Market Overview

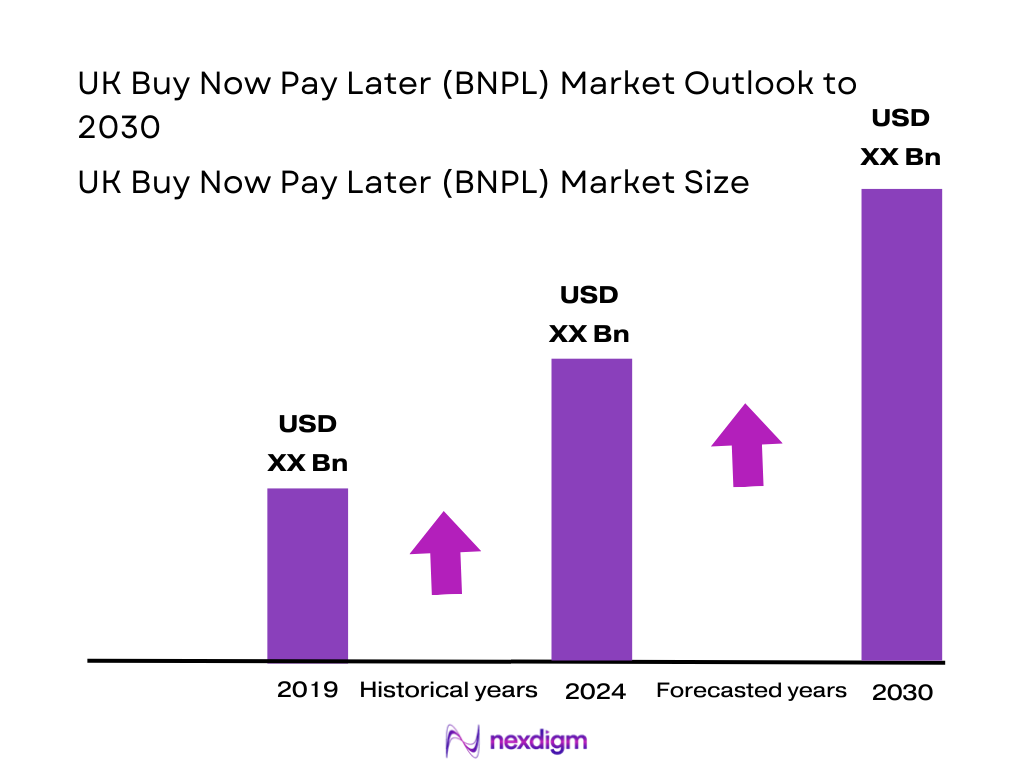

The UK BNPL market is valued at USD 11.46 billion, drawn from a comprehensive industry analysis that reflects precise transactional volume in the consumer and merchant ecosystem. Forecasts show a compound annual growth trajectory of 22.2% from 2024 to 2030, underpinned by uptake among digital-native consumers, rising e‑commerce penetration, and evolving “buy now, pay later” models fitting modern credit preferences. Growth is driven by rapid e‑commerce expansion, a shift toward seamless interest‑free installment options, and strong engagement among younger demographics—Millennials and Gen Z—influenced by tight household budgets and digital convenience.

Urban centers and affluent regions such as London, Manchester, and Birmingham dominate the UK BNPL market, owing to high digital penetration, dense retail networks offering BNPL options, and younger populations. These regions also benefit from greater financial literacy, extensive merchant adoption, and strong fintech presence—making them hotspots for BNPL innovation and usage.

Market Segmentation

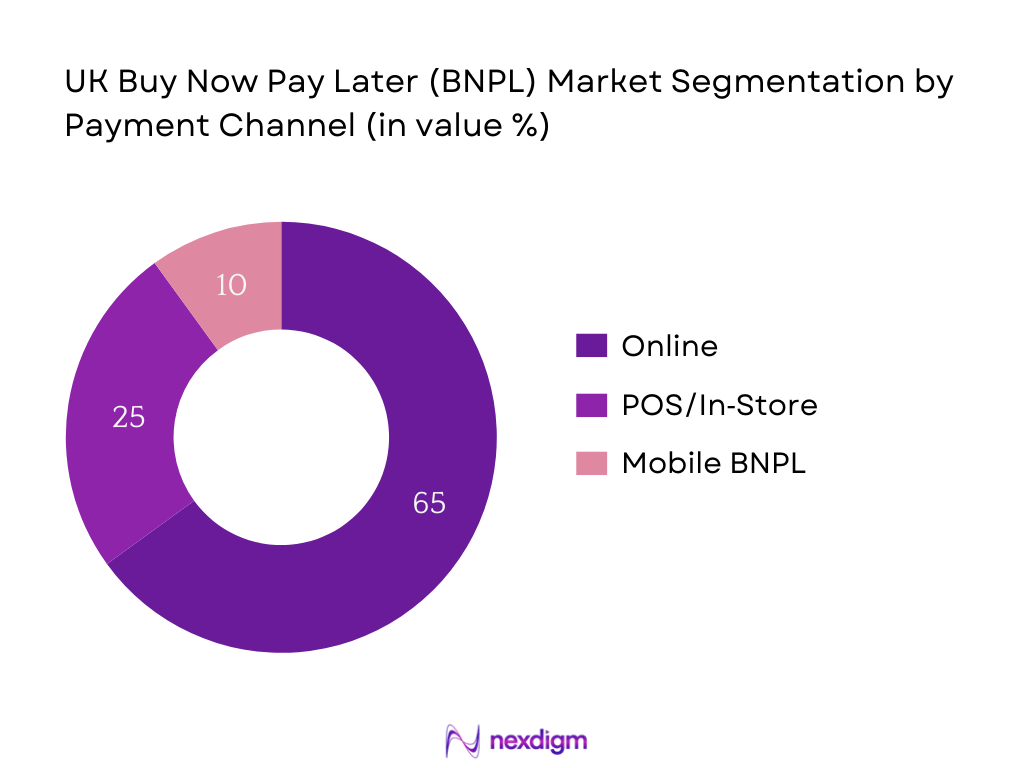

By Channel

The UK BNPL market segments into Online, In‑store POS, and Mobile App. The Online sub‑segment holds dominance with a significant majority share in 2024. This is due to consumers’ growing preference for digital-first purchasing, the seamless integration of BNPL at e-commerce checkouts, and ongoing shifts in shopping behavior toward remote channels. Retailers find online BNPL appealing as it boosts average order values and conversion rates, while consumers appreciate the speed, convenience, and instant approval—factors that drive its dominance.

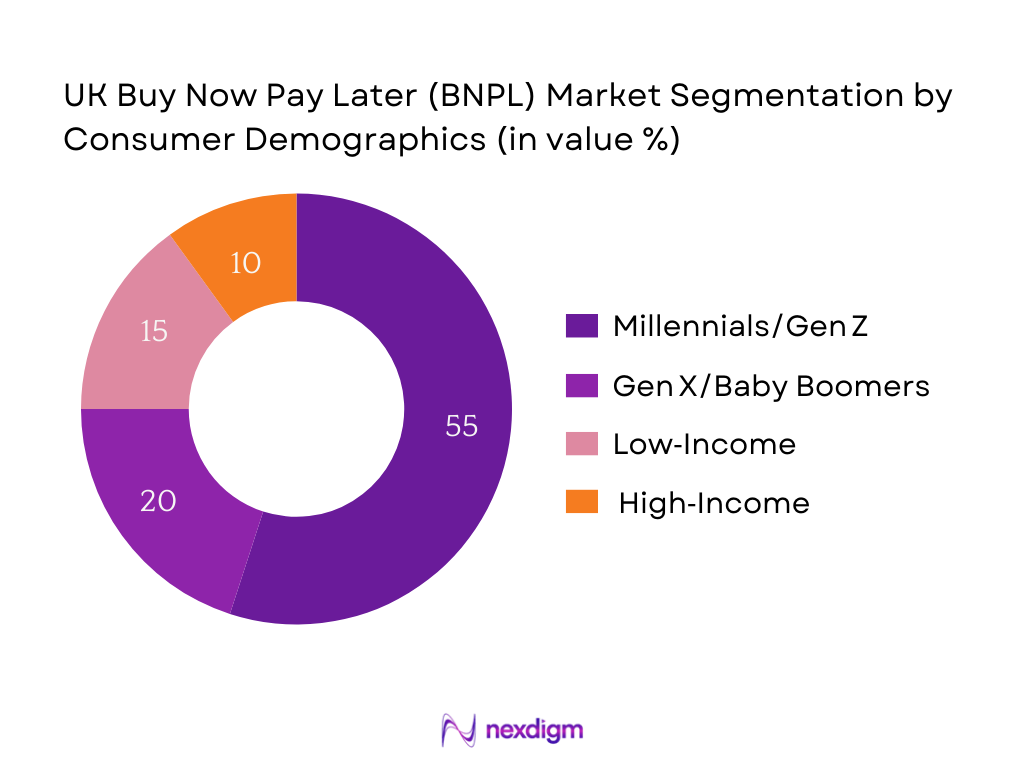

By Consumer Demographic

The market is segmented into Millennials/Gen Z, Gen X/Baby Boomers, Low‑Income, and High‑Income groups. The Millennials/Gen Z sub‑segment commands a dominant share of the UK BNPL market in 2024. Their high digital fluency, comfort with app-driven payment platforms, and tendency to delay full payment for flexibility give them an edge. Furthermore, cost-of-living pressures and students’ budget constraints make installment-based purchasing especially appealing to these younger cohorts, further reinforcing their market dominance.

Competitive Landscape

The UK BNPL market is shaped by a concentrated set of influential providers. This consolidation underscores the dominant role that key fintech and large-scale platforms play in defining market dynamics, consumer expectations, and regulatory discourse.

| Company | Establishment Year | Headquarters | Merchant Coverage (%) | Repeat User Rate (%) | Late‑Payment Incidence (%) | API Integration Readiness | FCA Authorization Status |

| Klarna | 2005 | Stockholm, Sweden | – | – | – | – | – |

| Clearpay (Afterpay) | 2011 | London, UK | – | – | – | – | – |

| Zilch | 2018 | London, UK | – | – | – | – | – |

| PayPal Credit | 2000s | London, UK | – | – | – | – | – |

| Monzo Flex | 2015 | London, UK | – | – | – | – | – |

UK BNPL Market Analysis

Key Growth Drivers

Surging Mobile‑First E‑commerce Adoption

The UK’s digital commerce ecosystem has benefited from high mobile penetration: in 2024, 96 percent of the UK population—over 66 million people—used mobile phones, with 100 percent of adults aged 16–24 on smartphones. Simultaneously, online retail now constitutes around 27 pence of every £1 spent in retail, reflecting strong online purchasing trends. These figures collectively underscore a digitally fluent consumer base accessing BNPL services via mobile and online channels, propelling BNPL adoption across e‑commerce platforms.

High Credit Card Aversion Among Young Adults

Though precise numbers on credit card ownership are limited, youth digital preferences are evidenced by 100 percent smartphone usage among 16–24 year-olds in 2024, reflecting digital-native behavior. Concurrently, the services sector—which includes digital payment platforms—expanded by 1.5 percent over 2024. Taken together, these data suggest that younger consumers lean toward seamless, mobile-enabled payment alternatives like BNPL, driven by convenience and resistance to traditional credit products.

Key Market Challenges

Default Risk Among Low‑Income BNPL Users

In Q4 2024, real household disposable income per head increased by 1.7 percent, yet real GDP per head showed zero growth for the year. This indicates limited increases in individual purchasing power, particularly in lower-income segments. Meanwhile, retail sales overall showed only a 0.7 percent annual rise in 2024. With wages and spending power not substantially rising across the board, lower-income consumers using BNPL face heightened default risk, potentially straining providers’ financial models.

Regulatory Uncertainty and Delay in Enforcement

Retail sales rebounded modestly in 2024 with a 0.7 percent increase, the first yearly uptick since 2021, yet consumer confidence and spending remain fragile. Concurrently, GDP growth remains subdued—real GDP increased by only 1.1 percent in 2024. Against this backdrop, BNPL regulation is evolving. Providers must navigate fluctuating enforcement timelines and unclear compliance costs, creating uncertainty in strategic planning and inhibiting aggressive expansion without explicit regulatory clarity.

Emerging Opportunities

BNPL Integration with Loyalty Programs of Large Retailers

In 2024, retail sector GVA reached £111.6 billion, contributing 4.5 percent of UK economic output. Online retail now accounts for 27 pence per £1 of total retail spending. These figures suggest that embedding BNPL into loyalty programs of high-output retailers can leverage existing consumer spending channels. Given high digital engagement and retail activity, integrating BNPL with loyalty schemes offers a route to tap into established purchase behaviors, encourage repeat transactions, and enhance both retailer and BNPL provider value.

NHS, Education and Public Sector BNPL Applications

Services sectors expanded by 1.5 percent in 2024, and households’ disposable income per head grew by 1.7 percent in Q4, aided by wage and benefit increases of £7.2 billion and £3.8 billion respectively. Public institutions like the NHS and education providers, managing constrained budgets amidst rising service demand, may explore BNPL-like arrangements for patient or student payments. The combination of increasing disposable income and sector funding pressures opens avenues for BNPL to offer flexible public sector financing solutions.

Future Outlook

Over the 2024–2030 period, the UK BNPL market is poised for strong expansion against a backdrop of evolving consumer preferences, regulatory tightening, and technological progress. Continued digital commerce growth, fintech competition, and demographic shifts toward younger, budget-conscious consumers will further reinforce BNPL’s role as a mainstream financing option. Regulatory changes under the Financial Conduct Authority will enhance consumer protections while fostering market trust—ultimately supporting sustainable growth and provider consolidation.

Major Players

- Klarna

- Clearpay (Afterpay)

- Zilch

- PayPal Credit

- Monzo Flex

- Payl8r

- Affirm (UK entrant)

- FuturePay

- Laybuy

- Openpay

- HSBC BNPL product

- American Express Plan It (UK)

- Revolut BNPL (if any)

- Curve Flex

- DivideBuy

Key Target Audiences

- Retailer CFOs / Payment Strategy Heads

- BNPL Product Managers (Fintech & Banks)

- Investor Relations / Strategy Teams in BNPL Fintechs

- Investments and Venture Capitalist Firms (e.g., Index Ventures, Accel)

- Government and Regulatory Bodies (Financial Conduct Authority, HM Treasury)

- Digital Payment Technology Providers

- Consumer Credit Risk Teams in Banks

- E-commerce Platform Partnerships Leads

Research Methodology

Step 1: Identification of Key Variables

We mapped the UK BNPL ecosystem—consumers, merchants, fintech providers, credit agencies—using desk research across proprietary and public data sources, defining critical market drivers such as transaction volume, user demographics, channel adoption, and regulatory context.

Step 2: Market Analysis and Construction

Historical data on UK BNPL value (2023), usage trends, channel penetration, and demographic patterns were compiled. We assessed consumer behavior metrics and merchant integration levels to build a bottom-up revenue estimation and ensure accurate size attribution.

Step 3: Hypothesis Validation and Expert Consultation

Our hypotheses on growth drivers, demographic engagement, and regulatory influence were validated via interviews with industry experts—including fintech leaders, merchant executives, and regulatory advisors—to align projections with market realities.

Step 4: Research Synthesis and Final Output

We cross-verified data by engaging with BNPL providers for insights into product performance, adoption rates, fee structures, and compliance strategies. This ensured convergence of bottom-up estimates with provider-reported metrics and bolstered report credibility.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players (Launches, Exits, Acquisitions, Regulatory Milestones)

- BNPL Business Lifecycle in UK (Mature Stage Indicators, Repeat Usage Lifecycle)

- Value Chain and Ecosystem Mapping (BNPL Integrators, Lenders, Merchants, End Consumers)

- Key Growth Drivers

Surging Mobile-First E-commerce Adoption

High Credit Card Aversion Among Young Adults

Emergence of BNPL-Embedded APIs for Merchants

FCA’s Regulatory Framework Creating Entry Barriers for Non-Compliant Players - Key Market Challenges

Default Risk Among Low-Income BNPL Users

Regulatory Uncertainty and Delay in Enforcement

Merchant Reluctance Due to High Commission Rates

Data Privacy and Consumer Profiling Restrictions Under UK GDPR - Emerging Opportunities

BNPL Integration with Loyalty Programs of Large Retailers

NHS, Education and Public Sector BNPL Applications

Embedded BNPL in Utility and Subscription Models

Open Banking and Credit Affordability Partnerships - Trends

Rise of Multi-Lender Marketplaces & Aggregators

Decline in Late Fee-Driven Models

Expansion into B2B BNPL for SMEs

Use of AI/ML for Dynamic Credit Scoring - Government Regulations (FCA Regulation Timeline, Risk-Based Consumer Profiling Guidelines, Creditworthiness Assessment Rules)

- SWOT Analysis

- Stake Ecosystem (Consumers, Banks, Fintechs, Merchants, Credit Bureaus, Payment Gateways)

- Porter’s Five Forces Analysis

- BNPL Value Chain and Competition Ecosystem

- By Total BNPL Transaction Value, 2019-2024

- By BNPL Users (Active User Base), 2019-2024

- By Total Merchant Partners, 2019-2024

- By Online vs Offline Share, 2019-2024

- By Frequency of BNPL Usage per Consumer, 2019-2024

- By Channel (In Value %)

Online

In-store POS

Mobile App

Super-apps

Embedded Finance - By Consumer Demographics (In Value %)

Gen Z

Millennials

Gen X

High-Income

Mid-Low Income - By Industry Vertical (In Value %)

Fashion

Electronics

Travel

Health

Home Improvement - By Provider Type (In Value %)

Fintech-only

Bank-led

Retailer-owned

Payment Gateway-Integrated - By Tenure of Repayment (In Value %)

Pay in ¾

Long Installments

Revolving BNPL

- Market Share of Major Players on the Basis of Value/Volume

Market Share of Major Players by Channel Type - Cross Comparison Parameters (Platform Conversion Rate, Merchant Acceptance Rate, BNPL Delinquency Ratio, Average Consumer Retention Rate, User Lifetime Value via BNPL, Late Fee Dependency Ratio, Integration Complexity for Merchants, Regulatory Compliance Rating (FCA readiness))

- SWOT Analysis of Major Players

- Comparative Pricing & Fee Structures (Pay in 3/4, Long-term BNPL, Default Charges)

- Detailed Profiles of Major Companies

Klarna

Clearpay (Afterpay)

Zilch

Laybuy

Monzo Flex

American Express Plan It

Payl8r

PayPal Credit

Curve Flex

FuturePay

Openpay

Affirm

Tymit

HSBC BNPL

Sezzle

- Average Monthly Usage and Spending

- Age-wise Preference Analysis

- Purchase Type Breakdown (Impulse vs Need-based)

- Risk Appetite and Default Trends by Income Segments

- User Experience Insights and Friction Points

- By Projected Transaction Value, 2025-2030

- By Active BNPL Users, 2025-2030

- By Merchant Partnerships, 2025-2030

- By Industry Vertical, 2025-2030

- By Format, 2025-2030