Market Overview

As of 2024, the UK stethoscopes market is valued at USD 29.3 million, with a growing CAGR of 5.5% from 2024 to 2030, showcasing a significant growth fuelled by the rising demand for advanced diagnostic equipment, particularly in hospital settings. This growth is supported by a surge in healthcare spending and increasing awareness regarding early disease diagnosis and management, making stethoscopes an essential tool for healthcare professionals.

Dominant regions such as England, particularly cities like London and Birmingham, significantly influence the market due to their high concentration of healthcare facilities and educational institutions. Scotland also plays a vital role due to its established healthcare system and medical training centers, creating a robust demand for quality stethoscopes.

Market Segmentation

By Technology Type

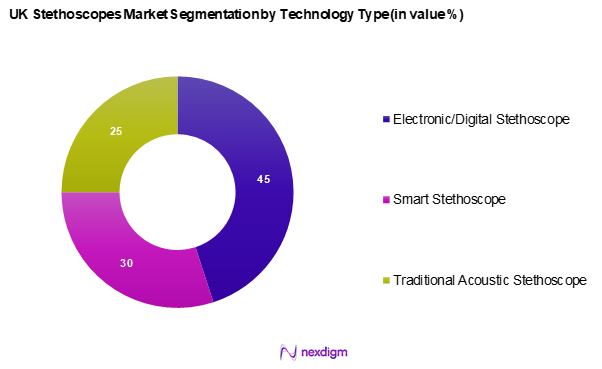

The UK stethoscopes market is segmented into electronic/digital stethoscopes, smart stethoscopes, and traditional acoustic stethoscopes. Among these, electronic/digital stethoscopes dominate the market share due to their innovative features such as sound amplification and Bluetooth connectivity, which enhance diagnostic accuracy and efficiency. As healthcare practitioners increasingly adopt advanced technologies for better patient outcomes, this segment’s growing popularity is evident.

By End-User

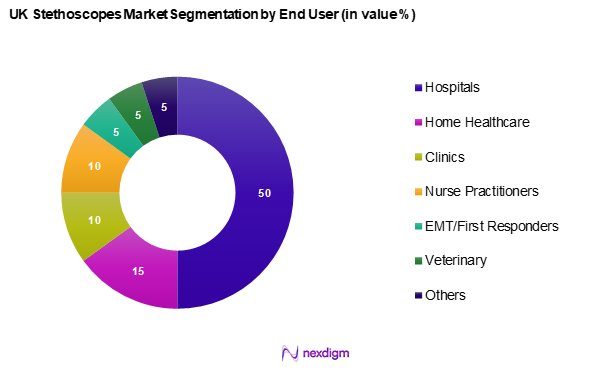

The UK stethoscopes market is segmented into home healthcare, hospitals, clinics, nurse practitioners, EMT/first responders, veterinary, and others. Among these segments, hospitals lead the market as they require a steady supply of stethoscopes for routine examinations and procedures. The continuous influx of patients and the increasing trend toward upgrading healthcare equipment in hospitals have intensified the demand for various types of stethoscopes within this segment.

Competitive Landscape

The UK stethoscopes market is characterized by the presence of several major players, with a few companies holding significant market share. The competitive landscape is shaped by key manufacturers known for their advanced technological offerings and rising brand loyalty among healthcare providers.

| Company | Establishment Year | Headquarters | Product Range | Market Share | Estimated Revenue (2024) |

| 3M | 1816 | Minnesota, United States | – | – | – |

| Welch Allyn | 1915 | Skaneateles, New York | – | – | – |

| Omron Healthcare | 1933 | Kyoto, Japan | – | – | – |

| ADC (American Diagnostic Corporation) | 1984 | New York, USA | – | – | – |

| Medtronic | 1949 | Dublin, Ireland | – | – | – |

UK Stethoscopes Market Analysis

Growth Drivers

Increasing Demand for Diagnostic Equipment

A heightened global emphasis on early diagnosis and preventive care is driving the need for diagnostic tools, especially stethoscopes. The healthcare spending in the UK indicates a strong commitment to enhancing health outcomes and services. As more individuals engage with healthcare systems, the necessity for dependable diagnostic instruments like stethoscopes has reached unprecedented levels. This growth in healthcare funding reflects an awareness of the critical role advanced diagnostic tools play in effective patient management.

Advancements in Medical Technology

The stethoscope market is strongly influenced by technological advancements in medicine, with innovations such as digital and smart stethoscopes leading the way. The healthcare technology sector is experiencing remarkable growth fueled by the introduction of state-of-the-art diagnostic tools. Notably, smart stethoscopes featuring Bluetooth and app integrations enhance auditory clarity and data management for healthcare professionals. As healthcare facilities adopt more sophisticated diagnostic technologies, the uptake of these innovative tools is expected to rise, further stimulating the stethoscope market.

Market Challenges

Price Sensitivity

Price sensitivity poses a considerable challenge in the UK stethoscope market. With the National Health Service facing budget constraints, healthcare providers often prioritize more affordable diagnostic options. While healthcare budgets are anticipated to increase, the pressure to spend wisely can result in hesitation to invest in premium diagnostic equipment. This cautious approach may steer providers towards budget-friendly alternatives, potentially stifling the growth of higher-end stethoscopes.

Competition from Alternative Diagnostic Tools

The stethoscope market encounters intense competition from alternative diagnostic methods like handheld ultrasound devices and telemedicine solutions. The growth of the telehealth sector reflects a movement towards non-invasive and remote diagnostic approaches. As healthcare practitioners incorporate these advanced tools into their routines, the traditional stethoscope may experience diminished usage. This trend presents a challenge for stethoscope manufacturers to innovate and maintain their relevance amid an evolving healthcare environment dominated by competing technologies.

Opportunities

Technological Innovations

Emerging technological advancements offer substantial growth prospects within the stethoscope market. With a global surge in healthcare technology investments anticipated, manufacturers have the chance to create next-generation stethoscopes. Innovations incorporating artificial intelligence can lead to more precise diagnostics, thereby enhancing patient care. Furthermore, developments in telehealth and remote monitoring provide new applications for stethoscopes, aligning with the demand for accessible healthcare delivery.

Expanding Telemedicine Trends

The rising prominence of telemedicine presents significant opportunities for the UK stethoscope market. As telehealth services gain traction, accompanied by increased acceptance and use, the requirement for compatible and reliable diagnostic tools becomes essential. The shift towards remote healthcare delivery highlights the need for stethoscope models specifically designed for telehealth, paving the way for a market ready to meet evolving healthcare demands while maintaining high diagnostic standards.

Future Outlook

Over the next five years, the UK stethoscopes market is expected to witness substantial growth, driven by advanced medical technologies, rising healthcare expenditure, and a growing emphasis on patient-cantered care. Additionally, the ongoing trend towards telemedicine is likely to catalyse the demand for both digital and smart stethoscopes, offering healthcare professionals improved diagnostic capabilities remotely.

Major Players

- 3M Littmann

- Welch Allyn

- Omron Healthcare

- ADC (American Diagnostic Corporation)

- Medtronic

- ZOLL Medical

- Eko Devices

- SonoSim

- Thinklabs

- A&E Medical

- American Diagnostic Corporation

- MDF Instruments

- Prestige Medical

- Rappaport

- Fluke Biomedical

Key Target Audience

- Healthcare Providers

- Hospitals and Clinics

- Home Healthcare Agencies

- Emergency Medical Services (EMS)

- Medical Equipment Distributors

- Veterinary Clinics

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., NHS)

Research Methodology

Step 1: Identification of Key Variables

The research begins with constructing an ecosystem map that includes all major stakeholders in the UK stethoscopes market. This process involves comprehensive desk research, utilizing secondary and proprietary databases to gather extensive industry-level information. The primary goal is to identify and define the key variables that significantly influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data regarding the UK stethoscopes market is compiled and analyzed. This analysis covers market penetration, the ratio of various stethoscope types, their distribution among service providers, and associated revenue generation. Additionally, service quality metrics are evaluated to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and verified through consultations with industry experts using computer-assisted telephone interviews (CATIs). These experts span various companies across the healthcare spectrum, providing operational and financial insights that are crucial in refining the market data and validating the findings.

Step 4: Research Synthesis and Final Output

The final stage involves direct engagement with multiple stethoscope manufacturers to gather detailed information on product segments, sales performance, consumer preferences, and other relevant factors. This interaction serves to corroborate and enhance the statistics obtained from a bottom-up approach, ensuring that the analysis of the UK stethoscopes market is comprehensive, accurate, and validated.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Demand for Diagnostic Equipment

Advancements in Medical Technology - Market Challenges

Price Sensitivity

Competition from Alternative Diagnostic Tools - Opportunities

Technological Innovations

Expanding Telemedicine Trends - Trends

Growth in E-health Solutions

Increased Utilization of Wearable Technology - Government Regulation

Medical Device Regulations

Standards for Medical Equipment - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Technology Type (In Value %)

Electronic/Digital Stethoscope

– Tube-Based

– Tubeless

Smart Stethoscope

Traditional Acoustic Stethoscope - By End-User (In Value %)

Home Healthcare

Hospitals

Clinics

Nurse Practitioners

EMT/ First Responders

Veterinary

Others - By Region (In Value %)

England

Scotland

Wales

Northern Ireland - By Distribution Channel (In Value %)

Distributors

E-commerce

Direct Purchase

- Market Share of Major Players by Value/Volume. 2024

Market Share of Major Players by Type Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Capacity, Unique Value Offering)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

3M Littmann

Welch Allyn

Omron Healthcare

ADC (American Diagnostic Corporation)

Medtronic

ZOLL Medical

Eko Devices

SonoSim

Thinklabs

A&E Medical

American Diagnostic Corporation

Mdf Instruments

Prestige Medical

Rappaport

Fluke Biomedical

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030