Market Overview

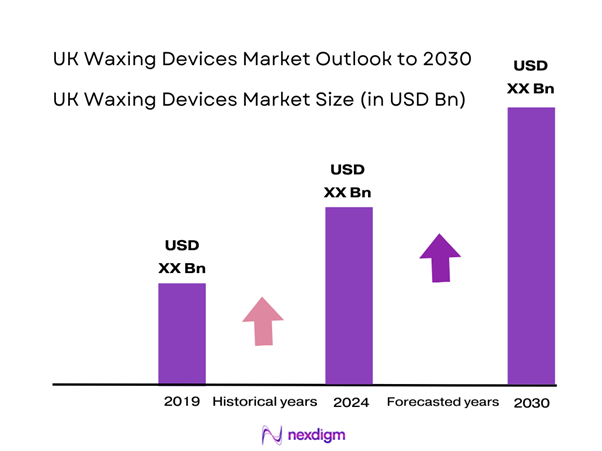

The UK Waxing Devices Market is valued at USD 491 million in 2024 with an approximated compound annual growth rate (CAGR) of 4% from 2024-2030, based on a five-year historical analysis. This market growth is driven by the increasing popularity of personal grooming and aesthetic devices among consumers, particularly in response to the rising social media influence showcasing beauty trends. Additionally, the growing availability of improved products and formulations tailored for various skin types has made home waxing more accessible and preferred.

The market is dominated by major urban areas such as London, Manchester, and Birmingham. These cities hold significant influence due to their larger populations and higher disposable incomes, which translate into greater spending on personal care. London, for instance, not only serves as a cultural epicenter but also houses a substantial number of beauty salons and retail stores, contributing to the high demand for waxing devices.

The advancement of distribution channels significantly contributes to the growth of the UK Waxing Devices Market. The acceleration of e-commerce has led to the number of online shoppers in the UK reaching roughly 45 million in 2023. As consumers gravitate towards online shopping due to its convenience, retailers have increasingly adopted omnichannel strategies to meet the demand.

Market Segmentation

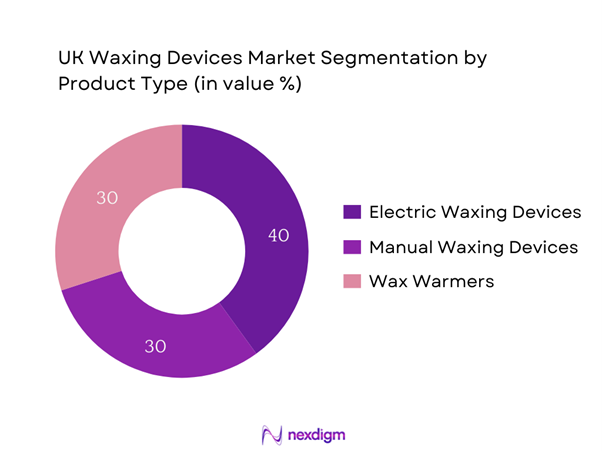

By Product Type

The UK Waxing Devices Market is segmented by product type into electric waxing devices, manual waxing devices, and wax warmers. Among these, electric waxing devices hold a dominant market share due to their ease of use and efficiency in delivering consistent results. The convenience associated with electric devices appeals significantly to both home users and professionals. Furthermore, advancements in technology have led to the development of multifunctional devices that enhance the consumer experience, thereby driving their widespread adoption.

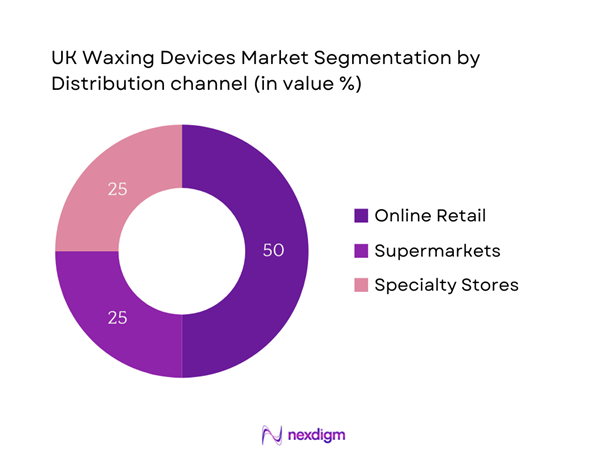

By Distribution Channel

The market is also segmented by distribution channel, including online retail, supermarkets/hypermarkets, and specialty stores. Online retail dominates the market segment due to the growing trend of e-commerce and consumer preferences for convenience and variety. The ease of comparing prices and reading reviews boosts consumer confidence in purchasing products online. Additionally, the pandemic has accelerated the shift towards online shopping, making it a primary sales channel for waxing devices.

Competitive Landscape

The UK Waxing Devices Market is highly competitive, dominated by a few major players including Philips, Wahl, and Veet. These companies leverage strong brand equity and extensive distribution networks to maintain market presence. The competitive landscape indicates that brand loyalty and innovative product offerings are pivotal for retaining market share.

| Company | Establishment Year | Headquarters | Product Types Offered | Distribution Network | Recent Innovations | Market Position |

| Philips | 1891 | Amsterdam, Netherlands | – | – | – | – |

| Wahl | 1919 | Sterling, Illinois | – | – | – | – |

| Veet | 2001 | Hull, United Kingdom | – | – | – | – |

| Remington | 1937 | Middleton, Wisconsin | – | – | – | – |

| Gigi | 1985 | Los Angeles, California | – | – | – | – |

UK Waxing Devices Market Analysis

Growth Drivers

Increasing Beauty Consciousness

The UK has experienced a significant surge in beauty consciousness, driven by changing social norms and the influence of social media platforms. According to a report by the British Beauty Council, the beauty market in the UK is valued at approximately £28 billion, highlighting the growing consumer commitment to personal grooming. Furthermore, data from the Office for National Statistics indicates that the number of beauty therapists in the UK has increased, reaching around 50,000 in 2023. As consumers prioritize skincare and grooming, their willingness to invest in effective hair removal methods elevates the demand for waxing devices.

Rise in Disposable Income

The average household disposable income in the UK has been on the rise, reported at approximately £32,000 in 2023 according to the Office for National Statistics. This increase allows consumers to allocate more funds toward personal care and grooming products, including waxing devices. Macroeconomic data indicates that as the economy recovers post-pandemic, consumer spending is expected to increase. A report from the Bank of England indicates consumer spending rose by 7.5% in the last year, further supporting the trend toward higher expenditures on beauty and grooming products, thus boosting demand in this segment.

Market Challenges

High Competition

The UK Waxing Devices Market faces fierce competition, with numerous brands vying for consumer attention. A recent analysis reveals that over 200 waxing device brands are available in the UK retail market, creating price pressure and demanding continuous innovation. As established brands like Philips and Veet dominate the space, newer entries struggle to gain foothold. The competitive environment translates to increased marketing spend, which impacts profit margins for smaller players. Additionally, the heightened competition correlates with consumer expectations for superior quality and variety in products, posing a continual challenge to brands.

Regulatory Compliance Issues

Regulatory compliance presents a significant challenge within the UK Waxing Devices Market. Manufacturers must adhere to stringent safety and quality standards outlined by government bodies such as the UK Environment Agency, which enforces regulations governing the manufacturing and sale of personal care products. Compliance requires rigorous testing, adding to overhead costs and extending product development cycles. With over 45% of consumers expressing concerns about product safety and ingredients, brands are pressured to prioritize regulatory adherence. As new regulations are introduced, companies must continuously adapt, facing potential risks of penalties or market recalls.

Opportunities

Emerging Trends in Natural Products

There is a growing consumer demand for natural and organic personal care products, including waxing devices. Recent surveys indicate that 62% of consumers in the UK prefer personal care products that contain organic ingredients, reflecting a larger trend toward natural beauty solutions. According to a report by the Soil Association, the UK organic market reached £2.8 billion in 2022, showing a 12.6% increase from the previous year. This shift encourages brands to innovate and develop eco-friendly waxing products that align with consumer preferences for sustainability, thus tapping into a lucrative market segment.

Growth of E-commerce Platforms

The growth of e-commerce platforms provides a dynamic opportunity for the Waxing Devices Market. In 2023, the value of online retail in the UK expanded to £100 billion, driven by the rise of innovative digital marketing strategies and improved online shopping experiences. The convenience of home delivery and the ability to browse a wide variety of products appeal to consumers. Additionally, data suggests that 76% of UK consumers aged 18-34 prefer purchasing beauty products online, indicating a demographic shift towards digital shopping. This trend represents a significant opportunity for waxing device manufacturers to expand their online presence and reach younger consumers.

Future Outlook

Over the next several years, the UK Waxing Devices Market is expected to show significant growth driven by continuous innovation in product formulations, an increasing number of beauty-conscious consumers, and the ongoing trend of self-care. The market is set for evolution as new technologies emerge, promising more efficient and user-friendly wax options. Furthermore, the rise of eco-friendly and organic products will likely attract a broader consumer base focused on sustainability, further driving market expansion.

Major Players

- Philips

- Wahl

- Veet

- Remington

- Gigi

- Satin Smooth

- Nair

- Cirepil

- Lycon

- Conair

- Sally Hansen

- Homiley

- Bliss

- Mylee

- Tress Wellness

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Health and Safety Executive, Trading Standards)

- Distribution Companies

- Retailers (Supermarkets and Beauty Stores)

- E-commerce Platforms

- Beauty Salons and Spas

- Personal Care Brands

- Industry Associations (e.g., British Beauty Council)

Research Methodology

Step 1: Identification of Key Variables

In this phase, the analysis begins by creating an ecosystem map that highlights all major stakeholders in the UK Waxing Devices Market. This involves extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The goal is to identify and define critical variables that influence market dynamics, including consumer behavior, pricing strategies, and competitive landscape.

Step 2: Market Analysis and Construction

During this phase, we compile and analyze historical data related to the UK Waxing Devices Market. This process encompasses assessing market penetration levels, the ratio of online to traditional retail sales, and overall revenue generation. Evaluating service quality statistics ensures the accuracy of the revenue estimates, while market size validation involves consulting various industry reports and reputable sources.

Step 3: Hypothesis Validation and Expert Consultation

Developed market hypotheses are validated through in-depth consultations via computer-assisted telephone interviews (CATIs) with industry experts from diverse companies within the waxing devices sector. These consultations provide valuable insights into operational and financial aspects directly from industry practitioners. The insights gathered are instrumental in refining and corroborating the market data collected.

Step 4: Research Synthesis and Final Output

The final phase engages with multiple waxing device manufacturers to obtain detailed insights into product segments, sales performance, consumer preferences, and other relevant factors. This interaction is critical for verifying and complementing the statistical data obtained through the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the UK Waxing Devices Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Beauty Consciousness

Rise in Disposable Income

Expanding Distribution Channels - Market Challenges

High Competition

Regulatory Compliance Issues - Opportunities

Emerging Trends in Natural Products

Growth of E-commerce Platforms - Trends

Eco-Friendly Products

Technological Innovations in Devices - Government Regulation

Quality Standards and Certifications - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Electric Waxing Devices

– Rechargeable Wax Heaters

– Cordless Waxing Kits

– Temperature-Controlled Units

Manual Waxing Devices

– Handheld Applicators

– Non-electric Wax Rollers

Wax Warmers

– Professional-grade Wax Melters

– Home-use Wax Pots

Kit Formulations

– Beginner Kits

– Refill Kits

– All-in-One Kits with Pre/Post-Care Products

Wax Strips

– Cold Wax Strips

– Ready-to-Use Body Strips

– Facial & Bikini Wax Strips - By Application (In Value %)

Home Use

– DIY Waxing Solutions

– Subscription Waxing Kits

Professional Salons

– Full-service Salons

– Boutique Waxing Studios

Spa Treatments

– Wellness & Day Spas

– Luxury Spa Resorts - By Distribution Channel (In Value %)

Online Retail

– Brand-Owned E-commerce Stores

– Marketplaces

Supermarkets/Hypermarkets

– Tesco

– Sainsbury’s

– ASDA

Specialty Stores

– Beauty & Personal Care Stores

– Professional Salon Suppliers - By Region (In Value %)

Greater London

Midlands

Glasgow

Edinburgh

Cardiff

Swansea

Belfast

Londonderry - By Consumer Demographics (In Value %)

Gender

– Female Consumers

– Male Grooming Segment

Age Group

– 16–24 Years

– 25–34 Years

– 35–44 Years

– 45+ Years

Income Levels

– Low-Income Consumers

– Middle-Income Consumers

– High-Income Consumers

- Market Share of Major Players on the Basis of Value/Volume

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Revenues by Product Type, Number of Touchpoints, Distribution Channels, Number of Retail and Wholesale Partners, Unique Value Offerings, others)

- SWOT Analysis of Major Players

- Detailed Profiles of Major Companies

Philips

Wahl

Veet

Remington

Gigi

Satin Smooth

Nair

Cirepil

Lycon

Conair

Sally Hansen

Homiley

Bliss

Mylee

Tress Wellness

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030