Market Overview

The US Aerospace Composites Market is projected to reach market value of USD ~ billion by leveraging innovations in composite materials for aerospace applications. Driven by increasing demand for lightweight and durable materials, aerospace composites play a crucial role in enhancing aircraft fuel efficiency, reducing carbon emissions, and improving performance. A combination of advancements in materials science and stringent environmental regulations further propels the adoption of these materials across commercial, military, and private aviation sectors.

Key countries leading the charge in aerospace composites include the US, with its advanced manufacturing capabilities and significant investment in defense and commercial aerospace projects. Regions like California, Washington, and Texas play prominent roles in both the research and development of aerospace materials and the large-scale manufacturing of composites. The US dominance in this market is primarily driven by its established aerospace industry, robust technological innovations, and government support for military and space exploration programs.

Market Segmentation

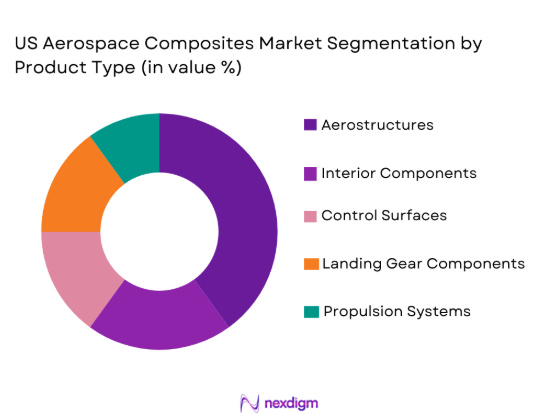

By Product Type

The US Aerospace Composites Market is segmented by product type into aerostructures, interior components, control surfaces, landing gear components, and propulsion systems. Recently, aerostructures have a dominant market share due to their extensive use in both military and commercial aircraft, where reducing weight for improved fuel efficiency and performance is a critical concern. The growing demand for lighter aircraft materials that contribute to lower fuel consumption and increased payload capacity directly influences the share of aerostructures in the market. Aerospace companies continue to innovate in this segment, utilizing advanced composites to manufacture structural components, which has further solidified its market leadership.

By Platform Type

The US Aerospace Composites Market is segmented by platform type into commercial aircraft, military aircraft, spacecraft, unmanned aerial vehicles (UAVs), and helicopters. Recently, commercial aircraft have a dominant market share due to the rapid expansion of global air travel and the increasing focus on fuel efficiency and performance enhancements. The continued evolution of next-generation commercial aircraft, driven by major manufacturers like Boeing and Airbus, contributes significantly to the increasing demand for lightweight composite materials in the design of aerostructures, interiors, and propulsion systems. Commercial aviation remains the key driver of the market’s growth, with further advancements in material science and aerospace engineering enhancing its relevance in the aerospace composites sector.

Competitive Landscape

The competitive landscape of the US Aerospace Composites Market features key players like Hexcel Corporation, Toray Industries, and Cytec Solvay Group, who dominate the market through continuous innovation, strategic mergers and acquisitions, and strong industry partnerships. The market is also characterized by an increasing trend of consolidation, where established players are acquiring smaller, specialized companies to expand their product portfolios and improve their technological capabilities. The influence of these major players shapes the market dynamics and sets a high standard for new entrants looking to penetrate the competitive environment.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Product Innovation Level |

| Hexcel Corporation | 1948 | Stamford, CT, USA | ~ | ~ | ~ | ~ | ~ |

| Toray Industries | 1926 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| Cytec Solvay Group | 1900 | Brussels, Belgium | ~ | ~ | ~ | ~ | ~ |

| SGL Carbon | 1992 | Wiesbaden, Germany | ~ | ~ | ~ | ~ | ~ |

| Teijin Limited | 1918 | Osaka, Japan | ~ | ~ | ~ | ~ | ~ |

US Aerospace Composites Market Analysis

Growth Drivers

Rising Demand for Lightweight Aircraft

The demand for lightweight aircraft is a major growth driver in the US Aerospace Composites Market. As fuel prices continue to rise, the aviation industry is increasingly seeking solutions that improve fuel efficiency while reducing operational costs. Aerospace composites, which offer significant weight reduction compared to traditional materials, provide a viable solution. Composite materials such as carbon fiber and glass fiber offer exceptional strength-to-weight ratios, enabling manufacturers to design more fuel-efficient and high-performance aircraft. In addition, lightweight composites help enhance aircraft payload capacity and reduce maintenance costs due to their resistance to corrosion and fatigue. With global air travel continuously on the rise and airlines striving to meet stringent environmental regulations, composites are becoming an essential component in modern aerospace designs. Airlines, aircraft manufacturers, and suppliers are increasingly turning to composites to meet these growing demands, resulting in a steady rise in the adoption of these materials.

Technological Advancements in Composites

Technological advancements in composite materials play a pivotal role in driving the growth of the US Aerospace Composites Market. Continuous innovations in fiber-reinforced polymers and thermoplastic composites are enhancing the performance characteristics of aerospace materials, providing superior durability, strength, and flexibility. These advancements allow for the production of lighter, stronger, and more cost-efficient materials, which are crucial for the aerospace industry’s goal of reducing fuel consumption and minimizing the carbon footprint. Furthermore, advancements in manufacturing technologies, such as automated fiber placement and 3D printing, have led to more cost-effective production processes. These innovations enable manufacturers to produce complex composite parts at lower costs, increasing the affordability of aerospace composites for a broader range of applications, including both commercial and military aircraft. As technology progresses, manufacturers are increasingly integrating these advanced composites into next-generation aircraft, fueling market growth.

Market Challenges

High Production Costs of Composites

One of the key challenges facing the US Aerospace Composites Market is the high production cost of composite materials. Although composites offer significant advantages in terms of weight reduction and durability, they remain more expensive to manufacture compared to traditional metals such as aluminum. The cost of raw materials, such as carbon fiber, coupled with the specialized manufacturing processes required to produce aerospace-grade composites, contributes to the overall high cost. This is particularly challenging for smaller manufacturers or those in emerging markets, as the initial investment for equipment and facilities is significant. Additionally, the lengthy and complex process of designing and testing new composite materials increases development costs. While the long-term benefits of aerospace composites in terms of fuel savings and performance improvements are clear, the high upfront costs can act as a barrier to widespread adoption, especially during periods of economic uncertainty or budget constraints.

Lack of Standardization and Regulation

Another challenge in the US Aerospace Composites Market is the lack of uniform standards and regulations for the use of composite materials across the aerospace sector. The aerospace industry relies heavily on certifications and compliance with government regulations, particularly from entities such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). However, the process of certifying composite materials for use in aerospace applications is still evolving, and the lack of universally accepted standards can create challenges for manufacturers. The variability in standards can result in delays in product approvals and may increase costs for companies attempting to meet regulatory requirements. Additionally, ensuring the durability, safety, and performance of composite materials under varying environmental conditions is a critical concern. As new materials and manufacturing techniques emerge, the industry must work toward achieving greater standardization to ensure widespread adoption and regulatory compliance.

Opportunities

Expansion in the Space Industry

The US Aerospace Composites Market is presented with a significant opportunity due to the rapid expansion of the space industry. With increasing private investment in space exploration, satellite deployment, and commercial space travel, the demand for advanced materials such as aerospace composites is expected to grow. Composites are essential for spacecraft and satellite applications, as they offer significant weight reduction without compromising strength or thermal resistance. The emergence of companies like SpaceX and Blue Origin has further stimulated this demand, as these companies continue to push the boundaries of space exploration, seeking lighter, more durable materials for their spacecraft. Additionally, government agencies like NASA are continually developing and testing new composites to withstand the extreme conditions of space. This growth in the space sector, along with advancements in satellite technologies, presents a unique opportunity for aerospace composite manufacturers to expand their product offerings and capitalize on this growing market.

Increasing Demand for UAVs and Autonomous Aircraft

The growing demand for unmanned aerial vehicles (UAVs) and autonomous aircraft presents a key opportunity for the US Aerospace Composites Market. These vehicles require lightweight, durable, and high-performance materials to achieve their operational goals of extended flight times and efficient performance. Aerospace composites, with their excellent strength-to-weight ratio and ability to withstand harsh conditions, are ideally suited for these applications. UAVs and autonomous aircraft are being increasingly adopted in various sectors, including defense, logistics, and environmental monitoring. As technological advancements in autonomy and battery power continue to evolve, the demand for lightweight composite materials in these vehicles will increase. Moreover, composites are essential for the design of electric aircraft, which are expected to play a significant role in the future of aviation. This growing demand in both commercial and military sectors creates a substantial opportunity for the aerospace composites market to expand its reach.

Future Outlook

The US Aerospace Composites Market is expected to grow steadily in the next five years, driven by the continued demand for lightweight materials and advancements in composite technologies. Technological innovations, such as 3D printing and hybrid composite materials, are poised to revolutionize the manufacturing of aerospace components. Government regulations and environmental concerns will encourage the aerospace industry to adopt more sustainable materials, further boosting demand for aerospace composites. Additionally, the increasing adoption of autonomous and electric aircraft technologies will further create opportunities for advanced composite materials.

Major Players

- Hexcel Corporation

- Toray Industries

- Cytec Solvay Group

- SGL Carbon

- Teijin Limited

- BASF SE

- Mitsubishi Chemical Corporation

- Oshkosh Corporation

- L3 Technologies

- Northrop Grumman

- Safran

- General Electric

- Lockheed Martin

- Collins Aerospace

- Aerospace Composite Products

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace manufacturers

- Aircraft manufacturers

- Defense contractors

- Commercial airlines

- Private sector / Aerospace component suppliers

- Technology firms

Research Methodology

Step 1: Identification of Key Variables

We identify the key factors influencing the market such as material types, technological trends, and regulatory impacts. This ensures that our research focuses on relevant data points that affect market behavior.

Step 2: Market Analysis and Construction

We analyze the current market landscape using historical data and industry trends. This step involves constructing a detailed market model to forecast future trends based on current growth patterns and innovations.

Step 3: Hypothesis Validation and Expert Consultation

We validate our findings through consultations with industry experts and key stakeholders, ensuring that our market assumptions are accurate and reflect current industry realities.

Step 4: Research Synthesis and Final Output

We synthesize all data into a comprehensive report that offers insights into market trends, growth drivers, challenges, and opportunities. This report provides actionable insights for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growing Demand for Lightweight Aerospace Components

Technological Advancements in Composite Materials

Rising Commercial Aircraft Production

Increased Military Modernization

Government Funding for Space Exploration - Market Challenges

High Material Costs

Manufacturing Complexity

Regulatory Compliance and Certification Delays

Lack of Skilled Workforce

Sustainability Concerns - Market Opportunities

Emerging Demand for Composite Materials in Spacecraft

Advancements in Carbon Fiber Recycling

Growth of UAV Market - Trends

Increased Adoption of 3D Printing in Aerospace Manufacturing

Advances in Hybrid Composite Materials

Integration of Artificial Intelligence in Composite Design

Growth in Sustainable Aviation Technologies

Shift Toward Autonomous Aerospace Systems - Government Regulations & Defense Policy

FAA Regulations for Composite Materials

Export Control and Compliance in Aerospace

Government Incentives for Aerospace R&D - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Aerostructures

Interior Components

Control Surfaces

Landing Gear Components

Propulsion Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Spacecraft

Unmanned Aerial Vehicles (UAVs)

Helicopters - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Replacement Parts

MRO (Maintenance, Repair, and Overhaul)

End-of-life Component Recycling - By EndUser Segment (In Value%)

Airline Operators

Aircraft Manufacturers

Space Agencies

Defense Contractors

Aerospace Component Suppliers - By Procurement Channel (In Value%)

Direct Procurement

Government Contracts

Third-party Suppliers

Online Bidding Platforms

Distributors - By Material / Technology (In Value%)

Carbon Fiber Composites

Glass Fiber Composites

Aramid Fiber Composites

Resins & Matrix Materials

Thermoplastic Composites

- Market share snapshot of major players

- Cross Comparison Parameters (Material Type, End-user Segment, Fitment Type, Platform Type, Procurement Channel, Technology, System Complexity, Regulatory Compliance)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Hexcel Corporation

Toray Industries

Cytec Solvay Group

SGL Carbon

Teijin Limited

BASF SE

Mitsubishi Chemical Corporation

Oshkosh Corporation

L3 Technologies

Northrop Grumman

Safran

General Electric

Lockheed Martin

Collins Aerospace

Aerospace Composite Products

- Airline Operators’ Demand for Fuel-efficient Aircraft

- Growth in Commercial Space Ventures

- Military Forces’ Shift to Advanced Materials

- Increased Collaboration Between Aerospace Manufacturers and Component Suppliers

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035