Market Overview

Based on a recent historical assessment, the US advanced airport technologies market is valued at approximately USD ~ billion, driven by technological advancements and increased investments in airport infrastructure. This market is propelled by rising demand for automation, improved passenger experience, and enhanced security protocols. The growing trend of smart airports and the adoption of AI, IoT, and robotics technologies are driving the market. The continued need for innovation in baggage handling, security screening, and air traffic management systems further contributes to the market’s expansion.

Dominant cities and countries in the US advanced airport technologies market include key airports in New York, Los Angeles, and Chicago, which are at the forefront of adopting cutting-edge technologies. These locations are prime due to their high passenger traffic, need for operational efficiency, and significant investments in modernizing infrastructure. The increasing focus on improving airport security and enhancing the overall passenger experience is prompting these cities to lead in the adoption of advanced technologies. Additionally, government support and partnerships with technology providers are facilitating the integration of smart systems in these regions.

Market Segmentation

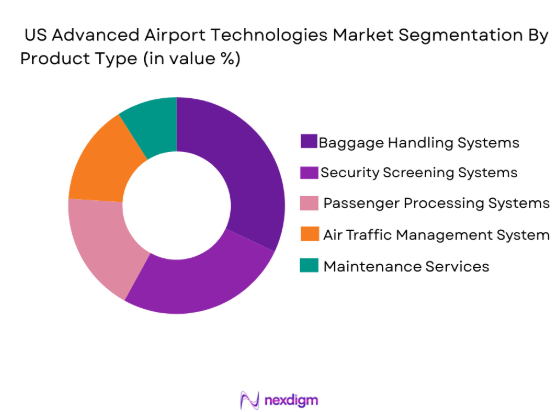

By Product Type

The US advanced airport technologies market is segmented by product type into baggage handling systems, security screening systems, passenger processing systems, air traffic management systems, and communication systems. Recently, baggage handling systems have captured a dominant market share due to the increasing demand for efficient, automated systems in high-traffic airports. The need to streamline operations, reduce human error, and improve operational speed has led to a surge in the adoption of automated baggage handling systems in major airports. With advancements in robotics and AI integration, these systems have become integral to airport operations, driving their dominance in the market.

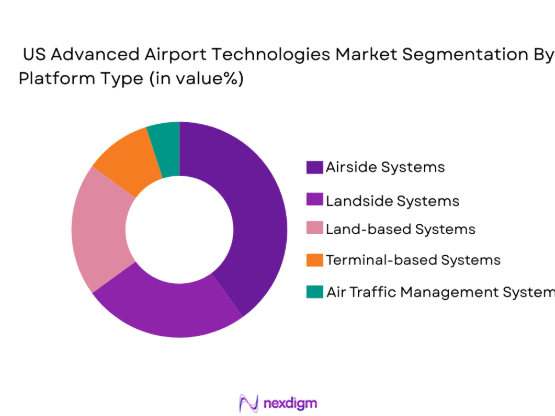

By Platform Type

The US advanced airport technologies market is segmented by platform type into airside systems, landside systems, land-based systems, terminal-based systems, and air traffic management systems. Airside systems have recently dominated the market share due to the increasing demand for enhanced runway and gate management systems. The integration of real-time data for efficient scheduling and better management of aircraft movements has driven their adoption. Terminals are also increasingly adopting advanced technologies to streamline passenger flow, baggage handling, and security. Air traffic management systems are gaining traction as airports enhance safety measures and optimize airspace. The growth in land-based systems, including security systems, has also contributed to the overall expansion of the platform type segment.

Competitive Landscape

The US advanced airport technologies market is highly competitive, with significant consolidation among key players. Major industry players are focusing on strategic partnerships, mergers, and acquisitions to strengthen their market position. These companies are leveraging advanced technology to provide integrated solutions that enhance operational efficiency and passenger experience. The market also sees the rise of startups and smaller players, which contribute to innovation in various segments of the market, pushing established companies to continuously upgrade their technologies.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Honeywell International | 1906 | Morris Plains, NJ | ~ | ~ | ~ | ~ | ~ |

| Siemens AG | 1847 | Munich, Germany | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1931 | Charlotte, NC | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| ABB Group | 1988 | Zurich, Switzerland | ~ | ~ | ~ | ~ | ~ |

US Advanced Airport Technologies Market Analysis

Growth Drivers

Increasing Passenger Volume

As air travel continues to rise, especially post-pandemic, airports are facing heightened demand for faster processing times, more efficient baggage handling, and enhanced safety measures. The growth in passenger volume has led to greater pressure on airport operators to adopt advanced technologies that improve throughput and reduce operational delays. With rising air traffic, airport infrastructure is being increasingly modernized to support the growing demand. Airports are adopting automation and AI-driven systems to streamline operations and enhance customer experiences. Moreover, security concerns have prompted airports to implement advanced screening technologies to ensure passenger safety while reducing wait times. The rising need to process passengers efficiently has driven significant investments in automation, improving operational efficiency. As airports expand and upgrade their systems, advanced technologies are becoming vital for ensuring smooth operations and reducing bottlenecks. This growth driver is directly related to the technological advancements necessary to handle increasing passenger flow and to meet growing expectations for convenience and security.

Technological Advancements in Automation and AI

The rapid pace of technological advancements in automation, AI, and robotics is revolutionizing airport operations. These innovations allow for enhanced decision-making, real-time data processing, and the ability to predict and mitigate operational disruptions. Technologies such as automated check-in kiosks, biometric screening, and AI-based baggage handling systems have gained significant traction in airports worldwide. Automation in air traffic management systems helps optimize airside operations, reducing delays and improving safety. The integration of AI in monitoring and predictive maintenance is improving the efficiency of airport systems, enabling predictive analytics for smoother operations. Airports are investing heavily in smart systems, utilizing AI algorithms to analyze traffic patterns, optimize staffing, and predict potential system failures. These advancements not only improve operational efficiency but also enhance customer experience by reducing wait times and offering more personalized services. As the demand for smart airports grows, technological innovations in AI and automation continue to drive market growth.

Market Challenges

High Initial Investment and Maintenance Costs

The significant initial capital required for the deployment of advanced airport technologies poses a major challenge for many airports, particularly smaller or regional ones. While the long-term benefits of these technologies are clear, such as enhanced efficiency, improved security, and better passenger experience, the upfront costs of implementing systems like automated baggage handling or advanced screening systems can be prohibitive. Additionally, these technologies require ongoing maintenance, upgrades, and staff training, all of which incur additional expenses. Many airports struggle to justify such large investments, especially in the face of economic uncertainty or competing priorities for infrastructure development. High costs also limit the adoption of advanced technologies to only the largest and busiest airports, leaving smaller airports at a technological disadvantage. These cost barriers are a key challenge to widespread adoption and innovation in the industry. Overcoming these financial constraints requires strategic partnerships, government support, or gradual, phased investments in new technologies.

Integration with Legacy Systems

Many airports are still operating on outdated legacy systems, which can present significant challenges when trying to implement new advanced technologies. The process of integrating new systems with existing infrastructure often involves technical difficulties, delays, and compatibility issues. In some cases, the old systems were not designed to accommodate modern technology, making integration more complex and costly. Airports face a challenge in ensuring smooth and secure data exchanges between legacy and new systems without disrupting day-to-day operations. The need for interoperability between old and new technologies is a key concern, particularly in airports with highly complex operations. Moreover, airport authorities must ensure that new systems comply with existing regulatory requirements and standards, further complicating integration efforts. The integration of advanced technologies in a way that complements existing infrastructure without causing significant disruptions to airport operations remains a key challenge that needs to be addressed for the broader industry to move forward.

Opportunities

Adoption of Biometric Technologies

The growing emphasis on improving security and enhancing passenger experience presents an opportunity for the adoption of biometric technologies in airports. Biometric authentication systems, including facial recognition and fingerprint scanning, are increasingly being deployed for check-in, boarding, and security screening. This trend not only streamlines the process for passengers but also enhances airport security by reducing the potential for human error and fraud. The ability to track passengers seamlessly through their journey, from check-in to boarding, creates a more efficient and frictionless airport experience. The adoption of biometrics also reduces the need for physical documents, such as boarding passes or passports, further enhancing convenience. As privacy concerns are addressed through secure data handling and regulatory compliance, airports are expected to accelerate the adoption of biometric systems. This presents an opportunity for technology providers to supply innovative biometric solutions tailored to the unique needs of the airport industry, driving market growth.

Smart Airport Infrastructure Development

With the increasing demand for efficient and seamless travel experiences, the development of smart airport infrastructure presents a significant opportunity for growth. Smart airports utilize interconnected technologies, such as IoT, AI, and automation, to optimize airport operations and enhance passenger experience. These technologies allow for real-time monitoring of passenger movements, baggage handling, and air traffic, leading to more efficient airport operations. The ability to monitor airport systems remotely and predict potential disruptions further enhances operational efficiency. Additionally, the implementation of smart technologies can help airports reduce their carbon footprint by optimizing energy usage and improving sustainability. Airports are increasingly focused on building smart infrastructure to cater to the needs of modern air travel. As global air traffic continues to rise, the demand for smart airports will increase, offering opportunities for players in the advanced airport technologies market to innovate and expand their offerings.

Future Outlook

The future outlook for the US advanced airport technologies market is highly promising, with expectations for continued growth driven by technological advancements and increasing air traffic. Over the next five years, the adoption of smart technologies, including automation, AI, and biometrics, is expected to increase, further transforming airport operations. Governments are likely to continue supporting these advancements through policy initiatives and investments in infrastructure. As airport operators seek to enhance passenger experience and improve operational efficiency, the demand for cutting-edge solutions will continue to rise, contributing to the overall growth of the market.

Major Players

- Honeywell International

- Siemens AG

- Collins Aerospace

- Thales Group

- ABB Group

- Rockwell Collins

- SITA

- Amadeus IT Group

- IBM Corporation

- Unisys Corporation

- Vanderlande Industries

- TAV Technologies

- Conduent Incorporated

- Serco Group

- NEC Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airport operators and authorities

- Technology providers and developers

- System integrators

- Aviation and aerospace companies

- Airline operators

- Transport and logistics companies

Research Methodology

Step 1: Identification of Key Variables

Key variables influencing the advanced airport technologies market were identified, focusing on the technological, operational, and regulatory factors.

Step 2: Market Analysis and Construction

Comprehensive market analysis was conducted using both primary and secondary research to construct a detailed market model and identify key trends and drivers.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations and hypothesis validation were undertaken to ensure the accuracy and reliability of the findings and address any emerging market nuances.

Step 4: Research Synthesis and Final Output

All findings were synthesized, and the final report was produced with a clear overview of market trends, growth drivers, challenges, and opportunities.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Air Traffic

Technological Advancements in Automation

Rising Demand for Smart Airports

Improvement in Passenger Experience

Government Investments in Infrastructure - Market Challenges

High Initial Investment Costs

Integration with Legacy Systems

Data Privacy and Security Concerns

Regulatory Compliance Challenges

Lack of Skilled Workforce - Market Opportunities

Adoption of Biometric Technologies

Smart Infrastructure Development

Growth of Private and Regional Airports - Trends

Shift Towards Automation in Baggage Handling

Rise of AI and IoT Integration

Growth in Contactless Technology

Sustainability and Green Airports

Focus on Enhanced Security Measures - Government Regulations & Defense Policy

Regulatory Support for Smart Airports

Environmental and Sustainability Regulations

Security and Surveillance Standards

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Baggage Handling Systems

Security Screening Systems

Passenger Processing Systems

Air Traffic Management Systems

Communication Systems - By Platform Type (In Value%)

Airside Systems

Landside Systems

Land-based Systems

Terminal-based Systems

Air Traffic Management Systems - By Fitment Type (In Value%)

In-house Fitment

Outsourced Fitment

Automated Fitment

Third-party Installation

Hybrid Fitment - By EndUser Segment (In Value%)

Commercial Airports

Private Airports

Cargo Airports

Government Aviation Bodies

Military Airports - By Procurement Channel (In Value%)

Direct Sales

Third-party Distributors

Online Platforms

Government Contracts

Strategic Partnerships - By Material / Technology (In Value%)

Automation Technologies

AI and Machine Learning

Robotic Systems

Biometric Systems

IoT-based Systems

- Market structure and competitive positioning

- Cross Comparison Parameters (Innovation, Market Reach, Pricing, Product Portfolio, Customer Base)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Honeywell International

Siemens AG

Collins Aerospace

Thales Group

ABB Group

Rockwell Collins

SITA

Amadeus IT Group

IBM Corporation

Unisys Corporation

Vanderlande Industries

TAV Technologies

Conduent Incorporated

Serco Group

NEC Corporation

- Commercial Airports Seeking Efficiency

- Private Airports Focusing on High-End Services

- Cargo Airports Adopting Automation

- Government Entities Driving Security Solutions

- Forecast Market Value, 2026-2030

- Forecast Installed Units, 2026-2030

- Price Forecast by System Tier, 2026-2030

- Future Demand by Platform, 2026-2030