further bolstered by public and private sector collaborations aimed at fostering innovation.

The UAE stands out as a dominant force in the market due to its strategic investments in sustainability and commitment to reducing carbon emissions in the aviation sector. The country’s strong regulatory framework, government-backed funding, and partnerships with major international aerospace players play a key role in fostering the market’s growth. Dubai and Abu Dhabi lead the charge, with investments in green aviation infrastructure and the development of electric aircraft technologies. These cities serve as hubs for technological advancements, enhancing the UAE’s competitive edge in the global market.

Market Segmentation

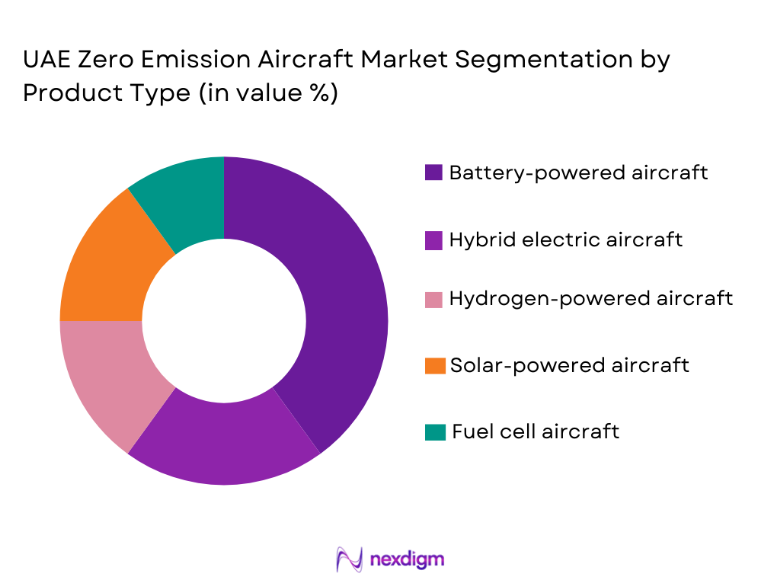

By Product Type

The UAE Zero Emission Aircraft Market is segmented by product type into battery-powered aircraft, hybrid electric aircraft, hydrogen-powered aircraft, solar-powered aircraft, and fuel cell aircraft. Currently, the battery-powered aircraft sub-segment dominates the market share due to the rapid advancements in battery technology and its feasibility for shorter regional flights. Battery-powered aircraft offer significant advantages in terms of cost-effectiveness, reduced carbon emissions, and quieter operations. These benefits are crucial for both commercial and private sector customers looking to reduce their environmental footprint while also lowering operational costs. The UAE’s investment in sustainable aviation technologies has provided substantial funding for battery-powered aircraft research, further supporting this sub-segment’s dominance.

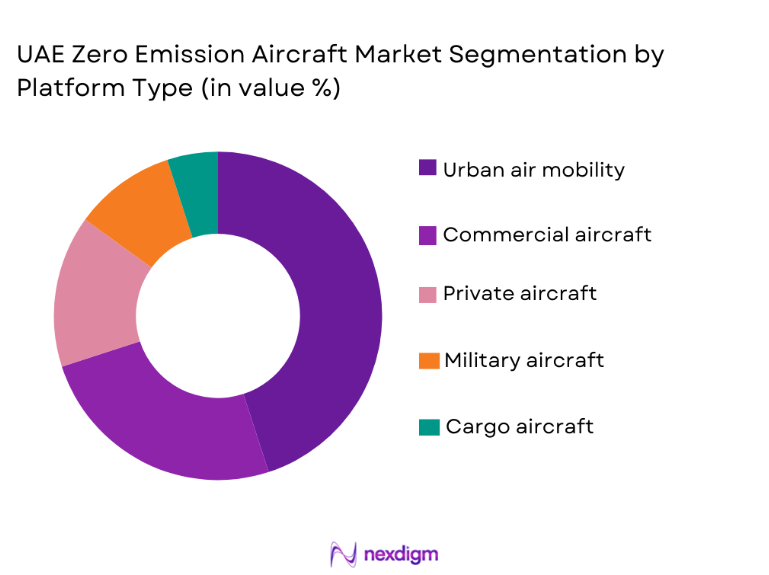

By Platform Type

The UAE Zero Emission Aircraft Market is segmented by platform type into commercial aircraft, private aircraft, military aircraft, urban air mobility, and cargo aircraft. Urban air mobility has recently gained significant market share due to the growing demand for eco-friendly transportation solutions in urban environments. This sub-segment benefits from the increasing adoption of electric vertical takeoff and landing (eVTOL) aircraft, which are seen as a viable solution to urban congestion and pollution. The UAE’s investments in infrastructure for electric aviation and its push for sustainable urban transport have contributed to the growth of this sub-segment, which is expected to continue expanding rapidly in the coming years.

Competitive Landscape

The UAE Zero Emission Aircraft Market is competitive, with key players focusing on advanced technologies, strategic partnerships, and regulatory compliance to capitalize on market growth. The consolidation of major players through mergers, acquisitions, and alliances is significantly shaping the market dynamics. Leading companies are focusing on increasing their technological capabilities, particularly in the development of electric propulsion systems and sustainable aviation fuel. These players are also leveraging the UAE’s favorable government policies and initiatives designed to promote the use of zero-emission aircraft in both commercial and private sectors.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Vertical Aerospace | 2016 | Bristol, UK | ~ | ~ | ~ | ~ | ~ |

| Joby Aviation | 2009 | California, USA | ~ | ~ | ~ | ~ | ~ |

| Lilium | 2015 | Munich, Germany | ~ | ~ | ~ | ~ | ~ |

UAE Zero Emission Aircraft Market Analysis

Growth Drivers

Government Incentives for Sustainable Aviation

Government incentives play a critical role in the growth of the UAE Zero Emission Aircraft Market. The UAE government has introduced multiple initiatives to support the development of sustainable aviation technologies, including subsidies and funding for research into green aviation. The UAE’s commitment to sustainability and its position as a global leader in technological innovation make it an ideal environment for the growth of zero-emission aircraft. Furthermore, the regulatory environment in the UAE is designed to encourage the development and adoption of sustainable aviation solutions. These initiatives have enabled manufacturers and developers of zero-emission aircraft to secure the necessary resources for technological advancements and infrastructure development. The UAE government’s ongoing support is expected to sustain the momentum of the market growth in the coming years.

Technological Advancements in Electric Propulsion

Technological advancements in electric propulsion systems are one of the key drivers for the expansion of the UAE Zero Emission Aircraft Market. The continuous evolution of battery technology, electric motors, and energy management systems has made it more feasible to develop fully electric aircraft capable of competing with conventional fossil fuel-powered aircraft. Electric propulsion systems are highly efficient, have fewer moving parts, and require less maintenance compared to traditional engines, which significantly reduces operational costs for aircraft operators. As battery storage and power-to-weight ratios improve, the performance capabilities of electric aircraft continue to evolve, further driving the demand for this technology. Furthermore, the growing emphasis on reducing aviation emissions is prompting investment in cleaner technologies, with electric propulsion playing a central role in this transformation.

Market Challenges

High Capital Investment

One of the primary challenges in the UAE Zero Emission Aircraft Market is the high capital investment required for the development and manufacturing of zero-emission aircraft. Research and development costs, as well as the costs associated with setting up manufacturing facilities and infrastructure for electric propulsion systems, are substantial. While these investments have the potential for significant returns in the long term, the initial costs create a barrier for many companies and stakeholders in the market. Despite the supportive regulatory environment in the UAE, the financial strain associated with these investments could slow down the adoption and scale of zero-emission aircraft in the near term. This challenge is particularly relevant for smaller manufacturers or startups without access to large amounts of capital, which may hinder their ability to compete in the market.

Limited Charging Infrastructure

A critical challenge facing the UAE Zero Emission Aircraft Market is the limited availability of charging infrastructure for electric aircraft. As the adoption of electric aviation technologies increases, there is a growing need for a robust network of charging stations, particularly at airports and other key aviation hubs. The establishment of this infrastructure requires significant investments, coordination between public and private sectors, and overcoming logistical hurdles related to the installation of fast-charging systems. Without a comprehensive charging network, the widespread adoption of electric aircraft will remain limited, as operators will face concerns over range anxiety and the availability of suitable charging facilities. The lack of a reliable charging infrastructure is a major barrier to the rapid growth of the market and must be addressed to ensure that zero-emission aircraft can be integrated into the broader aviation ecosystem.

Opportunities

Expansion of Urban Air Mobility

The increasing demand for sustainable and efficient urban transport solutions presents a significant opportunity for the UAE Zero Emission Aircraft Market. Urban air mobility (UAM) systems, including electric vertical takeoff and landing (eVTOL) aircraft, are becoming a key focus in the development of zero-emission aviation technologies. These aircraft are designed to alleviate urban congestion and provide quick, eco-friendly transportation solutions within cities. With the UAE’s advanced infrastructure, forward-thinking regulatory environment, and high urbanization levels, the country is well-positioned to lead the development and commercialization of UAM systems. This opportunity offers the potential for major advancements in green aviation technologies and the creation of a new market segment focused on sustainable urban transportation.

Growth in Private and Commercial Aircraft Adoption

The rising interest in reducing carbon footprints among private aircraft owners and commercial airlines provides significant growth opportunities for zero-emission aircraft. As concerns about environmental sustainability increase, both sectors are exploring alternative fuel sources and propulsion technologies to reduce their reliance on fossil fuels. The UAE’s focus on sustainability, along with the increasing pressure for the aviation sector to adopt cleaner technologies, positions the market for substantial growth in the coming years. Private aircraft owners, who tend to be early adopters of new technologies, are particularly well-suited to transition to zero-emission aircraft as part of their commitment to reducing their environmental impact.

Future Outlook

The future outlook for the UAE Zero Emission Aircraft Market is highly positive, with significant growth anticipated in the next five years. Technological advancements in electric propulsion systems, coupled with government support, will drive demand for zero-emission aircraft. The market will benefit from increasing investment in sustainable aviation infrastructure, including electric charging stations and hydrogen refueling facilities. Urban air mobility is expected to expand rapidly, with the UAE positioning itself as a leader in the development of electric vertical takeoff and landing aircraft. As the market matures, regulatory policies and consumer demand for eco-friendly aviation solutions will further bolster market growth. However, challenges such as high initial investments and the need for a reliable charging infrastructure must be addressed to ensure that the market reaches its full potential.

Major Players

- Airbus

- Boeing

- Vertical Aerospace

- Joby Aviation

- Lilium

- Rolls-Royce

- Honeywell Aerospace

- Embraer

- Magnix

- Eviation Aircraft

- AeroVironment

- Pipistrel Aircraft

- Quantum Systems

- Skai

- Wright Electric

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft manufacturers

- Airline operators

- Urban air mobility providers

- Aerospace and defense contractors

- Environmental advocacy groups

- Aviation technology developers

Research Methodology

Step 1: Identification of Key Variables

The key variables affecting the market are identified through a comprehensive review of industry reports, trends, and government policies.

Step 2: Market Analysis and Construction

The market is analyzed by segmenting it into key categories, including product type, platform type, and regional dynamics.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses are validated by consulting with experts in electric aviation, battery technology, and government policy to ensure accuracy.

Step 4: Research Synthesis and Final Output

The research findings are synthesized into a cohesive report, offering clear insights and projections based on data collected and expert consultations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Government Incentives and Subsidies

Increasing Focus on Sustainability in Aviation

Technological Advancements in Electric Propulsion

Growing Demand for Sustainable Air Travel

Reducing Carbon Emissions in Aviation Industry - Market Challenges

High Capital Investment Requirements

Technological Barriers in Energy Storage

Limited Infrastructure for Hydrogen Aircraft

Regulatory Approval for New Aircraft Technologies

Long Development Timelines - Market Opportunities

Partnerships with Technology Innovators

Expansion in Urban Air Mobility Solutions

Growth in Green Aviation Investments - Trends

Advancements in Battery Efficiency

Increase in Hybrid Aircraft Deployment

Integration of Autonomous Systems in Aviation

Emerging Demand for Short Regional Flights

Growth of Eco-friendly Airports - Government Regulations & Defense Policy

Strict Emission Reduction Targets

Government Funding for Green Aviation

Hydrogen Fuel Infrastructure Development - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Battery-powered Aircraft

Hybrid Electric Aircraft

Hydrogen-powered Aircraft

Solar-powered Aircraft

Fuel Cell Aircraft - By Platform Type (In Value%)

Commercial Aircraft

Private Aircraft

Military Aircraft

Urban Air Mobility

Cargo Aircraft - By Fitment Type (In Value%)

Retrofit Solutions

OEM Solutions

Hybrid Systems

Modular Systems

Integrated Systems - By EndUser Segment (In Value%)

Commercial Airlines

Private Jet Owners

Military Operators

Cargo and Logistics Companies

Urban Air Mobility Providers - By Procurement Channel (In Value%)

Direct Procurement

OEM Distribution

Private Sector Procurement

Government Tenders

Third-party Distributors - By Material / Technology (In Value%)

Lightweight Composite Materials

Electric Propulsion Systems

Battery Technologies

Hydrogen Fuel Cells

Fuel-efficient Aerodynamics

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Embraer

Airbus

Boeing

ZeroAvia

Vertical Aerospace

Lilium

Joby Aviation

Hyundai Motor Group

Rolls-Royce

Honeywell Aerospace

Electric Aircraft Corporation

Eviation Aircraft

MagniX

AeroVironment

General Electric

- Airlines Adopting Green Aircraft Solutions

- Private Jet Owners’ Focus on Sustainability

- Military Operators Integrating New Technologies

- Urban Air Mobility Providers’ Growth Potential

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035